UNDERSTANDING PULLBACK IN FOREX :

Pullback forex trading mein ek term hai jo ek currency pair ki maujooda trend mein ek temporary ulat-pultaav ko bayan karne ke liye istemaal hotijati hai. Iska matlab hai ki kisi currency pair ki maujooda trend ke samriddhikaran se pahle short-term mei price ka kami ya wapas chadhai hoti hai. Pullback price action ka ek prakritik hissa hai aur jab market ke participants apne munafe ko lete hai ya jab naye kharidari ya bikri karne wale market mei aate hai tab ye hoti hai. Ye uptrends mei ho sakti hai, jahan price support level tak wapas chadhti hai aur badhti hai, ya downtrends mei ho sakti hai, jahan price resistance level tak wapas chadhti hai aur ghatthi hai.

Pullbacks ko samajhna forex traders ke liye mahatvapurna hai kyunki ye unhe sasti keemat par trade karne ke mauke pradan karti hai. Pullbacks ko pehchanne aur unki visheshataon ko samajhne se traders risk ko prabandhit kar sakte hai aur potentiyal labh ko adhikatam kar sakte hai.

IDENTIFYING PULLBACKS :

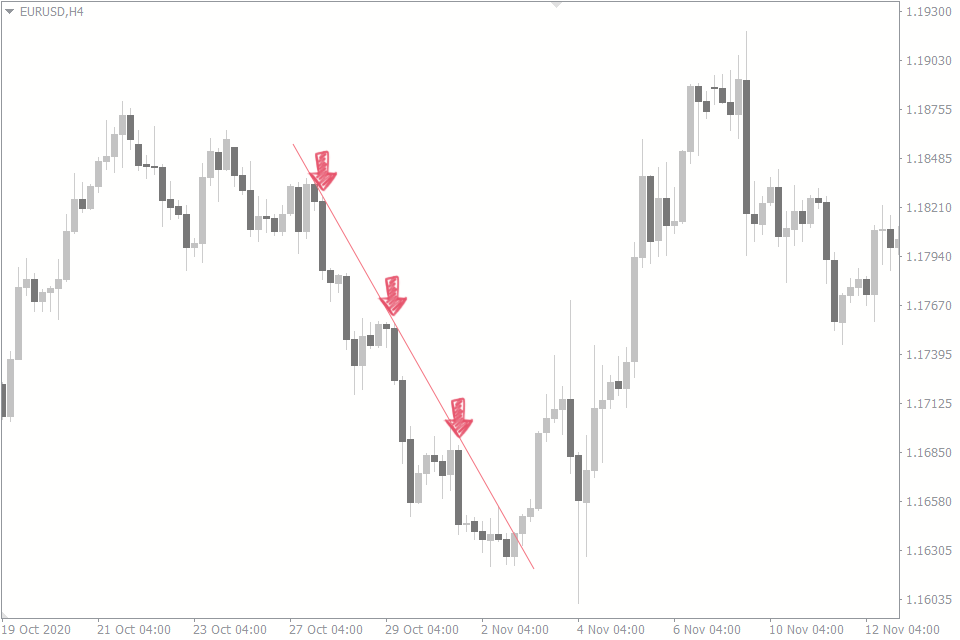

Pullbacks par safal trade karne ke liye traders ko price action ke andar unhe pehchanne ki shamta honi chahiye. Ek aam tareeka trend lines ya moving averages ka istemal karna hai. Uptrend mei, swing lows ko ek trend line se jodkar potentiyal pullback levels pe prakash dal sakta hai. Downtrend mei, swing highs ko jodkar pullback levels ko pehchan sakte hai. Ussi tarah, moving average ka istemal karke overall trend ko aur potential pullbacks ko moving average tak wapas chadhte dekhkar pehchana ja sakta hai.

Ek aur tareeka hai Fibonacci retracement levels ka istemal karna. Fibonacci retracements Fibonacci sequence par adharit hai, jo ek sankhyaon ka varg hai jahan pratyek sankhya pichle do sankhyon ka yuktank hai. Fibonacci retracement levels ko swing high se swing low tak ya ulte, traders Fibonacci ratios (jaise 38.2%, 50%, 61.8%) par adharit potential pullback levels ko pehchan sakte hai.

ANALYZING THE STRENGTH OF PULLBACKS :

Har pullback ek jaise nahi hoti hai aur pullback ki shakti kaanan karna forex traders ke liye mahatvapurna prakash pradata hai. Pullback ki shakti ko jaanchne ka ek tareeka retracement ke dauran maandandh ke prati volume ka observation karna hai. Majboot pullbacks adhik volume ki ghatna ko dekhte hai, jisse yeh prakaashit hota hai ki market ke participants retracement mei sakriy roop se hissa le rahe hai.

Iske alawa, traders price patterns jaise ki flags ya triangles ko bhi dekh sakte hai jo pullback ke dauran ban rahe hai. Ye patterns trend mei ek thahraav ko signal karte hai aur traders ko market mei pravesh ka ek mauka pradan karte hai.

TIMING THE ENTRY :

Entry ka samay nirdharit karna forex traders ke liye mahatvapurna hai pullback ke dauran. Iska lakshya hai mehenge keemat par, pullback ka ant ke paas, overall trend dubaara shuru hone se pehle trade mei pravesh karna. Traders trend lines, moving averages aur oscillators jaise tools aur takneek ka istemal karke apne entry ka samay nirdharit kar sakte hai.

Misaal ke taur par, trend line ka istemal karte hue traders trend line se bounce karne aur trend ki dubara shuru hone ki tasdeek karne ka intizar kar sakte hain, phir trade mein enter kar sakte hain. Usi tarah, Relative Strength Index (RSI) ya Stochastic Oscillator jaise oscillators ka istemal karte hue traders oversold ya overbought conditions ka intizar kar sakte hain, jo potential reversal ki soochak hai, aur trade mein us ke mutabiq enter kar sakte hain.

MANAGING RISK DURING PULLBACKS :

Forex mein pullbacks trade karte waqt risk ka tehaffuz karna ahem hai. Pullbacks overall trend ki ulat palat ho sakti hain, isliye traders ko apne capital ki hifazat ke liye munasib stop-loss orders set karna zaruri hai. Aam practice ye hai ke uptrend mein support level ke neeche aur downtrend mein resistance level ke upar stop-loss order lagaya jaye.

Is ke ilawa, traders trailing stop-loss orders ka istemal karke trade ko profit mein hone ke sath-sath risk ko bhi control kar sakte hain. Trailing stop-loss orders price ke hilne ke sath-sath automatically stop-loss level ko adjust karte hain, jisse traders potential profits ko pakad sakte hain lekin risk ko bhi manage kar sakte hain.

Akhiri mein, forex trading mein pullbacks ko samajhna faydemand hai taaki profit potential ko ziyada kiya ja sake aur risk ka tawakkal bhi kiya ja sake. Pullbacks ko pehchanne, unki taqat ka tafsiri karna, entry ka time tay karna aur risk ko effectively manage karna ke zariye, traders retracements ka faida utha sakte hain aur overall trend mein shirkat karke forex market mein kamyabi ke chances ko barha sakte hain.

Pullback forex trading mein ek term hai jo ek currency pair ki maujooda trend mein ek temporary ulat-pultaav ko bayan karne ke liye istemaal hotijati hai. Iska matlab hai ki kisi currency pair ki maujooda trend ke samriddhikaran se pahle short-term mei price ka kami ya wapas chadhai hoti hai. Pullback price action ka ek prakritik hissa hai aur jab market ke participants apne munafe ko lete hai ya jab naye kharidari ya bikri karne wale market mei aate hai tab ye hoti hai. Ye uptrends mei ho sakti hai, jahan price support level tak wapas chadhti hai aur badhti hai, ya downtrends mei ho sakti hai, jahan price resistance level tak wapas chadhti hai aur ghatthi hai.

Pullbacks ko samajhna forex traders ke liye mahatvapurna hai kyunki ye unhe sasti keemat par trade karne ke mauke pradan karti hai. Pullbacks ko pehchanne aur unki visheshataon ko samajhne se traders risk ko prabandhit kar sakte hai aur potentiyal labh ko adhikatam kar sakte hai.

IDENTIFYING PULLBACKS :

Pullbacks par safal trade karne ke liye traders ko price action ke andar unhe pehchanne ki shamta honi chahiye. Ek aam tareeka trend lines ya moving averages ka istemal karna hai. Uptrend mei, swing lows ko ek trend line se jodkar potentiyal pullback levels pe prakash dal sakta hai. Downtrend mei, swing highs ko jodkar pullback levels ko pehchan sakte hai. Ussi tarah, moving average ka istemal karke overall trend ko aur potential pullbacks ko moving average tak wapas chadhte dekhkar pehchana ja sakta hai.

Ek aur tareeka hai Fibonacci retracement levels ka istemal karna. Fibonacci retracements Fibonacci sequence par adharit hai, jo ek sankhyaon ka varg hai jahan pratyek sankhya pichle do sankhyon ka yuktank hai. Fibonacci retracement levels ko swing high se swing low tak ya ulte, traders Fibonacci ratios (jaise 38.2%, 50%, 61.8%) par adharit potential pullback levels ko pehchan sakte hai.

ANALYZING THE STRENGTH OF PULLBACKS :

Har pullback ek jaise nahi hoti hai aur pullback ki shakti kaanan karna forex traders ke liye mahatvapurna prakash pradata hai. Pullback ki shakti ko jaanchne ka ek tareeka retracement ke dauran maandandh ke prati volume ka observation karna hai. Majboot pullbacks adhik volume ki ghatna ko dekhte hai, jisse yeh prakaashit hota hai ki market ke participants retracement mei sakriy roop se hissa le rahe hai.

Iske alawa, traders price patterns jaise ki flags ya triangles ko bhi dekh sakte hai jo pullback ke dauran ban rahe hai. Ye patterns trend mei ek thahraav ko signal karte hai aur traders ko market mei pravesh ka ek mauka pradan karte hai.

TIMING THE ENTRY :

Entry ka samay nirdharit karna forex traders ke liye mahatvapurna hai pullback ke dauran. Iska lakshya hai mehenge keemat par, pullback ka ant ke paas, overall trend dubaara shuru hone se pehle trade mei pravesh karna. Traders trend lines, moving averages aur oscillators jaise tools aur takneek ka istemal karke apne entry ka samay nirdharit kar sakte hai.

Misaal ke taur par, trend line ka istemal karte hue traders trend line se bounce karne aur trend ki dubara shuru hone ki tasdeek karne ka intizar kar sakte hain, phir trade mein enter kar sakte hain. Usi tarah, Relative Strength Index (RSI) ya Stochastic Oscillator jaise oscillators ka istemal karte hue traders oversold ya overbought conditions ka intizar kar sakte hain, jo potential reversal ki soochak hai, aur trade mein us ke mutabiq enter kar sakte hain.

MANAGING RISK DURING PULLBACKS :

Forex mein pullbacks trade karte waqt risk ka tehaffuz karna ahem hai. Pullbacks overall trend ki ulat palat ho sakti hain, isliye traders ko apne capital ki hifazat ke liye munasib stop-loss orders set karna zaruri hai. Aam practice ye hai ke uptrend mein support level ke neeche aur downtrend mein resistance level ke upar stop-loss order lagaya jaye.

Is ke ilawa, traders trailing stop-loss orders ka istemal karke trade ko profit mein hone ke sath-sath risk ko bhi control kar sakte hain. Trailing stop-loss orders price ke hilne ke sath-sath automatically stop-loss level ko adjust karte hain, jisse traders potential profits ko pakad sakte hain lekin risk ko bhi manage kar sakte hain.

Akhiri mein, forex trading mein pullbacks ko samajhna faydemand hai taaki profit potential ko ziyada kiya ja sake aur risk ka tawakkal bhi kiya ja sake. Pullbacks ko pehchanne, unki taqat ka tafsiri karna, entry ka time tay karna aur risk ko effectively manage karna ke zariye, traders retracements ka faida utha sakte hain aur overall trend mein shirkat karke forex market mein kamyabi ke chances ko barha sakte hain.

تبصرہ

Расширенный режим Обычный режим