Forex trading mein candlestick patterns ka istemal market trends ko samajhne aur trading decisions ko tajaweezati taur par lenay mein madad karta hai. Aaj hum baat karenge "Tweezer Top" aur "Tweezer Bottom" ke patterns ki, jo market ke mizaj ko samajhne mein madadgar sabit hote hain.

Tweezer Top

Tweezer Top pattern, jab market mein bull trend ke baad aata hai, bearish reversal ko darust karta hai. Is pattern mein do alag alag candlesticks ki heights ek dosre ke buhat qareeb hoti hain aur yeh market mein bearish trend ki shuruaat ko indicate karta hai.

Do Barri Uper Wicks:

Tweezer Top pattern mein do alag alag candlesticks hote hain, jinke upper wicks buhat barri hoti hain. Yeh upper wicks prices ke upar gaye aur phir wapas neeche aaye hote hain, jise market mein selling pressure darust hoti hai.

Equal or Near Equal Heights:

Dono candlesticks ki heights ek dosre ke buhat qareeb hoti hain, jisse yeh samajhne mein madad hoti hai ke buyers aur sellers mein mawafiqi nahi hai aur market mein girawat hone wali hai.

Bullish Trend Ke Baad Aata Hai:

Tweezer Top pattern bull trend ke baad aata hai, iska matlub hai ke pehle market mein buying pressure thi lekin ab sellers ne control haasil kar liya hai.

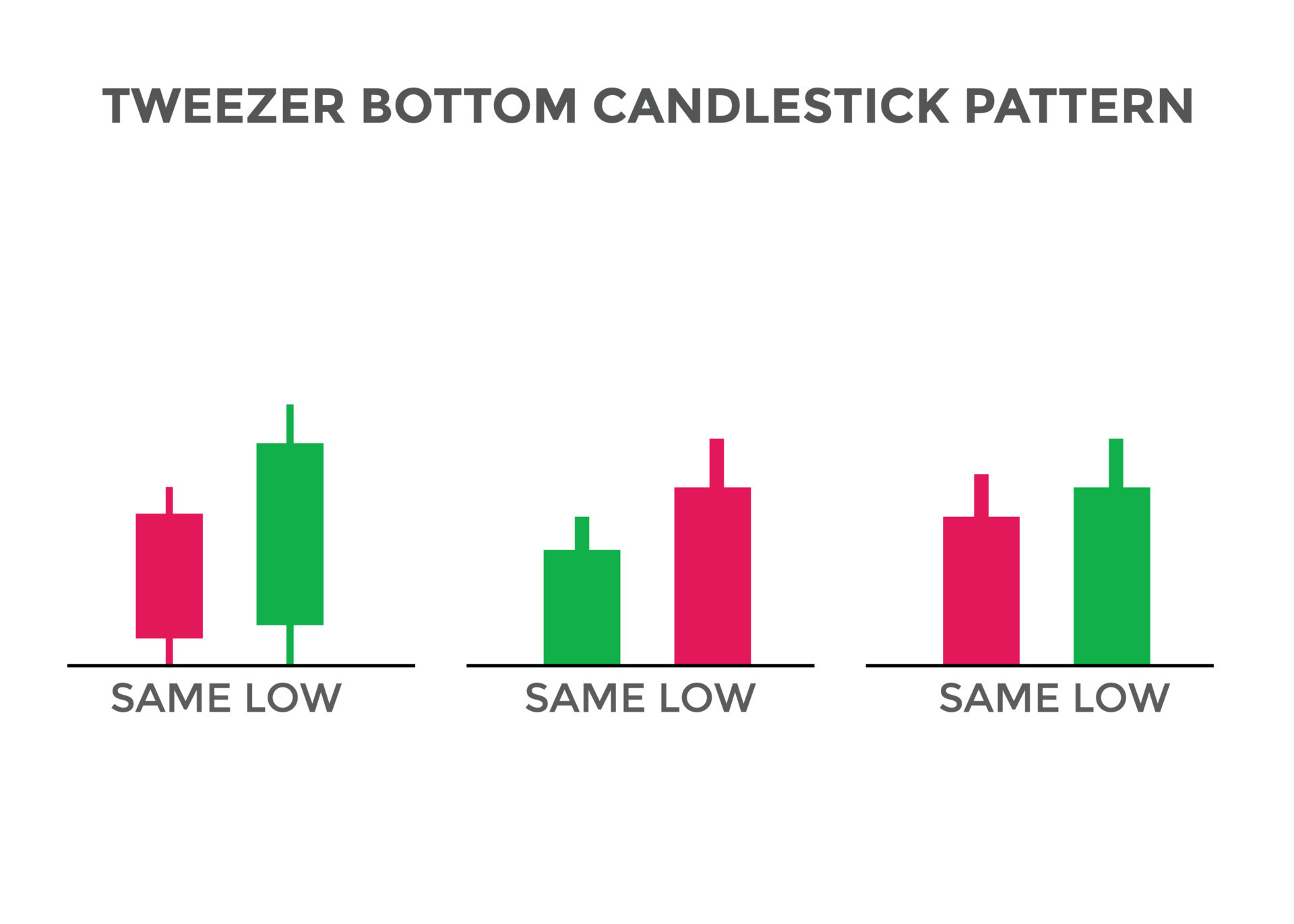

Tweezer Bottom

Tweezer Bottom pattern, jab market mein bear trend ke baad aata hai, bullish reversal ko darust karta hai. Is pattern mein do alag alag candlesticks ki bottoms ek dosre ke buhat qareeb hoti hain aur yeh market mein bullish trend ki shuruaat ko indicate karta hai.

Do Barri Lower Wicks:

Tweezer Bottom pattern mein do alag alag candlesticks hote hain, jinke lower wicks buhat barri hoti hain. Yeh lower wicks prices ke neeche gaye aur phir wapas ooper aaye hote hain, jise market mein buying pressure darust hoti hai.

Equal or Near Equal Heights:

Dono candlesticks ki bottoms ki heights ek dosre ke buhat qareeb hoti hain, jisse yeh samajhne mein madad hoti hai ke sellers aur buyers mein mawafiqi nahi hai aur market mein izafayi harkat hone wali hai.

Bearish Trend Ke Baad Aata Hai:

Tweezer Bottom pattern bearish trend ke baad aata hai, iska matlub hai ke pehle market mein selling pressure thi lekin ab buyers ne control haasil kar liya hai.

Tweezer Top aur Tweezer Bottom Ka Istemal

Tweezer Top aur Tweezer Bottom patterns traders ko market ke mizaj ko samajhne mein madadgar sabit hote hain. In patterns ko sahi taur par interpret karke traders apne trading strategies ko refine kar sakte hain.

Tweezer Top aur Tweezer Bottom patterns ka sahi taur par istemal karne ke liye, traders ko doosre technical indicators ke sath milakar market ko samajhna hoga. Hamesha yaad rakhein ke kisi single indicator par pura bharosa na karein aur apne trading decisions ko tajaweezati taur par lena zaroori hai. Hamesha apne trading plan aur risk management ka khayal rakhein taki aap market ke mizaj mein asani se sath chal sakein.

تبصرہ

Расширенный режим Обычный режим