Forex time frame, ya trading time frame, ek ahem concept hai jo forex market mein traders ke liye crucial role ada karta hai. Yeh traders ko market ka analysis karne aur trading decisions lene mein madad karta hai. Is post mein, hum forex time frame ke baare mein mukhtasar malumat hasil karenge.

Time Frame Kya Hai:

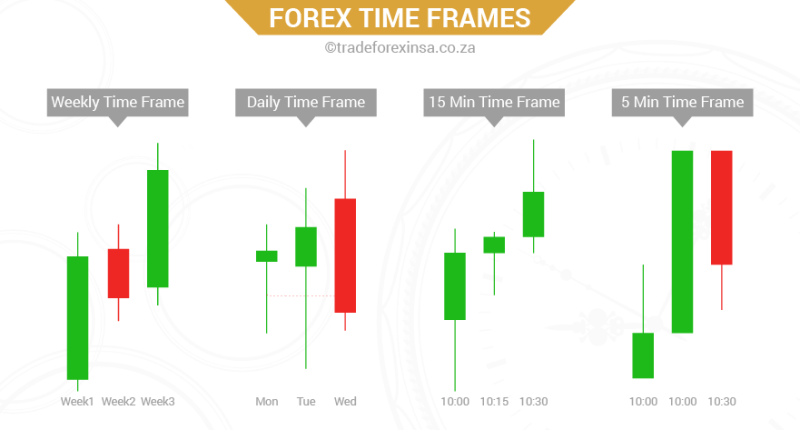

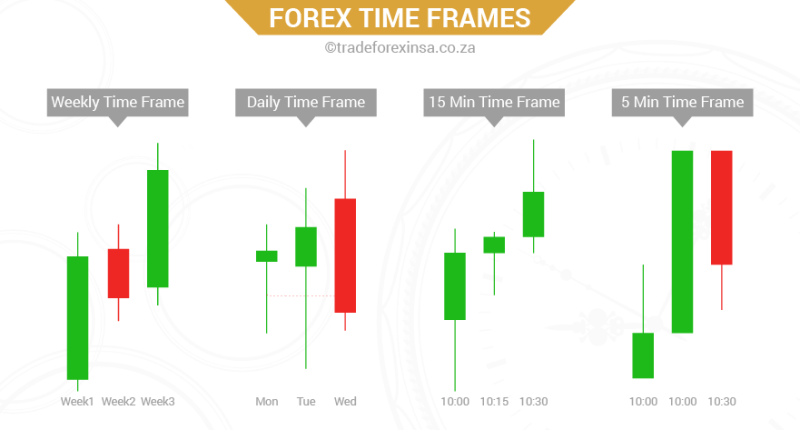

Time frame ek tareeqa hai jisse market ki movements aur price changes ko represent kiya jata hai. Har candlestick ya bar chart ek specific time frame ko darust karta hai, jaise ke 1 minute, 1 ghanta, 4 ghante, ya phir din. Yeh time frame traders ko market ke different aspects ko analyze karne mein madad karta hai.

Different Time Frames:

Forex market mein kai tarah ke time frames istemal kiye jate hain. Kuch common time frames mein shamil hain:

- 1-Minute Chart: Har candlestick ya bar 1-minute ka time period darust karta hai.

- 5-Minute Chart: Har candlestick ya bar 5-minute ke time period ko represent karta hai.

- 15-Minute Chart: Har candlestick ya bar 15-minute ka time period darust karta hai.

- 1-Hour Chart: Har candlestick ya bar 1-hour ka time period darust karta hai.

- 4-Hour Chart: Har candlestick ya bar 4-hour ka time period darust karta hai.

- Daily Chart: Har candlestick ya bar ek din ka time period darust karta hai.

- Weekly Chart: Har candlestick ya bar ek haftay ka time period darust karta hai.

- Monthly Chart: Har candlestick ya bar ek mahine ka time period darust karta hai.

Time Frame Ka Ahemiyat:

- Short-Term Trading:

Chhote time frames, jaise ke 1-minute, 5-minute, ya 15-minute, short-term trading ke liye istemal hote hain. In time frames mein market ki chhoti movements ko dekh kar traders intraday trades lete hain.

- Medium-Term Trading:

1-hour aur 4-hour time frames medium-term trading ke liye istemal hote hain. Ismein traders market trends ko capture karne aur position trading karne mein madad hasil karte hain.

- Long-Term Trading:

Daily, weekly, aur monthly time frames long-term trading ke liye istemal hote hain. Ismein traders market ke bade trends ko analyze karte hain aur long-term positions lete hain.

Intraday Trading Aur Short-Term Time Frames:

- Intraday Trading Mein Istemal:

Intraday trading mein traders chhote time frames ka istemal karte hain jaise ke 1-minute, 5-minute, ya 15-minute. Yeh time frames unko market ke short-term fluctuations ko dekhne aur uspar trade karne mein madad karte hain.

- Challenges:

Chhote time frames ka istemal karne mein kuch challenges bhi hote hain, jaise ke jaldi hone wale price changes, jinke kaaran risk management aur stop-loss orders ka sahi istemal zaroori hota hai.

Medium-Term Trading Aur Trend Analysis:

- Istemal Aur Faide:

Medium-term trading ke liye 1-hour aur 4-hour time frames istemal hote hain. Yeh time frames traders ko market ke trends ko analyze karne mein madad karte hain aur unko trend direction ka pata chalta hai.

- Position Trading:

Ismein traders apne positions ko kuch din ya hafton tak hold karte hain, aur ismein long-term trends ko follow karte hain. Trend analysis ke through, traders market ke future direction ka tajwez kar sakte hain.

Long-Term Trading Aur Strategic Planning:

- Istemal Aur Faide:

Long-term trading ke liye daily, weekly, aur monthly time frames istemal hote hain. Yeh time frames traders ko market ke bade trends ko analyze karne aur unke long-term strategic plans banane mein madad karte hain.

- Investment Decisions:

Long-term trading mein traders apne investments ko bade time frame par base karke karte hain. Ismein economic indicators, geopolitical events, aur market trends ka detailed analysis hota hai.

Kaise Choose Karein:

- Risk Tolerance:

Aapko apni risk tolerance ko madde nazar rakhte hue time frame choose karna chahiye. Chhote time frames mein jyada volatility hoti hai, jisse risk bhi badh jata hai.

- Trading Style:

Aapka trading style bhi ek important factor hai. Agar aap intraday trader hain, toh chhote time frames ka istemal karna behtar hota hai. Jabki agar aap position trader hain, toh long-term time frames ka istemal karna aapke liye suitable hoga.

- Analysis Ka Tareeqa:

Aapke analysis ka tareeqa bhi time frame choose karte waqt important hai. Chhote time frames mein technical analysis zyada effective hoti hai, jabki long-term time frames mein fundamental analysis bhi important hota hai.

Conclusion:

Forex time frame ka chayan karna, ek trader ke liye vital hai. Har time frame apne apne taur par ahemiyat rakhta hai aur traders ko market ke different aspects ko dekhne mein madad karta hai. Sahi time frame ka chayan karke traders apni trading strategies ko refine kar sakte hain aur market ke changes ke saath behtar taur par cope kar sakte hain. Jiseki wajah se, time frame choose karte waqt apne trading goals aur style ko madde nazar rakhna zaroori hai.

Time Frame Kya Hai:

Time frame ek tareeqa hai jisse market ki movements aur price changes ko represent kiya jata hai. Har candlestick ya bar chart ek specific time frame ko darust karta hai, jaise ke 1 minute, 1 ghanta, 4 ghante, ya phir din. Yeh time frame traders ko market ke different aspects ko analyze karne mein madad karta hai.

Different Time Frames:

Forex market mein kai tarah ke time frames istemal kiye jate hain. Kuch common time frames mein shamil hain:

- 1-Minute Chart: Har candlestick ya bar 1-minute ka time period darust karta hai.

- 5-Minute Chart: Har candlestick ya bar 5-minute ke time period ko represent karta hai.

- 15-Minute Chart: Har candlestick ya bar 15-minute ka time period darust karta hai.

- 1-Hour Chart: Har candlestick ya bar 1-hour ka time period darust karta hai.

- 4-Hour Chart: Har candlestick ya bar 4-hour ka time period darust karta hai.

- Daily Chart: Har candlestick ya bar ek din ka time period darust karta hai.

- Weekly Chart: Har candlestick ya bar ek haftay ka time period darust karta hai.

- Monthly Chart: Har candlestick ya bar ek mahine ka time period darust karta hai.

Time Frame Ka Ahemiyat:

- Short-Term Trading:

Chhote time frames, jaise ke 1-minute, 5-minute, ya 15-minute, short-term trading ke liye istemal hote hain. In time frames mein market ki chhoti movements ko dekh kar traders intraday trades lete hain.

- Medium-Term Trading:

1-hour aur 4-hour time frames medium-term trading ke liye istemal hote hain. Ismein traders market trends ko capture karne aur position trading karne mein madad hasil karte hain.

- Long-Term Trading:

Daily, weekly, aur monthly time frames long-term trading ke liye istemal hote hain. Ismein traders market ke bade trends ko analyze karte hain aur long-term positions lete hain.

Intraday Trading Aur Short-Term Time Frames:

- Intraday Trading Mein Istemal:

Intraday trading mein traders chhote time frames ka istemal karte hain jaise ke 1-minute, 5-minute, ya 15-minute. Yeh time frames unko market ke short-term fluctuations ko dekhne aur uspar trade karne mein madad karte hain.

- Challenges:

Chhote time frames ka istemal karne mein kuch challenges bhi hote hain, jaise ke jaldi hone wale price changes, jinke kaaran risk management aur stop-loss orders ka sahi istemal zaroori hota hai.

Medium-Term Trading Aur Trend Analysis:

- Istemal Aur Faide:

Medium-term trading ke liye 1-hour aur 4-hour time frames istemal hote hain. Yeh time frames traders ko market ke trends ko analyze karne mein madad karte hain aur unko trend direction ka pata chalta hai.

- Position Trading:

Ismein traders apne positions ko kuch din ya hafton tak hold karte hain, aur ismein long-term trends ko follow karte hain. Trend analysis ke through, traders market ke future direction ka tajwez kar sakte hain.

Long-Term Trading Aur Strategic Planning:

- Istemal Aur Faide:

Long-term trading ke liye daily, weekly, aur monthly time frames istemal hote hain. Yeh time frames traders ko market ke bade trends ko analyze karne aur unke long-term strategic plans banane mein madad karte hain.

- Investment Decisions:

Long-term trading mein traders apne investments ko bade time frame par base karke karte hain. Ismein economic indicators, geopolitical events, aur market trends ka detailed analysis hota hai.

Kaise Choose Karein:

- Risk Tolerance:

Aapko apni risk tolerance ko madde nazar rakhte hue time frame choose karna chahiye. Chhote time frames mein jyada volatility hoti hai, jisse risk bhi badh jata hai.

- Trading Style:

Aapka trading style bhi ek important factor hai. Agar aap intraday trader hain, toh chhote time frames ka istemal karna behtar hota hai. Jabki agar aap position trader hain, toh long-term time frames ka istemal karna aapke liye suitable hoga.

- Analysis Ka Tareeqa:

Aapke analysis ka tareeqa bhi time frame choose karte waqt important hai. Chhote time frames mein technical analysis zyada effective hoti hai, jabki long-term time frames mein fundamental analysis bhi important hota hai.

Conclusion:

Forex time frame ka chayan karna, ek trader ke liye vital hai. Har time frame apne apne taur par ahemiyat rakhta hai aur traders ko market ke different aspects ko dekhne mein madad karta hai. Sahi time frame ka chayan karke traders apni trading strategies ko refine kar sakte hain aur market ke changes ke saath behtar taur par cope kar sakte hain. Jiseki wajah se, time frame choose karte waqt apne trading goals aur style ko madde nazar rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим