Overbought

Forex market mein, overbought aur oversold conditions wo maqamat hote hain jahan kisi maal ki qeemat mein tezi se izafa hota hai, aur yeh tasawwur hota hai ke mojooda qeemat mawafiq nahin hai. Traders overbought conditions ko ek mumkin signal samajhte hain ke qeemat ulte rukh lenay ka imkan hai. Overbought aur oversold shorat, forex trading mein samajhna aham hai. Ye terminologies amuman technical analysis mein istemal hoti hain takay kisi mawad ki taraf se mawalat ka imkan pesh kia ja sake.

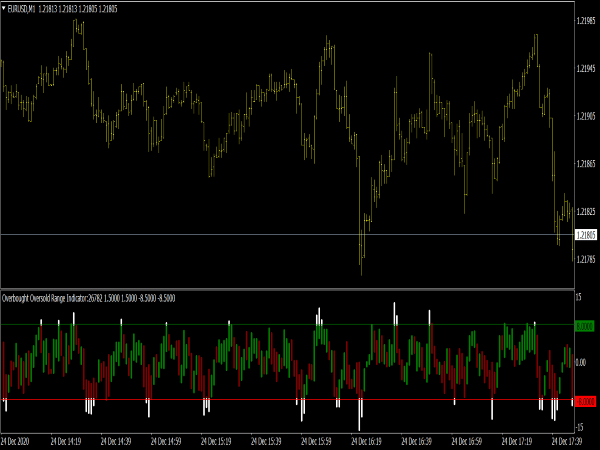

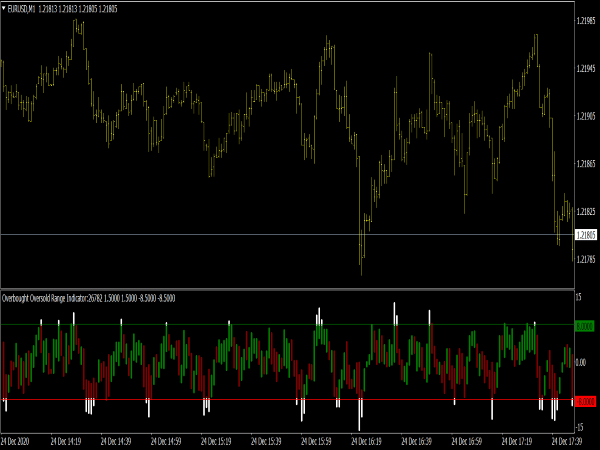

Relative Strength Index (RSI)

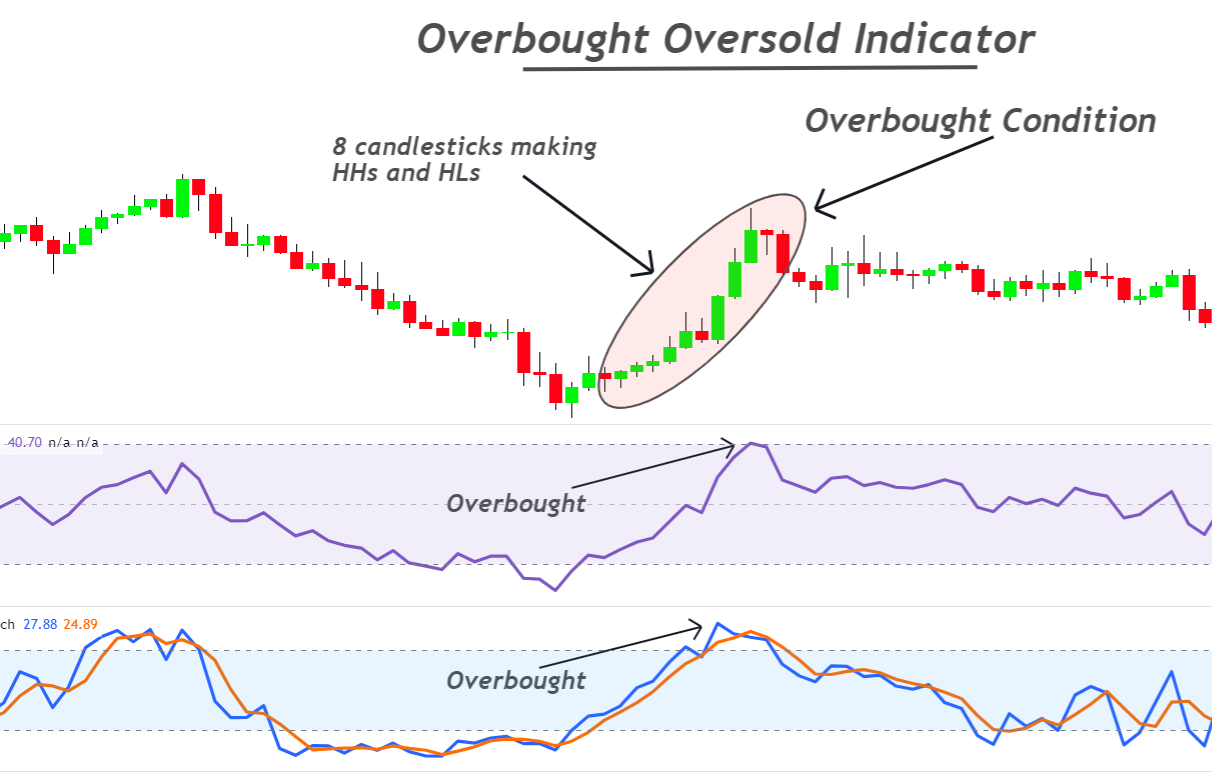

RSI ek mashhoor momentum oscillator hai jo qeemat ki raftar aur tabdili ko napta hai. Iska range 0 se 100 tak hota hai aur isay amuman price chart ke neeche dikhaya jata hai. Riwayati tor par, RSI ki qeemat 70 se ooper overbought samjhi jati hai, jo ke ishara hai ke maal mein inqilab ya correction hone ka imkan hai. Misal ke tor par, agar kisi currency pair ka RSI 75 tak pahunchta hai, to traders isay overbought hone ka ishara samajh sakte hain, aur yeh ke qeemat mein girawat hone ka khatra hai.

Oversold

Barabri ke teht, ek maal ko oversold samjha jata hai jab uski qeemat ne tezi se girna shuru kia ho, aur traders ko lagta ho ke ab isay ulatne ka waqt aa gaya hai. Oversold conditions yeh batati hain ke bechne ki dabaw zyada ho gayi hai, aur market ko upar jane ka waqt aa sakta hai. RSI ke hawale se, 30 se neeche ki qeemat amuman oversold samjhi jati hai. Jab RSI is hadood se neeche chala jata hai, to traders ko ek mawafiq upar ki taraf rawani se rukhne ka imkan mehsoos hota hai.

Understanding Market Sentiment

Overbought aur oversold concepts market sentiment se gehre talluqat rakhte hain. Jab koi maal overbought hota hai, to yeh ishara hota hai ke bullish sentiment zyada hai, jo ke dikhata hai ke khareedne walay mawafiq hain aur market ko correction ka waqt aa gaya hai. Ulta, oversold conditions bearish sentiment ko zyada batati hain, ke ishara hota hai ke bechne walay zyada aggressive hue hain, aur ek mawafiq upar ki taraf jane ka imkan hai.

Limitations of Overbought and Oversold Indicators

Jabke overbought aur oversold indicators forex trading mein ahem hain, inki kuch hadood hain. Market lambi muddat tak overbought ya oversold ho sakti hai, khas kar majboot trends mein. Traders ko in indicators ko signals ke liye confirm karne ke liye doosre analysis tools ke sath istemal karna chahiye taki ghalat faislay se bacha ja sake.

Strategies for Trading Overbought and Oversold Conditions

Risks In Overbought and Oversold

Yeh zaroori hai ke traders samajhain ke sirf overbought ya oversold conditions par bharosa kar ke market reversal guarantee nahin hota. Forex markets irational ho sakti hain, aur trends umeed se zyada muddat tak bani reh sakti hain. Is liye, risk management aur mukhtalif factors ki tafseel se tajaweezat ko pehchanne ke liye in indicators ko istemal karna zaroori hai.

Overbought aur oversold conditions ko samajhna intehai zaroori hai taake aqalmandi se faislay liye ja sakein. Ye conditions market sentiment aur mumkin reversal points ki taraf ishara karne mein madadgar hain. Traders ko in indicators se hasil hone wale signals ki ittefaq ko barhane ke liye technical indicators, price action analysis, aur trend ki tafseel se jaaiz istemal karna chahiye. Is ke ilawa nuksanat se bachne aur trading strategies ki bharpoor effectiveness ko barhane ke liye risk management ki amli tadabeer intehai ahem hain. Jaisa ke har trading tajaweez mein hota hai, lambayi muddat tak kamyabi ke liye mustaqil taleem aur tabdeel hone ki zaroorat hoti hai.

Forex market mein, overbought aur oversold conditions wo maqamat hote hain jahan kisi maal ki qeemat mein tezi se izafa hota hai, aur yeh tasawwur hota hai ke mojooda qeemat mawafiq nahin hai. Traders overbought conditions ko ek mumkin signal samajhte hain ke qeemat ulte rukh lenay ka imkan hai. Overbought aur oversold shorat, forex trading mein samajhna aham hai. Ye terminologies amuman technical analysis mein istemal hoti hain takay kisi mawad ki taraf se mawalat ka imkan pesh kia ja sake.

Relative Strength Index (RSI)

RSI ek mashhoor momentum oscillator hai jo qeemat ki raftar aur tabdili ko napta hai. Iska range 0 se 100 tak hota hai aur isay amuman price chart ke neeche dikhaya jata hai. Riwayati tor par, RSI ki qeemat 70 se ooper overbought samjhi jati hai, jo ke ishara hai ke maal mein inqilab ya correction hone ka imkan hai. Misal ke tor par, agar kisi currency pair ka RSI 75 tak pahunchta hai, to traders isay overbought hone ka ishara samajh sakte hain, aur yeh ke qeemat mein girawat hone ka khatra hai.

Oversold

Barabri ke teht, ek maal ko oversold samjha jata hai jab uski qeemat ne tezi se girna shuru kia ho, aur traders ko lagta ho ke ab isay ulatne ka waqt aa gaya hai. Oversold conditions yeh batati hain ke bechne ki dabaw zyada ho gayi hai, aur market ko upar jane ka waqt aa sakta hai. RSI ke hawale se, 30 se neeche ki qeemat amuman oversold samjhi jati hai. Jab RSI is hadood se neeche chala jata hai, to traders ko ek mawafiq upar ki taraf rawani se rukhne ka imkan mehsoos hota hai.

Understanding Market Sentiment

Overbought aur oversold concepts market sentiment se gehre talluqat rakhte hain. Jab koi maal overbought hota hai, to yeh ishara hota hai ke bullish sentiment zyada hai, jo ke dikhata hai ke khareedne walay mawafiq hain aur market ko correction ka waqt aa gaya hai. Ulta, oversold conditions bearish sentiment ko zyada batati hain, ke ishara hota hai ke bechne walay zyada aggressive hue hain, aur ek mawafiq upar ki taraf jane ka imkan hai.

Limitations of Overbought and Oversold Indicators

Jabke overbought aur oversold indicators forex trading mein ahem hain, inki kuch hadood hain. Market lambi muddat tak overbought ya oversold ho sakti hai, khas kar majboot trends mein. Traders ko in indicators ko signals ke liye confirm karne ke liye doosre analysis tools ke sath istemal karna chahiye taki ghalat faislay se bacha ja sake.

Strategies for Trading Overbought and Oversold Conditions

- Divergence: Price aur indicator ke darmiyan divergence talash karen. Misal ke tor par, agar prices naye oonche banane lage hain, lekin RSI in oonchon ko tasdeeq nahin kar raha aur girne lage, to yeh ishara ho sakta hai ke trend kamzor ho raha hai, walaupun overbought conditions hain.

- Wait for Confirmation: Overbought ya oversold signals par turant amal karne ke bajaye, mazeed tasdeeq ke liye intezar karen. Is mein price action ka mutala karna, doosre technical indicators ko dekhna, ya potential reversal ko support karne wale candlestick pattern ka intezar karna shamil ho sakta hai.

- Trend Analysis: Faislay se pehle overall trend ko madde nazar rakhen. Agar trend majboot hai, to overbought conditions turant reversal nahi, balki upar ki taraf jane se pehle ek consolidation ka imkan hai.

Risks In Overbought and Oversold

Yeh zaroori hai ke traders samajhain ke sirf overbought ya oversold conditions par bharosa kar ke market reversal guarantee nahin hota. Forex markets irational ho sakti hain, aur trends umeed se zyada muddat tak bani reh sakti hain. Is liye, risk management aur mukhtalif factors ki tafseel se tajaweezat ko pehchanne ke liye in indicators ko istemal karna zaroori hai.

Overbought aur oversold conditions ko samajhna intehai zaroori hai taake aqalmandi se faislay liye ja sakein. Ye conditions market sentiment aur mumkin reversal points ki taraf ishara karne mein madadgar hain. Traders ko in indicators se hasil hone wale signals ki ittefaq ko barhane ke liye technical indicators, price action analysis, aur trend ki tafseel se jaaiz istemal karna chahiye. Is ke ilawa nuksanat se bachne aur trading strategies ki bharpoor effectiveness ko barhane ke liye risk management ki amli tadabeer intehai ahem hain. Jaisa ke har trading tajaweez mein hota hai, lambayi muddat tak kamyabi ke liye mustaqil taleem aur tabdeel hone ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим