Currency pair of the week EURUSD

Haftay ki Currency Pair: EURUSD

Tijarat mein mukhtalif currency pairs ka tajziya karna har trader ke liye zaroori hai, aur is haftay hum apne tajziye ki roshni mein haftay ki currency pair, EURUSD, par ghaur karenge.

Taqreeban Har Trader ki Shuruwat:

EURUSD, ya Euro aur US Dollar ka combination, tijarat mein shuruwat karne wale har trader ki tohfeh hai. Yeh duniya ke do bade tareen economic regions, Eurozone aur United States, ke darmiyan tijarat ko darust karti hai.

Current Market Scenario:

Mozu

Is waqt, EURUSD market mein tezi aur mandgi ka muzahira kar rahi hai. Economic indicators, geopolitical events, aur global economic conditions is pair par asar daal rahe hain.

Economic Factors:

Eurozone aur United States ki Tijarati Shurtiyan

Is pair ko samajhne ke liye, Eurozone aur United States ki economic conditions par ghaur karna zaroori hai. Eurozone mein Euro ki strength par asar dalta hai jabke United States mein Dollar ki value ko control karte hain.

Geopolitical Influences

Siasati Aur Raqabi Asrat

Haal hi mein Europe mein siasati aur raqabi asrat, jese ke Brexit aur Eurozone ke internal matters, ne is pair par asarat dalne mein hissa liya hai. Is tarah ke events se traders ko chahiye ke masbat ya manfi rukh se faida uthayein.

Key Levels and Trends:

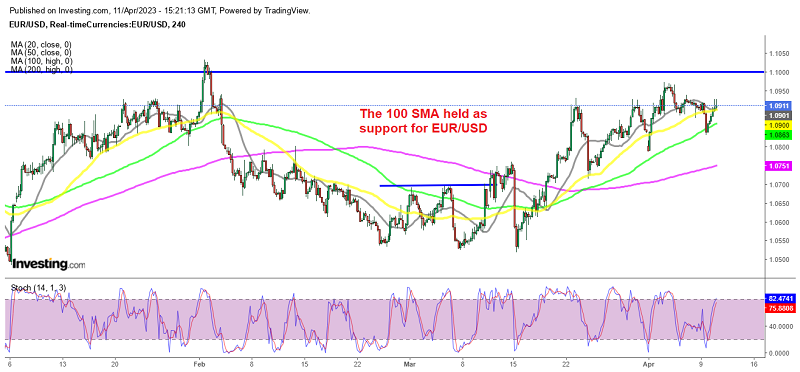

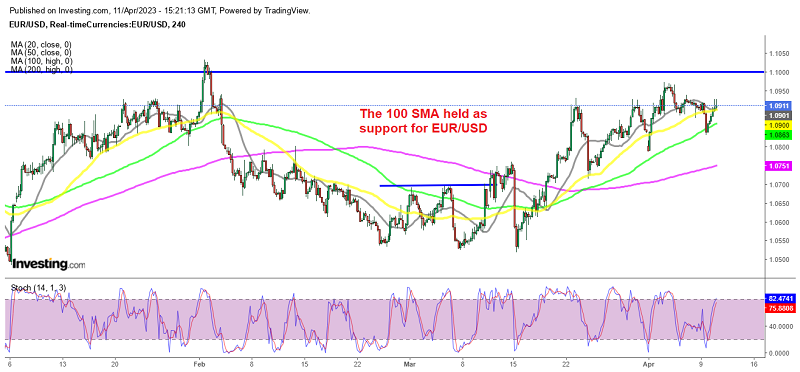

Ahem Satahain aur Rujhanat

EURUSD pair ki tijarat mein amooman key levels aur trends dekhe jate hain. Support aur resistance levels ko samajhna, aur trend lines ki roshni mein price ka analysis karna, traders ke liye aham hai.

Trading Strategies:

Tijarati Raqam

Traders apni trading strategies banate waqt, is pair ke trends aur price movements ka khaas khayal rakhte hain. Kuch traders range-bound markets mein kaam karte hain jabke doosre trends par focus karte hain.

Risk Management:

Khatraat Ka Tawun

Trading mein safalta ke liye risk management zaroori hai. EURUSD pair mein trading karte waqt, traders ko apne positions ko monitor karna aur stop-loss orders ka istemal karna chahiye taki nuksan se bacha ja sake.

Upcoming Events:

Aanay Wale Waqeaton Ka Asar

Tijarat mein mukhtalif waqiat jese ke economic reports, central bank meetings, aur geopolitical developments is pair par asar dal sakte hain. Traders ko in waqiaton ka asar samajhna zaroori hai.

Trader Sentiment:

Trader Ka Jazbat

EURUSD pair par trading karte waqt trader sentiment ko bhi mad e nazar rakhna zaroori hai. Agar market mein ziada tijarati faalat ho rahi hai toh ye ek bullish ya bearish trend ka ishara ho sakta hai.

EURUSD pair, tijarat mein apni jagah banaye hue hai aur iske andar chand dinon ki mukhtalif hawaein chal rahi hain. Traders ko apne tijarati strategies ko is pair ke tez aur behtareen tajaweezat ke mutabiq customize karna chahiye. Haftay ki currency pair par amal karte waqt, hamesha taqatwar taalluqaat aur ehtiyaati tajaweezat par amal karna zaroori hai.

Haftay ki Currency Pair: EURUSD

Tijarat mein mukhtalif currency pairs ka tajziya karna har trader ke liye zaroori hai, aur is haftay hum apne tajziye ki roshni mein haftay ki currency pair, EURUSD, par ghaur karenge.

Taqreeban Har Trader ki Shuruwat:

EURUSD, ya Euro aur US Dollar ka combination, tijarat mein shuruwat karne wale har trader ki tohfeh hai. Yeh duniya ke do bade tareen economic regions, Eurozone aur United States, ke darmiyan tijarat ko darust karti hai.

Current Market Scenario:

Mozu

Is waqt, EURUSD market mein tezi aur mandgi ka muzahira kar rahi hai. Economic indicators, geopolitical events, aur global economic conditions is pair par asar daal rahe hain.

Economic Factors:

Eurozone aur United States ki Tijarati Shurtiyan

Is pair ko samajhne ke liye, Eurozone aur United States ki economic conditions par ghaur karna zaroori hai. Eurozone mein Euro ki strength par asar dalta hai jabke United States mein Dollar ki value ko control karte hain.

Geopolitical Influences

Siasati Aur Raqabi Asrat

Haal hi mein Europe mein siasati aur raqabi asrat, jese ke Brexit aur Eurozone ke internal matters, ne is pair par asarat dalne mein hissa liya hai. Is tarah ke events se traders ko chahiye ke masbat ya manfi rukh se faida uthayein.

Key Levels and Trends:

Ahem Satahain aur Rujhanat

EURUSD pair ki tijarat mein amooman key levels aur trends dekhe jate hain. Support aur resistance levels ko samajhna, aur trend lines ki roshni mein price ka analysis karna, traders ke liye aham hai.

Trading Strategies:

Tijarati Raqam

Traders apni trading strategies banate waqt, is pair ke trends aur price movements ka khaas khayal rakhte hain. Kuch traders range-bound markets mein kaam karte hain jabke doosre trends par focus karte hain.

Risk Management:

Khatraat Ka Tawun

Trading mein safalta ke liye risk management zaroori hai. EURUSD pair mein trading karte waqt, traders ko apne positions ko monitor karna aur stop-loss orders ka istemal karna chahiye taki nuksan se bacha ja sake.

Upcoming Events:

Aanay Wale Waqeaton Ka Asar

Tijarat mein mukhtalif waqiat jese ke economic reports, central bank meetings, aur geopolitical developments is pair par asar dal sakte hain. Traders ko in waqiaton ka asar samajhna zaroori hai.

Trader Sentiment:

Trader Ka Jazbat

EURUSD pair par trading karte waqt trader sentiment ko bhi mad e nazar rakhna zaroori hai. Agar market mein ziada tijarati faalat ho rahi hai toh ye ek bullish ya bearish trend ka ishara ho sakta hai.

EURUSD pair, tijarat mein apni jagah banaye hue hai aur iske andar chand dinon ki mukhtalif hawaein chal rahi hain. Traders ko apne tijarati strategies ko is pair ke tez aur behtareen tajaweezat ke mutabiq customize karna chahiye. Haftay ki currency pair par amal karte waqt, hamesha taqatwar taalluqaat aur ehtiyaati tajaweezat par amal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим