INTRODUCTION TO THE DESCENDING CHANNEL PATTERN:

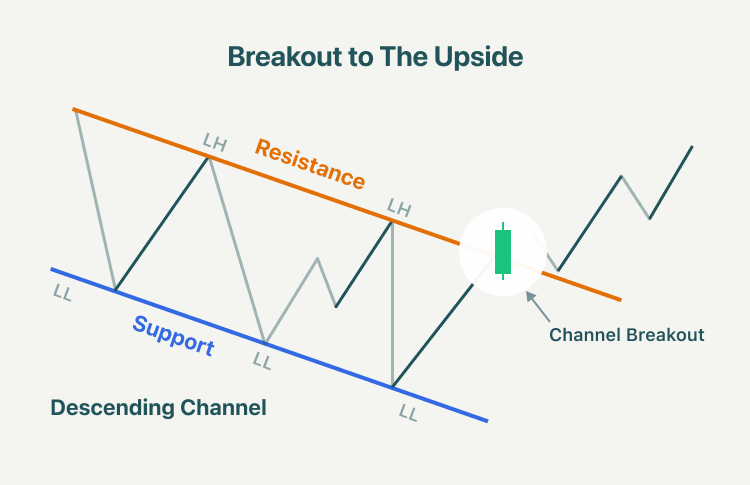

Descending channel pattern forex trading mein istemaal hone wala ek technical analysis tool hai, jo ek bearish trend ko pehchanne mein madad karta hai. Isme do 'trendlines' hote hain, ek neeche se neeche jhuke hote hain aur doosra uppar se uppar. Ye trendlines ek doosre ke saath parallel hote hain aur neeche ki taraf jhuke hote hain, jisse keemat mein dhire-dhire kami hone ka sanket hota hai.

Jab keemat ek descending channel pattern ke andar trade kar rahi hai, to yeh is baat ka sanket deta hai ki bechne wale control mein hain aur yahan ek consistent pattern hai jisme keemat ki haddi aur haddi neeche jaati hai. Yeh ek bearish sentiment ko dikhata hai aur traders mauke ki talash kar sakte hain currency pair bechne ya short karne ke liye.

IDENTIFYING THE DESCENDING CHANNEL PATTERN:

Ek descending channel pattern ki pahchan karne ke liye, traders ko uppar aur neeche trendlines ke beech judne wale do ya isse zyaada swing highs aur swing lows ko dhoondhna hota hai. Swing highs woh points hote hain jahan keemat uptrend se palat kar neeche jaati hai aur swing lows woh points hote hain jahan keemat downtrend se palat kar upar jaati hai.

Jab trendlines ban jaayein, tab traders ko price action ko dekh kar confirmation dhoondhni hoti hai. Yahan ek consistent pattern hona chahiye lower highs aur lower lows ka, jahan price trendlines ko support aur resistance level ki tarah respect karta hai.

TRADING STRATEGIES USING THE DESCENDING CHANNEL PATTERN:

Descending channel pattern ke saath kuch trading strategies istemaal ki ja sakti hain. Ek common strategy hai ki jab keemat upper trendline se bounce back kare aur lower trendline ki taraf niche jaaye, tab currency pair ko bechne ya short karne ke liye mauka pakadna. Traders upper trendline ke upar stop-loss order lagakar risk manage kar sakte hain aur potential reversals se bachne ke liye.

Ek aur strategy hai ki lower trendline ka breakout hone ka wait karna, jo bearish trend ka continuation bata sakta hai. Jab price lower trendline se break kare, tab traders currency pair ko bechne ya short kar sakte hain, jahan par breakout level se upar stop-loss order lagaya jaaye.

SUPPORT AND RESISTANCE LEVELS WITHIN THE DESCENDING CHANNEL PATTERN:

Descending channel pattern ke trendlines price ke liye support aur resistance levels ki tarah kaam karte hain. Uppar trendline ek resistance level ke roop mein kaam karta hai, jahan par keemat ko bechne wala daabav ka samna karna padta hai. Traders mauke ki talash kar sakte hain currency pair ko bechne ya short karne ke liye jab price upper trendline tak pahunch jaaye aur rejection signs ya bearish candlestick patterns dikhaaye.

Dusri taraf, neeche trendline ek support level ke roop mein kaam karta hai, jahan par keemat ko kharidne wala interest milta hai. Traders mauke ki talash kar sakte hain currency pair ko kharidne ya long karne ke liye jab price lower trendline tak pahunch jaaye aur reversal signs ya bullish candlestick patterns dikhaaye.

IMPORTANCE OF VOLUME IN THE DESCENDING CHANNEL PATTERN:

Volume descending channel pattern mein trading karte samay mahatvapurna jaankari pradaan kar sakta hai. Agar volume upper trendline tak pahunchte samay badhe, to yeh dikhata hai ki bechne wale daabav badh raha hai aur bearish reversal hone ki ashanka zyada hai.

Ulte, agar volume lower trendline tak pahunchte samay badhe, to yeh dikhata hai ki kharidne wala interest badh raha hai aur bullish reversal hone ki ashanka zyada hai. Traders ko descending channel pattern ke andar volume patterns par dhyaan dena chahiye, apne trade setups ki validity ko confirm karne ke liye.

Descending channel pattern forex trading mein istemaal hone wala ek technical analysis tool hai, jo ek bearish trend ko pehchanne mein madad karta hai. Isme do 'trendlines' hote hain, ek neeche se neeche jhuke hote hain aur doosra uppar se uppar. Ye trendlines ek doosre ke saath parallel hote hain aur neeche ki taraf jhuke hote hain, jisse keemat mein dhire-dhire kami hone ka sanket hota hai.

Jab keemat ek descending channel pattern ke andar trade kar rahi hai, to yeh is baat ka sanket deta hai ki bechne wale control mein hain aur yahan ek consistent pattern hai jisme keemat ki haddi aur haddi neeche jaati hai. Yeh ek bearish sentiment ko dikhata hai aur traders mauke ki talash kar sakte hain currency pair bechne ya short karne ke liye.

IDENTIFYING THE DESCENDING CHANNEL PATTERN:

Ek descending channel pattern ki pahchan karne ke liye, traders ko uppar aur neeche trendlines ke beech judne wale do ya isse zyaada swing highs aur swing lows ko dhoondhna hota hai. Swing highs woh points hote hain jahan keemat uptrend se palat kar neeche jaati hai aur swing lows woh points hote hain jahan keemat downtrend se palat kar upar jaati hai.

Jab trendlines ban jaayein, tab traders ko price action ko dekh kar confirmation dhoondhni hoti hai. Yahan ek consistent pattern hona chahiye lower highs aur lower lows ka, jahan price trendlines ko support aur resistance level ki tarah respect karta hai.

TRADING STRATEGIES USING THE DESCENDING CHANNEL PATTERN:

Descending channel pattern ke saath kuch trading strategies istemaal ki ja sakti hain. Ek common strategy hai ki jab keemat upper trendline se bounce back kare aur lower trendline ki taraf niche jaaye, tab currency pair ko bechne ya short karne ke liye mauka pakadna. Traders upper trendline ke upar stop-loss order lagakar risk manage kar sakte hain aur potential reversals se bachne ke liye.

Ek aur strategy hai ki lower trendline ka breakout hone ka wait karna, jo bearish trend ka continuation bata sakta hai. Jab price lower trendline se break kare, tab traders currency pair ko bechne ya short kar sakte hain, jahan par breakout level se upar stop-loss order lagaya jaaye.

SUPPORT AND RESISTANCE LEVELS WITHIN THE DESCENDING CHANNEL PATTERN:

Descending channel pattern ke trendlines price ke liye support aur resistance levels ki tarah kaam karte hain. Uppar trendline ek resistance level ke roop mein kaam karta hai, jahan par keemat ko bechne wala daabav ka samna karna padta hai. Traders mauke ki talash kar sakte hain currency pair ko bechne ya short karne ke liye jab price upper trendline tak pahunch jaaye aur rejection signs ya bearish candlestick patterns dikhaaye.

Dusri taraf, neeche trendline ek support level ke roop mein kaam karta hai, jahan par keemat ko kharidne wala interest milta hai. Traders mauke ki talash kar sakte hain currency pair ko kharidne ya long karne ke liye jab price lower trendline tak pahunch jaaye aur reversal signs ya bullish candlestick patterns dikhaaye.

IMPORTANCE OF VOLUME IN THE DESCENDING CHANNEL PATTERN:

Volume descending channel pattern mein trading karte samay mahatvapurna jaankari pradaan kar sakta hai. Agar volume upper trendline tak pahunchte samay badhe, to yeh dikhata hai ki bechne wale daabav badh raha hai aur bearish reversal hone ki ashanka zyada hai.

Ulte, agar volume lower trendline tak pahunchte samay badhe, to yeh dikhata hai ki kharidne wala interest badh raha hai aur bullish reversal hone ki ashanka zyada hai. Traders ko descending channel pattern ke andar volume patterns par dhyaan dena chahiye, apne trade setups ki validity ko confirm karne ke liye.

تبصرہ

Расширенный режим Обычный режим