INTRODUCTION TO DOWNSIDE TASUKI GAP PATTERN:

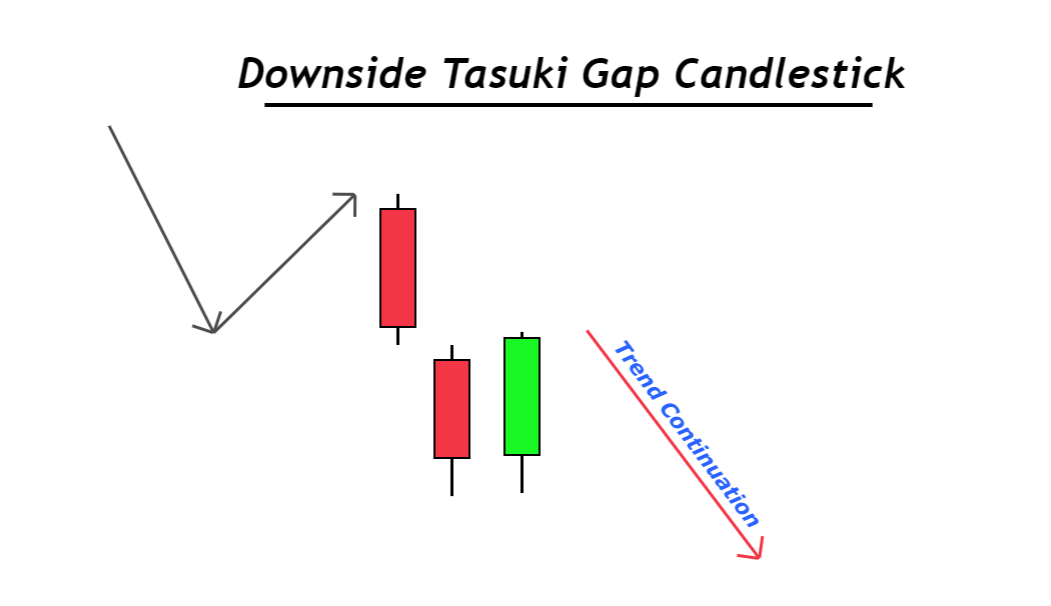

Downside Tasuki Gap pattern forex trading mein commonly observed chart pattern hai jo ek potential reversal ko signify karta hai downward trend mein. Is pattern mein teen candlesticks hote hain: ekbearish candlestick, phir ek gap down, aur phir do consecutive bullish candlesticks. Is pattern ka naam "tasuki" naam ke Japanese word se liya gaya hai, jo traditional Japanese garment hai jismein do lambe sashes ya bands waist ke aas paas bandhe hote hain.

CHARACTERISTICS OF THE DOWNSIDE TASUKI GAP PATTERN:

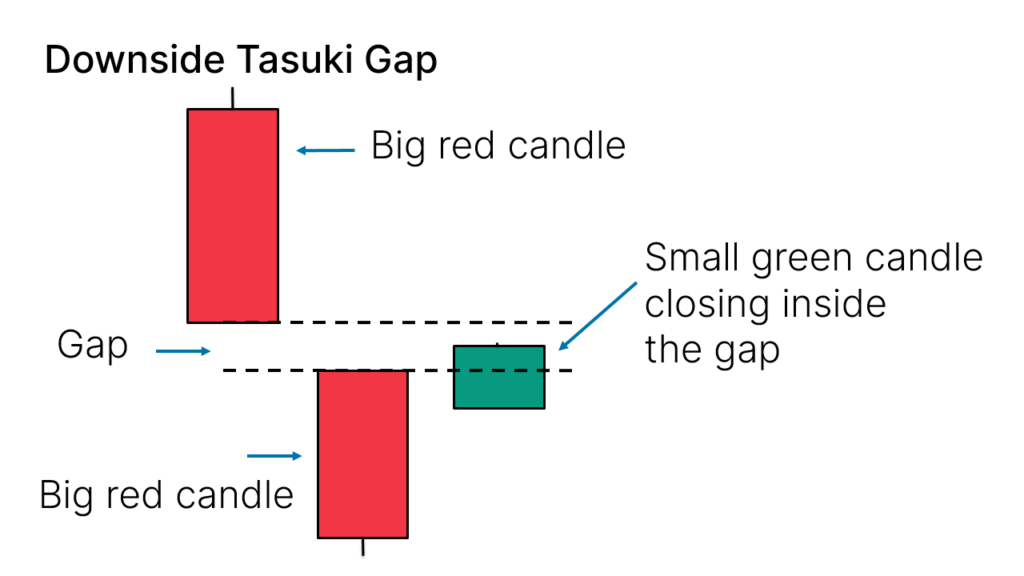

Downside Tasuki Gap pattern ki khasiyat hai uski distinct structure aur specific candlestick formations. Pattern mein pehla candlestick ek bearish candlestick hota hai, jo downward price movement ki continuation ko indicate karta hai. Iske baad gap down hota hai, jismein dusre candlestick ki opening price pehle candlestick ki closing price se kam hoti hai. Dusre aur teesre candlesticks dono bullish candlesticks hote hain, jismein dusra candlestick pehle candlestick ke andar close hota hai aur teesra candlestick dusre candlestick ki closing price se upar open hota hai.

SIGNIFICANCE OF THE DOWNSIDE TASUKI GAP PATTERN:

Downside Tasuki Gap pattern bearish se bullish trend ki potential reversal ki significant signal samjha jata hai. Isse samjha jata hai ki selling pressure khatam ho chuki hai aur buyers market mein control lene ke liye aage badhe hain. Pattern sentiment mein shift dikhata hai aur forex traders ko trend reversal ki early indication deta hai. Halaanki, pattern ki validity ko confirm karna technical indicators ki analysis aur overall market conditions ko consider karke zaruri hai.

TRADING STRATEGIES USING THE DOWNSIDE TASUKI GAP PATTERN:

Traders Downside Tasuki Gap pattern ka istemaal karke trading strategies develop kar sakte hain jo potential trend reversals ka faida utha sakte hain. Ek strategy ye hai ki pattern ke formation aur confirm hone ka wait karein phir long position enter karne ke liye. Isko karne ke liye third candlestick ki high se thoda upar buy order place karein, aur stop-loss order first candlestick ki low se neeche rakhein. Ek aur strategy ye hai ki pattern complete hone ke baad pullback ka wait karein phir pullback low se neeche stop-loss order ke saath long position enter karein.

LIMITATIONS AND CONSIDERATIONS:

Downside Tasuki Gap pattern potential trend reversals ke baare mein valuable information provide kar sakta hai, lekin iski limitations ko consider karna aur use karna zaruri hai dusre technical analysis tools ke saath. False signals ho sakte hain, isliye overall market conditions ki analysis karna aur additional indicators ki confirmation par rely karna zaruri hai. Additionally, proper risk management techniques ka istemaal karna aur appropriate stop-loss orders set karna potential losses se bachne ke liye zaruri hai. Forex traders ko market manipulations ya sudden news events ke possibility ke baare mein bhi aware rehna chahiye jo pattern ki reliability ko invalidate kar sakte hain.

Downside Tasuki Gap pattern forex trading mein commonly observed chart pattern hai jo ek potential reversal ko signify karta hai downward trend mein. Is pattern mein teen candlesticks hote hain: ekbearish candlestick, phir ek gap down, aur phir do consecutive bullish candlesticks. Is pattern ka naam "tasuki" naam ke Japanese word se liya gaya hai, jo traditional Japanese garment hai jismein do lambe sashes ya bands waist ke aas paas bandhe hote hain.

CHARACTERISTICS OF THE DOWNSIDE TASUKI GAP PATTERN:

Downside Tasuki Gap pattern ki khasiyat hai uski distinct structure aur specific candlestick formations. Pattern mein pehla candlestick ek bearish candlestick hota hai, jo downward price movement ki continuation ko indicate karta hai. Iske baad gap down hota hai, jismein dusre candlestick ki opening price pehle candlestick ki closing price se kam hoti hai. Dusre aur teesre candlesticks dono bullish candlesticks hote hain, jismein dusra candlestick pehle candlestick ke andar close hota hai aur teesra candlestick dusre candlestick ki closing price se upar open hota hai.

SIGNIFICANCE OF THE DOWNSIDE TASUKI GAP PATTERN:

Downside Tasuki Gap pattern bearish se bullish trend ki potential reversal ki significant signal samjha jata hai. Isse samjha jata hai ki selling pressure khatam ho chuki hai aur buyers market mein control lene ke liye aage badhe hain. Pattern sentiment mein shift dikhata hai aur forex traders ko trend reversal ki early indication deta hai. Halaanki, pattern ki validity ko confirm karna technical indicators ki analysis aur overall market conditions ko consider karke zaruri hai.

TRADING STRATEGIES USING THE DOWNSIDE TASUKI GAP PATTERN:

Traders Downside Tasuki Gap pattern ka istemaal karke trading strategies develop kar sakte hain jo potential trend reversals ka faida utha sakte hain. Ek strategy ye hai ki pattern ke formation aur confirm hone ka wait karein phir long position enter karne ke liye. Isko karne ke liye third candlestick ki high se thoda upar buy order place karein, aur stop-loss order first candlestick ki low se neeche rakhein. Ek aur strategy ye hai ki pattern complete hone ke baad pullback ka wait karein phir pullback low se neeche stop-loss order ke saath long position enter karein.

LIMITATIONS AND CONSIDERATIONS:

Downside Tasuki Gap pattern potential trend reversals ke baare mein valuable information provide kar sakta hai, lekin iski limitations ko consider karna aur use karna zaruri hai dusre technical analysis tools ke saath. False signals ho sakte hain, isliye overall market conditions ki analysis karna aur additional indicators ki confirmation par rely karna zaruri hai. Additionally, proper risk management techniques ka istemaal karna aur appropriate stop-loss orders set karna potential losses se bachne ke liye zaruri hai. Forex traders ko market manipulations ya sudden news events ke possibility ke baare mein bhi aware rehna chahiye jo pattern ki reliability ko invalidate kar sakte hain.

تبصرہ

Расширенный режим Обычный режим