Range-bound trading forex market mein aik mashhoor strateji hai jahan traders qeemat ki harkaton se munafa kamana chahte hain jo ek mukarrar mawafiqat ke andar hoti hai. Forex market mein, currency pairs aksar consolidation ya sideways movement ki muddaton mein mubtala hoti hain, jis se support aur resistance ke maqami darajay paida hote hain. Traders jo range-bound trading strategies istemal karte hain, unka maqsad hota hai ke woh in qeemat mawafiqaton se faida uthayen, support levels par khareedari karte hain aur resistance levels par farokht karte hain.

Identifying the Range

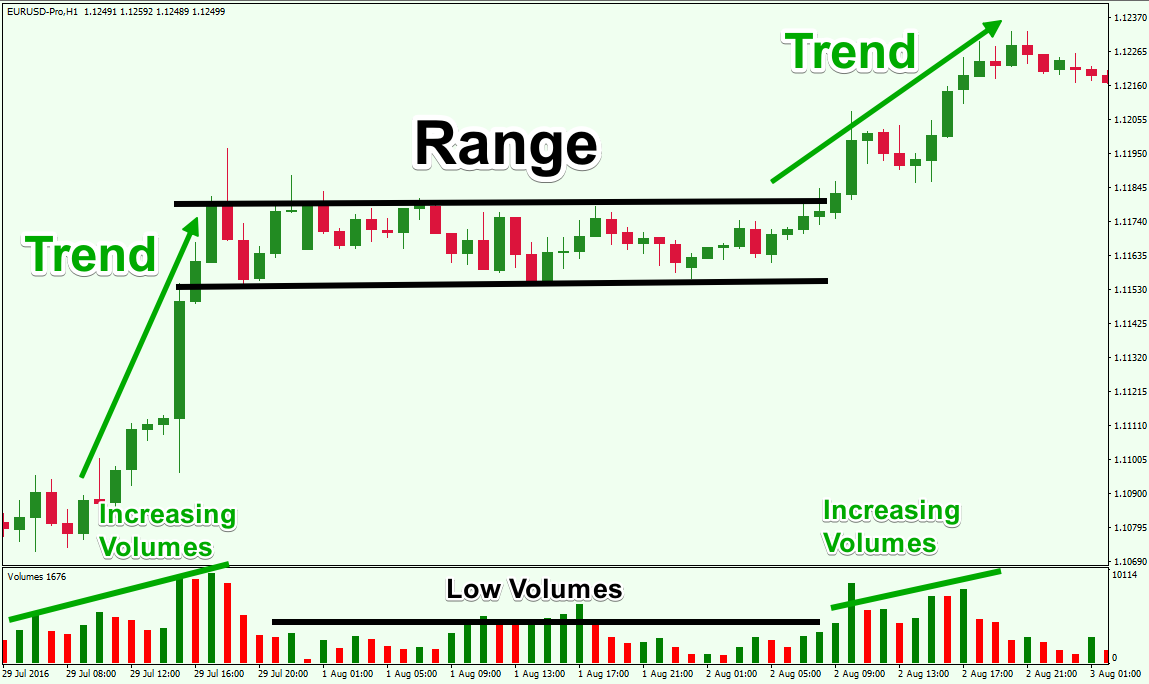

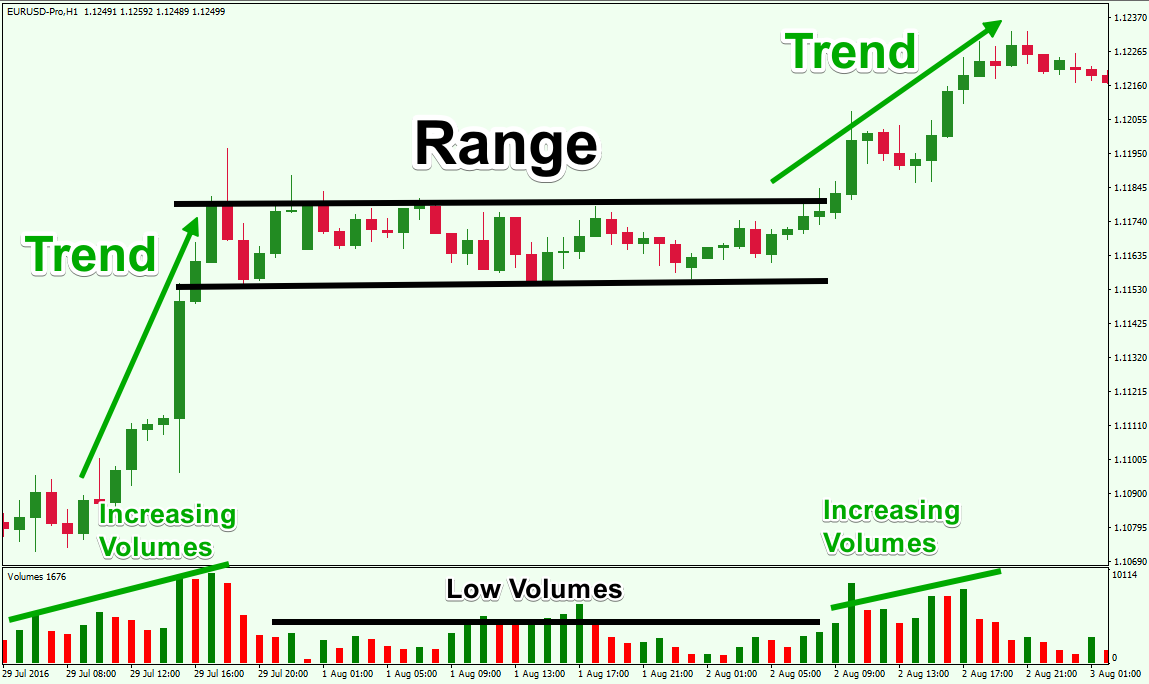

Range-bound trading ka pehla qadam ye hai ke currency pair ki mawafiqat ko pehchanen. Is mein currency pair ka mawafiqat mein chal raha hota hai, isko pehchanne ke liye tareekhi qeemat data ko tanasub se mutala karna shamil hai, aur aise areas ko dhundhna jahan qeemat ne bar-bar lower support level aur upper resistance level ke darmiyan bounce kiya ho. Traders aksar technical analysis ke tools istemal karte hain, jese ke trendlines, support aur resistance levels, aur chart patterns, in mawafiqaton ko pehchanne ke liye.

Support and Resistance

Support aur resistance levels range-bound trading mein ahem hain. Support woh qeemat hai jahan currency pair girne ka tend karta hai aur ye mumkin hai ke woh wapas chadh jaye, jabke resistance woh level hai jahan qeemat barhne ka tend karta hai aur ye mumkin hai ke woh palat jaye. Traders in levels ko apni trades ke dakhilay aur nikalay ke liye tay karna ke liye istemal karte hain.

Range-Bound Market Conditions

Mawafiqat market conditions ko is bat se pahchana jata hai ke koi wazeh trend nahi hai. Uptrend (higher highs aur higher lows) ya downtrend (lower highs aur lower lows) ki bajaye, prices sideways move karte hain. Traders ko ye maloom hona chahiye ke market mawafiqat mein hai taki ye strateji ko effectively istemal kiya ja sake.

Range-Bound Trading Strategies

Buy at Support, Sell at Resistance

Range-bound trading ki aik sabse seedhi strateji hai ke support level par khareedari ki jaye aur resistance level par farokht ki jaye. Jab qeemat support level tak pohanchti hai aur waha se wapas chadhne ke signs dikhata hai, to traders lambi position le sakte hain (khareed sakte hain). Barabtar, jab qeemat resistance level tak pohanchti hai aur palatne ke signs dikhata hai, to traders short position le sakte hain (farokht sakte hain).

Bollinger Bands

Bollinger Bands aik mashhoor technical indicator hain jo volatility aur dakhilay ke potential points ko pehchanne mein madad karta hai. Ye bands aik moving average aur do standard deviation lines se milte hain. Range-bound market mein, qeemat aksar in bands ke andar rehti hai. Traders jab chahein to buy trade shuru kar sakte hain jab qeemat lower band ko choo jati hai aur waha se bounce hone ki ummed hoti hai, aur isi tarah, jab qeemat upper band ko choo jati hai, to traders waha se reversal ki ummed karte hain aur sell trade shuru karte hain.

Mean Reversion

Mean reversion aksar range-bound trading mein istemal hone wala ek tasawwur hai. Iska matlub hai ke qeematon ka tend hota hai ke waqt ke sath apne average ya mean par lautne ka rujhan hota hai. Mean reversion strategies istemal karne wale traders average qeemat se dooriyan talash kar sakte hain aur trades ko is umeed ke sath rakh sakte hain ke qeemat apne tareekhi mean par wapas lautegi. Ye approach qeemat ki hadood mein intehai harkaton ko pehchanne aur mean ki taraf palatne ke liye positions lena shamil karta hai.

Breakout Confirmation

Jabke range-bound trading aam taur par support par khareedari aur resistance par farokht shamil karti hai, kuch traders trade mein dakhil hone se pehle breakout confirmation ka intezar karte hain. Breakout traders ek mukarrar mawafiqat se bahut ziada qeemat ki harkat ka intezar karte hain. Agar qeemat resistance ke ooper toot jati hai to woh long trade mein dakhil ho sakte hain, ya agar woh support ke neeche toot jati hai to woh short trade mein dakhil ho sakte hain. Breakout strategies range-bound trading mein momentum ka aik pahlu jor deti hain, aur traders aksar ye bhi dekhte hain ke breakout ki taqat ko tasdeeq karne ke liye mazeed indicators istemal kiye jate hain.

Moving Averages

Moving averages range-bound trading mein qeematen pehchanne ke liye qeemati tools ho sakte hain. Traders aksar short-term aur long-term moving averages ka istemal trends aur potential reversal points ko pehchanne ke liye karte hain. Jab qeemat moving average ke qareeb pohanchti hai, to traders isay ek signal samajh sakte hain ke trade mein dakhil ya nikal jayein. Moving averages qeemati fluctuations ko kam karne mein madad karte hain, jo traders ko range ke andar mool roop se chalne wale trend ko pehchanne mein asani dete hain.

Challenges of Range-Bound Trading

Jabke range-bound trading munafa deh ho sakti hai, lekin iske saath apne khaas challenges bhi hote hain. False breakouts, jahan qeemat mukarrar mawafiqat se briefly bahir jaati hai lekin phir jaldi se palat jati hai, achanak hone wale nuksanat ka sabab ho sakti hain. Iske alawa, mawafiqat ki hadood ko durust taur par pehchanana mushkil ho sakta hai, aur mukhtalif traders support aur resistance levels ko mukhtalif taur par draw kar sakte hain. Market conditions bhi tezi se tabdeel ho sakti hain, ek range-bound market ko trending market mein badal deti hai, aur traders ko apne strateji ko mutabiq taqatwar karna hoga.

Identifying the Range

Range-bound trading ka pehla qadam ye hai ke currency pair ki mawafiqat ko pehchanen. Is mein currency pair ka mawafiqat mein chal raha hota hai, isko pehchanne ke liye tareekhi qeemat data ko tanasub se mutala karna shamil hai, aur aise areas ko dhundhna jahan qeemat ne bar-bar lower support level aur upper resistance level ke darmiyan bounce kiya ho. Traders aksar technical analysis ke tools istemal karte hain, jese ke trendlines, support aur resistance levels, aur chart patterns, in mawafiqaton ko pehchanne ke liye.

Support and Resistance

Support aur resistance levels range-bound trading mein ahem hain. Support woh qeemat hai jahan currency pair girne ka tend karta hai aur ye mumkin hai ke woh wapas chadh jaye, jabke resistance woh level hai jahan qeemat barhne ka tend karta hai aur ye mumkin hai ke woh palat jaye. Traders in levels ko apni trades ke dakhilay aur nikalay ke liye tay karna ke liye istemal karte hain.

Range-Bound Market Conditions

Mawafiqat market conditions ko is bat se pahchana jata hai ke koi wazeh trend nahi hai. Uptrend (higher highs aur higher lows) ya downtrend (lower highs aur lower lows) ki bajaye, prices sideways move karte hain. Traders ko ye maloom hona chahiye ke market mawafiqat mein hai taki ye strateji ko effectively istemal kiya ja sake.

Range-Bound Trading Strategies

Buy at Support, Sell at Resistance

Range-bound trading ki aik sabse seedhi strateji hai ke support level par khareedari ki jaye aur resistance level par farokht ki jaye. Jab qeemat support level tak pohanchti hai aur waha se wapas chadhne ke signs dikhata hai, to traders lambi position le sakte hain (khareed sakte hain). Barabtar, jab qeemat resistance level tak pohanchti hai aur palatne ke signs dikhata hai, to traders short position le sakte hain (farokht sakte hain).

Bollinger Bands

Bollinger Bands aik mashhoor technical indicator hain jo volatility aur dakhilay ke potential points ko pehchanne mein madad karta hai. Ye bands aik moving average aur do standard deviation lines se milte hain. Range-bound market mein, qeemat aksar in bands ke andar rehti hai. Traders jab chahein to buy trade shuru kar sakte hain jab qeemat lower band ko choo jati hai aur waha se bounce hone ki ummed hoti hai, aur isi tarah, jab qeemat upper band ko choo jati hai, to traders waha se reversal ki ummed karte hain aur sell trade shuru karte hain.

Mean Reversion

Mean reversion aksar range-bound trading mein istemal hone wala ek tasawwur hai. Iska matlub hai ke qeematon ka tend hota hai ke waqt ke sath apne average ya mean par lautne ka rujhan hota hai. Mean reversion strategies istemal karne wale traders average qeemat se dooriyan talash kar sakte hain aur trades ko is umeed ke sath rakh sakte hain ke qeemat apne tareekhi mean par wapas lautegi. Ye approach qeemat ki hadood mein intehai harkaton ko pehchanne aur mean ki taraf palatne ke liye positions lena shamil karta hai.

Breakout Confirmation

Jabke range-bound trading aam taur par support par khareedari aur resistance par farokht shamil karti hai, kuch traders trade mein dakhil hone se pehle breakout confirmation ka intezar karte hain. Breakout traders ek mukarrar mawafiqat se bahut ziada qeemat ki harkat ka intezar karte hain. Agar qeemat resistance ke ooper toot jati hai to woh long trade mein dakhil ho sakte hain, ya agar woh support ke neeche toot jati hai to woh short trade mein dakhil ho sakte hain. Breakout strategies range-bound trading mein momentum ka aik pahlu jor deti hain, aur traders aksar ye bhi dekhte hain ke breakout ki taqat ko tasdeeq karne ke liye mazeed indicators istemal kiye jate hain.

Moving Averages

Moving averages range-bound trading mein qeematen pehchanne ke liye qeemati tools ho sakte hain. Traders aksar short-term aur long-term moving averages ka istemal trends aur potential reversal points ko pehchanne ke liye karte hain. Jab qeemat moving average ke qareeb pohanchti hai, to traders isay ek signal samajh sakte hain ke trade mein dakhil ya nikal jayein. Moving averages qeemati fluctuations ko kam karne mein madad karte hain, jo traders ko range ke andar mool roop se chalne wale trend ko pehchanne mein asani dete hain.

Challenges of Range-Bound Trading

Jabke range-bound trading munafa deh ho sakti hai, lekin iske saath apne khaas challenges bhi hote hain. False breakouts, jahan qeemat mukarrar mawafiqat se briefly bahir jaati hai lekin phir jaldi se palat jati hai, achanak hone wale nuksanat ka sabab ho sakti hain. Iske alawa, mawafiqat ki hadood ko durust taur par pehchanana mushkil ho sakta hai, aur mukhtalif traders support aur resistance levels ko mukhtalif taur par draw kar sakte hain. Market conditions bhi tezi se tabdeel ho sakti hain, ek range-bound market ko trending market mein badal deti hai, aur traders ko apne strateji ko mutabiq taqatwar karna hoga.

تبصرہ

Расширенный режим Обычный режим