INTRODUCTION TO THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Bullish Mat Hold Candlestick pattern forex market mein aksar aik ahem downtrend ke baad hota hai. Is mein panch candlesticks ko shamilkia jata hai, jismein beech wali candlestick pehle walay bearish candles ke oopar "hold" karta hai. Ye pattern bearish se bullish ki taraf momentum ka taqaza karta hai aur traders ke liye long positions mein dakhil honay ka ek mazboot signal ho sakta hai.

IDENTIFYING THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Bullish Mat Hold Candlestick pattern pehchanay ke liye, traders ko in khasosiyat ki taraf tawajjo deni hogi:

a) Pehli candlestick lambi bearish candle hai, jo aik ahem downtrend ko darshaati hai.

b) Dusra candlestick chota bearish candle hai, jo pehle candle ki body ke andar khulta hai.

c) Teesri candlestick bari bullish candle hai, jo dusre candle ki close se niche khulti hai.

d) Chothi candlestick choti bullish candle hai, jo teesri candle ki body ke andar khulti hai.

e) Panchvi candlestick bari bullish candle hai, jo chothi candle ki close se oopar khulti hai aur qareeb qareeb high pe band hoti hai, is se sakht khareedari ka dabao zahir hota hai.

TRADING THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Jab Bullish Mat Hold Candlestick pattern pehchana jata hai, to traders ko paanchvi candlestick ka open ya phir pattern ke support level pe hone wale pullback par long positions mein dakhil honay ka ghor karna chahiye. Stop-loss orders pattern ki low se neechay rakhay jate hain potential reversals se bachne ke liye.

Profit targets technical analysis techniques jaise Fibonacci levels, previous swing highs, ya price projections ke base pe set kiye ja sakte hain. Is ke sath hi, traders dusre indicators ya confirmation signals ka istemal kar sakte hain, jaise trendlines, moving averages, ya volume analysis, taake trade success ke chances ko barhaya ja sake.

CONFIRMATION AND REVERSAL PATTERNS:

Bullish Mat Hold Candlestick pattern khud mein aik strong reversal signal samjha jata hai, lekin traders ko dusre technical indicators ya patterns se mazeed confirmation hasil karne mein faida ho sakta hai. Maslan, RSI ya MACD mein bullish divergence pattern ke bullish bias ko support kar sakti hai. Is ke ilawa, koi ahem resistance level break ya phir bullish chart pattern, jaise flag ya symmetrical triangle, successful trade ki sambhavna ko taiz kar sakta hai.

Waisay hi, agar pattern expected bullish move paida na kar paye, to traders ko ehtiyat karne aur potential reversal patterns ka ghor karnay ki zarurat hai. Misal ke taur pe, agar Bullish Mat Hold pattern ke baad bearish engulfing pattern ya shooting star candlestick banaye jaye, to ye failed bullish reversal aur potential downtrend ki continuation ka ishara ho sakta hai.

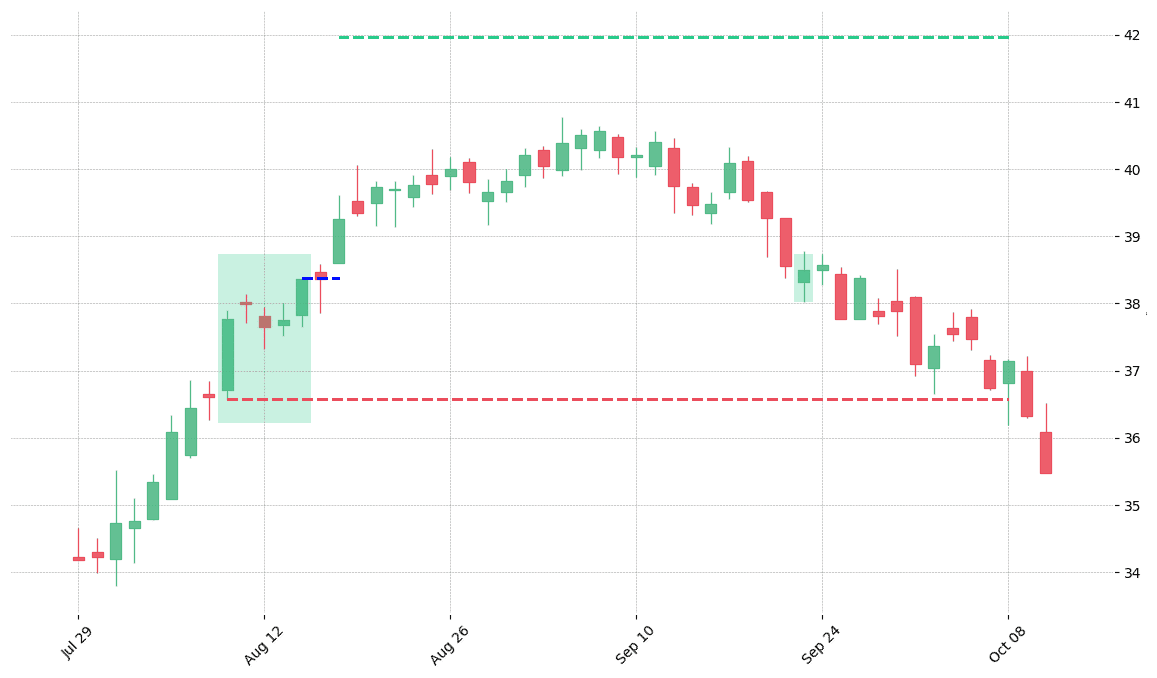

EXAMPLE OF THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Practical misal provide karne ke liye, maan lijiye koi currency pair kuch waqt se ahem downtrend ka samna kar raha hai. Achanak, paanch candlesticks ka series ban jata hai, jismein doosri aur chothi candles pehli aur teesri bari candles ke andar chote bearish candles hai. Panchvi candle chothi candle ki close se oopar khulti hai, jis se sakht khareedari ka dabao zahir hota hai. Traders jo isey Bullish Mat Hold pattern samjhtay hain, long position mein dakhil ho sakte hain aur stop-loss orders pattern ki low se neechay rakh sakte hain.

Jab keemat mazeed barhti hai, traders apni positions ko trailing stop loss ya predetermined targets pe hisab se manage kar sakte hain. Ye misal dikhata hai ke Bullish Mat Hold pattern traders ko market reversal mein munafa kamane ka mauqa deta hai.

Bullish Mat Hold Candlestick pattern forex market mein aksar aik ahem downtrend ke baad hota hai. Is mein panch candlesticks ko shamilkia jata hai, jismein beech wali candlestick pehle walay bearish candles ke oopar "hold" karta hai. Ye pattern bearish se bullish ki taraf momentum ka taqaza karta hai aur traders ke liye long positions mein dakhil honay ka ek mazboot signal ho sakta hai.

IDENTIFYING THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Bullish Mat Hold Candlestick pattern pehchanay ke liye, traders ko in khasosiyat ki taraf tawajjo deni hogi:

a) Pehli candlestick lambi bearish candle hai, jo aik ahem downtrend ko darshaati hai.

b) Dusra candlestick chota bearish candle hai, jo pehle candle ki body ke andar khulta hai.

c) Teesri candlestick bari bullish candle hai, jo dusre candle ki close se niche khulti hai.

d) Chothi candlestick choti bullish candle hai, jo teesri candle ki body ke andar khulti hai.

e) Panchvi candlestick bari bullish candle hai, jo chothi candle ki close se oopar khulti hai aur qareeb qareeb high pe band hoti hai, is se sakht khareedari ka dabao zahir hota hai.

TRADING THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Jab Bullish Mat Hold Candlestick pattern pehchana jata hai, to traders ko paanchvi candlestick ka open ya phir pattern ke support level pe hone wale pullback par long positions mein dakhil honay ka ghor karna chahiye. Stop-loss orders pattern ki low se neechay rakhay jate hain potential reversals se bachne ke liye.

Profit targets technical analysis techniques jaise Fibonacci levels, previous swing highs, ya price projections ke base pe set kiye ja sakte hain. Is ke sath hi, traders dusre indicators ya confirmation signals ka istemal kar sakte hain, jaise trendlines, moving averages, ya volume analysis, taake trade success ke chances ko barhaya ja sake.

CONFIRMATION AND REVERSAL PATTERNS:

Bullish Mat Hold Candlestick pattern khud mein aik strong reversal signal samjha jata hai, lekin traders ko dusre technical indicators ya patterns se mazeed confirmation hasil karne mein faida ho sakta hai. Maslan, RSI ya MACD mein bullish divergence pattern ke bullish bias ko support kar sakti hai. Is ke ilawa, koi ahem resistance level break ya phir bullish chart pattern, jaise flag ya symmetrical triangle, successful trade ki sambhavna ko taiz kar sakta hai.

Waisay hi, agar pattern expected bullish move paida na kar paye, to traders ko ehtiyat karne aur potential reversal patterns ka ghor karnay ki zarurat hai. Misal ke taur pe, agar Bullish Mat Hold pattern ke baad bearish engulfing pattern ya shooting star candlestick banaye jaye, to ye failed bullish reversal aur potential downtrend ki continuation ka ishara ho sakta hai.

EXAMPLE OF THE BULLISH MAT HOLD CANDLESTICK PATTERN:

Practical misal provide karne ke liye, maan lijiye koi currency pair kuch waqt se ahem downtrend ka samna kar raha hai. Achanak, paanch candlesticks ka series ban jata hai, jismein doosri aur chothi candles pehli aur teesri bari candles ke andar chote bearish candles hai. Panchvi candle chothi candle ki close se oopar khulti hai, jis se sakht khareedari ka dabao zahir hota hai. Traders jo isey Bullish Mat Hold pattern samjhtay hain, long position mein dakhil ho sakte hain aur stop-loss orders pattern ki low se neechay rakh sakte hain.

Jab keemat mazeed barhti hai, traders apni positions ko trailing stop loss ya predetermined targets pe hisab se manage kar sakte hain. Ye misal dikhata hai ke Bullish Mat Hold pattern traders ko market reversal mein munafa kamane ka mauqa deta hai.

تبصرہ

Расширенный режим Обычный режим