DEFINITION AND CHARACTERISTICS OF A PIN BAR CANDLESTICK PATTERN :

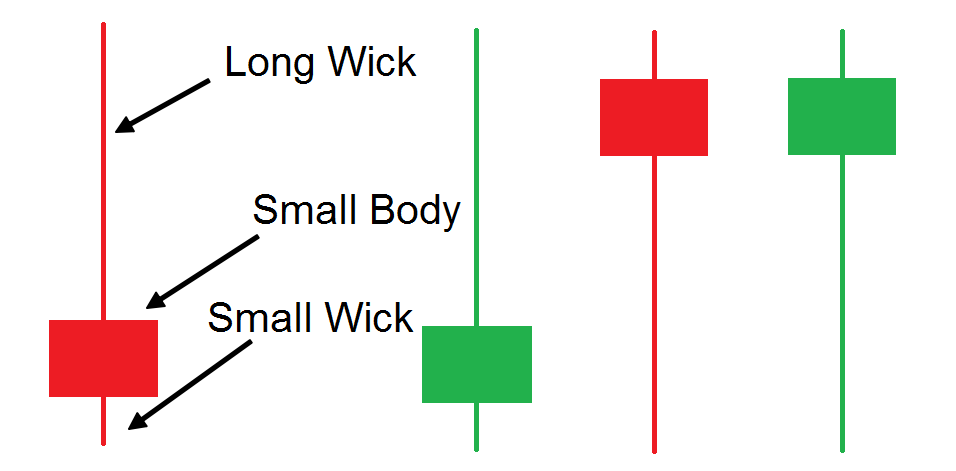

Pin Bar candlestick pattern forex trading mein istemal hone wala aik bohat asar anda technical analysis tool hai jo market trends mein potential reversals ko pehchanne ke liye istemal hota hai. Ye pattern aik single candle se bana hota hai, jisme long tail ya wick aur chota body hota hai. Tail higher ya lower prices ki inkar ko represent karta hai, jisse potential reversal ka pata chalta hai. Candle ka body bullish ya bearish ho sakta hai, lekin sab se ahem baat tail ki length ka body ke sath mutabiq hoti hai.

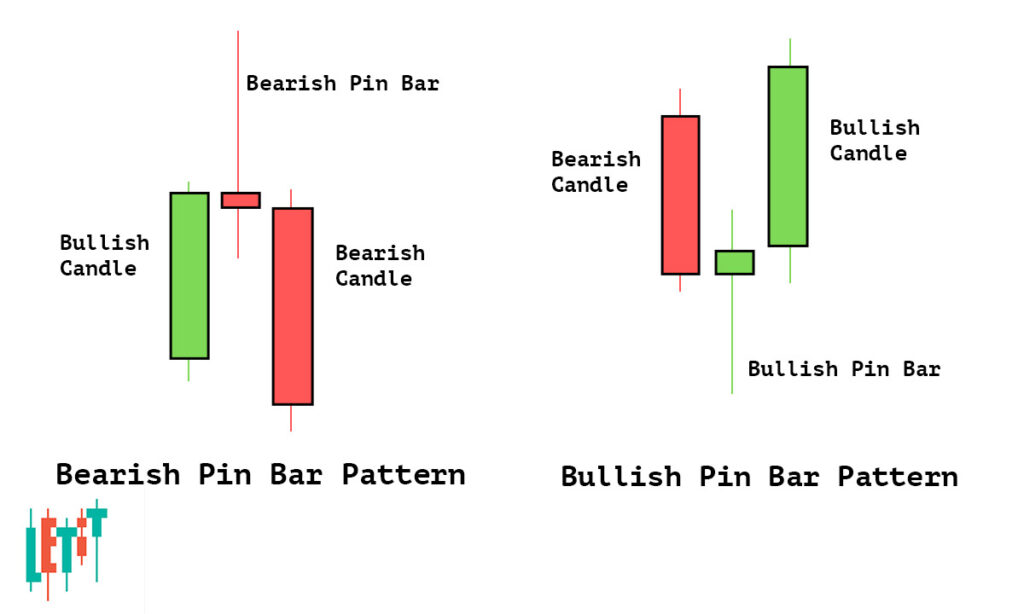

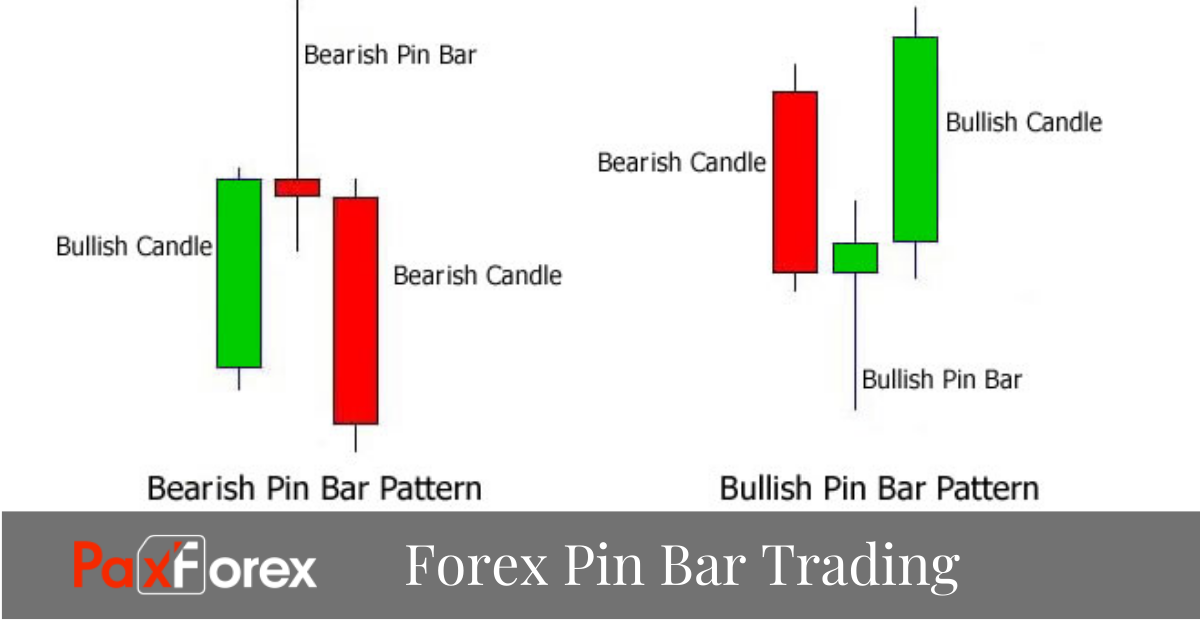

Bullish pin bar ki long tail body ke neeche hoti hai, jabke bearish pin bar ki long tail body ke ooper hoti hai. Ye pattern yeh batata hai ke buyers ya sellers initially control mein the, lekin momentum ko sambhalne mein asar nahi kar sake, jisse strong rejection aur potential reversal ka pata chalta hai. Traders pin bars ki talash kartay hain jo key support ya resistance levels par hote hain, kyunke ye potential reversal ko aur tasdeeq karte hain.

UNDERSTANDING THE SIGNIFICANCE OF A PIN BAR CANDLESTICK PATTERN :

Pin bar candlestick pattern ki ahmiyat se ye pata chalta hai ke market sentiment aur potential price reversals ke bare mein traders ko qeemati maloomat faraham karti hai. Jab aik sustained move ke baad pin bar aata hai, to ye ishara deta hai ke market sentiment changing hai, aur opposite group traders control mein aa rahe hain.

Misaal ke taur par, aik lamba downtrend ke baad bullish pin bar ye batata hai ke buyers prices ko ooper le jane ke liye step le rahe hain. Usi tarah, aik mazboot uptrend ke baad bearish pin bar ye ishara deta hai ke sellers control hasil kar rahe hain aur prices girne shuru ho sakti hain. Ye maloomat un traders ke liye ahmiyat rakhti hain jo potential trend reversals ka faida uthana chahte hain aur optimal levels par trades enter karna chahte hain.

KEY FACTORS TO CONSIDER WHEN TRADING PIN BAR CANDLESTICK PATTERNS :

Jab pin bar pattern highly reliable ho sakta hai, to isse pehle trades lena us par ghor karne ke kuch ahem factors ko samajhna zaroori hai. Sab se pehle, pin bar significant support ya resistance level par hona chahiye. Is se potential reversal mein tahawwur aata hai aur trade ki successful hone ki imkan barh jati hai.

Dusra, traders ko overall market context aur currency pair par jitney bhi fundamental news affect kar sakte hain us par bhi ghor karna chahiye. Agar pin bar prevailing market trend ke khilaf ya high volatility ke waqt aata hai, to ye itna reliable nahi ho sakta.

Aakhir mein, traders ko pin bar ki tail ki length par bhi tawajah deni chahiye. Pin bar ka tail body ke comparison mein lamba ho to strong rejection aur reversal ki imkan barh jati hai. Lekin agar pin bar ka tail chota ho, to ye weak rejection aur kam reliable signal ka pata deta hai.

ENTRY AND EXIT STRATEGIES WHEN TRADING PIN BAR CANDLESTICK PATTERNS :

Pin bar candlestick patterns trading mein, traders apne trading style aur risk tolerance ke mutabiq mukhtalif entry aur exit strategies istemal kar sakte hain. Aik common approach ye hai ke trade pin bar formation confirm hone ke baad enter kiya jaye.

Misaal ke taur par, trader bullish pin bar ke high se upar buy order place kar sakta hai ya bearish pin bar ke low se neeche sell order place kar sakta hai. Ye entry strategy potential reversal ko capture karne aur subsequent price move ko follow karne ki koshish karti hai.

Exit strategies ke liye, traders predetermined profit target set kar sakte hain ya trailing stop-loss orders ka istemaal karke apne gains ko protect kar sakte hain. Kuch traders pin bar ki high ya low ko exit level ke taur pe istemaal karte hain, jahan par trade ko band kar dete hain agar price unki direction ke khilaaf move karta hai.

LIMITATIONS AND POTENTIAL PITFALLS OF TRADING PIN BAR CANDLESTICK PATTERNS :

Pin Bar Candlestick Patterns ek widely used aur reliable technical analysis tool hai, lekin ye infallible nahi hai, aur traders ko iski limitations ke baare mein jaan deni chahiye. Ek aam trap hai overtrading ka, jahan traders har jagah pin bars dekhkar proper analysis kiye bina har signal le lete hain. Isse excessive losses aur poor risk management ho sakta hai.

Ek aur limitation hai false signal rate ki. Pin bars potential reversals ke baare mein valuable information provide karte hain, lekin har pin bar significant price move mai nahi result karta hai. Traders ko false signals ke liye prepared rehna chahiye aur dusre technical indicators ya confirmation signals ka istemaal karke successful trade ki probability ko increase karna chahiye.

Conclusion mein, Pin Bar candlestick pattern ek powerful tool hai jo traders ko forex market mein potential reversals identify karne mai madad kar sakta hai. Iski definition, characteristics aur significance ko samajhna, saath hi trading ke liye key factors ko consider karna, is pattern ki effectiveness ko enhance kar sakta hai.

Pin Bar candlestick pattern forex trading mein istemal hone wala aik bohat asar anda technical analysis tool hai jo market trends mein potential reversals ko pehchanne ke liye istemal hota hai. Ye pattern aik single candle se bana hota hai, jisme long tail ya wick aur chota body hota hai. Tail higher ya lower prices ki inkar ko represent karta hai, jisse potential reversal ka pata chalta hai. Candle ka body bullish ya bearish ho sakta hai, lekin sab se ahem baat tail ki length ka body ke sath mutabiq hoti hai.

Bullish pin bar ki long tail body ke neeche hoti hai, jabke bearish pin bar ki long tail body ke ooper hoti hai. Ye pattern yeh batata hai ke buyers ya sellers initially control mein the, lekin momentum ko sambhalne mein asar nahi kar sake, jisse strong rejection aur potential reversal ka pata chalta hai. Traders pin bars ki talash kartay hain jo key support ya resistance levels par hote hain, kyunke ye potential reversal ko aur tasdeeq karte hain.

UNDERSTANDING THE SIGNIFICANCE OF A PIN BAR CANDLESTICK PATTERN :

Pin bar candlestick pattern ki ahmiyat se ye pata chalta hai ke market sentiment aur potential price reversals ke bare mein traders ko qeemati maloomat faraham karti hai. Jab aik sustained move ke baad pin bar aata hai, to ye ishara deta hai ke market sentiment changing hai, aur opposite group traders control mein aa rahe hain.

Misaal ke taur par, aik lamba downtrend ke baad bullish pin bar ye batata hai ke buyers prices ko ooper le jane ke liye step le rahe hain. Usi tarah, aik mazboot uptrend ke baad bearish pin bar ye ishara deta hai ke sellers control hasil kar rahe hain aur prices girne shuru ho sakti hain. Ye maloomat un traders ke liye ahmiyat rakhti hain jo potential trend reversals ka faida uthana chahte hain aur optimal levels par trades enter karna chahte hain.

KEY FACTORS TO CONSIDER WHEN TRADING PIN BAR CANDLESTICK PATTERNS :

Jab pin bar pattern highly reliable ho sakta hai, to isse pehle trades lena us par ghor karne ke kuch ahem factors ko samajhna zaroori hai. Sab se pehle, pin bar significant support ya resistance level par hona chahiye. Is se potential reversal mein tahawwur aata hai aur trade ki successful hone ki imkan barh jati hai.

Dusra, traders ko overall market context aur currency pair par jitney bhi fundamental news affect kar sakte hain us par bhi ghor karna chahiye. Agar pin bar prevailing market trend ke khilaf ya high volatility ke waqt aata hai, to ye itna reliable nahi ho sakta.

Aakhir mein, traders ko pin bar ki tail ki length par bhi tawajah deni chahiye. Pin bar ka tail body ke comparison mein lamba ho to strong rejection aur reversal ki imkan barh jati hai. Lekin agar pin bar ka tail chota ho, to ye weak rejection aur kam reliable signal ka pata deta hai.

ENTRY AND EXIT STRATEGIES WHEN TRADING PIN BAR CANDLESTICK PATTERNS :

Pin bar candlestick patterns trading mein, traders apne trading style aur risk tolerance ke mutabiq mukhtalif entry aur exit strategies istemal kar sakte hain. Aik common approach ye hai ke trade pin bar formation confirm hone ke baad enter kiya jaye.

Misaal ke taur par, trader bullish pin bar ke high se upar buy order place kar sakta hai ya bearish pin bar ke low se neeche sell order place kar sakta hai. Ye entry strategy potential reversal ko capture karne aur subsequent price move ko follow karne ki koshish karti hai.

Exit strategies ke liye, traders predetermined profit target set kar sakte hain ya trailing stop-loss orders ka istemaal karke apne gains ko protect kar sakte hain. Kuch traders pin bar ki high ya low ko exit level ke taur pe istemaal karte hain, jahan par trade ko band kar dete hain agar price unki direction ke khilaaf move karta hai.

LIMITATIONS AND POTENTIAL PITFALLS OF TRADING PIN BAR CANDLESTICK PATTERNS :

Pin Bar Candlestick Patterns ek widely used aur reliable technical analysis tool hai, lekin ye infallible nahi hai, aur traders ko iski limitations ke baare mein jaan deni chahiye. Ek aam trap hai overtrading ka, jahan traders har jagah pin bars dekhkar proper analysis kiye bina har signal le lete hain. Isse excessive losses aur poor risk management ho sakta hai.

Ek aur limitation hai false signal rate ki. Pin bars potential reversals ke baare mein valuable information provide karte hain, lekin har pin bar significant price move mai nahi result karta hai. Traders ko false signals ke liye prepared rehna chahiye aur dusre technical indicators ya confirmation signals ka istemaal karke successful trade ki probability ko increase karna chahiye.

Conclusion mein, Pin Bar candlestick pattern ek powerful tool hai jo traders ko forex market mein potential reversals identify karne mai madad kar sakta hai. Iski definition, characteristics aur significance ko samajhna, saath hi trading ke liye key factors ko consider karna, is pattern ki effectiveness ko enhance kar sakta hai.

تبصرہ

Расширенный режим Обычный режим