Dumpling Top Candlestick Pattern Ki Ta'aruf

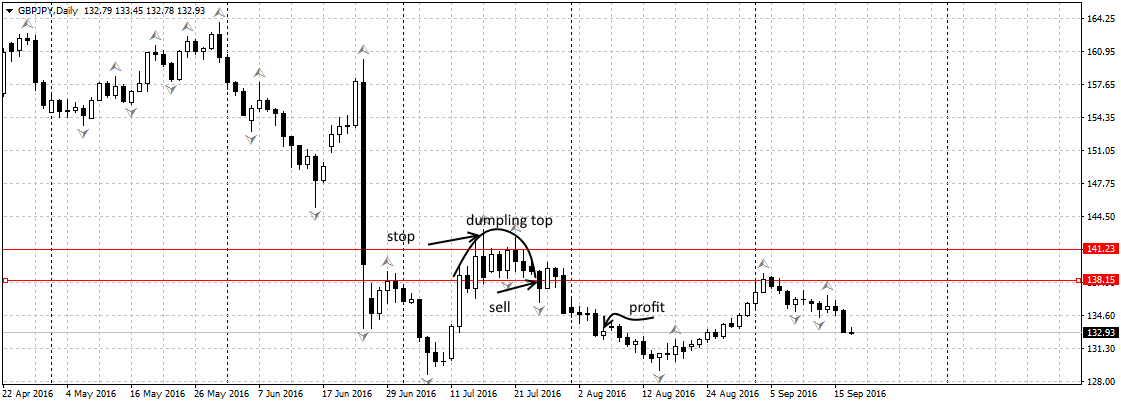

Dumpling Top Candlestick pattern ek aham technical analysis tool hai jo market trends ko identify karne mein madad karta hai. Is pattern ka appearance market mein potential trend reversal ko indicate karta hai, specifically bullish trend ke baad. Dumpling Top pattern mein ek lambi bullish candle hoti hai jo ek strong uptrend ko darust karti hai. Iske baad, doji ya small-sized bearish candle ata hai, jo market mein indecision ko represent karta hai. Teesra aur akhri candle phir se bearish hota hai aur pehle wale lambi bullish candle ko engulf karta hai, indicating ke bearish trend shuru ho sakta hai.

Dumpling Top Pattern Ki Formation kaisy hoti hy

Dumpling Top pattern ka key component hota hai pehla candle, jo ke market mein strong bullish momentum ko indicate karta hai. Iske baad ata hai doji ya small-sized bearish candle jo indecision ko show karta hai aur market mein buyers aur sellers ke darmiyan tug-of-war ko darust karta hai. Akhri candle jo bearish hota hai, engulfing the first large bullish candle, ye confirm karta hai ke bearish trend shuru ho sakta hai. Is pattern ki pehchan candlesticks ki shapes aur positioning par mabni hoti hai.

Dumpling Top Pattern ki Pehchan

Dumpling Top pattern ki pehchan karne ke liye, traders ko pehle market ki overall trend ko determine karna hota hai. Agar market uptrend mein hai, to ye pattern bearish reversal ko indicate karta hai. Is pattern mein pehla candle lamba aur bullish hota hai, doosra candle small-sized bearish hota hai, aur teesra candle phir se bearish hota hai aur pehle wale candle ko engulf karta hai. Ye pattern ko confirm karne ke liye, doosre candle ki closing price pehle wale candle ki body ke andar ya uske qareeb honi chahiye.

Dumpling Top Pattern Ka Istemal trading main

Dumpling Top pattern ka istemal traders ko advance mein indicate karta hai ke market mein bearish trend shuru ho sakta hai. Jab ye pattern confirm hota hai, to traders short positions le sakte hain, expecting ke market mein bearish momentum barqarar rahega. Stop-loss orders ko set karna bhi important hai taake in case of a false signal, nuksan se bacha ja sake. Is pattern ko doosre technical indicators ke sath milake aur market analysis ke sath combine karke istemal karna behtar results dene mein madad karta hai.

Dumpling Top Candlestick pattern ek aham technical analysis tool hai jo market trends ko identify karne mein madad karta hai. Is pattern ka appearance market mein potential trend reversal ko indicate karta hai, specifically bullish trend ke baad. Dumpling Top pattern mein ek lambi bullish candle hoti hai jo ek strong uptrend ko darust karti hai. Iske baad, doji ya small-sized bearish candle ata hai, jo market mein indecision ko represent karta hai. Teesra aur akhri candle phir se bearish hota hai aur pehle wale lambi bullish candle ko engulf karta hai, indicating ke bearish trend shuru ho sakta hai.

Dumpling Top Pattern Ki Formation kaisy hoti hy

Dumpling Top pattern ka key component hota hai pehla candle, jo ke market mein strong bullish momentum ko indicate karta hai. Iske baad ata hai doji ya small-sized bearish candle jo indecision ko show karta hai aur market mein buyers aur sellers ke darmiyan tug-of-war ko darust karta hai. Akhri candle jo bearish hota hai, engulfing the first large bullish candle, ye confirm karta hai ke bearish trend shuru ho sakta hai. Is pattern ki pehchan candlesticks ki shapes aur positioning par mabni hoti hai.

Dumpling Top Pattern ki Pehchan

Dumpling Top pattern ki pehchan karne ke liye, traders ko pehle market ki overall trend ko determine karna hota hai. Agar market uptrend mein hai, to ye pattern bearish reversal ko indicate karta hai. Is pattern mein pehla candle lamba aur bullish hota hai, doosra candle small-sized bearish hota hai, aur teesra candle phir se bearish hota hai aur pehle wale candle ko engulf karta hai. Ye pattern ko confirm karne ke liye, doosre candle ki closing price pehle wale candle ki body ke andar ya uske qareeb honi chahiye.

Dumpling Top Pattern Ka Istemal trading main

Dumpling Top pattern ka istemal traders ko advance mein indicate karta hai ke market mein bearish trend shuru ho sakta hai. Jab ye pattern confirm hota hai, to traders short positions le sakte hain, expecting ke market mein bearish momentum barqarar rahega. Stop-loss orders ko set karna bhi important hai taake in case of a false signal, nuksan se bacha ja sake. Is pattern ko doosre technical indicators ke sath milake aur market analysis ke sath combine karke istemal karna behtar results dene mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим