Falling Window Chart Pattern: Girte Hue Khidki Ka Tareeqa

Cryptocurrency, Forex, aur Stock Market mein istemaal hone wale chart patterns mein se ek aham aur mawafiq pattern "Falling Window" hai. Ye pattern market analysis mein istemal hota hai aur traders ko market ke future movements ke bare mein malumat farahem karta hai. Is article mein, hum Falling Window Chart Pattern ke hawale se mukhtasar malumat hasil karenge.

Falling Window Chart Pattern Kya Hai?

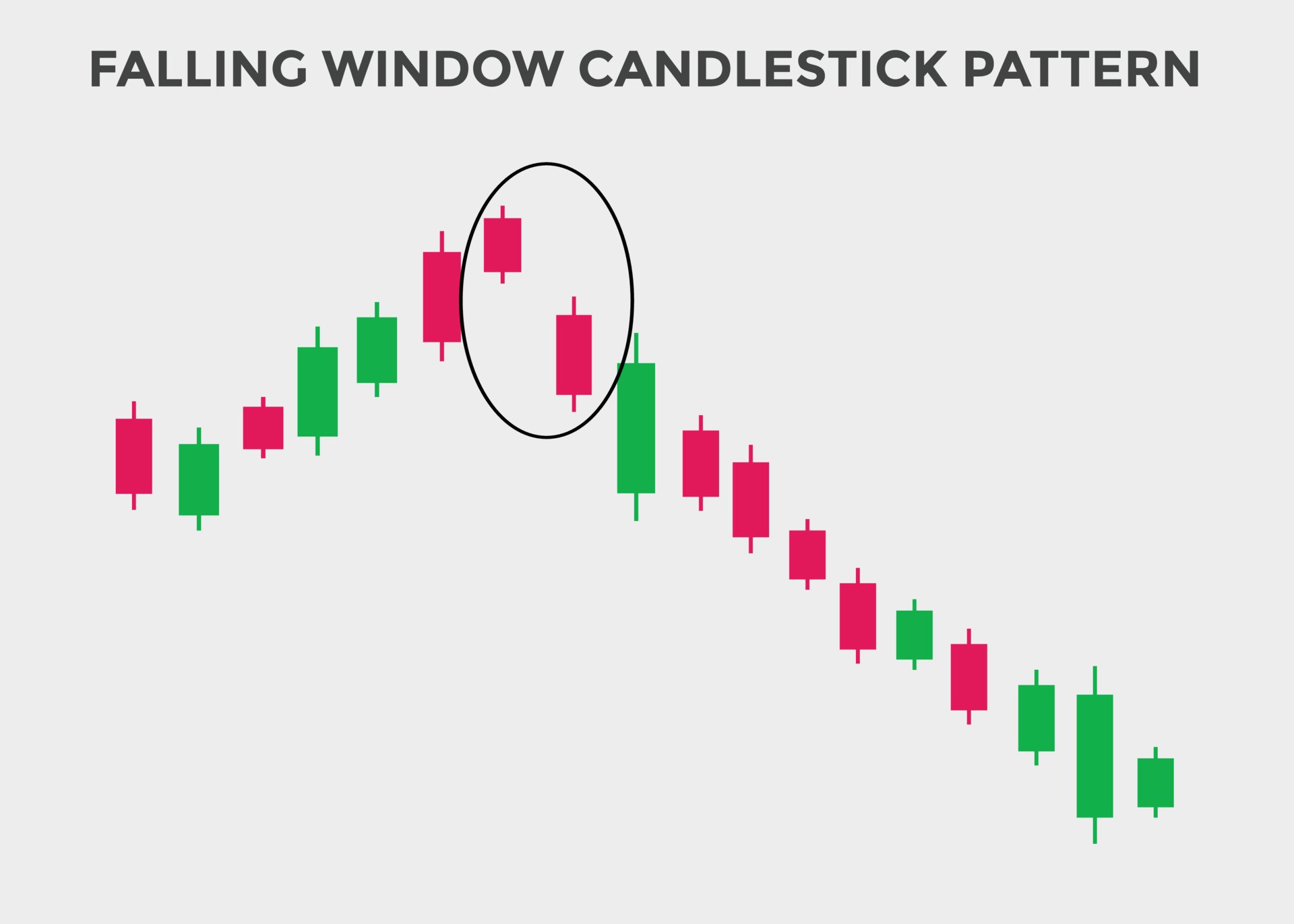

Falling Window Chart Pattern ek technical analysis tool hai jo market trend aur price movement ko samajhne mein madad karta hai. Is pattern ka pehla nam "Gap Down" bhi hai. Falling Window ka matn hota hai "girte hue khidki," aur is pattern ko is liye is naam se pukara jata hai kyun ke isme price mein achanak girawat hoti hai, jise hum gap kehte hain.

Falling Window Kaise Paida Hota Hai?

Falling Window Chart Pattern tab paida hota hai jab market mein achanak se ek gap create hota hai. Yani ke ek din ke opening price pehle din ke closing price se behtar hoti hai. Is gap ko hum Falling Window kehte hain. Is gap ki wajah se chart par ek khidki ki tarah khula hua area nazar aata hai, jise traders Falling Window kehte hain.

Iska Matlab Kya Hai?

Jab Falling Window Chart Pattern banta hai, to ye ishara hota hai ke market mein ek tezi se girawat aayi hai aur traders mein beqarari ka mahol paida hua hai. Is pattern ka sabse ahem hissa ye hai ke ye market ke bearish phase ko darust karti hai. Falling Window ka matn khud mein hi girawat aur kamzori ko dikhata hai.

Trading Mein Falling Window Ka Istemal Kaise Hota Hai?

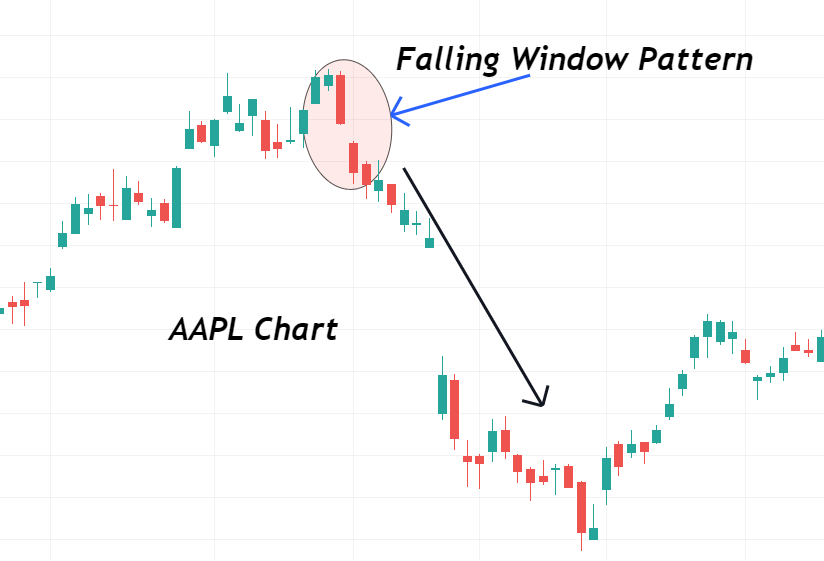

Traders Falling Window ko market ke future movements ka andaza lagane mein istemal karte hain. Agar kisi stock ya cryptocurrency mein Falling Window banta hai, to traders ishe samajhte hain ke is market mein girawat ane wali hai aur wo apne trading strategies ko is ke mutabiq adjust karte hain. Is pattern ko samajh kar traders apne positions ko manage karte hain aur nuksan se bachne ke liye sahi waqt par apni strategy badal lete hain.

Akhiri Alfaz

Falling Window Chart Pattern ek aham tool hai jo traders ko market ke future movements ke bare mein malumat farahem karta hai. Is pattern ki sahi samajh aur istemal se traders apne nuksan se bach sakte hain aur market ke tezi se girne ke daur ko pehchan sakte hain. Yehi wajah hai ke Falling Window ko market analysis mein ahmiyat di jati hai aur isse traders apne trading decisions ko behtar banane mein madad lete hain.

تبصرہ

Расширенный режим Обычный режим