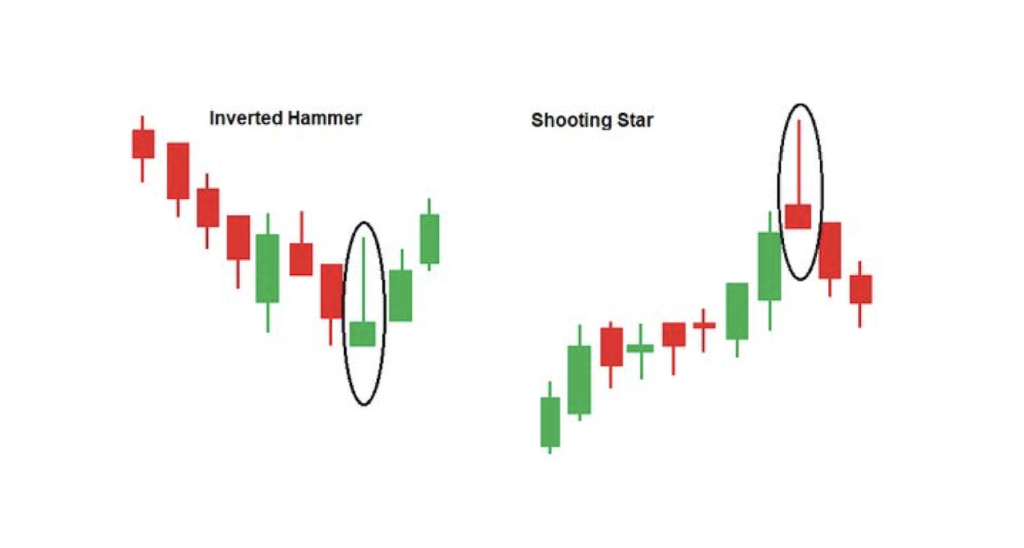

Inverted Hammer Pattern: Aik Reversal Signal

Inverted Hammer pattern, jo market analysis mein istemal hone wala ek candlestick pattern hai, generally downtrend ke baad dekha jata hai. Yeh pattern, market ke trend ko badalne ka ek initial indication deta hai.

Pattern Ki Pehchan

Inverted Hammer pattern market ke trend reversal ka indication deti hai, lekin yeh single signal ke taur par nahi dekhi ja sakti. Isko confirm karne ke liye doosre technical tools aur market ki overall analysis ki zaroorat hoti hai. Traders ko hamesha caution aur risk management ke saath trading decisions leni chahiye.

Inverted Hammer pattern, jo market analysis mein istemal hone wala ek candlestick pattern hai, generally downtrend ke baad dekha jata hai. Yeh pattern, market ke trend ko badalne ka ek initial indication deta hai.

Pattern Ki Pehchan

- Shape:

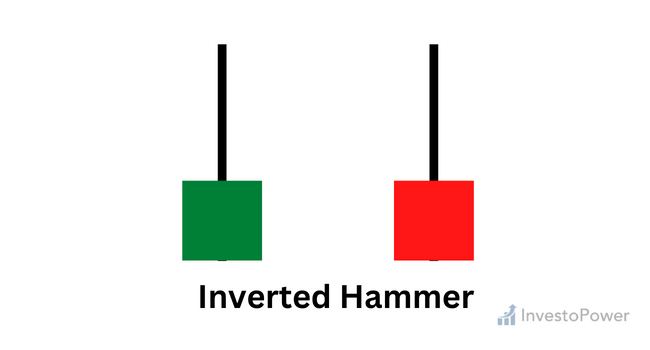

- Is pattern ki pehchan lambi tail (wick) se hoti hai jo candle ke upper side mein hoti hai, aur chhoti body neechay hoti hai. Yeh shape ek hammer ki ulta shape ki tarah dikhta hai.

- Context:

- Is pattern ko aksar downtrend ke baad dekha jata hai.

- Candle neeche se shuru hoti hai aur session ke dauran upar aakar close hoti hai.

- Bullish Reversal Signal:

- Jab market downtrend mein hota hai aur Inverted Hammer candle form hoti hai, to yeh ek reversal signal provide karti hai.

- Candle neeche se upar move karta hai aur close karne ke kareeb neeche ki jagah se close hoti hai, iska matlab hai ki sellers initially control karte hue phir se buyers ne control assume kiya hai.

- Confirmation:

- Yeh pattern single candle pattern hai, is liye isko confirm karne ke liye doosre technical indicators aur price action ko bhi dekha jata hai jaise trend lines, moving averages, aur volume analysis.

- Reversal Trading:

- Inverted Hammer pattern bullish reversal ka initial sign hai, lekin isko confirm karne ke liye aur signals ki zaroorat hoti hai.

- Traders isko confirm karne ke liye doosre indicators aur patterns ki madad lete hain.

- Risk Management:

- Pattern ko dekhte hue traders apni trading strategies ko manage karte hain. Stop loss aur profit targets ko adjust karte hain pattern ke hisaab se.

Inverted Hammer pattern market ke trend reversal ka indication deti hai, lekin yeh single signal ke taur par nahi dekhi ja sakti. Isko confirm karne ke liye doosre technical tools aur market ki overall analysis ki zaroorat hoti hai. Traders ko hamesha caution aur risk management ke saath trading decisions leni chahiye.

تبصرہ

Расширенный режим Обычный режим