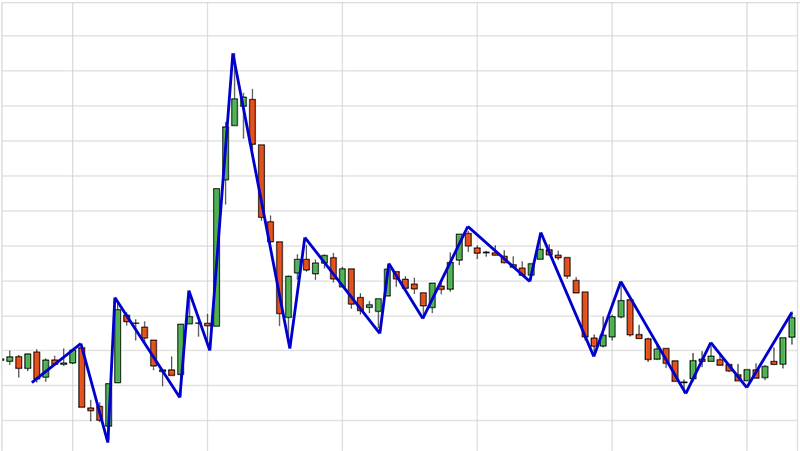

How does each timeframe reflect market movements?

Forex trading mein, har timeframe market movements ko alag taur par reflect karta hai. Har timeframe apne andar aik khasiyat rakhta hai aur traders ko market ke mukhtalif pahluon ko samajhne mein madad karta hai. Is post mein, hum dekheinge ke har timeframe kis tarah se market movements ko darust karta hai.

Monthly Timeframe:

Monthly timeframe, yaani mahinay ka timeframe, market ke lambay trend ko darust karta hai. Is timeframe par har candlestick aik mahinay ke price movement ko represent karta hai. Yeh timeframe macro-level analysis ke liye istemal hota hai aur long-term trends ko identify karne mein madad karta hai.

Weekly Timeframe:

Weekly timeframe, yaani haftay ka timeframe, market ke overall trend ko darust karta hai lekin thoda zyada detail mein. Har candlestick aik haftay ke price movement ko represent karta hai. Is timeframe par bhi long-term trends ko analyze kiya jata hai.

Daily Timeframe:

Daily timeframe, yaani roz ka timeframe, market ke short to medium-term trends ko darust karta hai. Har candlestick aik din ke price movement ko represent karta hai. Is timeframe par traders daily price action aur key support/resistance levels ko dekhte hain.

4-Hour Timeframe:

4-hour timeframe, yaani chaar ghantay ka timeframe, market ke intraday trends ko darust karta hai. Har candlestick aik chaar ghantay ke price movement ko represent karta hai. Is timeframe par traders short to medium-term trades plan karte hain.

1-Hour Timeframe:

1-hour timeframe, yaani aik ghanta ka timeframe, market ke short-term trends ko darust karta hai. Har candlestick aik ghantay ke price movement ko represent karta hai. Is timeframe par traders intraday trading strategies ke liye tajaweezat banate hain.

15-Minute Timeframe:

15-minute timeframe, yaani pandrah minute ka timeframe, market ke bohot hi short-term trends ko darust karta hai. Har candlestick aik pandrah minute ke price movement ko represent karta hai. Is timeframe par traders short-term trades execute karte hain.

5-Minute Timeframe:

5-minute timeframe, yaani paanch minute ka timeframe, market ke bohot hi chhote trends ko darust karta hai. Har candlestick aik paanch minute ke price movement ko represent karta hai. Is timeframe par traders scalping yaani bohot hi chhote time frame par trades execute karte hain.

Har Timeframe Ki Ahmiyat:

Macro-level Analysis:

Mahinay ya haftay ke timeframe se traders ko market ke lambay trends ka andaza hota hai.

Intermediate-term Analysis:

Din ya chaar ghantay ke timeframe se traders ko short to medium-term trends ka pata chalta hai.

Intraday Analysis:

Ghantay ya paanch minute ke timeframe se traders ko market ke daily price movements aur short-term trends ka pata chalta hai.

Kis Timeframe Par Trading Karein?

Long-Term Traders:

Jo log mahine ya hafton tak hold karna pasand karte hain, woh monthly ya weekly timeframe par zyada focus karte hain.

Swing Traders:

Jo log kuch din tak hold karna pasand karte hain, woh daily ya 4-hour timeframe par tawajju dete hain.

Intraday Traders:

Jo log din bhar ke chhote price movements se faida uthana pasand karte hain, woh 1-hour ya 15-minute timeframe par focus karte hain.

Khatima:

Har timeframe apne apne taur par market movements ko darust karta hai aur traders ko market ke mukhtalif pahluon ko samajhne mein madad karta hai. Sahi timeframe ka chunao karna aur use theek se samajhna, ek mahir trader banne ke liye zaroori hai. Trading mein safalta hasil karne ke liye, traders ko apne trading plan mein sahi timeframe ka chunao karna hamesha zaroori hota hai.

تبصرہ

Расширенный режим Обычный режим