Forex trading mein, market trends aur reversals ko pehchanna aur samajhna mahir tijaratkaron ke liye zaroori hai. Ek aise geometric pattern ka jo market mein hone wale reversals ko dikhane mein madad karta hai, wo hai "Crab Pattern."

Crab Pattern Kya Hai?

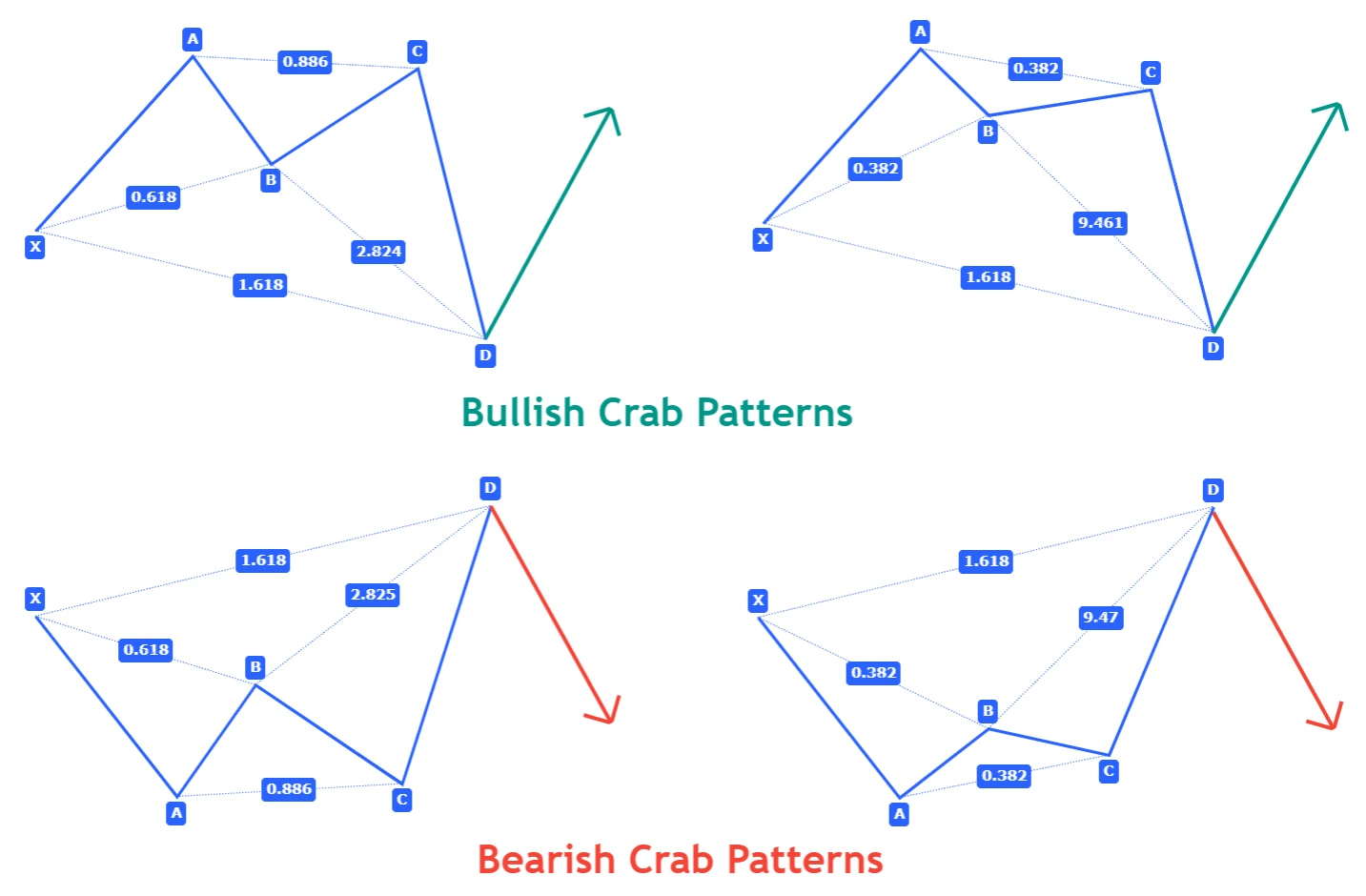

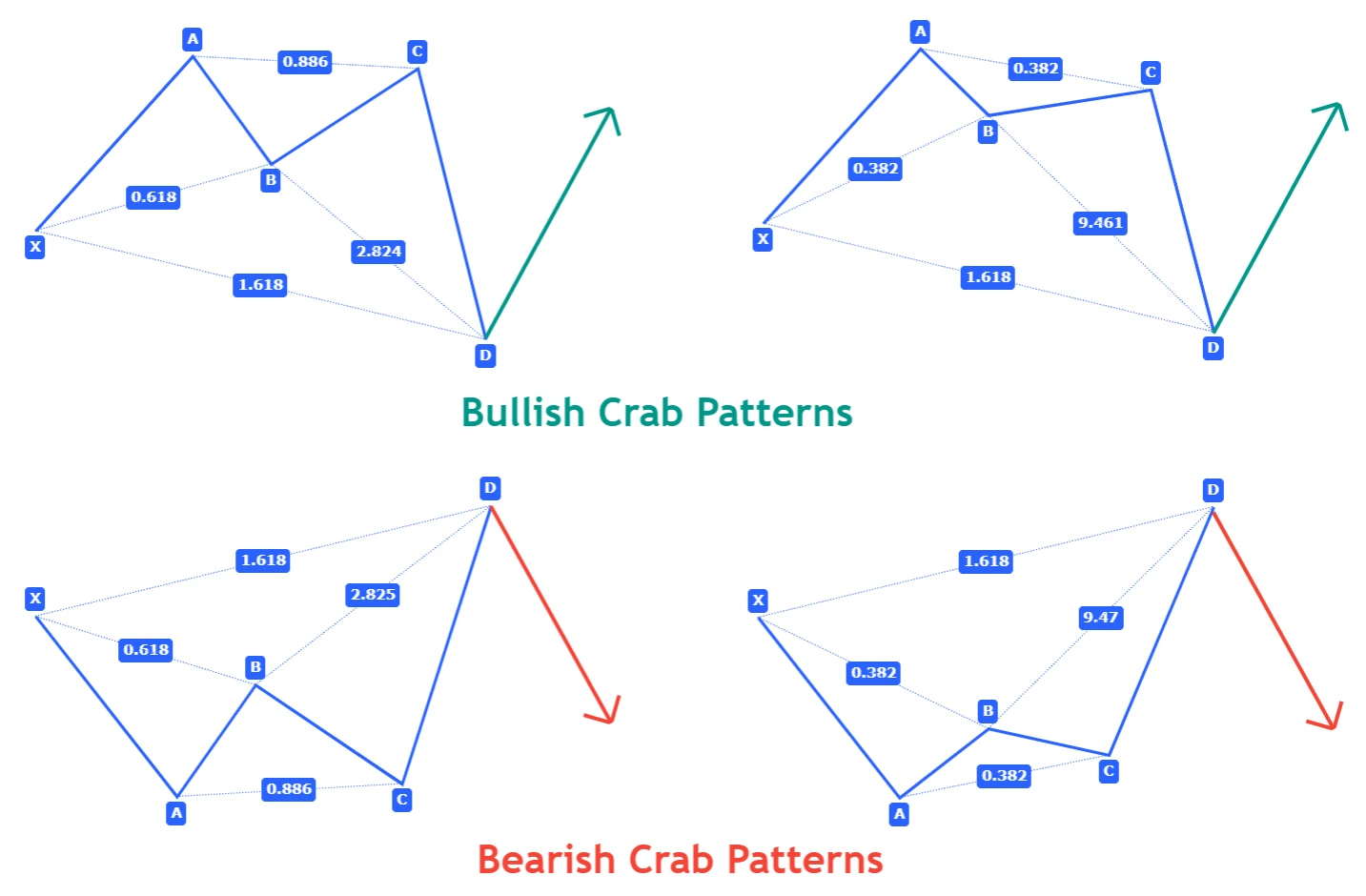

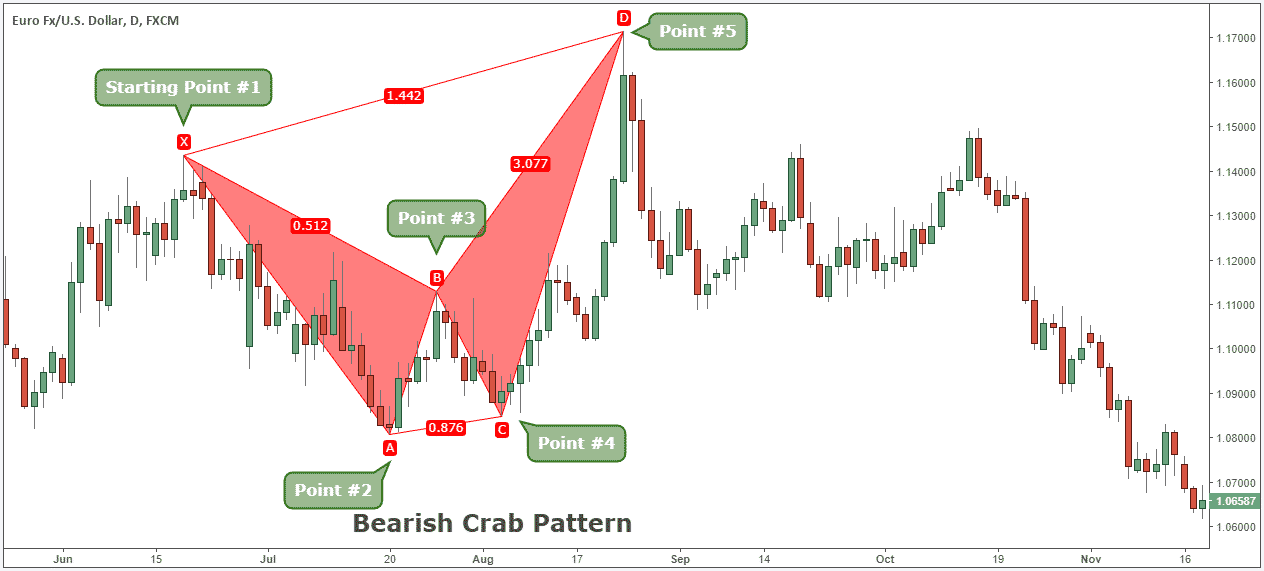

Crab pattern, Fibonacci retracement levels par mabni ek specific geometric shape hai. Ye pattern mainly 4 legs (X to A, A to B, B to C, C to D) par mabni hota hai, jismein Fibonacci ratios aur specific price levels ka istemal hota hai. Crab pattern, market mein hone wale reversals ko identify karne ke liye istemal hota hai.

Crab Pattern Ki Pehchan:

Crab pattern ko pehchane ke liye kuch steps hote hain:

X to A Leg:

Pehla leg hota hai X se A tak ka, jo downward direction mein hota hai. Yahan, market mein ek down move hota hai.

A to B Leg:

A ke baad B tak ka leg hai, jo upward direction mein hota hai. Is leg mein price A ke level se upar jaata hai.

B to C Leg:

B se C tak ka leg phir downward direction mein hota hai, jismein price Fibonacci retracement levels ko touch karti hai.

C to D Leg:

C ke baad D tak ka leg phir upward direction mein hota hai, jismein price specific Fibonacci extension levels ko touch karti hai.

Crab Pattern Ka Istemal:

Trading Signals:

Crab pattern traders ko trading signals deta hai. Agar pattern complete hota hai, toh traders ko isse ye ishara milta hai ke market mein reversal hone wala hai.

Entry Aur Exit Points:

Traders Crab pattern ko istemal karke apne entry aur exit points tay karte hain. Pattern complete hone par, traders apne trades ko enter karte hain expecting ke market ka direction ab change hoga.

Stop-Loss Aur Take-Profit Levels:

Crab pattern ko istemal karke traders apne stop-loss aur take-profit levels tay karte hain. Isse wo apne trades ko control mein rakh sakte hain aur nuksanat se bach sakte hain.

Crab Pattern Ki Mukhtalif Types:

Bullish Crab Pattern:

Yeh pattern market mein hone wale bullish reversals ko dikhata hai. D point par price girne ke baad, market mein upward move expected hota hai.

Bearish Crab Pattern:

Ismein market mein hone wale bearish reversals ko dikhaya jata hai. D point par price girne ke baad, market mein downward move expected hota hai.

Crab pattern ek advanced technical analysis tool hai jo market trends aur reversals ko pehchanne mein madad karta hai. Lekin, hamesha yaad rakhein ke kisi bhi pattern ya indicator ka istemal keval ek tajzia ka hissa hota hai aur market risks ko puri tarah samajh kar hi trading karna chahiye. Crab pattern ke istemal mein mukhtalif factors aur confirmations ko madde nazar rakhein, aur hamesha apne research aur analysis ko mazbooti se karein.

تبصرہ

Расширенный режим Обычный режим