Three Inside Up Candlestick Pattern ka Introduction

Three Inside Up candlestick pattern ek bullish reversal pattern hai jo traders aur investors ke liye market analysis mein istemal hota hai. Yeh pattern market mein hone wale trend changes aur reversals ko detect karne mein madadgar hota hai. Aaiye, is pattern ko detail mein samajhte hain.Trading mein successful hone ke liye, aapko stop-loss aur take-profit orders ka bhi istemal karna chahiye taki aap apne trades ko manage kar saken. Risk management ka dhyan rakhna bhi ahem hai.

Three Inside Up Pattern ki Formation

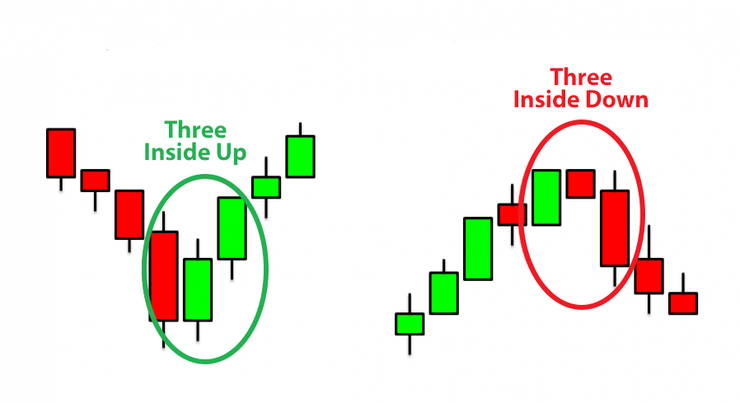

Three Inside Up pattern ko confirm karne ke liye aapko doosre technical indicators ka bhi istemal karna zaroori hai. Aap RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur volume analysis ka istemal karke pattern ko verify kar sakte hain.Three Inside Up pattern market mein hone wale bearish (girawat wale) trend ke baad aane wale bullish (barhne wale) trend ko indicate karta hai. Is pattern mein teen consecutive candlesticks shamil hote hain jinmein se do bearish hote hain aur teesra bullish hota hai. Bullish candlestick pehle ke do bearish candlesticks ke andar ki range mein hota hai.

Three Inside Up Pattern Ki Tafseeli Wazahat

Pehli Bearish Candlestick:Pehla candlestick ek lambi bearish candlestick hoti hai jo market mein price girawat ko darust karti hai.Doosri candlestick bhi bearish hoti hai aur pehle wale candlestick ke range mein hoti hai.Teesri candlestick ek lambi bullish candlestick hoti hai aur pehle do bearish candlesticks ke andar ki range mein hoti hai. Iski close price pehle ke do candlesticks ke close price se higher hoti hai.Three Inside Up candlestick pattern ek powerful tool hai jo market analysis mein madadgar ho sakta hai. Lekin, iska istemal samajhdari aur experience ke sath karna chahiye. Market volatility aur risk ko samajh kar trading decisions lena zaroori hai. Agar aap is pattern ko sahi tarah se samajh lete hain aur use karne mein maharat hasil karte hain, toh aap apne trading skills ko improve kar sakte hain aur market mein safalta pa sakte hain.

Three Inside Up Pattern Ka Istemal

Three Inside Up pattern traders ko suggest karta hai ke market mein potential reversal hone ka chance hai. Jab do consecutive bearish candlesticks ke baad ek lambi bullish candlestick aata hai aur uska close price pehle ke do bearish candlesticks ke close price se higher hota hai, toh yeh indicate karta hai ke sellers ki control kamzor ho rahi hai aur buyers ka dominance barh raha hai.Traders is pattern ko dekhte hain aur iska istemal karke long (buy) positions le sakte hain, ummid karte hain ke market mein price increase hone ka chance hai. Lekin, yaad rahe ke candlestick patterns ko confirm karne ke liye aur trading decisions lene ke liye, aapko doosri technical indicators aur market analysis bhi karni chahiye.

Three Inside Up candlestick pattern ek bullish reversal pattern hai jo traders aur investors ke liye market analysis mein istemal hota hai. Yeh pattern market mein hone wale trend changes aur reversals ko detect karne mein madadgar hota hai. Aaiye, is pattern ko detail mein samajhte hain.Trading mein successful hone ke liye, aapko stop-loss aur take-profit orders ka bhi istemal karna chahiye taki aap apne trades ko manage kar saken. Risk management ka dhyan rakhna bhi ahem hai.

Three Inside Up Pattern ki Formation

Three Inside Up pattern ko confirm karne ke liye aapko doosre technical indicators ka bhi istemal karna zaroori hai. Aap RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur volume analysis ka istemal karke pattern ko verify kar sakte hain.Three Inside Up pattern market mein hone wale bearish (girawat wale) trend ke baad aane wale bullish (barhne wale) trend ko indicate karta hai. Is pattern mein teen consecutive candlesticks shamil hote hain jinmein se do bearish hote hain aur teesra bullish hota hai. Bullish candlestick pehle ke do bearish candlesticks ke andar ki range mein hota hai.

Three Inside Up Pattern Ki Tafseeli Wazahat

Pehli Bearish Candlestick:Pehla candlestick ek lambi bearish candlestick hoti hai jo market mein price girawat ko darust karti hai.Doosri candlestick bhi bearish hoti hai aur pehle wale candlestick ke range mein hoti hai.Teesri candlestick ek lambi bullish candlestick hoti hai aur pehle do bearish candlesticks ke andar ki range mein hoti hai. Iski close price pehle ke do candlesticks ke close price se higher hoti hai.Three Inside Up candlestick pattern ek powerful tool hai jo market analysis mein madadgar ho sakta hai. Lekin, iska istemal samajhdari aur experience ke sath karna chahiye. Market volatility aur risk ko samajh kar trading decisions lena zaroori hai. Agar aap is pattern ko sahi tarah se samajh lete hain aur use karne mein maharat hasil karte hain, toh aap apne trading skills ko improve kar sakte hain aur market mein safalta pa sakte hain.

Three Inside Up Pattern Ka Istemal

Three Inside Up pattern traders ko suggest karta hai ke market mein potential reversal hone ka chance hai. Jab do consecutive bearish candlesticks ke baad ek lambi bullish candlestick aata hai aur uska close price pehle ke do bearish candlesticks ke close price se higher hota hai, toh yeh indicate karta hai ke sellers ki control kamzor ho rahi hai aur buyers ka dominance barh raha hai.Traders is pattern ko dekhte hain aur iska istemal karke long (buy) positions le sakte hain, ummid karte hain ke market mein price increase hone ka chance hai. Lekin, yaad rahe ke candlestick patterns ko confirm karne ke liye aur trading decisions lene ke liye, aapko doosri technical indicators aur market analysis bhi karni chahiye.

تبصرہ

Расширенный режим Обычный режим