Island Reversal Pattern ek technical analysis concept hai jo stock market mein istemal hota hai. Yeh pattern trend reversal ko darust karnay mein madadgar hota hai. Island Reversal Pattern tab paida hota hai jab ek stock ka price trend abruptly change hota hai. Yeh pattern traders ko indicate karta hai ke market ki direction badal sakti hai.

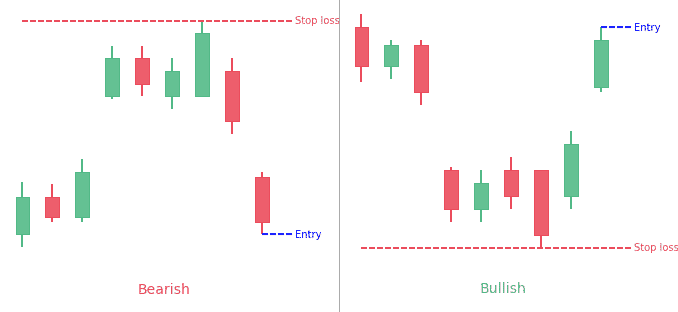

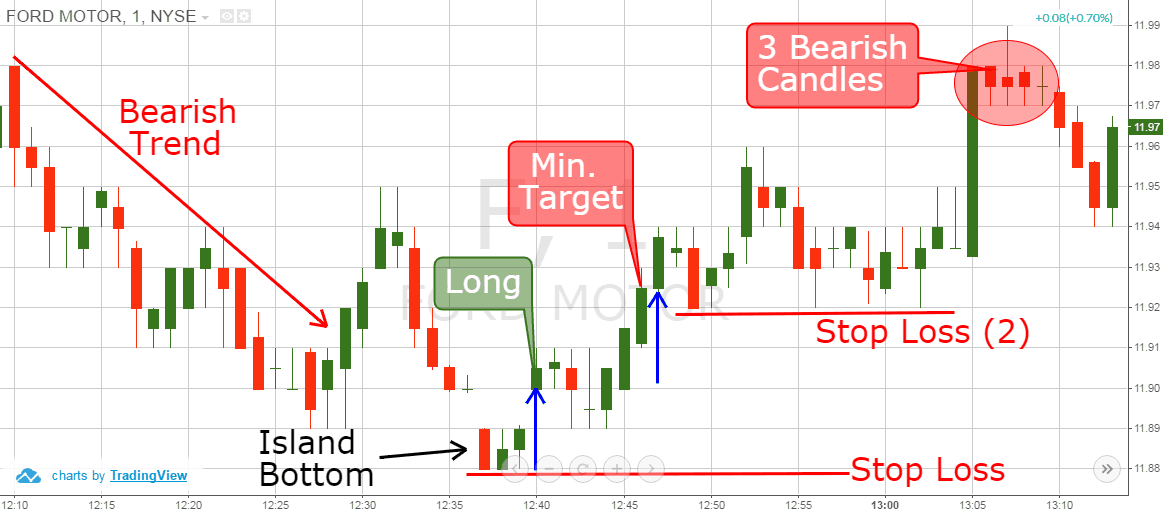

Island Reversal Pattern Kya Hai: Island Reversal Pattern tab banta hai jab ek stock ka price ek sudden gap ke baad chalta hai, phir ek aur gap ke baad wapas wahi se wapas aa jata hai. Iska asar ek 'island' ki tarah hota hai jo beech mein khara hota hai. Yani, ek chhota sa price gap se start hota hai, phir ek break hoti hai jismein price ek arsay tak stagnant rehta hai, aur phir doosra gap hota hai jo pehle wale gap se opposite direction mein hota hai.

Island Reversal Pattern Identifying:

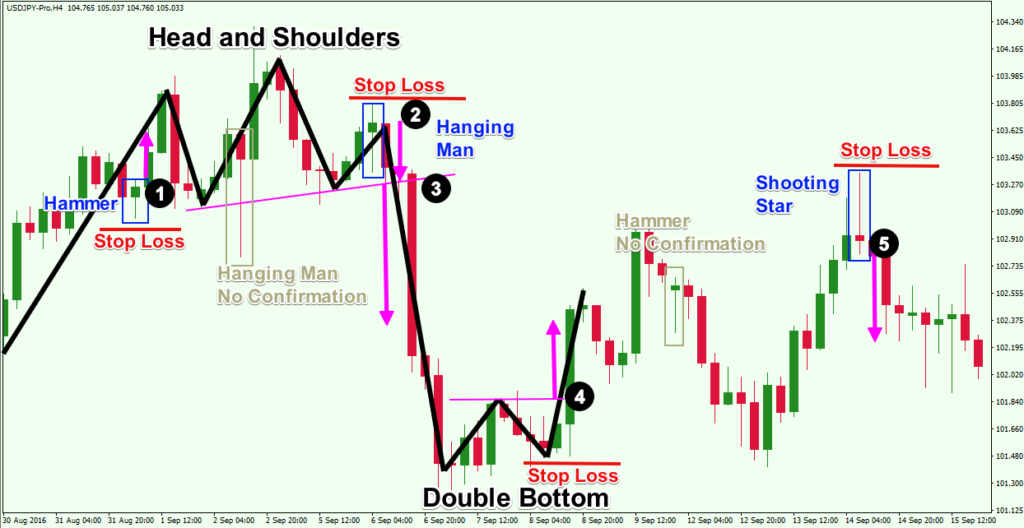

- Gaps Ka Tafseelat: Sab se pehle, traders ko gaps ki details samajhni chahiye. Yeh dekhein ke kis tarah ka gap hai, kitna bada hai, aur kis direction mein hai.

- Price Behavior Ki Tafseelat: Traders ko dekhein ke price kis tarah se react kar raha hai. Agar ek island reversal pattern ban raha hai, toh ek sudden price change hoga aur fir stagnant phase aayega.

- Volume Check Karein: Volume bhi ek ahem factor hai. Agar ek island reversal pattern ban raha hai, toh volume mein bhi significant change dikhega.

Island Reversal Pattern Ka Tabeer: Agar traders ek island reversal pattern detect karte hain, toh yeh indicate kar sakta hai ke market direction badalne wala hai. Agar pehla gap up hota hai, phir doosra gap down hota hai, toh yeh bearish reversal ho sakta hai, aur vice versa bhi ho sakta hai.

Hosla Afzaai aur Hifazati Tadabeer: Traders ko yaad rakhna chahiye ke technical patterns hamesha 100% sahi nahi hote hain. Hosla afzaai aur risk management ka khayal rakhna zaroori hai taake galat signal se nuksan bacha ja sake. Isi liye, ek mukhlis analysis aur market trends ki samajhdari se kam lena behtar hai.

Island Reversal Pattern ko sahi taur par samajh kar istemal karna traders ke liye market trends ko predict karne mein madadgar sabit ho sakta hai.

تبصرہ

Расширенный режим Обычный режим