Bearish Kicking Candlestick: Ek Tijarat (Trading) Strateji

Candlestick patterns ek purani aur muqaddas tijarat (trading) tareeqa hain jin ka istemal chart analysis mein hota hai. In patterns mein se ek aham pattern "Bearish Kicking" hai, jo ke traders ke liye ek eham tijarat strateji (strategy) ban sakta hai. Is article mein, hum Bearish Kicking candlestick pattern ke baare mein roman Urdu mein tafseel se baat karenge aur samajhenge ke is ka istemal kaise kiya ja sakta hai tijarat mein.

Bearish Kicking Candlestick Kya Hai?

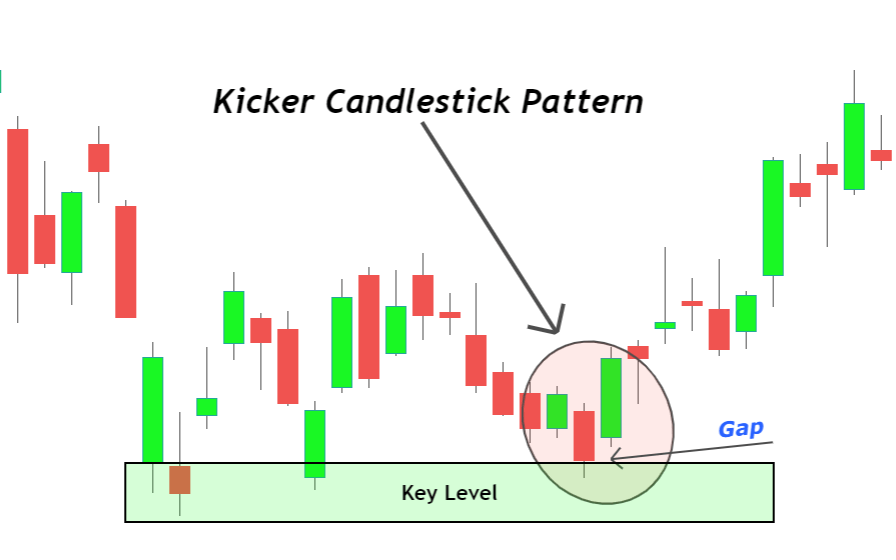

Bearish Kicking ek candlestick pattern hai jo market ke downtrend (girawat) ko darust karti hai. Yeh pattern do alag alag candlesticks se banta hai. Pehla candle bullish hota hai, jo ke uptrend (baraqat) ko darust karta hai, aur doosra candle bearish hota hai, jo ke market ki girawat ko darust karta hai.

Bearish Kicking Pattern Ki Pechan

Bearish Kicking pattern ko pehchanne ke liye, aapko do candlesticks par tawajjuh deni hogi. Pehla candle bullish hoga, yani ke is ka opening price neeche hota hai aur closing price ooncha hota hai. Doosra candle bearish hota hai, jiska opening price pehle candle ke closing price ke barabar ya us se ooncha hota hai. Is pattern mein dono candles ka size barabar ya aik dosre ke qareeb hota hai.

Bearish Kicking Ki Tijarat Strateji

Bearish Kicking pattern ko istemal karne ka ek tijarat strateji shamil hai. Jab aap Bearish Kicking pattern dekhte hain, toh yeh ishara hota hai ke market ki girawat shuru hone wali hai. Isi waqt, aap short position le sakte hain, yaani ke aap market ke girne par fayda utha sakte hain.

Is tijarat strateji mein, aap apne stop-loss order ko set karte hain, taake nuksan se bacha ja sake. Iske ilawa, aap apne target price ko bhi set kar sakte hain, jisse ke jab market apne manzil tak pahunchti hai, aap apna munafa hasil kar sakein.

bearish-kicker-trade-example-1024x615-4.webp

Faida Uthana

Bearish Kicking pattern ki tijarat strateji istemal karke, aap market ke girne ka faida utha sakte hain. Yeh ek asan tareeqa hai market ke mawafiqat ka andaza lagane ka. Magar yaad rahe ke har tijarat strateji mein risk hota hai, is liye maqami research aur market ki tafseeli samajh zaroori hai.

Candlestick patterns, jaise ke Bearish Kicking, traders ko market ke tabdiliyon ko samajhne mein madadgar ho sakte hain. Lekin, yaad rahe ke tijarat mein kisi bhi waqt tabdiliyon ka samna kiya ja sakta hai, is liye hoshyari aur tawajjuh bani rahe.

تبصرہ

Расширенный режим Обычный режим