Leading aur lagging indicators forex trading mein ahem concepts hain. Forex traders in indicators ko market conditions ka tajziya karne, moghalay ki mumkin trends ko pehchanne, aur inform kiye gaye trading decisions par amal karne ke liye istemal karte hain. Ye indicators technical analysis mein aham kirdar ada karte hain, jisme past data par buniyad par aane wale qeemat ki tashkeel aur doosre qeematon ki peshgoiyan ki jati hain.

Leading Indicators

Leading indicators aise tools hain jo ek currency pair ki keemat ke asal harkat se pehle uske raaste mein hone wale tabdiliyon ke bare mein signals farahem karte hain. Traders aksar leading indicators ka istemal trend reversals ya naye trend ki shuruaat ko pehle se anayat karne ke liye karte hain. Ye indicators mustaqil tor par future price movements ka tajaweez karnay ki koshish karte hain.

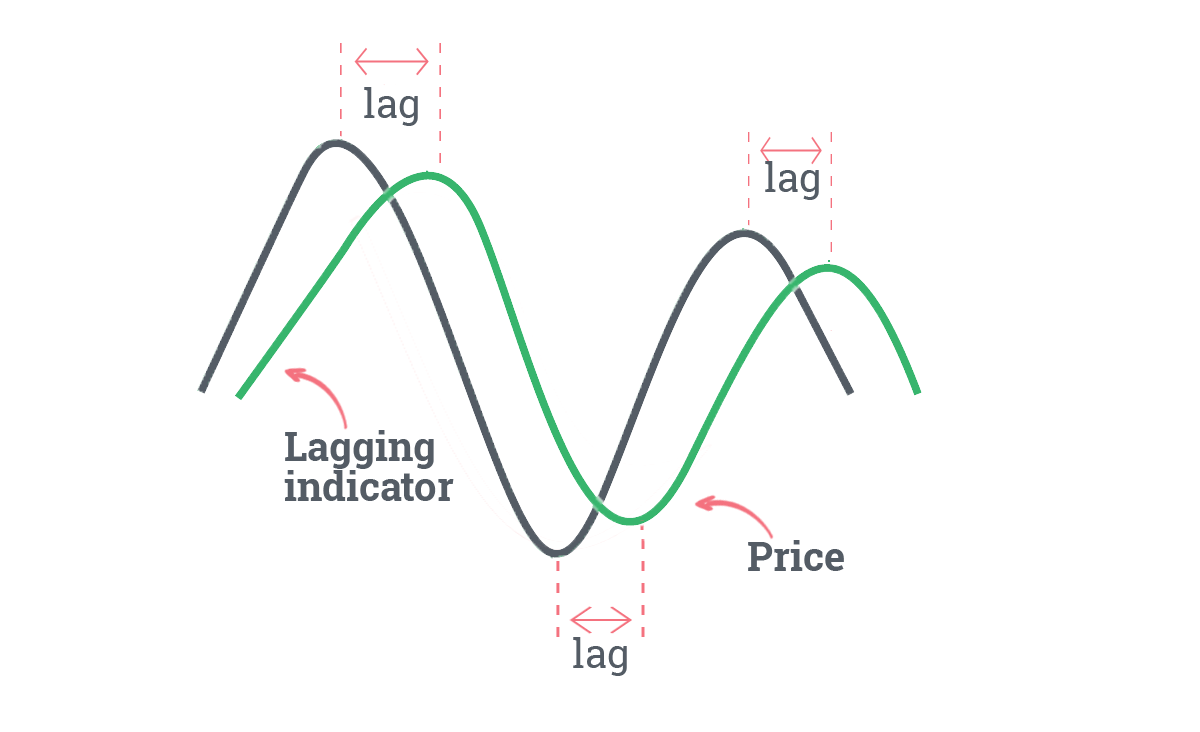

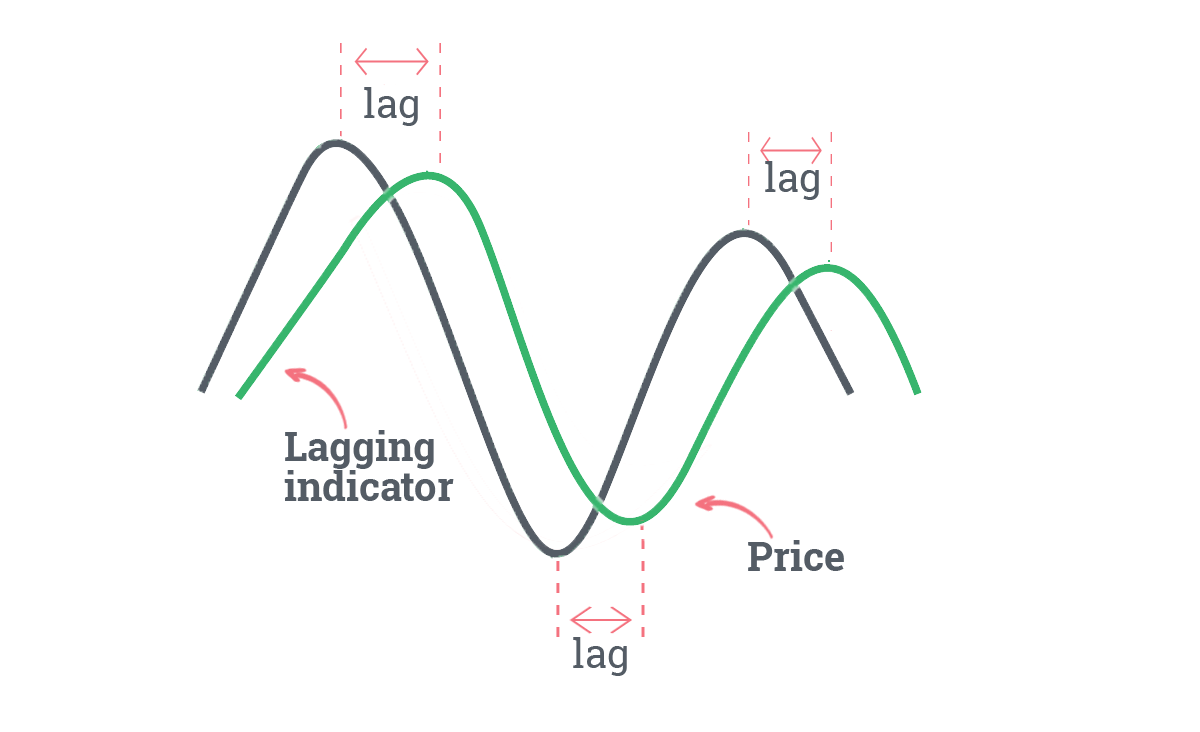

Lagging Indicators

Lagging indicators mukhalif mein, keemat ki harkaton ko follow karte hain aur ek trend ya reversal ki tasdeek baad mein farahem karte hain. Jabke ye leading indicators se kam proactive hote hain, ye trend ki quwat aur istemariyat ko tasdeek karne mein ahem hote hain.

Practical Application

Kamyab forex traders aksar leading aur lagging indicators ka aik mix istemal karte hain takay wo aik mokammal trading strategy banasakain. Misal ke tor par, aik trader moving average crossovers (leading indicator) ka istemal potential trend changes ko pehchanne ke liye kar sakta hai, phir wo Bollinger Bands (lagging indicator) ka istemal ki sakta hai takay wo pehchanay gaye trend ki quwat ko tasdeek kar sake. Yeh zaroori hai ke traders samajhain ke koi bhi indicator foolproof nahi hota, aur tajziya mein aksar behtareen natijay hasil karne ke liye holistic approach istemal karna behtar hota hai. Iske alawa, market conditions tabdeel ho sakti hain, aur indicators ko doosre tajziya tareeqon ke saath, jaise ke fundamental analysis aur geopolitical considerations ke saath istemal karna chahiye.

Leading Indicators

Leading indicators aise tools hain jo ek currency pair ki keemat ke asal harkat se pehle uske raaste mein hone wale tabdiliyon ke bare mein signals farahem karte hain. Traders aksar leading indicators ka istemal trend reversals ya naye trend ki shuruaat ko pehle se anayat karne ke liye karte hain. Ye indicators mustaqil tor par future price movements ka tajaweez karnay ki koshish karte hain.

- Moving Averages: Moving averages aam leading indicator hain. Ye keemat data ko hamwar safaid karte hain takay trend ko pehchanne mein asani ho. Do aam types hain: simple moving average (SMA) aur exponential moving average (EMA). Chhotay aur lambay term moving averages ke crossovers potential trend reversals ko indicate kar sakte hain.

- Relative Strength Index (RSI): RSI ek momentum oscillator hai jo keemat ke tez aur tabdil hone ki raftar ko napta hai. Iska range 0 se 100 tak hota hai aur iska istemal market mein overbought ya oversold conditions ka pata lagane ke liye hota hai. RSI 70 se oopar hone par ye ishara kar sakta hai ke asset overbought hai aur reversal ke liye tayyar hai, jabke RSI 30 se neeche hone par ye ishara kar sakta hai ke asset oversold hai aur upar ki taraf ja sakta hai.

- Stochastic Oscillator: Stochastic oscillator ek aur momentum indicator hai jo ek closing price ko uske price range ke sath mawafiq karta hai. Ye overbought ya oversold conditions ko pata lagane mein madad karta hai. Traders stochastic oscillator aur price movement ke darmiyan ikhtilaf dhoondte hain, jo ek mumkin reversal ka ishara ho sakta hai.

- MACD (Moving Average Convergence Divergence): MACD ek trend-following momentum indicator hai jo ek asset ki price ke do moving averages ke darmiyan taaluqat ko dikhata hai. Traders MACD line ke crossovers aur MACD line aur price chart ke darmiyan ikhtilaf ko dekhte hain taake potential trend changes ko pehchan saken.

Lagging Indicators

Lagging indicators mukhalif mein, keemat ki harkaton ko follow karte hain aur ek trend ya reversal ki tasdeek baad mein farahem karte hain. Jabke ye leading indicators se kam proactive hote hain, ye trend ki quwat aur istemariyat ko tasdeek karne mein ahem hote hain.

- Moving Average Convergence Divergence (MACD): Haan ki MACD bhi ek leading indicator hai, lekin MACD ke signal line ka hissa lagging indicator ki tarah kaam karta hai. Jab MACD line signal line ke upar ya neeche se guzarti hai, to ye trend ko tasdeek karte hai.

- Bollinger Bands: Bollinger Bands ek middle band se banti hain jo N-period simple moving average hota hai, aur upper aur lower bands jo middle band se N-period standard deviations door hote hain. Ye bands volatility par mabni hote hain. Bands ke bahar breakouts ya breakdowns naye trend ki shuruaat ko indicate kar sakte hain.

- Parabolic SAR (Stop and Reverse): Parabolic SAR ek trend-following indicator hai jo potential reversal points farahem karta hai. SAR dots downtrend mein keemat ke upar aur uptrend mein keemat ke neeche aate hain. Jab dots side change karte hain, to ye potential trend reversal ko ishara karta hai.

- Ichimoku Cloud: Ichimoku Cloud ek mukammal indicator hai jo support aur resistance levels, trend direction, aur momentum ke bare mein malumat farahem karta hai. Isme Kumo (Cloud) bhi shamil hai, jo keemat ke peeche rehta hai aur trends ko tasdeek karne mein istemal ho sakta hai.

Practical Application

Kamyab forex traders aksar leading aur lagging indicators ka aik mix istemal karte hain takay wo aik mokammal trading strategy banasakain. Misal ke tor par, aik trader moving average crossovers (leading indicator) ka istemal potential trend changes ko pehchanne ke liye kar sakta hai, phir wo Bollinger Bands (lagging indicator) ka istemal ki sakta hai takay wo pehchanay gaye trend ki quwat ko tasdeek kar sake. Yeh zaroori hai ke traders samajhain ke koi bhi indicator foolproof nahi hota, aur tajziya mein aksar behtareen natijay hasil karne ke liye holistic approach istemal karna behtar hota hai. Iske alawa, market conditions tabdeel ho sakti hain, aur indicators ko doosre tajziya tareeqon ke saath, jaise ke fundamental analysis aur geopolitical considerations ke saath istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим