Forex trading ek challenging lekin lucrative career ho sakti hai, lekin shuruwat karne walon ke liye sahi currency pairs ka chayan karna zaroori hai. Sahi currency pair ka chayan karna, aapki trading experience ko asaan aur successful banane mein madadgar ho sakta hai. Is post mein, hum dekheinge ke shuruwat karne walon ke liye behtareen currency pairs kaun se hain.

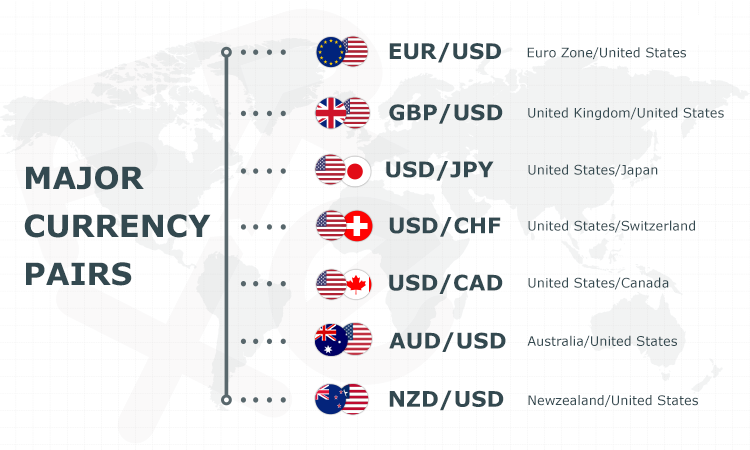

Major Currency Pairs:

Major currency pairs woh hote hain jo dunia ke sabse bade economies se jude hote hain. Inmein shamil hain:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

- NZD/USD (New Zealand Dollar/US Dollar)

Major currency pairs ka chayan karne ka faida hai ke inmein liquidity zyada hoti hai, aur spread (buying aur selling ke beech ka difference) kam hota hai. Isse shuruwat karne wale traders ko market mein achhi flexibility milti hai.

EUR/USD - Euro/US Dollar:

EUR/USD, sabse zyada traded currency pair mein se ek hai. Iska spread kam hota hai aur iski movements predict karne mein relatively asaan hoti hain. Isse traders ko achha learning experience milta hai.

Market Ka Deep Dive:

EUR/USD market mein popular hai, iska mtlb hai ke aapko iske baray mein zyada malumat mil sakti hai. Iske movements ka analysis karna shuruwat karne walon ke liye beneficial ho sakta hai.

USD/JPY - US Dollar/Japanese Yen:

USD/JPY bhi ek major currency pair hai jo liquidity aur volatility mein rich hota hai. Is pair mein price ka movement relatively stable hota hai, jo beginners ke liye achha hai.

Yen Ki Stability:

Japanese Yen ek stable currency hai, isliye USD/JPY mein sharp movements kam hote hain. Yeh beginners ke liye trading ko samajhne mein madad karta hai.

GBP/USD - British Pound/US Dollar:

GBP/USD ek volatile currency pair hai, lekin ismein opportunities zyada hoti hain. Iske movements ka analysis karke traders ko market trends ka accha insight mil sakta hai.

High Potential Profits:

GBP/USD mein high volatility hone ke bawajood, ismein potential profits bhi zyada hote hain. Lekin is volatility ke sath risk management bhi zaroori hai.

USD/CHF - US Dollar/Swiss Franc:

USD/CHF mein bhi liquidity acchi hoti hai aur ismein spread kam hota hai. Iska matlab hai ke trading costs kam hote hain, jo beginners ke liye faydemand hai.

Safe-Haven Currency:

Swiss Franc ek safe-haven currency hai, jiski wajah se USD/CHF mein economic uncertainties ke doraan bhi stability rehti hai.

Trading Strategies:

Trend Analysis:

Shuruwat karne wale traders ko trend analysis par focus karna chahiye. Major currency pairs mein trends relatively asaan hoti hain, jisse traders ko price movements samajhne mein madad milti hai.

Risk Management:

Har trade mein risk management ka hona zaroori hai. Beginners ko pata hona chahiye ke har trade mein kitna risk lena sahi hai aur stop-loss orders ka sahi istemal karna chahiye.

Demo Trading:

Demo trading account ka istemal karke shuruwat karne wale traders apni skills ko improve kar sakte hain bina kisi nuksan ke. Demo trading aapko real market conditions mein practice karne ka mauka deta hai.

Conclusion:

Shuruwat karne wale traders ke liye behtareen currency pair ka chayan karna, unke trading journey ke liye crucial hai. Major currency pairs, jaise ke EUR/USD, USD/JPY, aur GBP/USD, liquidity aur volatility ke mamle mein beginners ke liye acchi hoti hain. In pairs mein trading karte waqt, traders ko market ki nuances samajhne mein madad milti hai aur unko achhi flexibility milti hai. Lekin yaad rahe, har trading decision ko dhyan se lena chahiye aur risk management ka tajwez karna zaroori hai. Sahi currency pair ka chayan karke, shuruwat karne wale traders apni trading skills ko develop karke market mein acche results achieve kar sakte hain.

Major Currency Pairs:

Major currency pairs woh hote hain jo dunia ke sabse bade economies se jude hote hain. Inmein shamil hain:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

- NZD/USD (New Zealand Dollar/US Dollar)

Major currency pairs ka chayan karne ka faida hai ke inmein liquidity zyada hoti hai, aur spread (buying aur selling ke beech ka difference) kam hota hai. Isse shuruwat karne wale traders ko market mein achhi flexibility milti hai.

EUR/USD - Euro/US Dollar:

EUR/USD, sabse zyada traded currency pair mein se ek hai. Iska spread kam hota hai aur iski movements predict karne mein relatively asaan hoti hain. Isse traders ko achha learning experience milta hai.

Market Ka Deep Dive:

EUR/USD market mein popular hai, iska mtlb hai ke aapko iske baray mein zyada malumat mil sakti hai. Iske movements ka analysis karna shuruwat karne walon ke liye beneficial ho sakta hai.

USD/JPY - US Dollar/Japanese Yen:

USD/JPY bhi ek major currency pair hai jo liquidity aur volatility mein rich hota hai. Is pair mein price ka movement relatively stable hota hai, jo beginners ke liye achha hai.

Yen Ki Stability:

Japanese Yen ek stable currency hai, isliye USD/JPY mein sharp movements kam hote hain. Yeh beginners ke liye trading ko samajhne mein madad karta hai.

GBP/USD - British Pound/US Dollar:

GBP/USD ek volatile currency pair hai, lekin ismein opportunities zyada hoti hain. Iske movements ka analysis karke traders ko market trends ka accha insight mil sakta hai.

High Potential Profits:

GBP/USD mein high volatility hone ke bawajood, ismein potential profits bhi zyada hote hain. Lekin is volatility ke sath risk management bhi zaroori hai.

USD/CHF - US Dollar/Swiss Franc:

USD/CHF mein bhi liquidity acchi hoti hai aur ismein spread kam hota hai. Iska matlab hai ke trading costs kam hote hain, jo beginners ke liye faydemand hai.

Safe-Haven Currency:

Swiss Franc ek safe-haven currency hai, jiski wajah se USD/CHF mein economic uncertainties ke doraan bhi stability rehti hai.

Trading Strategies:

Trend Analysis:

Shuruwat karne wale traders ko trend analysis par focus karna chahiye. Major currency pairs mein trends relatively asaan hoti hain, jisse traders ko price movements samajhne mein madad milti hai.

Risk Management:

Har trade mein risk management ka hona zaroori hai. Beginners ko pata hona chahiye ke har trade mein kitna risk lena sahi hai aur stop-loss orders ka sahi istemal karna chahiye.

Demo Trading:

Demo trading account ka istemal karke shuruwat karne wale traders apni skills ko improve kar sakte hain bina kisi nuksan ke. Demo trading aapko real market conditions mein practice karne ka mauka deta hai.

Conclusion:

Shuruwat karne wale traders ke liye behtareen currency pair ka chayan karna, unke trading journey ke liye crucial hai. Major currency pairs, jaise ke EUR/USD, USD/JPY, aur GBP/USD, liquidity aur volatility ke mamle mein beginners ke liye acchi hoti hain. In pairs mein trading karte waqt, traders ko market ki nuances samajhne mein madad milti hai aur unko achhi flexibility milti hai. Lekin yaad rahe, har trading decision ko dhyan se lena chahiye aur risk management ka tajwez karna zaroori hai. Sahi currency pair ka chayan karke, shuruwat karne wale traders apni trading skills ko develop karke market mein acche results achieve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим