Bearish Pennant Pattern:

Forex trading mein bearish pennant pattern ek ahem technical analysis tool hai jo market trends ko anticipate karne mein madad karta hai. Yeh pattern ek chhota consolidation phase hota hai jise flag ya pennant bhi kaha jata hai.

Formation Of Bearish Pennant Pattern:

Bearish pennant pattern ek market situation hai jahan ek downtrend ke beech mein chhota sa rectangular-shaped consolidation phase hota hai. Is phase mein price range kam hoti hai aur ek triangular pennant ban jata hai. Yeh pattern market ke temporary pause ko darust karta hai, jiska matlab hai ki sellers aur buyers mein tawun (tug-of-war) ho raha hai.

Bearish Pennant Pattern Kaise Banta Hai:

1. Downtrend: Pehle, market mein ek clear downtrend hona chahiye jisme prices continuously ghat rahe hain.

2. Consolidation: Downtrend ke baad, ek chhota sa consolidation phase aata hai jisme price range narrow hoti hai.

3. Triangle Formation: Is consolidation phase mein, ek symmetrical triangle ya pennant shape ban jata hai jisme price highs aur lows ek line ko chhute hain.

Trading Signals aur Entry Points:

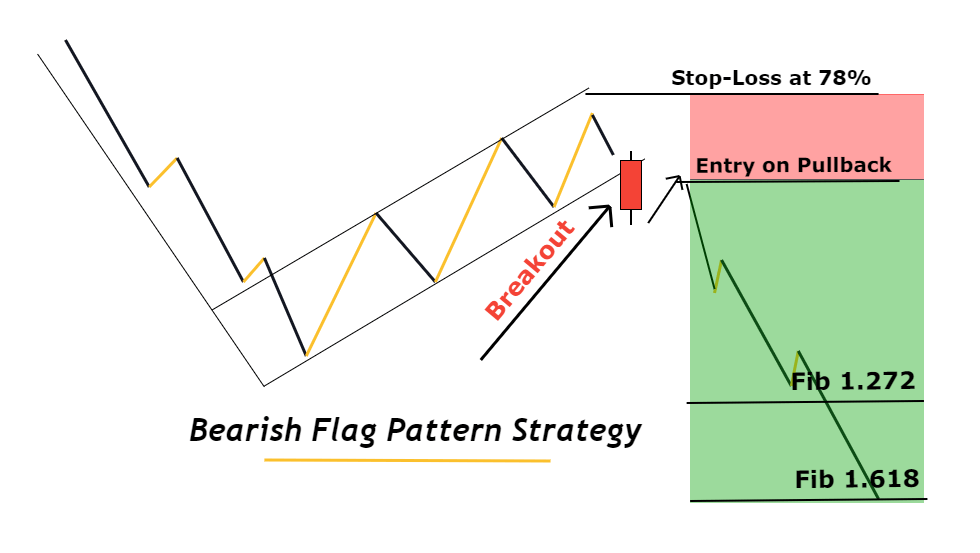

1. Breakout: Jab triangle formation pura hota hai, aur price ek direction mein breakout karta hai, woh bearish breakout hota hai.

2. Volume: Trading decision mein volume ka bhi dhyan rakhna important hai. Agar breakout high volume ke saath hota hai, toh yeh bearish signal ko confirm karta hai.

Stop-Loss aur Target Levels:

1. Stop-Loss: Agar aap bearish pennant pattern par trade kar rahe hain, toh aapko ek tight stop-loss set karna chahiye, taki sudden price reversal se bacha ja sake.

2. Target Levels: Price projection ke liye pennant pole ka use kiya ja sakta hai. Yeh pole downtrend ke starting point se lekar consolidation phase ke starting point tak ka distance hota hai.

Conclusion:

Bearish pennant pattern ek powerful tool hai jo traders ko market ke future movements ke liye taiyar karne mein madad karta hai. Lekin, market risks ko hamesha dhyan mein rakhte hue, traders ko is pattern ka sahi se istemal karna chahiye.

Forex trading mein bearish pennant pattern ek ahem technical analysis tool hai jo market trends ko anticipate karne mein madad karta hai. Yeh pattern ek chhota consolidation phase hota hai jise flag ya pennant bhi kaha jata hai.

Formation Of Bearish Pennant Pattern:

Bearish pennant pattern ek market situation hai jahan ek downtrend ke beech mein chhota sa rectangular-shaped consolidation phase hota hai. Is phase mein price range kam hoti hai aur ek triangular pennant ban jata hai. Yeh pattern market ke temporary pause ko darust karta hai, jiska matlab hai ki sellers aur buyers mein tawun (tug-of-war) ho raha hai.

Bearish Pennant Pattern Kaise Banta Hai:

1. Downtrend: Pehle, market mein ek clear downtrend hona chahiye jisme prices continuously ghat rahe hain.

2. Consolidation: Downtrend ke baad, ek chhota sa consolidation phase aata hai jisme price range narrow hoti hai.

3. Triangle Formation: Is consolidation phase mein, ek symmetrical triangle ya pennant shape ban jata hai jisme price highs aur lows ek line ko chhute hain.

Trading Signals aur Entry Points:

1. Breakout: Jab triangle formation pura hota hai, aur price ek direction mein breakout karta hai, woh bearish breakout hota hai.

2. Volume: Trading decision mein volume ka bhi dhyan rakhna important hai. Agar breakout high volume ke saath hota hai, toh yeh bearish signal ko confirm karta hai.

Stop-Loss aur Target Levels:

1. Stop-Loss: Agar aap bearish pennant pattern par trade kar rahe hain, toh aapko ek tight stop-loss set karna chahiye, taki sudden price reversal se bacha ja sake.

2. Target Levels: Price projection ke liye pennant pole ka use kiya ja sakta hai. Yeh pole downtrend ke starting point se lekar consolidation phase ke starting point tak ka distance hota hai.

Conclusion:

Bearish pennant pattern ek powerful tool hai jo traders ko market ke future movements ke liye taiyar karne mein madad karta hai. Lekin, market risks ko hamesha dhyan mein rakhte hue, traders ko is pattern ka sahi se istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим