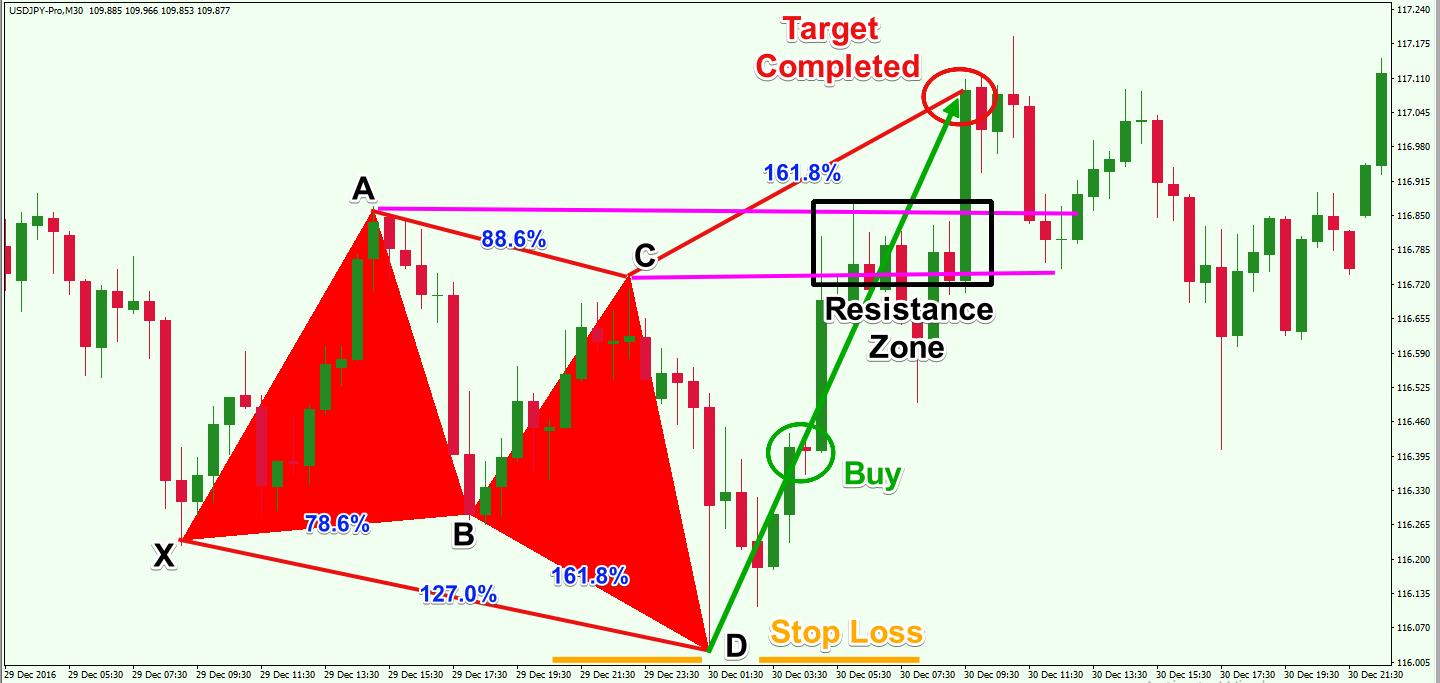

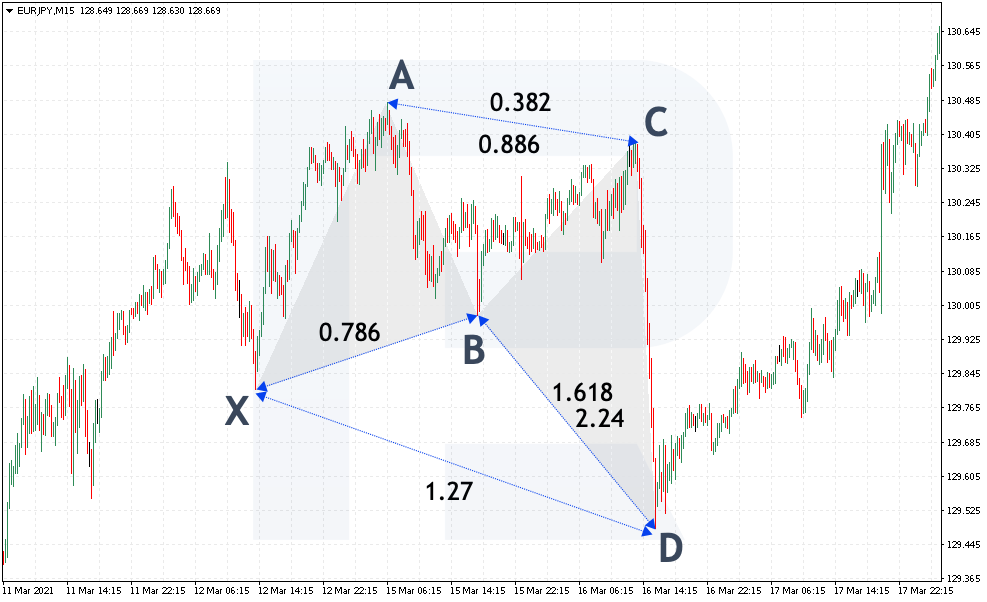

Butterfly Candlestick Pattern

Butterfly candlestick pattern ye ishara karta hai keh sellers apni sell pressure khatam kar chuke hain aur buyers ke dabaav ke bajaaye keemat ko oonchi karne mein mautaad hain. Bearish pattern mein, ye ishara karta hai keh buyers apni buy pressure khatam kar chuke hain aur sellers ke dabaav ke bajaaye keemat ko neechay le jane mein mautaad hain.

Butterfly pattern ka presence trendline break ya Fibonacci retracement level ke saath ek zyada confluence of signals provide kar sakta hai. Iske ilawa, traders alag-alag timeframes par candlestick patterns ka istemal karke potential reversal ki aur evidence hasil kar sakte hain. Multip0le factors ko apni analysis mein shamil karke....ye aik reversal pattern ha, jaisa k name sa zahir ha k is ma three candles hoti hain jo teeno lambi aur bullish hoti hain, teeno candles ki lambai b aik jaisi hoti ha aur har candle ka oppening point dusri k upar hota ha,

down trend ki bottom ma traders nafsiati aur buniadi wajoohat ki waja sa market ma trend changing ka andaza lagatay hain aur wo buy ki trades kartay hain, ye buy ka amal three white soldiers pattern bnata ha, Multiple factors ko apni analysis mein shamil karke,ye ishara karta hai keh sellers apni sell pressure khatam kar chuke hain aur buyers ke dabaav ke bajaaye keemat ko oonchi karne mein mautaad hain. jiska matlab hai ki yeh indicate karta hai ke market ka trend reverse hone wala hai. Is pattern mein kuch khas candlesticks ka combination hota hai, jise dekh kar traders infer karte hain ke market mein reversal hone ke chances hain.

down trend ki bottom ma traders nafsiati aur buniadi wajoohat ki waja sa market ma trend changing ka andaza lagatay hain aur wo buy ki trades kartay hain, ye buy ka amal three white soldiers pattern bnata ha, Multiple factors ko apni analysis mein shamil karke,ye ishara karta hai keh sellers apni sell pressure khatam kar chuke hain aur buyers ke dabaav ke bajaaye keemat ko oonchi karne mein mautaad hain. jiska matlab hai ki yeh indicate karta hai ke market ka trend reverse hone wala hai. Is pattern mein kuch khas candlesticks ka combination hota hai, jise dekh kar traders infer karte hain ke market mein reversal hone ke chances hain.

تبصرہ

Расширенный режим Обычный режим