Evening Star Candlestick Pattern ka Tauraf

Evening Star Candlestick Pattern, ya evening star candlestick pattern, ek important technical analysis tool hai jo traders aur investors ke liye market trends aur reversals ko samajhne mein madad karta hai. Ye pattern market mein hone wale potential bearish reversals ko dikhata hai. Is article mein, hum evening star candlestick pattern ko roman urdu mein detail se samjhenge.Evening Star Candlestick Pattern ek useful technical analysis tool ho sakti hai traders aur investors ke liye. Is pattern ko samajh kar, market ke potential bearish reversals ko pehle se identify kar sakte hain aur traders ko alert karta hai. Lekin, trading decisions banate waqt hamesha caution aur risk management ka istemal karna zaroori hai.

Evening Star Pattern Ki Pechan

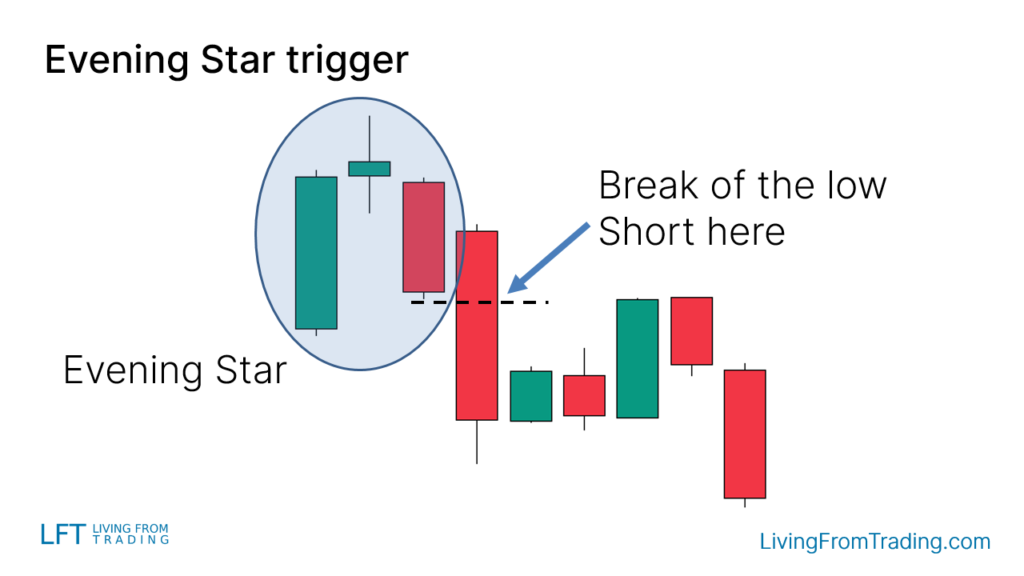

Evening star candlestick pattern ko pehchanne ke liye, traders ko teeno consecutive candlesticks ki zaroorat hoti hai. Pehli candlestick ek uptrend mein hoti hai aur bullish momentum dikhata hai. Doosri candlestick mein price mein change hota hai lekin ye candlestick small hoti hai aur upper shadow bhi choti hoti hai. Teesri candlestick bearish hoti hai aur doosri candlestick ki range ke neeche close hoti hai, indicating ke bearish momentum build ho raha hai.

Evening Star Pattern Ka Matlab

Evening star pattern ka matlab hota hai ke market mein initial buying pressure hai, lekin phir sellers ne control regain kiya hai aur bearish momentum create kiya hai. Pehli candlestick mein bullish momentum hoti hai, lekin doosri candlestick mein range narrow hoti hai, jo ke bullish strength ki kami ko dikhata hai. Iska asal matlab hota hai ke sellers ke paas initial strength thi, lekin phir buyers ne market ko control kiya aur bearish momentum create kiya. Is situation mein, traders ko alert karta hai ke market mein bearish reversal hone ke chances hain.

Trading Strategies with Evening Star Pattern

Evening star pattern traders ke liye ek important tool ho sakti hai trading decisions banane mein. Jab ye pattern market mein aata hai, to traders isko dekhte hain aur samajhte hain ke market mein bearish reversal hone ke chances hain. Agar ye pattern ek uptrend ke baad aata hai, to iska matlab ho sakta hai ke bullish trend weak ho raha hai aur bearish reversal hone ke chances hain. Is tarah se, traders long positions ko close kar sakte hain ya short positions le sakte hain.Lekin, yaad rahe ke evening star pattern ek single indicator nahi hai, aur trading decisions banate waqt dusre technical indicators aur analysis tools ka bhi istemal karna zaroori hai. Market mein risk hota hai, aur isliye risk management ka bhi khayal rakha jana chahiye. Evening star pattern ko dusre indicators ke saath combine karke hi trading decisions lena behtar hota hai.

Evening Star Candlestick Pattern, ya evening star candlestick pattern, ek important technical analysis tool hai jo traders aur investors ke liye market trends aur reversals ko samajhne mein madad karta hai. Ye pattern market mein hone wale potential bearish reversals ko dikhata hai. Is article mein, hum evening star candlestick pattern ko roman urdu mein detail se samjhenge.Evening Star Candlestick Pattern ek useful technical analysis tool ho sakti hai traders aur investors ke liye. Is pattern ko samajh kar, market ke potential bearish reversals ko pehle se identify kar sakte hain aur traders ko alert karta hai. Lekin, trading decisions banate waqt hamesha caution aur risk management ka istemal karna zaroori hai.

Evening Star Pattern Ki Pechan

Evening star candlestick pattern ko pehchanne ke liye, traders ko teeno consecutive candlesticks ki zaroorat hoti hai. Pehli candlestick ek uptrend mein hoti hai aur bullish momentum dikhata hai. Doosri candlestick mein price mein change hota hai lekin ye candlestick small hoti hai aur upper shadow bhi choti hoti hai. Teesri candlestick bearish hoti hai aur doosri candlestick ki range ke neeche close hoti hai, indicating ke bearish momentum build ho raha hai.

Evening Star Pattern Ka Matlab

Evening star pattern ka matlab hota hai ke market mein initial buying pressure hai, lekin phir sellers ne control regain kiya hai aur bearish momentum create kiya hai. Pehli candlestick mein bullish momentum hoti hai, lekin doosri candlestick mein range narrow hoti hai, jo ke bullish strength ki kami ko dikhata hai. Iska asal matlab hota hai ke sellers ke paas initial strength thi, lekin phir buyers ne market ko control kiya aur bearish momentum create kiya. Is situation mein, traders ko alert karta hai ke market mein bearish reversal hone ke chances hain.

Trading Strategies with Evening Star Pattern

Evening star pattern traders ke liye ek important tool ho sakti hai trading decisions banane mein. Jab ye pattern market mein aata hai, to traders isko dekhte hain aur samajhte hain ke market mein bearish reversal hone ke chances hain. Agar ye pattern ek uptrend ke baad aata hai, to iska matlab ho sakta hai ke bullish trend weak ho raha hai aur bearish reversal hone ke chances hain. Is tarah se, traders long positions ko close kar sakte hain ya short positions le sakte hain.Lekin, yaad rahe ke evening star pattern ek single indicator nahi hai, aur trading decisions banate waqt dusre technical indicators aur analysis tools ka bhi istemal karna zaroori hai. Market mein risk hota hai, aur isliye risk management ka bhi khayal rakha jana chahiye. Evening star pattern ko dusre indicators ke saath combine karke hi trading decisions lena behtar hota hai.

تبصرہ

Расширенный режим Обычный режим