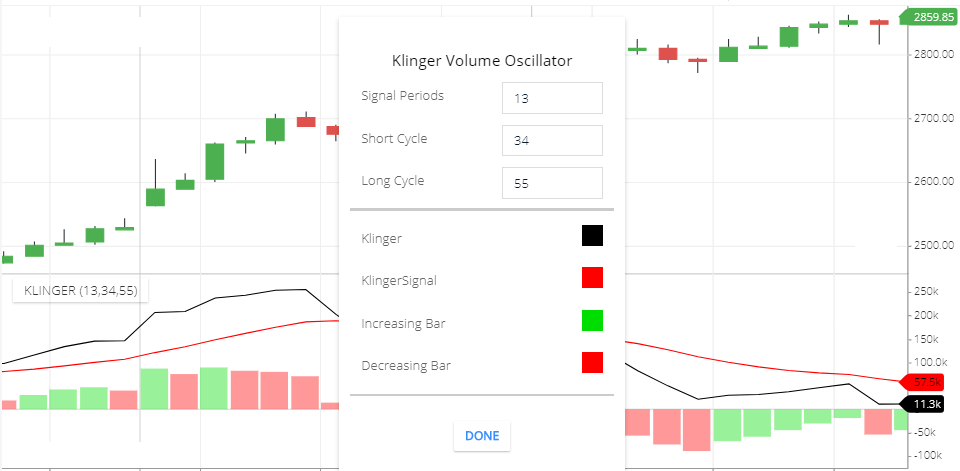

Klinger Volume Oscillator (KVO) ek technical indicator hai jo volume aur price ke relationship ko measure karta hai. Iska calculation volume aur price ke difference ko dekhta hai, jo market trend aur price movement ko samajhne mein madad karta hai.

Yeh indicator do parts mein divide hota hai:

- Klinger Volume: Klinger Volume formula mein present volume aur previous volume ke difference ko consider kiya jata hai, sath hi volume ke price ke sath ke relation ko bhi dekhta hai.

- Positive volume bars jab present volume greater hoti hai previous volume se aur price bhi increase karta hai.

- Negative volume bars jab present volume previous volume se kam hoti hai aur price bhi decrease karta hai.

- Signal Line: Signal line ka use short-term aur long-term trends ko evaluate karne ke liye hota hai. Yeh 13-period EMA (Exponential Moving Average) se calculate hota hai.

- Agar Klinger Volume line Signal line ko cross karta hai aur upar jaata hai, toh yeh bullish signal ho sakta hai.

- Agar Klinger Volume line Signal line ko neeche jaata hai aur cross karta hai, toh yeh bearish signal ho sakta hai.

Interpretation:

- Positive KVO values bullish trends ko represent karte hain jabki negative values bearish trends ko indicate karte hain.

- Jab KVO zero line ko cross karta hai, woh price direction ke change ko suggest karta hai.

- Signal line cross-over buy aur sell signals provide karta hai.

- KVO ka use primarily volume-based confirmation ke liye hota hai, jo ki price movements ko validate karta hai.

KVO ke use mein, traders aur investors typically iska use trend identification, reversals, aur volume-based confirmation ke liye karte hain, jo unko trading decisions lene mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим