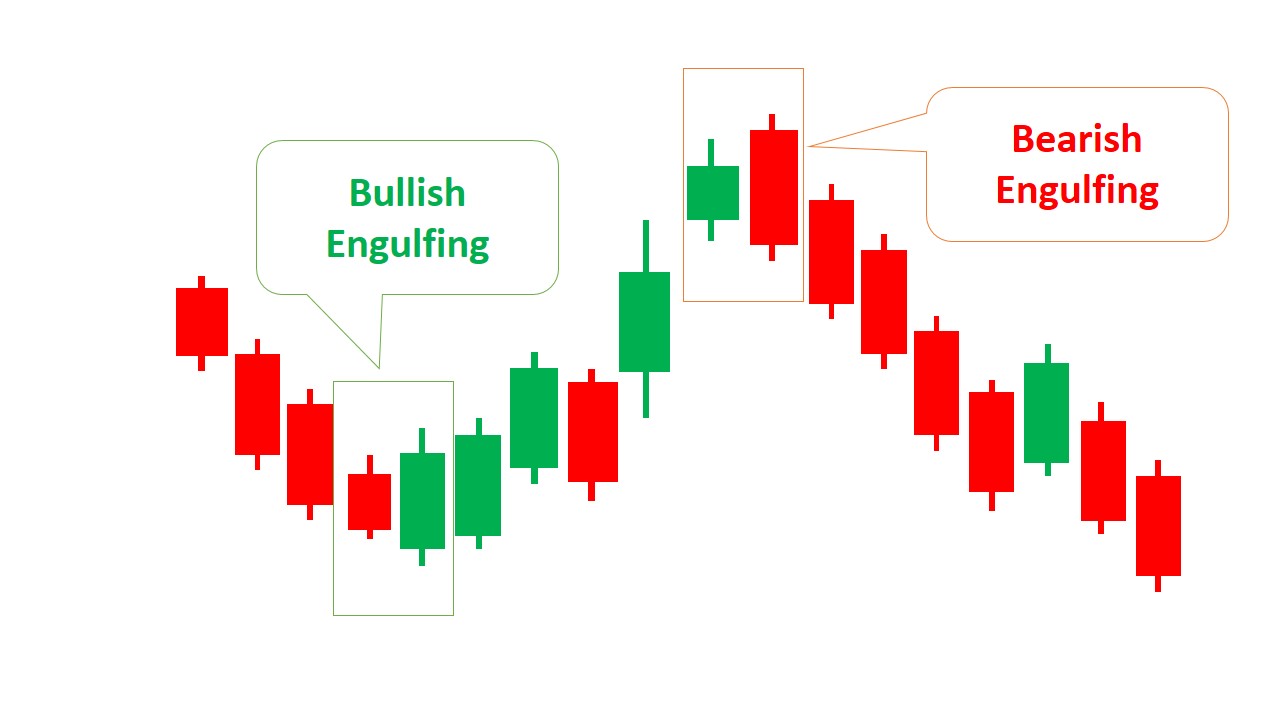

DEFINITION AND CHARACTERISTICS OF THE BEARISH ENGULFING PATTERN :

Bearish Engulfing pattern ek technical pattern hai jo aam taur par ek uptrend ki reversal ki nishaani deti hai. Isme docandlesticks hote hain, jisme dusra candlestick pehle wale se bada hota hai aur use poori tarah "engulf" kar leta hai. Dusre candlestick ka open pehle wale candlestick ke close se niche hota hai aur close pehle wale candlestick ke open se niche hota hai. Is pattern ko bearish sign samjha jata hai kyunki isse yeh sujhaya jata hai ki sell karne wale buyers ko harna ke karobar par qabza ho gaya hai.

IMPORTANCE OF VOLUME IN BEARISH ENGULFING PATTERNS :

Volume bearish engulfing patterns ki tashkhees karte waqt tawazun ka ahem factor hai. Bearish engulfing pattern ke formation ke dauran high volume mein bechne wale pressure ka buhat zor hota hai aur is pattern ki ahmiyat mein izafa hota hai. Isse yeh samjha jata hai ki traders ki barhti hui shirkat hai aur pattern zayada reliable signal ban sakta hai. Wahi kam volume yeh ishara de sakta hai ki pattern kam ahmiyat ka hai aur yeh false signal bhi ho sakta hai. Is liye bearish engulfing pattern ki tashkhees mein volume ke saath saath ghor karna zaroori hai takay uski qowat tasdeeq ho sake.

BEARISH ENGULFING PATTERN IN VARIOUS TIME FRAMES :

Bearish engulfing pattern mukhtalif timeframes mein paya ja sakta hai, jaise ke intraday charts se lekar long-term charts tak. Pattern ki ahmiyat timeframe par depend karti hai jisme woh appear hota hai. Chote timeframes, jaise ke hourly ya 15-minute charts, mein bearish engulfing pattern ek potentiial short-term reversal ya pullback ki nishaani ho sakta hai. Lambe timeframes, jaise ke daily ya weekly charts, mein bearish engulfing pattern ek zyada important trend reversal ya market sentiment ki tabdeeli ki nishaani ho sakta hai. Traders ko bearish engulfing pattern ki tashkhees mein timeframe ko samjhna zaroori hai takay pattern ka potential impact tay kar sake.

CONFIRMATION AND VALIDITY OF THE BEARISH ENGULFING PATTERN :

Jaise ke kisi bhi technical pattern ki tasdeeq ke liye, bearish engulfing pattern bhi dusre technical indicators ya price action signals ki tasdeeq se confirm hona chahiye. Traders indicators jaise moving averages, trendlines, ya support aur resistance levels ki madad se additional confirmation talash kar sakte hain. For example, agar bearish engulfing pattern kisi bada resistance level ke qareeb ya multiple technical factors ki milaawat mein ban raha hai, toh woh zyada reliable signal ban jata hai. Iske sath hi, traders ko bearish engulfing pattern par amal karne se pehle overall market context aur sentiment ko bhi samjhna chahiye. Agar market mein strong uptrend hai ya bullish factors market ko support kar rahe hain, toh bearish engulfing pattern kam ahmiyat ka ho sakta hai.

TRADING STRATEGIES AND RISK MANAGEMENT WITH BEARISH ENGULFING PATTERNS :

Bearish engulfing pattern ke saath kuch trading strategies istemaal ki ja sakti hai. Traders bearish engulfing pattern banane par short position le sakte hain, jisme pattern ke high se oopar ek stop-loss order lagaya jata hai. Isse traders apna risk kam kar sakte hain aur khud ko mehfooz kar sakte hain agar pattern nakam ho jaye aur market ooncha chalne ka jari rakhe. Iske alawa, traders bearish engulfing pattern ko ek signal ke taur par istemaal karke existing long positions ko band kar sakte hain ya munafa haasil kar sakte hain. Yeh strategy pattern dwaara indicate hone wale potential trend reversal ka faida uthati hai. Risk management ke hawale se, traders ko stop-loss orders set karna zaroori hai aur apne trading capital ka kisi single trade par zyada risk na lena.

Bearish Engulfing pattern ek technical pattern hai jo aam taur par ek uptrend ki reversal ki nishaani deti hai. Isme docandlesticks hote hain, jisme dusra candlestick pehle wale se bada hota hai aur use poori tarah "engulf" kar leta hai. Dusre candlestick ka open pehle wale candlestick ke close se niche hota hai aur close pehle wale candlestick ke open se niche hota hai. Is pattern ko bearish sign samjha jata hai kyunki isse yeh sujhaya jata hai ki sell karne wale buyers ko harna ke karobar par qabza ho gaya hai.

IMPORTANCE OF VOLUME IN BEARISH ENGULFING PATTERNS :

Volume bearish engulfing patterns ki tashkhees karte waqt tawazun ka ahem factor hai. Bearish engulfing pattern ke formation ke dauran high volume mein bechne wale pressure ka buhat zor hota hai aur is pattern ki ahmiyat mein izafa hota hai. Isse yeh samjha jata hai ki traders ki barhti hui shirkat hai aur pattern zayada reliable signal ban sakta hai. Wahi kam volume yeh ishara de sakta hai ki pattern kam ahmiyat ka hai aur yeh false signal bhi ho sakta hai. Is liye bearish engulfing pattern ki tashkhees mein volume ke saath saath ghor karna zaroori hai takay uski qowat tasdeeq ho sake.

BEARISH ENGULFING PATTERN IN VARIOUS TIME FRAMES :

Bearish engulfing pattern mukhtalif timeframes mein paya ja sakta hai, jaise ke intraday charts se lekar long-term charts tak. Pattern ki ahmiyat timeframe par depend karti hai jisme woh appear hota hai. Chote timeframes, jaise ke hourly ya 15-minute charts, mein bearish engulfing pattern ek potentiial short-term reversal ya pullback ki nishaani ho sakta hai. Lambe timeframes, jaise ke daily ya weekly charts, mein bearish engulfing pattern ek zyada important trend reversal ya market sentiment ki tabdeeli ki nishaani ho sakta hai. Traders ko bearish engulfing pattern ki tashkhees mein timeframe ko samjhna zaroori hai takay pattern ka potential impact tay kar sake.

CONFIRMATION AND VALIDITY OF THE BEARISH ENGULFING PATTERN :

Jaise ke kisi bhi technical pattern ki tasdeeq ke liye, bearish engulfing pattern bhi dusre technical indicators ya price action signals ki tasdeeq se confirm hona chahiye. Traders indicators jaise moving averages, trendlines, ya support aur resistance levels ki madad se additional confirmation talash kar sakte hain. For example, agar bearish engulfing pattern kisi bada resistance level ke qareeb ya multiple technical factors ki milaawat mein ban raha hai, toh woh zyada reliable signal ban jata hai. Iske sath hi, traders ko bearish engulfing pattern par amal karne se pehle overall market context aur sentiment ko bhi samjhna chahiye. Agar market mein strong uptrend hai ya bullish factors market ko support kar rahe hain, toh bearish engulfing pattern kam ahmiyat ka ho sakta hai.

TRADING STRATEGIES AND RISK MANAGEMENT WITH BEARISH ENGULFING PATTERNS :

Bearish engulfing pattern ke saath kuch trading strategies istemaal ki ja sakti hai. Traders bearish engulfing pattern banane par short position le sakte hain, jisme pattern ke high se oopar ek stop-loss order lagaya jata hai. Isse traders apna risk kam kar sakte hain aur khud ko mehfooz kar sakte hain agar pattern nakam ho jaye aur market ooncha chalne ka jari rakhe. Iske alawa, traders bearish engulfing pattern ko ek signal ke taur par istemaal karke existing long positions ko band kar sakte hain ya munafa haasil kar sakte hain. Yeh strategy pattern dwaara indicate hone wale potential trend reversal ka faida uthati hai. Risk management ke hawale se, traders ko stop-loss orders set karna zaroori hai aur apne trading capital ka kisi single trade par zyada risk na lena.

تبصرہ

Расширенный режим Обычный режим