Stochastic Oscillator ek technical analysis tool hai jo traders ko price momentum ko measure karne aur overbought ya oversold conditions ko identify karne mein madad deta hai. Yeh indicator market volatility aur price movements ko samajhne mein istemal hota hai.

Is indicator ke background mein yeh concept hai ke jab ek security (jaise ke currency pair) ke price ek specific time frame mein zyada se zyada ya kam se kam tak pohanchta hai, toh woh overbought ya oversold ho sakta hai, aur potenital reversal ke chances hote hain.

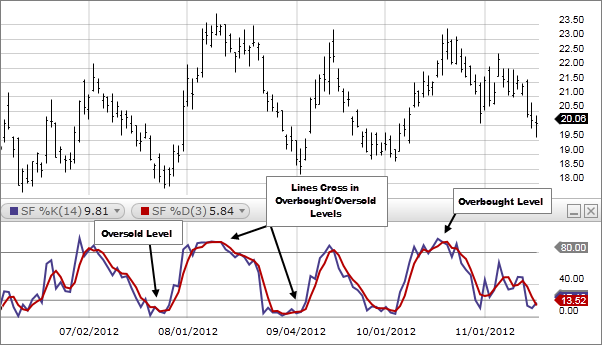

Stochastic Oscillator do lines ya bands par mabni hota hai:

- %K Line: Yeh line current price ko past trading range ke high aur low ke darmiyan compare karti hai. %K line short-term price movements ko represent karti hai.

- %D Line (Signal Line): Yeh %K line ka moving average hota hai. Iska purpose %K line ki smoothing karna hota hai aur isse market trends ko samajhne mein madad milti hai.

Stochastic Oscillator ke reading 0 se 100 ke darmiyan hoti hai aur ye traders ko indicate karta hai ke market overbought (80 ke upar) ya oversold (20 ke neeche) hai.

- Overbought Condition (80+): Jab %K line 80 ke upar hoti hai, toh yeh indicate karta hai ke market mein excessive buying hui hai aur price ko nichay le jaane ki possibility ho sakti hai.

- Oversold Condition (20-): Jab %K line 20 ke neeche hoti hai, toh yeh indicate karta hai ke market mein excessive selling hui hai aur price ko ooper le jaane ki possibility ho sakti hai.

Traders is indicator ko use kar ke entry aur exit points tayyar karte hain. Jaise ke agar market overbought hai aur Stochastic Oscillator ne down crossover kiya hai, toh woh ek selling opportunity indicate kar sakta hai. Ya agar market oversold hai aur Stochastic Oscillator ne up crossover kiya hai, toh woh ek buying opportunity indicate kar sakta hai.

Lekin, yaad rahe ke Stochastic Oscillator jaise har indicator ki tarah, yeh bhi kabhi-kabhi false signals de sakta hai aur sirf ek tool hai trading decisions ke liye. Isliye, isko dusre indicators aur market analysis ke saath istemal karna zaroori hota hai.

تبصرہ

Расширенный режим Обычный режим