Assiam o Alikum Dosto?

Falling Window Chart Pattern ic bearish continuation pattern hay jo tab hota hay jab do consecutive candlesticks kay darmiyan ic gap down hota hay. dosri candlestick ka opening price pahli candlestick kay closing price se kam hota hay، jis se pahli aur dosri candlesticks kay darmiyan ic "window" ya space ban jata hay.

Falling Window Chart Pattern ki khasusiyaten:

Falling Window Chart Pattern ka matlab hay kah bearish trend jari rahane ka imkan hay. gap down bearish pressure ka ic signal hay، aur dosri candlestick ka kam opening price is baat ki tasdeeq karta hay kah sellers control me hain.

Falling Window Chart Pattern ka istemal karne kay kuch tarike:

Falling Window Chart Pattern ic mazbooot bearish signal hay، lekin is ka istemal karne se pahle tasdeeq kar lena zaruri hay. is tasdeeq kay liye ap aap trend analysis aur dusre technical indicators ka istemal kar sakte hain.

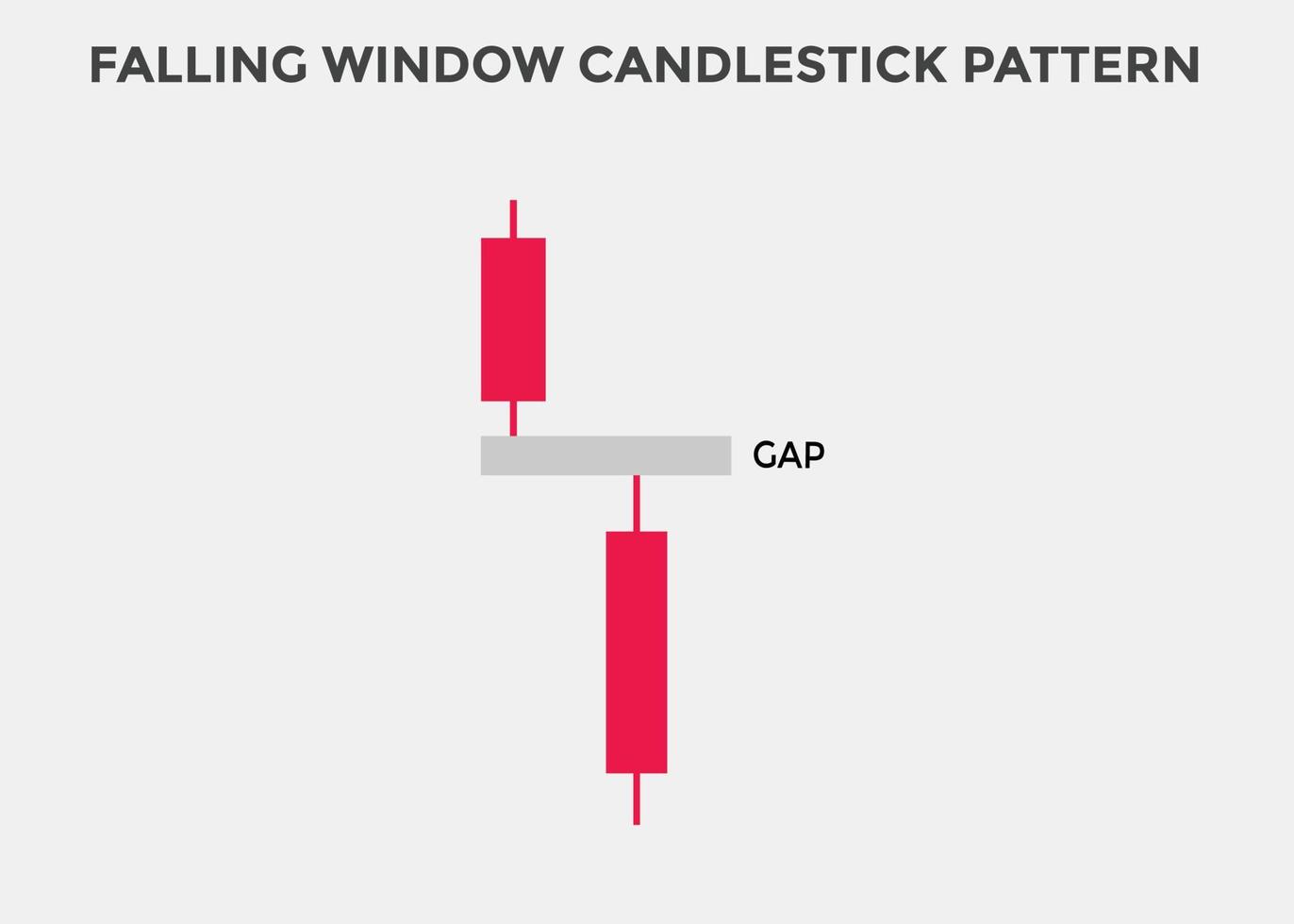

yahan Falling Window Chart Pattern ki ic tasweer hay:

is tasweer me، aap dekh sakte hain kah Falling Window Chart Pattern do bearish candlesticks se bana hay. pahli candlestick ic bearish engulfing pattern hay، jo bearish pressure ka ic signal hay. dosri candlestick ka opening price pahli candlestick kay closing price se kam hay، jis se ic gap down ban jata hay. yah gap down bearish pressure ka ic aur signal hay.

Falling Window Chart Pattern ic mazboo

Falling Window Chart Pattern ic bearish continuation pattern hay jo tab hota hay jab do consecutive candlesticks kay darmiyan ic gap down hota hay. dosri candlestick ka opening price pahli candlestick kay closing price se kam hota hay، jis se pahli aur dosri candlesticks kay darmiyan ic "window" ya space ban jata hay.

Falling Window Chart Pattern ki khasusiyaten:

- ic bearish trend me hota hay

- do consecutive candlesticks kay darmiyan ic gap down hota hay

- dosri candlestick ka opening price pahli candlestick kay closing price se kam hota hay

- ic "window" ya space ban jata hay

Falling Window Chart Pattern ka matlab hay kah bearish trend jari rahane ka imkan hay. gap down bearish pressure ka ic signal hay، aur dosri candlestick ka kam opening price is baat ki tasdeeq karta hay kah sellers control me hain.

Falling Window Chart Pattern ka istemal karne kay kuch tarike:

- bearish trend ki tasdeeq karne kay liye

- short position lene kay liye ic signal ke taur per

- stop-loss order lagane kay liye ic signal ke taur per

Falling Window Chart Pattern ic mazbooot bearish signal hay، lekin is ka istemal karne se pahle tasdeeq kar lena zaruri hay. is tasdeeq kay liye ap aap trend analysis aur dusre technical indicators ka istemal kar sakte hain.

yahan Falling Window Chart Pattern ki ic tasweer hay:

is tasweer me، aap dekh sakte hain kah Falling Window Chart Pattern do bearish candlesticks se bana hay. pahli candlestick ic bearish engulfing pattern hay، jo bearish pressure ka ic signal hay. dosri candlestick ka opening price pahli candlestick kay closing price se kam hay، jis se ic gap down ban jata hay. yah gap down bearish pressure ka ic aur signal hay.

Falling Window Chart Pattern ic mazboo

تبصرہ

Расширенный режим Обычный режим