DEFINITION AND CALCULATION OF GOLDEN CROSS IN FOREX :

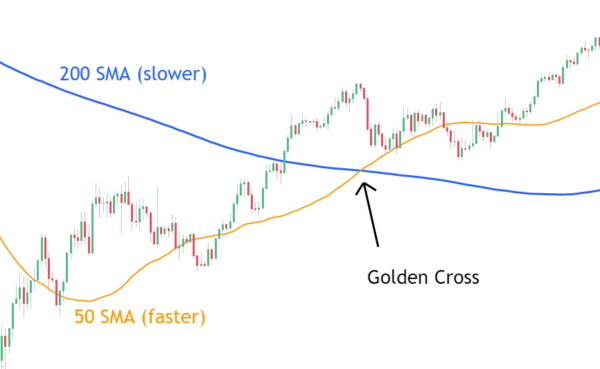

Golden Cross forex market mein istemaal hone wala ek technical analysis indicator hai jo bullish trends ko pehchane ke liye istemal hota hai. IsGolden Cross ka matlab hai ki short-term moving average (aam taur par 50-day MA) lamb-term moving average (aam taur par 200-day MA) ko upar se cross kar jata hai. Yeh cross market sentiment ko bearish se bullish mein badalne ka sanket hai, jisse yeh samjhaya jata hai ki ab accha samay hai long positions mein enter karne ke liye ya phir existing long positions ko hold karne ke liye.

Golden Cross ko calculate karne ke liye, pehle aapko chune gaye short-term aur long-term moving averages ka faisla karna hoga. Sabse aam istemal hone wale averages 50-day aur 200-day moving averages hai. Yeh averages currency pair ke specified time period mein average closing price lekar calculate kiye jate hai.

Jab aapke paas moving averages ho jaye, toh bas unhe price chart par plot karna hai. Jab short-term moving average long-term moving average se upar cross karta hai, aur "golden cross" banata hai, toh yeh traders ke liye ek buying signal hai.

Yeh jaruri hai ki Golden Cross ek lagging indicator hai, matlab yeh trend ko confirm karta hai, jo pehle se develop ho chuki hai. Traders ise aksar dusre indicators aur tools ke saath combine karte hai, taki successful trades ke probability badh sake.

SIGNIFICANCE OF THE GOLDEN CROSS IN FOREX :

Golden Cross forex market mein mahatvapurna hai kyun ki yeh bullish trend ki pushti karta hai. Jab short-term moving average long-term moving average se upar cross karta hai, yeh ishara karta hai ki buyers market mein control kar rahe hai aur currency pair aur bhi upar ja sakta hai.

Yeh bullish signal trend-following strategies istemal karne wale traders ke liye khasa mahatvapurna ho sakta hai. Golden Cross ko pehchante hue, woh long positions ko upward trend ke shuruat mein enter kar sakte hai aur aur bhi price appreciation se profit kar sakte hai.

Golden Cross ka mahatva sirf individual currency pairs tak simit nahi hai. Yeh specific currency crosses aur poore currency baskets mein bhi bullish trends ki pehchan karne ke liye istemal kiya ja sakta hai.

Halaanki, Golden Cross par pure tawakkal karne par savdhani bartani chahiye. Jaise ki koi bhi technical indicator, yeh bhi 100% perfect nahi hai aur false signals bhi generate kar sakta hai. Traders ko isko strength of the bullish trend ko confirm karne ke liye aur dusre indicators aur tools ke saath istemal karna chahiye.

GOLDEN CROSS AS A REVERSAL PATTERN IN FOREX :

Golden Cross normally bullish trend ki pehchane ke liye istemal kiya jata hai, lekin yeh reversal pattern ke roop mein bhi kaam kar sakta hai. Yeh uss waqt hota hai jab short-term moving average long-term moving average se neeche cross karta hai, aur "death cross" banata hai.

Death cross ko bearish signal samjha jata hai aur yeh ishara karta hai ki sellers market mein control kar rahe hai. Traders jo iss pattern ko pehchante hai, woh short positions mein enter karne ya long positions ko exit karne ka vichaar kar sakte hai, taaki woh downside price movements ka fayda utha sake.

Golden Cross ka reversal aspect counter-trend strategies istemal karne wale traders ke liye valuable ho sakta hai. Potential reversals ko pehchante hue, woh positions enter kar sakte hai, jo prevailing trend ke khilaaf jaate hai aur price moves ko opposite direction mein profit ke liye upyog kar sakte hai.

Halaanki, note karna mahatvapurna hai ki Golden Cross ka reversal aspect bullish trend confirmation se kam common aur reliable hai. Traders ko savdhani bartani chahiye aur Golden Cross par trades enter karne se pehle reversal ko confirm karne ke liye aur dusre technical indicators aur tools ka upyog karna chahiye.

RISK AND PITFALLS OF GOLDEN CROSS TRADING :

Jabki Golden Cross bullish trends ka pata lagane ke liye ek upyogi tool ho sakta hai, lekin ye apne risk aur nuksaan ke saathbhi hai. Traders ko in sambhavnayein aur nuksaanon ke baare mein jagruk hona chahiye aur Golden Cross ka istemaal karte samay inhe gaur mein lena chahiye.

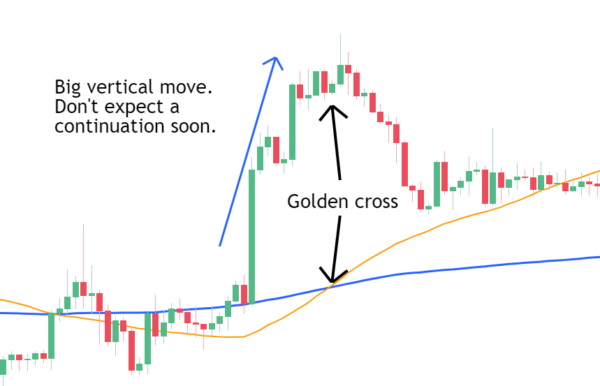

Golden Cross trading ka ek mukhya risk hai false signals ka sambhavna. Golden Cross ek lagging indicator hai aur bullish trend ka shuru hone ka sahi pata nahi laga sakta hai. Traders ko iska istemaal dusre indicators aur tools ke saath karna chahiye, jisse trend ki taakat aur sustaai ko confirm kiya ja sake.

Dusra risk hai whipsaw effect ka sambhavna, jahan price moving averages ke beech mein hin aur wahin cross karti hai, jisse multiple buy aur sell signals generate hote hain. Isse frequent aur avashyak se adhik trading ho sakti hai, jiski wajah se transaction costs aur nuksaan badh sakte hain.

Iske alawa, Golden Cross range-bound markets mein jahan price sidewise move kar rahi hai aur clear trending direction nahi hai, usmein itna prabhavi nahi ho sakta hai. Traders ko in market conditions mein Golden Cross ka istemaal samajhdari se karna chahiye aur dusre trading strategies ka istemaal karna chahiye, jo range-bound markets ke liye adhik upyukt hain.

GOLDEN CROSS STRATEGIES AND VARIATIONS :

Traders ne Golden Cross ke base par alag-alag strategies aur variations develop kiye hain, jisse iski prabhavita ko badhaya ja sake aur ise alag-alag trading conditions mein adapt kiya ja sake. Inme se kuch strategies include karte hain multiple moving averages ka istemaal, volume indicators ka shaamil hona ya phir Golden Cross ko chhote time frames par apply karna.

Ek lokpriya variation hai "Golden Cross and Moving Average Filter" strategy ka istemaal karna. Is strategy mein Golden Cross ko ek aur chhote time frame wale moving average ke saath combine kiya jata hai, jisse false signals ko filter kiya ja sake. For example, koi trader 50-day aur 100-day moving averages ka istemaal kar sakta hai, aur sirf tab Golden Cross ko valid samjhega jab 50-day MA bhi 100-day MA se upar ho.

Golden Cross forex market mein istemaal hone wala ek technical analysis indicator hai jo bullish trends ko pehchane ke liye istemal hota hai. IsGolden Cross ka matlab hai ki short-term moving average (aam taur par 50-day MA) lamb-term moving average (aam taur par 200-day MA) ko upar se cross kar jata hai. Yeh cross market sentiment ko bearish se bullish mein badalne ka sanket hai, jisse yeh samjhaya jata hai ki ab accha samay hai long positions mein enter karne ke liye ya phir existing long positions ko hold karne ke liye.

Golden Cross ko calculate karne ke liye, pehle aapko chune gaye short-term aur long-term moving averages ka faisla karna hoga. Sabse aam istemal hone wale averages 50-day aur 200-day moving averages hai. Yeh averages currency pair ke specified time period mein average closing price lekar calculate kiye jate hai.

Jab aapke paas moving averages ho jaye, toh bas unhe price chart par plot karna hai. Jab short-term moving average long-term moving average se upar cross karta hai, aur "golden cross" banata hai, toh yeh traders ke liye ek buying signal hai.

Yeh jaruri hai ki Golden Cross ek lagging indicator hai, matlab yeh trend ko confirm karta hai, jo pehle se develop ho chuki hai. Traders ise aksar dusre indicators aur tools ke saath combine karte hai, taki successful trades ke probability badh sake.

SIGNIFICANCE OF THE GOLDEN CROSS IN FOREX :

Golden Cross forex market mein mahatvapurna hai kyun ki yeh bullish trend ki pushti karta hai. Jab short-term moving average long-term moving average se upar cross karta hai, yeh ishara karta hai ki buyers market mein control kar rahe hai aur currency pair aur bhi upar ja sakta hai.

Yeh bullish signal trend-following strategies istemal karne wale traders ke liye khasa mahatvapurna ho sakta hai. Golden Cross ko pehchante hue, woh long positions ko upward trend ke shuruat mein enter kar sakte hai aur aur bhi price appreciation se profit kar sakte hai.

Golden Cross ka mahatva sirf individual currency pairs tak simit nahi hai. Yeh specific currency crosses aur poore currency baskets mein bhi bullish trends ki pehchan karne ke liye istemal kiya ja sakta hai.

Halaanki, Golden Cross par pure tawakkal karne par savdhani bartani chahiye. Jaise ki koi bhi technical indicator, yeh bhi 100% perfect nahi hai aur false signals bhi generate kar sakta hai. Traders ko isko strength of the bullish trend ko confirm karne ke liye aur dusre indicators aur tools ke saath istemal karna chahiye.

GOLDEN CROSS AS A REVERSAL PATTERN IN FOREX :

Golden Cross normally bullish trend ki pehchane ke liye istemal kiya jata hai, lekin yeh reversal pattern ke roop mein bhi kaam kar sakta hai. Yeh uss waqt hota hai jab short-term moving average long-term moving average se neeche cross karta hai, aur "death cross" banata hai.

Death cross ko bearish signal samjha jata hai aur yeh ishara karta hai ki sellers market mein control kar rahe hai. Traders jo iss pattern ko pehchante hai, woh short positions mein enter karne ya long positions ko exit karne ka vichaar kar sakte hai, taaki woh downside price movements ka fayda utha sake.

Golden Cross ka reversal aspect counter-trend strategies istemal karne wale traders ke liye valuable ho sakta hai. Potential reversals ko pehchante hue, woh positions enter kar sakte hai, jo prevailing trend ke khilaaf jaate hai aur price moves ko opposite direction mein profit ke liye upyog kar sakte hai.

Halaanki, note karna mahatvapurna hai ki Golden Cross ka reversal aspect bullish trend confirmation se kam common aur reliable hai. Traders ko savdhani bartani chahiye aur Golden Cross par trades enter karne se pehle reversal ko confirm karne ke liye aur dusre technical indicators aur tools ka upyog karna chahiye.

RISK AND PITFALLS OF GOLDEN CROSS TRADING :

Jabki Golden Cross bullish trends ka pata lagane ke liye ek upyogi tool ho sakta hai, lekin ye apne risk aur nuksaan ke saathbhi hai. Traders ko in sambhavnayein aur nuksaanon ke baare mein jagruk hona chahiye aur Golden Cross ka istemaal karte samay inhe gaur mein lena chahiye.

Golden Cross trading ka ek mukhya risk hai false signals ka sambhavna. Golden Cross ek lagging indicator hai aur bullish trend ka shuru hone ka sahi pata nahi laga sakta hai. Traders ko iska istemaal dusre indicators aur tools ke saath karna chahiye, jisse trend ki taakat aur sustaai ko confirm kiya ja sake.

Dusra risk hai whipsaw effect ka sambhavna, jahan price moving averages ke beech mein hin aur wahin cross karti hai, jisse multiple buy aur sell signals generate hote hain. Isse frequent aur avashyak se adhik trading ho sakti hai, jiski wajah se transaction costs aur nuksaan badh sakte hain.

Iske alawa, Golden Cross range-bound markets mein jahan price sidewise move kar rahi hai aur clear trending direction nahi hai, usmein itna prabhavi nahi ho sakta hai. Traders ko in market conditions mein Golden Cross ka istemaal samajhdari se karna chahiye aur dusre trading strategies ka istemaal karna chahiye, jo range-bound markets ke liye adhik upyukt hain.

GOLDEN CROSS STRATEGIES AND VARIATIONS :

Traders ne Golden Cross ke base par alag-alag strategies aur variations develop kiye hain, jisse iski prabhavita ko badhaya ja sake aur ise alag-alag trading conditions mein adapt kiya ja sake. Inme se kuch strategies include karte hain multiple moving averages ka istemaal, volume indicators ka shaamil hona ya phir Golden Cross ko chhote time frames par apply karna.

Ek lokpriya variation hai "Golden Cross and Moving Average Filter" strategy ka istemaal karna. Is strategy mein Golden Cross ko ek aur chhote time frame wale moving average ke saath combine kiya jata hai, jisse false signals ko filter kiya ja sake. For example, koi trader 50-day aur 100-day moving averages ka istemaal kar sakta hai, aur sirf tab Golden Cross ko valid samjhega jab 50-day MA bhi 100-day MA se upar ho.

تبصرہ

Расширенный режим Обычный режим