INTRODUCTION TO THE COUNTERATTACK LINE CANDLESTICK PATTERN:

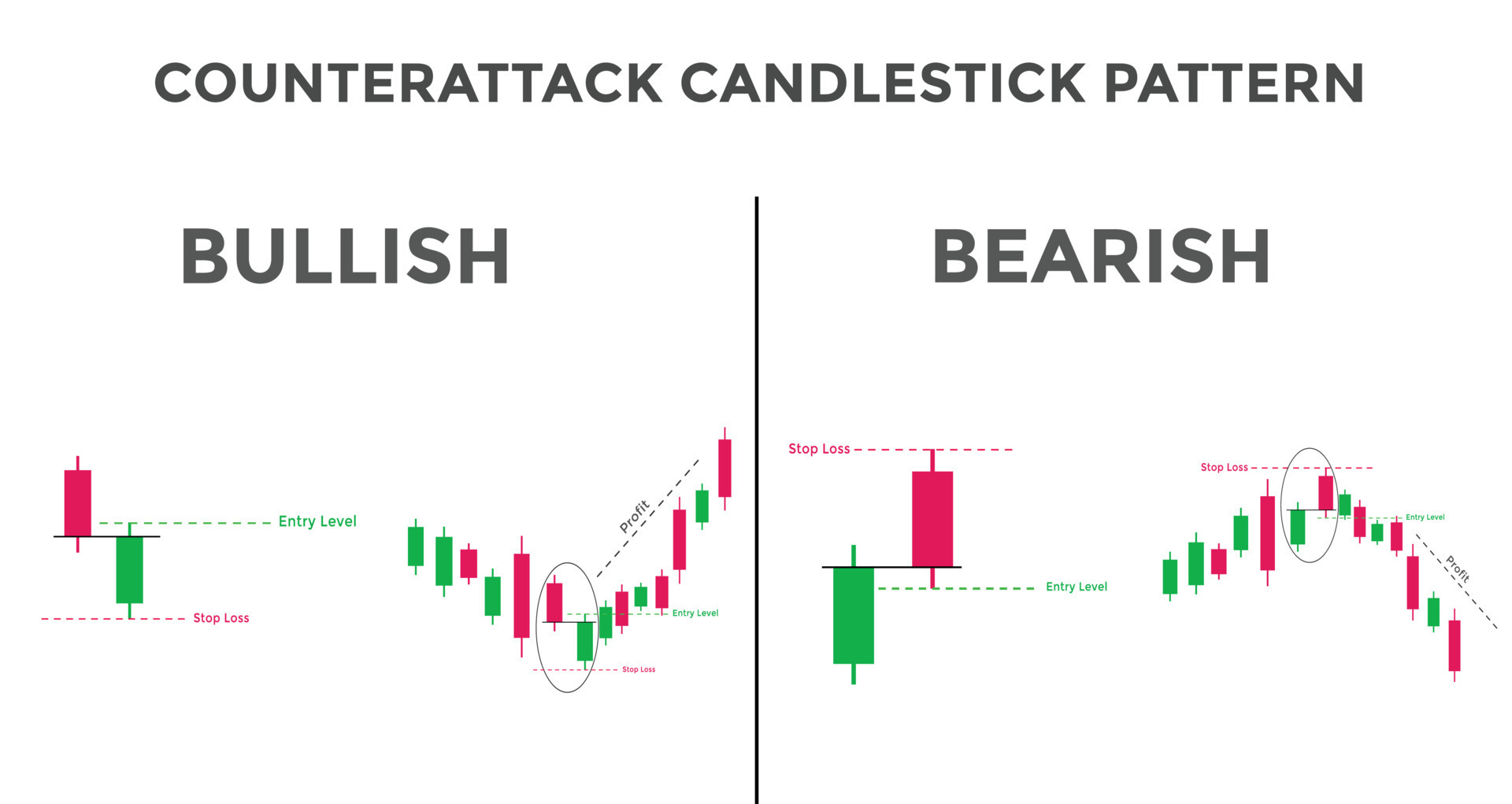

Counterattack Line candlestick pattern forex trading ke market fluctuations mein aam taur par paaye jane wala ek behad mukhlis reversal pattern hai. Is pattern mein domite hue candlesticks hote hain: ek bullish candlestick aur uske baad ek bearish candlestick. Ye pattern market sentiment mein ek possible change ya to bullish se bearish ya fir bearish se bullish ka sanket deta hai.

ANATOMY OF THE COUNTERATTACK LINE CANDLESTICK PATTERN:

Counterattack Line pattern mein, pehla candlestick ek bullish candlestick hota hai, jo ongoing uptrend ya bullish market sentiment ko darshata hai. Dusra candlestick ek bearish candlestick hota hai, jo pehle bullish candlestick ki puri body ko engulf kar leta hai. Ye bearish candlestick market sentiment mein ek sudden shift aur bechna pressure ka sanket deta hai.

Counterattack Line pattern ki pehchan ke liye iske kuch important characteristics hote hain. Bearish candlestick ki body pehle bullish candlestick ki body se bada hona chahiye. Iske alawa, agar bearish candlestick bullish candlestick ki body aur wicks dono ko engulf karta hai, to ye pattern jyada reliable hoti hai.

INTERPRETATION OF THE COUNTERATTACK LINE CANDLESTICK PATTERN:

Jab Counterattack Line pattern ek lambe samay tak ka uptrend ke baad dikhta hai, to ye bullish se bearish market sentiment mein ek possible reversal darshata hai. Jitna bada bearish candlestick pehle bullish candlestick ko engulf karta hai, utna hi strong reversal signal hota hai.

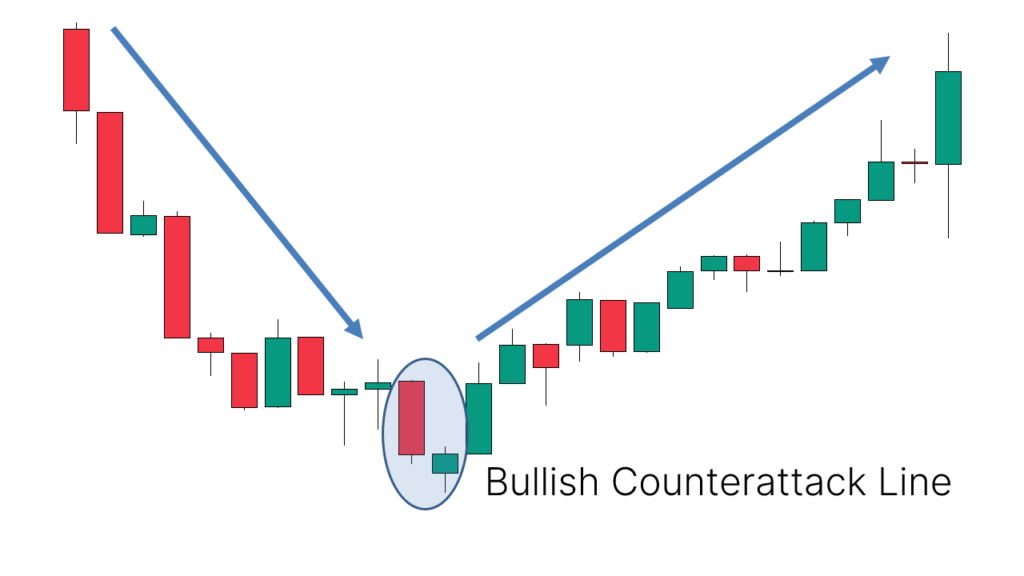

Dusri taraf, agar Counterattack Line pattern ek downtrend ke baad dikhta hai, to ye bearish se bullish reversal ka sanket deta hai. Phir se, bearish candlestick ki size aur extent pehle bullish candlestick ko engulf karne ke isarae se reversal ki strength ka idea milta hai.

TRADING STRATEGIES USING THE COUNTERATTACK LINE PATTERN:

Traders Counterattack Line pattern ka use karke alag-alag trading strategies bana sakte hain. Ek common strategy hai pattern ki confirmation ka wait karna trade mein enter hone se pehle. Traders pattern ke reversal signal ko validate karne ke liye bullish engulfing ya bearish engulfing pattern jaise tisre candlestick ka wait kar sakte hain.

Dusri strategy hai Counterattack Line pattern ka use karke potential support ya resistance levels ko identify karna. Traders significant price levels jaise previous highs ya lows ke pass pattern ko search kar sakte hain aur ise trade mein enter karne ka signal samajh sakte hain.

LIMITATIONS AND CONSIDERATIONS:

Counterattack Line pattern reliable hai, lekin ye infallible nahi hai. Traders ko reversal signal ko confirm karne ke liye additional technical indicators ya chart patterns ka use karna chahiye. Iske alawa, market conditions aur overall trend ko interpret karte waqt bhi dhyan dena chahiye.

Iske alawa, traders ko candlestick analysis ke dusre elements jaise pattern ki size aur location, overall volume aur market sentiment ko dhyan mein rakhna chahiye, Counterattack Line pattern par based trading decisions lene se pehle.

Ant mein, Counterattack Line candlestick pattern forex trading mein potential reversals identify karne ke liye ek powerful tool hai. Iska anatomy, interpretation aur alag-alag trading strategies ko samajh kar, traders informed trading decisions le sakte hain. Lekin, iske limitations ko dhyan mein rakhna aur iska use dusre technical analysis tools ke saath karna accuracy ke liye important hai.

Counterattack Line candlestick pattern forex trading ke market fluctuations mein aam taur par paaye jane wala ek behad mukhlis reversal pattern hai. Is pattern mein domite hue candlesticks hote hain: ek bullish candlestick aur uske baad ek bearish candlestick. Ye pattern market sentiment mein ek possible change ya to bullish se bearish ya fir bearish se bullish ka sanket deta hai.

ANATOMY OF THE COUNTERATTACK LINE CANDLESTICK PATTERN:

Counterattack Line pattern mein, pehla candlestick ek bullish candlestick hota hai, jo ongoing uptrend ya bullish market sentiment ko darshata hai. Dusra candlestick ek bearish candlestick hota hai, jo pehle bullish candlestick ki puri body ko engulf kar leta hai. Ye bearish candlestick market sentiment mein ek sudden shift aur bechna pressure ka sanket deta hai.

Counterattack Line pattern ki pehchan ke liye iske kuch important characteristics hote hain. Bearish candlestick ki body pehle bullish candlestick ki body se bada hona chahiye. Iske alawa, agar bearish candlestick bullish candlestick ki body aur wicks dono ko engulf karta hai, to ye pattern jyada reliable hoti hai.

INTERPRETATION OF THE COUNTERATTACK LINE CANDLESTICK PATTERN:

Jab Counterattack Line pattern ek lambe samay tak ka uptrend ke baad dikhta hai, to ye bullish se bearish market sentiment mein ek possible reversal darshata hai. Jitna bada bearish candlestick pehle bullish candlestick ko engulf karta hai, utna hi strong reversal signal hota hai.

Dusri taraf, agar Counterattack Line pattern ek downtrend ke baad dikhta hai, to ye bearish se bullish reversal ka sanket deta hai. Phir se, bearish candlestick ki size aur extent pehle bullish candlestick ko engulf karne ke isarae se reversal ki strength ka idea milta hai.

TRADING STRATEGIES USING THE COUNTERATTACK LINE PATTERN:

Traders Counterattack Line pattern ka use karke alag-alag trading strategies bana sakte hain. Ek common strategy hai pattern ki confirmation ka wait karna trade mein enter hone se pehle. Traders pattern ke reversal signal ko validate karne ke liye bullish engulfing ya bearish engulfing pattern jaise tisre candlestick ka wait kar sakte hain.

Dusri strategy hai Counterattack Line pattern ka use karke potential support ya resistance levels ko identify karna. Traders significant price levels jaise previous highs ya lows ke pass pattern ko search kar sakte hain aur ise trade mein enter karne ka signal samajh sakte hain.

LIMITATIONS AND CONSIDERATIONS:

Counterattack Line pattern reliable hai, lekin ye infallible nahi hai. Traders ko reversal signal ko confirm karne ke liye additional technical indicators ya chart patterns ka use karna chahiye. Iske alawa, market conditions aur overall trend ko interpret karte waqt bhi dhyan dena chahiye.

Iske alawa, traders ko candlestick analysis ke dusre elements jaise pattern ki size aur location, overall volume aur market sentiment ko dhyan mein rakhna chahiye, Counterattack Line pattern par based trading decisions lene se pehle.

Ant mein, Counterattack Line candlestick pattern forex trading mein potential reversals identify karne ke liye ek powerful tool hai. Iska anatomy, interpretation aur alag-alag trading strategies ko samajh kar, traders informed trading decisions le sakte hain. Lekin, iske limitations ko dhyan mein rakhna aur iska use dusre technical analysis tools ke saath karna accuracy ke liye important hai.

تبصرہ

Расширенный режим Обычный режим