INTRODUCTION TO ENGULFING CANDLESTICK PATTERNS IN FOREX:

Engulfing candlestick patterns forex traders ke liye ahem tools hai jo market mein potential trend reversals ko pehchaanne ke liye istemaalkiye jate hain. Ye patterns tab hoti hain jab ek chota candlestick puri tarah se ek bada candlestick dwara ghira jata hai. Engulfing candlestick pattern ko mazboot signal mana jata hai kyunki ye aksar market sentiment aur momentum mein badlav ka sanket deti hai.

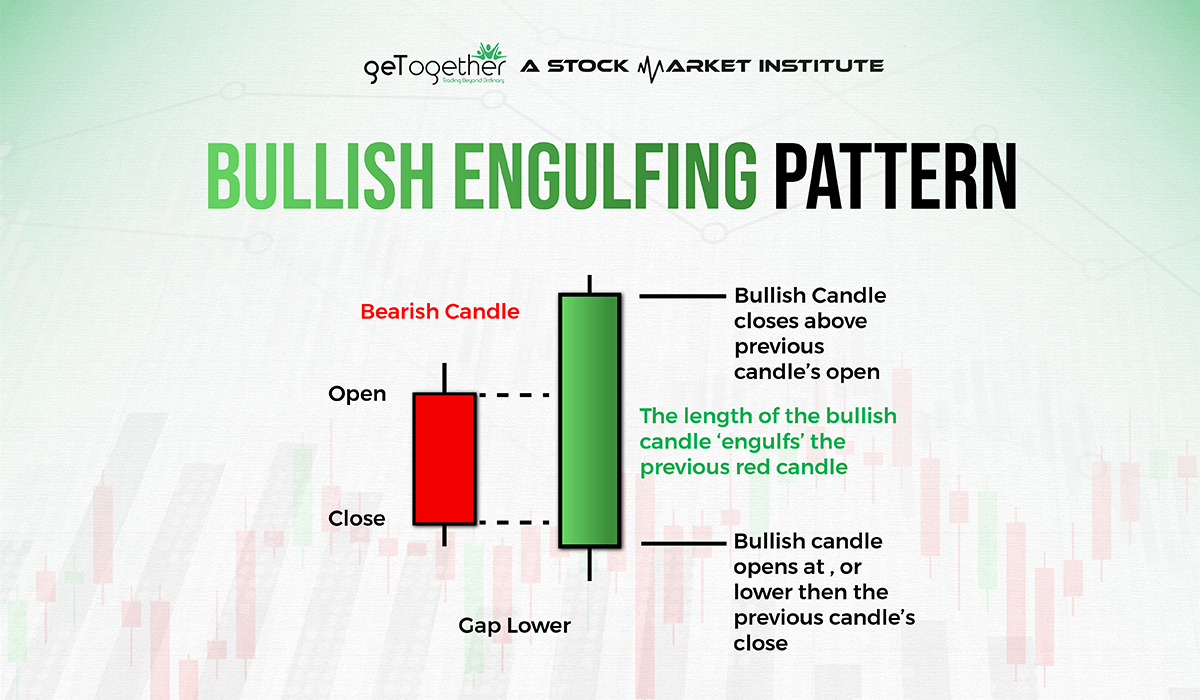

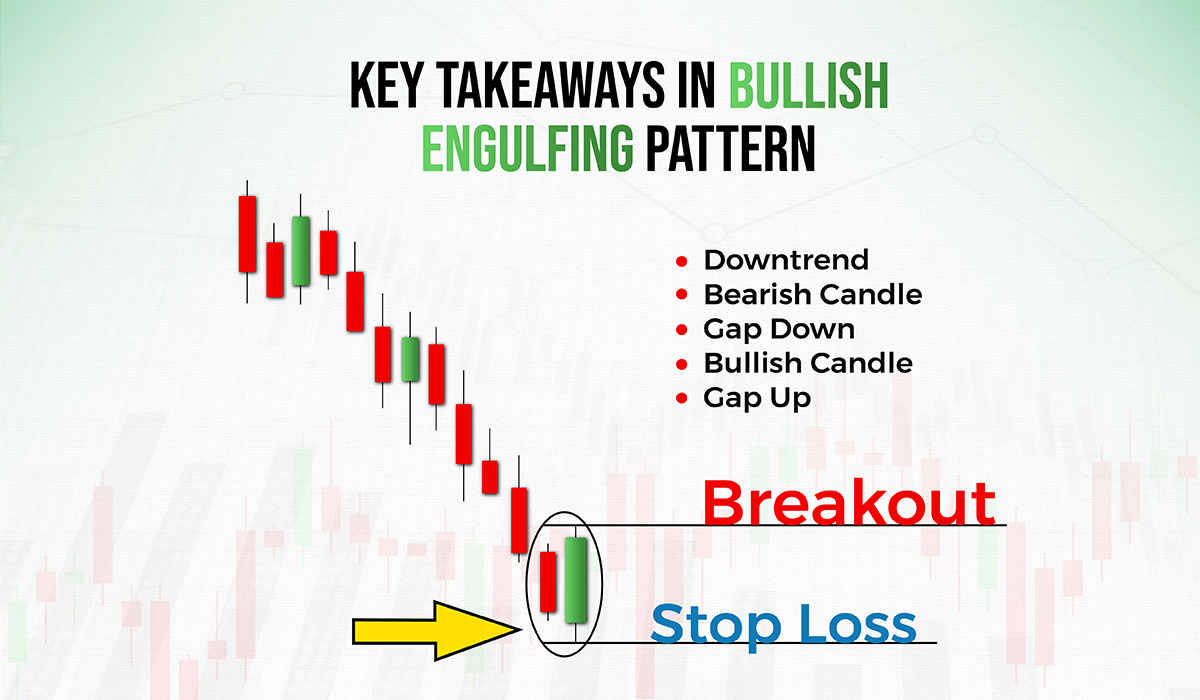

BULLISH ENGULFING PATTERN:

Bullish engulfing pattern ek do-candlestick pattern hota hai jo ek downtrend ke dauraan hota hai. Pehla candlestick ek bearish candle hoti hai, jo market mein selling pressure ko darshati hai. Lekin dusri candlestick peechle close se niche khulti hai lekin peechle open se upar bandh hoti hai. Isse ek bullish engulfing pattern banta hai kyunki dusri candlestick pehli candlestick ko ghira leti hai. Bullish engulfing pattern pehle ke downtrend ki reversal aur naye uptrend ki shuruwat ka sanket karta hai. Traders ise ek mauka samajhte hain market mein khareedne aur lambi position lena ka.

BEARISH ENGULFING PATTERN:

Bearish engulfing pattern bullish engulfing pattern ka ulta hota hai aur ye ek uptrend ke dauraan hota hai. Pehla candlestick ek bullish candle hoti hai, jo market mein buying pressure ko darshati hai. Lekin dusri candlestick peechle close se upar khulti hai lekin peechle open se niche bandh hoti hai. Isse ek bearish engulfing pattern banta hai kyunki dusri candlestick pehli candlestick ko ghira leti hai. Bearish engulfing pattern pehle ke uptrend ki reversal aur naye downtrend ki shuruwat ka sanket karta hai. Traders ise ek mauka samajhte hain market mein bechne aur chhoti position lena ka.

CRITERIA FOR ENGULFING CANDLESTICK PATTERNS:

Engulfing pattern ke hone ko confirm karne ke liye, traders kuch criteria ka palan karte hain. Sabse pehle, dusri candlestick ki body pehli candlestick ki body ko puri tarah se gherna chahiye. Dusri baat, ye pattern ek significant support ya resistance level par honi chahiye. Isse pattern ki vishwasniyata badhti hai kyunki ye ek possible reversal zone ko darshati hai. Iss pattern ke dauran volume bhi ahem hai. Jyada volume hone par engulfing pattern ki reversal signal ki takat ko tasleem kiya jata hai. Ant mein, engulfing candlestick ki size bhi mahatvapurna hai. Ek badi engulfing candlestick ek majboot reversal signal ko darshati hai.

ENGULFING CANDLESTICK PATTERNS AS REVERSAL SIGNALS IN FOREX:

Engulfing candlestick patterns forex mein takatwar reversal signals hote hain. Jab ye patterns support aur resistance ke mukhya star par hoti hain, to ye market ki disha mein badlav ka sanket deti hain. Traders ise dusre technical indicators aur chart patterns ke saath istemaal karte hain apne trading signals ki vishwasniyata ko badhane ke liye. Ye zaruri hai ki jabki engulfing patterns mazboot signals deti hain, lekin ye infallible nahi hote. Traders ko hamesha risk management ki pratha karni chahiye aur apne signals ko aur analysis se tasdeek karna chahiye.

Ant mein, engulfing candlestick patterns forex trading mein mahatvapurna bhoomika nibhate hain. Ye market mein potential trend reversals ke baare mein mahatvapurna jaankari pradan karte hain. Alag-alag prakar ke engulfing patterns aur unke criteria ko samajh kar, traders behatar trading nirnay le sakte hain. Lekin, mahatvapurna hai ki hamesha thorough analysis kare aur risk management ka palan kare, taki safal trading ke parinam prapt ho sake.

Engulfing candlestick patterns forex traders ke liye ahem tools hai jo market mein potential trend reversals ko pehchaanne ke liye istemaalkiye jate hain. Ye patterns tab hoti hain jab ek chota candlestick puri tarah se ek bada candlestick dwara ghira jata hai. Engulfing candlestick pattern ko mazboot signal mana jata hai kyunki ye aksar market sentiment aur momentum mein badlav ka sanket deti hai.

BULLISH ENGULFING PATTERN:

Bullish engulfing pattern ek do-candlestick pattern hota hai jo ek downtrend ke dauraan hota hai. Pehla candlestick ek bearish candle hoti hai, jo market mein selling pressure ko darshati hai. Lekin dusri candlestick peechle close se niche khulti hai lekin peechle open se upar bandh hoti hai. Isse ek bullish engulfing pattern banta hai kyunki dusri candlestick pehli candlestick ko ghira leti hai. Bullish engulfing pattern pehle ke downtrend ki reversal aur naye uptrend ki shuruwat ka sanket karta hai. Traders ise ek mauka samajhte hain market mein khareedne aur lambi position lena ka.

BEARISH ENGULFING PATTERN:

Bearish engulfing pattern bullish engulfing pattern ka ulta hota hai aur ye ek uptrend ke dauraan hota hai. Pehla candlestick ek bullish candle hoti hai, jo market mein buying pressure ko darshati hai. Lekin dusri candlestick peechle close se upar khulti hai lekin peechle open se niche bandh hoti hai. Isse ek bearish engulfing pattern banta hai kyunki dusri candlestick pehli candlestick ko ghira leti hai. Bearish engulfing pattern pehle ke uptrend ki reversal aur naye downtrend ki shuruwat ka sanket karta hai. Traders ise ek mauka samajhte hain market mein bechne aur chhoti position lena ka.

CRITERIA FOR ENGULFING CANDLESTICK PATTERNS:

Engulfing pattern ke hone ko confirm karne ke liye, traders kuch criteria ka palan karte hain. Sabse pehle, dusri candlestick ki body pehli candlestick ki body ko puri tarah se gherna chahiye. Dusri baat, ye pattern ek significant support ya resistance level par honi chahiye. Isse pattern ki vishwasniyata badhti hai kyunki ye ek possible reversal zone ko darshati hai. Iss pattern ke dauran volume bhi ahem hai. Jyada volume hone par engulfing pattern ki reversal signal ki takat ko tasleem kiya jata hai. Ant mein, engulfing candlestick ki size bhi mahatvapurna hai. Ek badi engulfing candlestick ek majboot reversal signal ko darshati hai.

ENGULFING CANDLESTICK PATTERNS AS REVERSAL SIGNALS IN FOREX:

Engulfing candlestick patterns forex mein takatwar reversal signals hote hain. Jab ye patterns support aur resistance ke mukhya star par hoti hain, to ye market ki disha mein badlav ka sanket deti hain. Traders ise dusre technical indicators aur chart patterns ke saath istemaal karte hain apne trading signals ki vishwasniyata ko badhane ke liye. Ye zaruri hai ki jabki engulfing patterns mazboot signals deti hain, lekin ye infallible nahi hote. Traders ko hamesha risk management ki pratha karni chahiye aur apne signals ko aur analysis se tasdeek karna chahiye.

Ant mein, engulfing candlestick patterns forex trading mein mahatvapurna bhoomika nibhate hain. Ye market mein potential trend reversals ke baare mein mahatvapurna jaankari pradan karte hain. Alag-alag prakar ke engulfing patterns aur unke criteria ko samajh kar, traders behatar trading nirnay le sakte hain. Lekin, mahatvapurna hai ki hamesha thorough analysis kare aur risk management ka palan kare, taki safal trading ke parinam prapt ho sake.

تبصرہ

Расширенный режим Обычный режим