Butterfly Candlestick Pattern ek technical analysis tool hai jo stock market mein istemal hota hai. Yeh pattern traders ko market trends ke changes aur possible reversals ke liye signal deta hai. Butterfly pattern ka structure butterfly jaisa hota hai, jismein teen distinct price movements hote hain. Yeh pattern trend reversal ko darust karnay mein madadgar hota hai.

Butterfly Candlestick Pattern Kya Hai: Butterfly pattern ek complex candlestick pattern hai jo three legs ya phases se milti hai. Yeh typically market ke upar ya neeche hone wale reversals ko indicate karta hai. Pattern ka naam isliye hai kyunki iski shape ek butterfly ki tarah hoti hai.

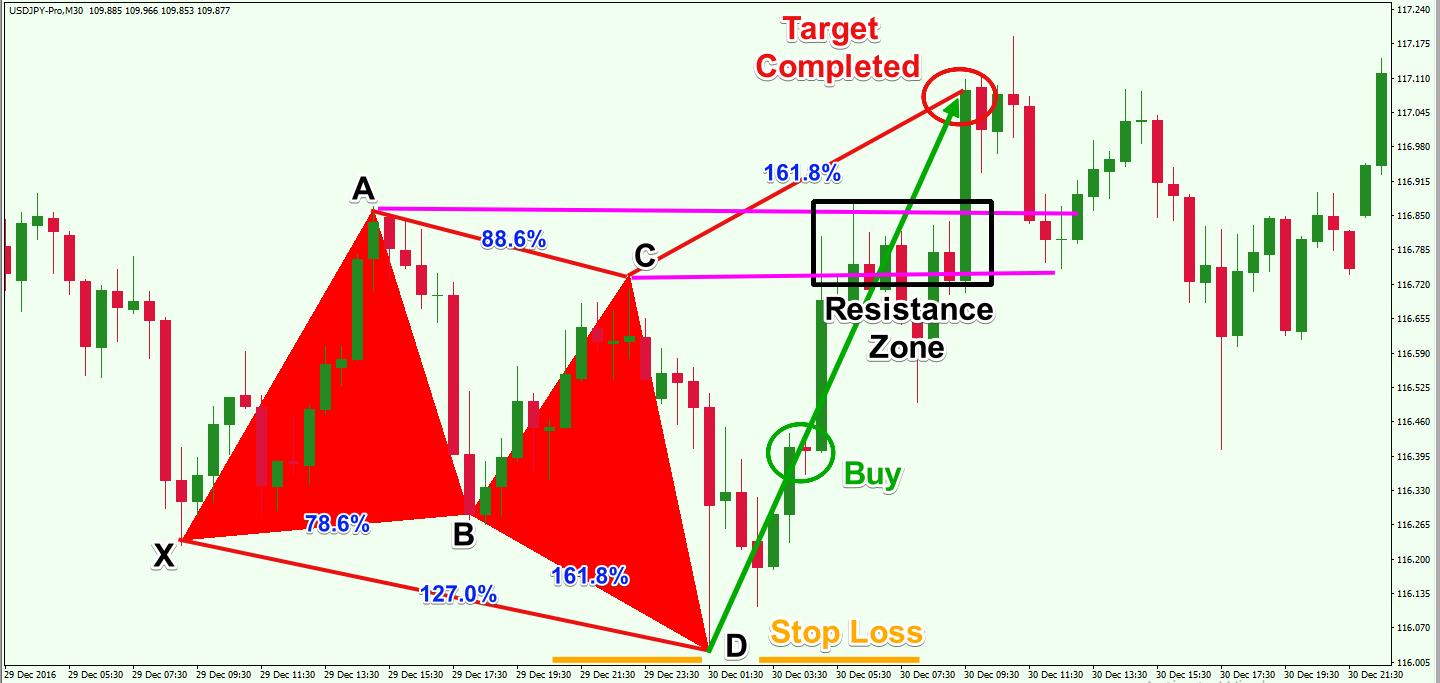

Butterfly Pattern Ka Structure:

- First Leg (AB): Pehla leg hota hai jab price ek certain trend mein move karta hai, either upar ya neeche.

- Second Leg (BC): Doosra leg hota hai jab price ek reversal shuru karta hai, matlab trend change hone ka signal milta hai.

- Third Leg (CD): Teesra leg hota hai jab price wapas original trend mein move karta hai, lekin is phase mein reversal hota hai aur trend opposite direction mein change hota hai.

Butterfly Pattern Identifying:

- Legs ki Length Check Karein: Har leg ki length ka tafseelat dekhein. Proportions ka khayal rakhna important hai.

- Fibonacci Levels Ka Istemal: Butterfly pattern mein Fibonacci retracement levels ka istemal hota hai. Legs ke movements ko Fibonacci ratios ke sath compare kiya jata hai.

- Candlestick Shapes: Har leg ke dauran ki candlesticks ka shape bhi important hai. Bullish aur bearish candlesticks ke patterns ko samajhna zaroori hai.

Butterfly Pattern Ka Tabeer: Agar Butterfly pattern sahi tarah se ban raha hai, toh yeh indicate karta hai ke market mein reversal hone wala hai. Agar pehla leg upar gaya, phir second leg neeche gaya, aur phir third leg upar gaya, toh yeh bullish reversal signal ho sakta hai, aur vice versa bhi.

Hosla Afzaai aur Hifazati Tadabeer: Traders ko yaad rakhna chahiye ke technical patterns hamesha 100% sahi nahi hote hain. Butterfly pattern ka istemal sahi taur par karne ke liye, hosla afzaai aur risk management ka khayal rakhna zaroori hai. Trading decisions lene se pehle market trends aur overall conditions ko madde nazar rakhein.

Butterfly Candlestick Pattern ka istemal karke traders market ke possible reversals ko anticipate kar sakte hain, lekin iska istemal mukhlis tajwezat aur analysis ke sath karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим