DEFINITION AND CONCEPT OF MAT HOLD PATTERN IN FOREX :

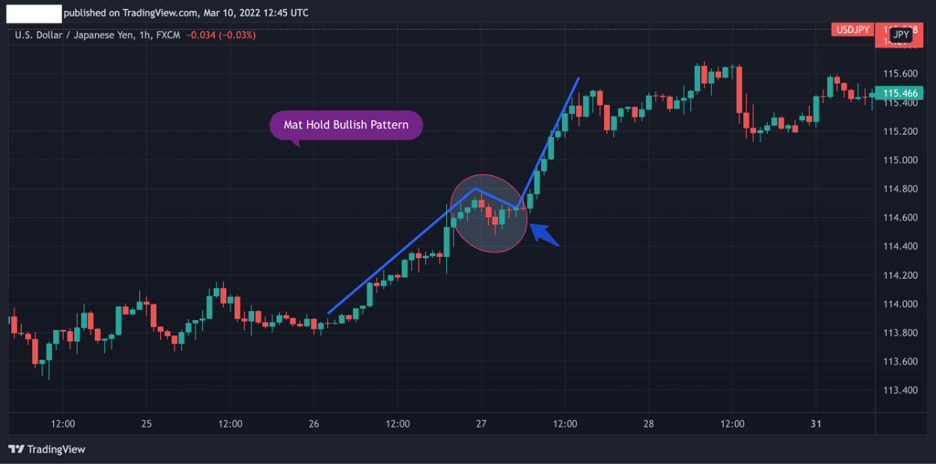

Mat Hold pattern forex market mein bohat istemal hota hai. Ye ek continuation pattern hai jo batata hai ke market pehle keMat Hold pattern, forex market mein istemal hone wala ek technical analysis pattern hai. Ye ek aisa pattern hai jo batata hai ke market pehle ke trend ke baad ek chota sa consolidation period ke baad wahi direction mein aage badhega. Is pattern mein ek lamba bullish candlestick hota hai, uske baad ek chota ya doji candlestick hoti hai, aur phir ek series of bullish candlesticks hoti hai jo pehle candlestick ke range mein rehti hai. Is pattern ko "mat" ya carpet ki tarah dekh kar iska naam "Mat Hold" rakha gaya hai.

Jab Mat Hold pattern banega, to ye batata hai ke bullish momentum abhi bhi strong hai aur buyers market pe control mein hain. Iska matlab hai ke koi bhi pullback ya consolidation temporary hai aur trend aage ki taraf badhega. Traders is pattern ka istemal karke potential buying opportunities ko identify kar sakte hain aur bullish trend ke continuation se profit karne ke liye long positions mein enter kar sakte hain.

CHARACTERISTICS AND FORMATION OF A MAT HOLD PATTERN :

Mat Hold pattern ko pehchanne ke liye traders ko iske kuch khasiyat ko dekhna hota hai:

1. Ek strong bullish candlestick: Pattern ek lambi bullish candlestick se shuru hota hai, jo market mein prevailing bullish sentiment ko show karta hai. Is candlestick mein body significant hoti hai aur lower shadow chota ya absent hota hai.

2. Ek chota ya doji candlestick: Is pattern mein dusri candlestick normally ek choti ya doji candlestick hoti hai, jo market mein indecision ya short pause ko depict karti hai. Is candlestick ki body pehle candlestick se choti hoti hai aur isme longer upper ya lower shadow ho sakti hai.

3. Ek series of bullish candlesticks: Choti ya doji candlestick ke baad ek series of bullish candlesticks form hoti hai, jo pehle candlestick ke range mein rehti hai. Ye candlesticks small bodies ki hoti hai aur chote upper ya lower shadows ho sakte hain.

Mat Hold pattern banne se market mein bulls phir bhi control mein hote hain, jaise pehle candlestick ke range mein bullish candlesticks ke continuation se dikhaya jata hai. Traders ko trade consider karne se pehle pattern ka pura formation hona chahiye, kyunki pattern ki reliability tab jyada hoti hai jab sare characteristics mojud hote hain.

IMPORTANCE OF VOLUME IN MAT HOLD PATTERNS :

Volume, Mat Hold pattern ki validity ko analyze karne aur confirm karne mein ek crucial role ada karta hai. Jab pattern ban raha hota hai, tab traders ko har candlestick ke saath associated volume pe dhyan dena chahiye. Agar initial bullish candlestick ke saath high volume ho, to ye strong buying pressure ki indication hai aur pattern ki reliability increase karta hai.

Subsequent candlesticks ke formation ke dauran, ideally volume decrease ya stable rehna chahiye. Ye batata hai ke buyers abhi bhi control mein hain aur trend aage continue hone ki sambhavna hai. However, agar subsequent candlesticks ke formation ke dauran volume suddenly spike ho jaaye, to ye potential trend reversal ya bullish momentum ki kamzori ka signal ho sakta hai. Traders ko aise situations mein cautious rehna chahiye aur trade enter karne se pehle additional factors ko consider karna chahiye.

POTENTIAL ENTRY AND EXIT STRATEGIES FOR MAT HOLD PATTERNS :

Traders, Mat Hold pattern ke basis par trade enter aur exit karne ke liye various strategies ka istemal kar sakte hain. Yahan kuch common approaches hai:

1. Entry strategy: Traders Mat Hold pattern puri tarah se bane hone par aur agle candlesticks pahle candlestick ki range ke andar rahe par long position mein enter kar sakte hain. Agar price pattern se bahar nikal jaye toh unhone buy stop order ko first candlestick ki high se upar set kar sakte hain.

2. Stop-loss strategy: Risk ko manage karne ke liye, traders first candlestick ki low ya small-bodied ya doji candlestick ki low se neeche stop-loss order rakhe sakte hain. Yeh madad karta hai losses ko limit karne mein agar price reverse ho jaye.

3. Take-profit strategy: Traders apne pasandeeda risk-reward ratio par based take-profit order set kar sakte hain ya Fibonacci retracements ya pehle ke resistance levels jaise technical analysis tools ka istemal karke potential target levels identify kar sakte hain. Price in targets tak pahuchte huye gradually profits lena bhi suitable strategy ho sakti hai.

LIMITATIONS AND CONSIDERATIONS WHEN TRADING MAT HOLD PATTERNS :

Mat Hold pattern forex trading mein ek useful tool ho sakti hai, lekin trading decisions lene se pehle iske limitations ko consider karna aur dusre factors ko bhi dhyan mein rakhna zaroori hai. Yahan kuch important considerations hain:

1. Market conditions: Overall market conditions, jaise major news events ya economic data releases, ka consideration karna zaroori hai joh pattern ki reliability pe asar dal sakte hain. Potentially volatile periods mein Mat Hold patterns par trade karne se bachna chahiye.

2. Confirmation: Pattern ki validity ko confirm karne ke liye dusre technical analysis tools ya indicators, jaise trend lines, moving averages, ya oscillators ka istemal karne ka salah diya jata hai. Yeh pattern ki reliability ko badhata hai aur false signals ke chances ko kam karta hai.

Mat Hold pattern forex market mein bohat istemal hota hai. Ye ek continuation pattern hai jo batata hai ke market pehle keMat Hold pattern, forex market mein istemal hone wala ek technical analysis pattern hai. Ye ek aisa pattern hai jo batata hai ke market pehle ke trend ke baad ek chota sa consolidation period ke baad wahi direction mein aage badhega. Is pattern mein ek lamba bullish candlestick hota hai, uske baad ek chota ya doji candlestick hoti hai, aur phir ek series of bullish candlesticks hoti hai jo pehle candlestick ke range mein rehti hai. Is pattern ko "mat" ya carpet ki tarah dekh kar iska naam "Mat Hold" rakha gaya hai.

Jab Mat Hold pattern banega, to ye batata hai ke bullish momentum abhi bhi strong hai aur buyers market pe control mein hain. Iska matlab hai ke koi bhi pullback ya consolidation temporary hai aur trend aage ki taraf badhega. Traders is pattern ka istemal karke potential buying opportunities ko identify kar sakte hain aur bullish trend ke continuation se profit karne ke liye long positions mein enter kar sakte hain.

CHARACTERISTICS AND FORMATION OF A MAT HOLD PATTERN :

Mat Hold pattern ko pehchanne ke liye traders ko iske kuch khasiyat ko dekhna hota hai:

1. Ek strong bullish candlestick: Pattern ek lambi bullish candlestick se shuru hota hai, jo market mein prevailing bullish sentiment ko show karta hai. Is candlestick mein body significant hoti hai aur lower shadow chota ya absent hota hai.

2. Ek chota ya doji candlestick: Is pattern mein dusri candlestick normally ek choti ya doji candlestick hoti hai, jo market mein indecision ya short pause ko depict karti hai. Is candlestick ki body pehle candlestick se choti hoti hai aur isme longer upper ya lower shadow ho sakti hai.

3. Ek series of bullish candlesticks: Choti ya doji candlestick ke baad ek series of bullish candlesticks form hoti hai, jo pehle candlestick ke range mein rehti hai. Ye candlesticks small bodies ki hoti hai aur chote upper ya lower shadows ho sakte hain.

Mat Hold pattern banne se market mein bulls phir bhi control mein hote hain, jaise pehle candlestick ke range mein bullish candlesticks ke continuation se dikhaya jata hai. Traders ko trade consider karne se pehle pattern ka pura formation hona chahiye, kyunki pattern ki reliability tab jyada hoti hai jab sare characteristics mojud hote hain.

IMPORTANCE OF VOLUME IN MAT HOLD PATTERNS :

Volume, Mat Hold pattern ki validity ko analyze karne aur confirm karne mein ek crucial role ada karta hai. Jab pattern ban raha hota hai, tab traders ko har candlestick ke saath associated volume pe dhyan dena chahiye. Agar initial bullish candlestick ke saath high volume ho, to ye strong buying pressure ki indication hai aur pattern ki reliability increase karta hai.

Subsequent candlesticks ke formation ke dauran, ideally volume decrease ya stable rehna chahiye. Ye batata hai ke buyers abhi bhi control mein hain aur trend aage continue hone ki sambhavna hai. However, agar subsequent candlesticks ke formation ke dauran volume suddenly spike ho jaaye, to ye potential trend reversal ya bullish momentum ki kamzori ka signal ho sakta hai. Traders ko aise situations mein cautious rehna chahiye aur trade enter karne se pehle additional factors ko consider karna chahiye.

POTENTIAL ENTRY AND EXIT STRATEGIES FOR MAT HOLD PATTERNS :

Traders, Mat Hold pattern ke basis par trade enter aur exit karne ke liye various strategies ka istemal kar sakte hain. Yahan kuch common approaches hai:

1. Entry strategy: Traders Mat Hold pattern puri tarah se bane hone par aur agle candlesticks pahle candlestick ki range ke andar rahe par long position mein enter kar sakte hain. Agar price pattern se bahar nikal jaye toh unhone buy stop order ko first candlestick ki high se upar set kar sakte hain.

2. Stop-loss strategy: Risk ko manage karne ke liye, traders first candlestick ki low ya small-bodied ya doji candlestick ki low se neeche stop-loss order rakhe sakte hain. Yeh madad karta hai losses ko limit karne mein agar price reverse ho jaye.

3. Take-profit strategy: Traders apne pasandeeda risk-reward ratio par based take-profit order set kar sakte hain ya Fibonacci retracements ya pehle ke resistance levels jaise technical analysis tools ka istemal karke potential target levels identify kar sakte hain. Price in targets tak pahuchte huye gradually profits lena bhi suitable strategy ho sakti hai.

LIMITATIONS AND CONSIDERATIONS WHEN TRADING MAT HOLD PATTERNS :

Mat Hold pattern forex trading mein ek useful tool ho sakti hai, lekin trading decisions lene se pehle iske limitations ko consider karna aur dusre factors ko bhi dhyan mein rakhna zaroori hai. Yahan kuch important considerations hain:

1. Market conditions: Overall market conditions, jaise major news events ya economic data releases, ka consideration karna zaroori hai joh pattern ki reliability pe asar dal sakte hain. Potentially volatile periods mein Mat Hold patterns par trade karne se bachna chahiye.

2. Confirmation: Pattern ki validity ko confirm karne ke liye dusre technical analysis tools ya indicators, jaise trend lines, moving averages, ya oscillators ka istemal karne ka salah diya jata hai. Yeh pattern ki reliability ko badhata hai aur false signals ke chances ko kam karta hai.

تبصرہ

Расширенный режим Обычный режим