Forex trading, jasa ke kisi bhi tijarat mein profit aur loss ka risk hota hai. es risk ko control krne aur apne trades ko behtar taur par manage karne ke liye do ahem concepts hote hain: "Take Profit" aur "Stop Loss."

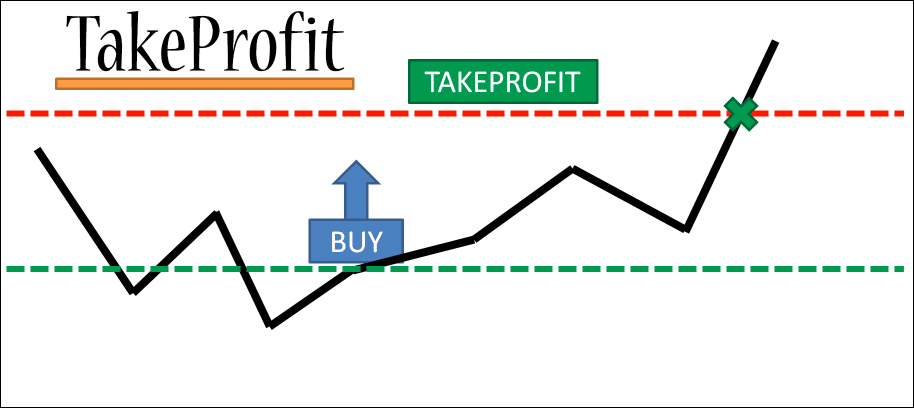

What Is Take-Profit In Forexx ?

Take Profit ek trading strategy hai jismein trader apne trade ko aise point par band karta hai jahan se woh munafa hasil karne mein qamyaab hota hai. Jab trader apne trade ka maqsad hasil karta hai ya phir market uske favor mein move karta hai, toh woh take profit order istemal karta hai. Is order mein trader apne munafa ko lock karta hai, aur jab market specified level tak pohanchta hai, toh trade automatically band ho jati hai.

Lock Profit:

Take Profit ka sab se bara faida yeh hai ke trader apne munafa ko lock kar leta hai. Agar market favorable direction mein move karta hai, toh trader apna maqsad hasil kar leta hai.

Emotional Control:

Take Profit ka istemal karke trader apne trades ko emotional decisions se bacha sakta hai. Jab maqsad hasil ho jata hai, toh trader ko ghabrane ya avaricious hone ki zarurat nahi hoti.

Trading Plan:

Take Profit, trading plan ke mutabiq amal karne ka aik tareeqa hai. Trader apne trading plan mein tay kiye gaye maqsadat tak pohanchne ke liye take profit orders istemal karta hai.

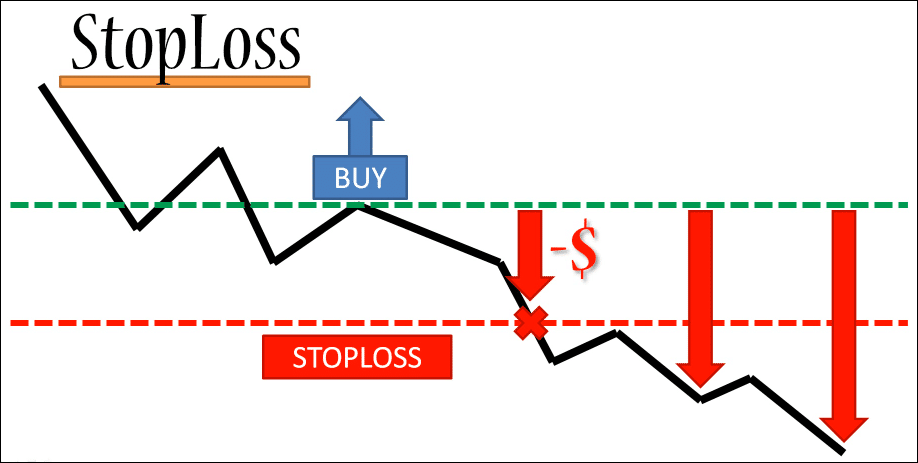

What Is Stop-Loss In Forex ?

Stop Loss bhi ek ahem trading concept hai jiska istemal trader apne nuksan se bachne ke liye karta hai. Stop Loss order mein trader apne trade ko aise point par band karta hai jahan se nuksan bardasht karna mushkil ho jaye. Agar market trader ke favor mein nahi ja raha, toh stop loss order uski investment ko protect karta hai.

Nuksan Se Bachao:

Stop Loss ka sab se bara faida yeh hai ke trader apne nuksan se bacha sakta hai. Agar market unfavorable direction mein move karta hai, toh stop loss order uski investment ko protect karta hai.

Emotional Control:

Stop Loss ka istemal karke trader apne nuksan se bachne ke liye emotional decisions se bacha sakta hai. Nuksan bardasht karne ki jagah, trader apne trading plan ke mutabiq amal karne par tawajju de sakta hai.

Risk Management:

Stop Loss, risk management ka aik ahem hissa hai. Trader apne har trade mein nuksan bardasht karne ke liye tay kiye gaye risk level tak pohanchne ka tareeqa tay karta hai.

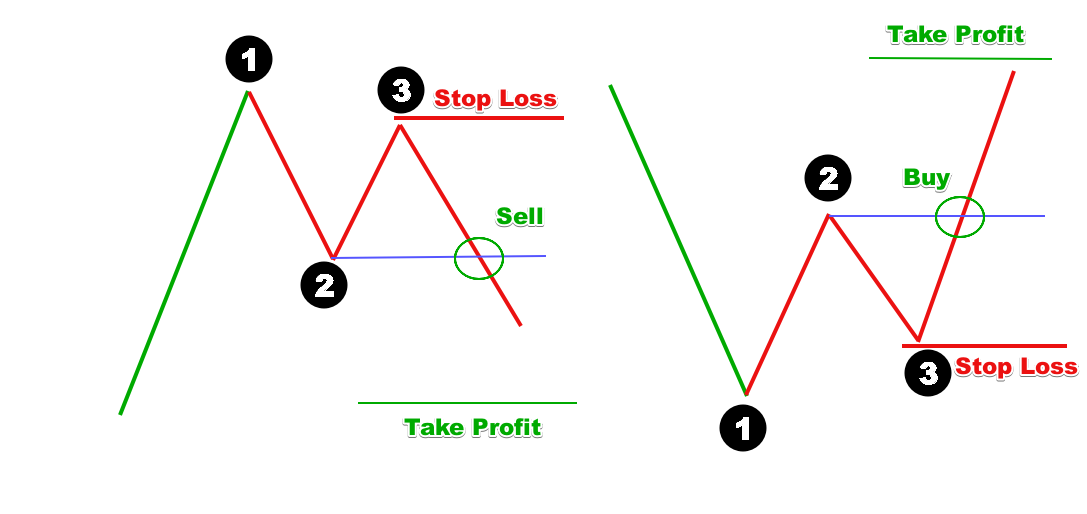

Simultaneous use of Take Profit and Stop Loss

Traders aksar take profit aur stop loss ka ek sath istemal karte hain takay unka risk management behtar ho. Agar market favorable direction mein move karta hai, toh take profit unko munafa hasil karne mein madad karta hai. Aur agar market unfavorable direction mein move karta hai, toh stop loss unki investment ko protect karta hai.

Technical Aur Fundamental Analysis:

Take profit aur stop loss levels tay karte waqt, trader ko market ki technical aur fundamental analysis par tawajju dena chahiye. Yeh levels market ke trends aur conditions ke mutabiq tay kiye jate hain.

Risk-Reward Ratio:

Traders ko apne take profit aur stop loss levels tay karte waqt risk-reward ratio ka bhi khayal rakhna chahiye. Isse unko pata chalta hai ke woh kitna nuksan bardasht kar sakte hain aur kitna munafa hasil ho sakta hai.

Market Volatility:

Market ki volatility ko samajhna bhi ahem hai take profit aur stop loss levels tay karte waqt. Zayada volatile markets mein, levels ko adjust karna zaroori ho sakta hai.

Trailing Stop Loss:

Kuch traders trailing stop loss ka istemal karte hain, jo ke market ke favorable movement ke sath sath automatically update hota hai. Isse trader nuksan se bachne ke sath sath munafa ko bhi maximize kar sakte hain.

Take-profit aur Stop-Loss ka istemal kr k traders apne trading experience ko behtar banate hain. Yeh dono tools unko market mein kamiyaabi hasil karne mein helpp krte ha aur unko nuksan se bachne ka tareeqa muhaiya karte hain. Hr trader ku apne trading plan ke mutabiq take profit aur stop loss levels tay karne ki zarurat hoti hai takay woh apni tijarat mein discipline aur control bnye rakh sake.

تبصرہ

Расширенный режим Обычный режим