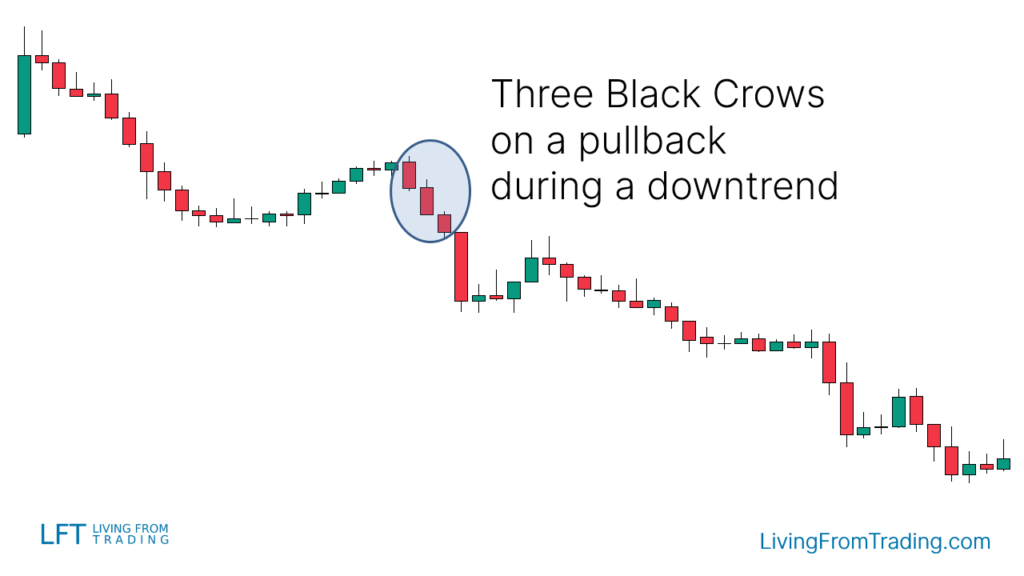

Three Black Crow candlestick pattern

Three black crow kai pattern ki tashree kaise ki jati hai three black crow kai pattern mein har aik candle pahle ki nisbat kam hoti hai bulls ki keemat ko wapis lana bulls ka fawaid ko reverse karna ka liya aik jarana ikdam ki nisandahe karta hai pattern nicha kai wakfa kai sath kul sakta hai dosri aur third candles mein taqreeban aik hi size ka barah jisam hona chahiya is ko itemad pattern samjha jata hai astamal krnay ka msale treqh degr tkneke asharay say tsdeq kay leay aek asharh hay۔ ten kalay koon ka petrn ktna achhe trh say zahr hota hay as ka as pr ahm asr prrta hay kh aek tajr ko as pr ktna aatmad ho skta hay۔ maqol hd tk lmbay jsmon kay sath msale mnde oale mom btean jo mdt kay leay km qemt pr ya as kay qreb hote hen ten kalay koّon ke shkl akhtear kren۔ ya، dosray treqay say، shma dan men lmbay، asle jsm aor chhotay، ya nhen، sae'ay honay chahe'en۔ agr sae'ay lmbay ho rhay hen، to yh teze aor mnde ke rftar men aek lmhate tbdele ho skte hay as say phlay kh ap trend dobarh shroa ho jaey hree Black Crow candlestick pattern ki judgement kay liye trader ko bahot experience ki zaroorat hoti hea kyn kay is pattern ki development main market ki volatility bahot aihm factors considered kia ja sakta hea friends is kee candlesticks kee technical shape kuch is tarha hoti hea kay Pahle candle long real body bullish candle banti hai aur 2nd candle long real body bearish candle banti hai jo kay gap up ke sath open hoti hai aur is patton mein Main third candle second candle ki real body mein say open hoti hai aur is ka close first candle se niche hona chahie aur is patton mein fourth candle third candle kay real body mein say open hoti hai.

:max_bytes(150000):strip_icc()/The5MostPowerfulCandlestickPatterns3-f3b280e0165a4b2fa5e5d3b42b36e337.png)

example tor par koi saya nhi ya zahir karta hai kah reach section kam ka qareeb keemat rakhna ka qabil hai

تبصرہ

Расширенный режим Обычный режим