Forex trading mein safalta paane ke liye, traders ko apne trades ko hoshiyari se manage karna zaroori hai. Take-Profit (TP) aur Stop-Loss (SL) do aham tools hain jo traders ko nuksan se bachane aur munafa maximise karne mein madad karte hain. Is post mein, hum in dono concepts par ghaur karenge aur samajhenge ke inka istemal trading mein kaise hota hai.

What Is Take-Profit (TP) ?

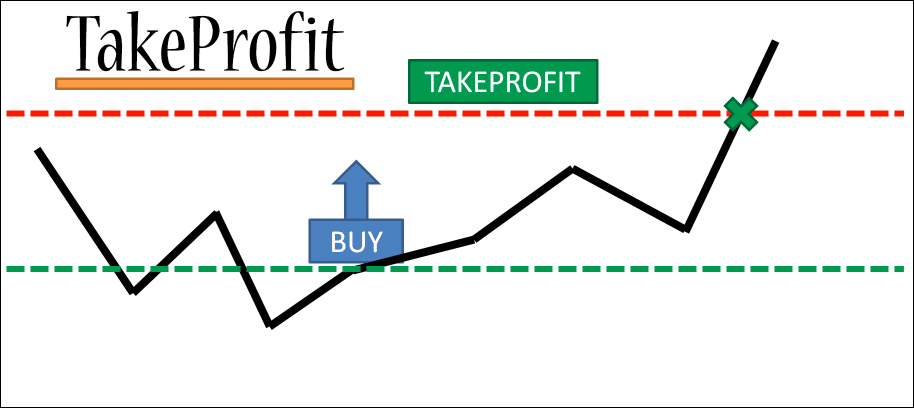

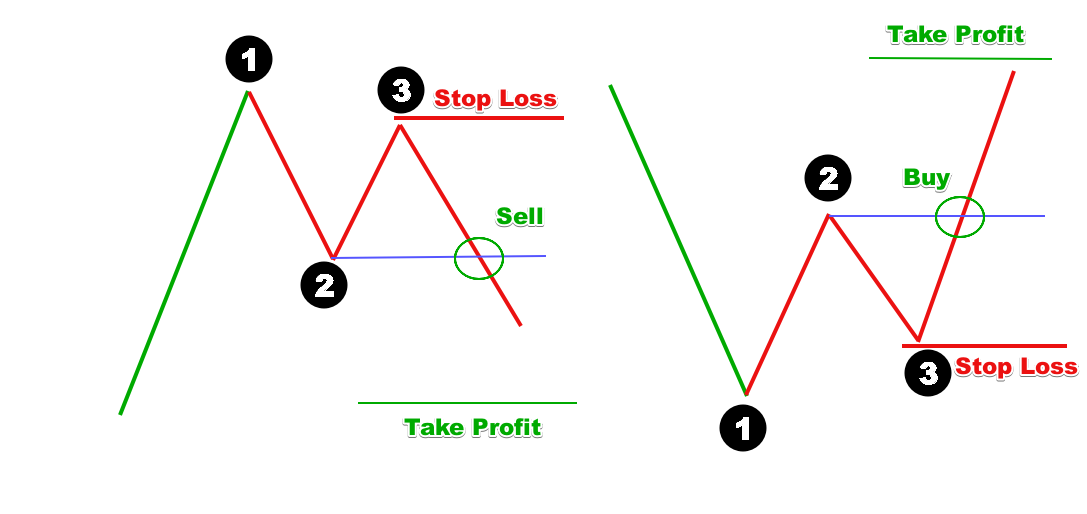

Take-Profit (TP) ek predefined level hai jahan par trader apne trade ko band karna chahta hai, takay usse desired profit mil sake. Jab aap ek trade open karte hain, aap apne trading platform par TP level set karte hain, jise market reach karte hi aapka trade automatically close ho jata hai.

TP level ko tay karte waqt, traders apne profit goals aur market conditions ka bhi dhyan rakhte hain. Yeh level ek strategy ka hissa hota hai jise trader ne pehle se decide kia hota hai, taake emotional decision-making se bacha ja sake. TP level ko set karte waqt, aap apne risk-reward ratio ka bhi khayal rakhte hain, jise aapko pata chalta hai ke kitna risk le rahe hain compared to expected profit.

What Is Stop-Loss (SL) ?

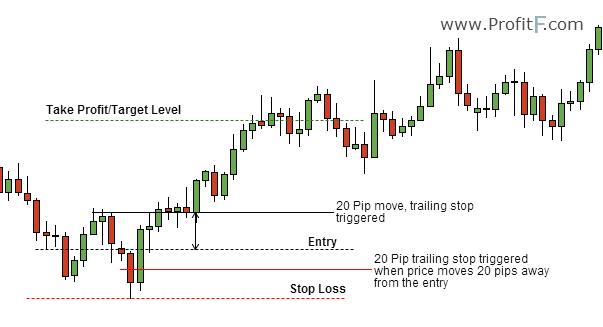

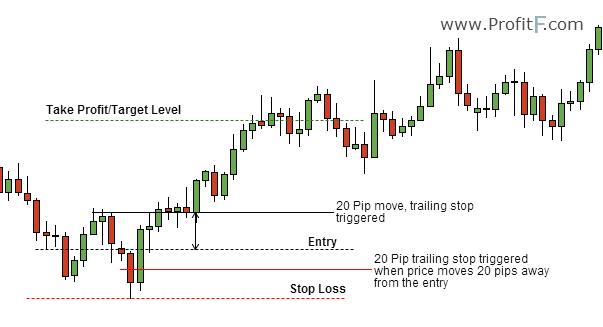

Stop-Loss (SL) ek dusra important concept hai jo traders ko nuksan se bachane mein madad karta hai. SL level ek predefined point hota hai jahan par trader apne trade ko automatically band karna chahta hai agar market against direction move karta hai. Is level ko set karte waqt, trader decide karta hai ke woh kitna nuksan tolerate karne ke liye tayyar hai.

SL ka istemal emotional decision-making se bachane ke liye bhi hota hai. Jab market conditions unfavourable ho jaati hain aur trade direction ke against move karta hai, to SL level se trade automatically close ho jata hai, aur nuksan minimum rehta hai. Yeh traders ko market volatility se bachane mein madad karta hai.

Take-Profit Aur Stop-Loss Ka Istemal Kaise Karein

Risk Management:

Take-Profit aur Stop-Loss ka istemal karke traders apne risk ko manage kar sakte hain. TP level se munafa lock hota hai aur SL level se nuksan control mein rehta hai. Risk management strategy banate waqt, traders ye decide karte hain ke kitna percentage apne total capital se risk le sakte hain.

Emotions Se Bachayein:

TP aur SL ka predefined hona traders ko emotions se bachane mein madad karta hai. Jab market mein volatility hoti hai, to traders kaam par focus karke apne trading plan ko follow kar sakte hain, bina emotional decisions ke.

Profit Maximization:

TP ka istemal karke traders apne profits ko maximize kar sakte hain. Jab market aapke desired profit level tak pahunchta hai, to TP level se trade automatically close ho jata hai, aur aap apna munafa secure kar lete hain.

Risk Minimization:

SL level se nuksan ko minimum karne mein bhi madad milti hai. Agar market direction ke against move hota hai, to SL level se trade band ho jata hai aur nuksan control mein rehta hai.

Strategy Development:

Take-Profit aur Stop-Loss levels ko tay karte waqt, traders apne trading strategy ko develop karte hain. In levels ko tay karte waqt, aapko apne trading plan aur market analysis ka bharosa hota hai, jisse aap apne trades ko hoshiyari se manage kar sakte hain.

To conclude, Take-Profit aur Stop-Loss levels forex trading mein crucial tools hain jo traders ko nuksan se bachane aur munafa maximize karne mein madad karte hain. In levels ko tay karte waqt, traders ko market volatility, risk tolerance, aur overall trading plan ka dhyan rakhna chahiye. Hamesha yaad rahe ke in levels ko tay karte waqt hoshiyari aur tajaweez ke sath kaam karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим