Range Breakout Strategy:

Aik Tehqiqati Jaiza

Trading mein kamyabi hasil karne ke liye, traders ko rozana tajaweezat aur strategies tajwez karna parta hai. Range breakout strategy ek aisi tijarat ki tafseelat mein ek ahem hissa hai jo ke traders ko market ke muqami asarat se faida uthane mein madadgar sabit ho sakti hai. Is article mein hum "Range Breakout Strategy" par tafseelat se guzarne ka maqam par hain.

Range Breakout Strategy Kya Hai?

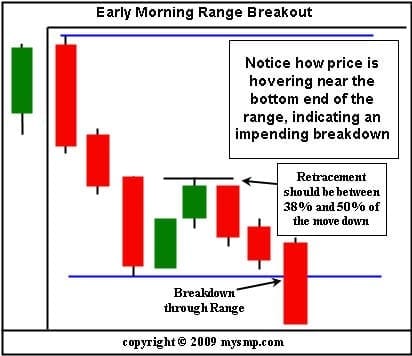

Range breakout strategy ek aisi trading strategy hai jo market mein mojood range ko pehchan kar is range ke baahar hone wale breakout par amal karti hai. Range yani ke market mein mojood ek taqat mein tijarat ka doran, jise traders price chart ki madad se pehchan sakte hain. Jab market ek makhsoos range mein chalti hai, to traders is range mein mazeed tezi ya kamzori ka izhar karne ke liye intezar karte hain.

Jab market is range ke bahar nikalne ka imkan dikhaye, to yeh breakout aksar strong trend ka aghaz hota hai. Is strategy mein traders market ki direction ke mutabiq kharidari ya farokht karke faida hasil karne ki koshish karte hain.

Range Breakout Strategy Kaise Kaam Karti Hai?

Range breakout strategy ka kaam is tareeqe se hota hai:

- Range Pehchan: Sab se pehle to trader ko market mein mojood range ko pehchan karne ki zarurat hoti hai. Iske liye, price chart ki madad se high aur low points ko note karna zaroori hota hai.

- Breakout Ka Intezar: Range ke andar hone wale breakout ka intezar karna ek ahem hissa hai. Jab market is range ke bahar nikalti hai, to yeh ek signal ho sakta hai ke ab market mein strong trend shuru ho sakta hai.

- Entry Point Ka Tajarba: Traders ko entry point ka tajurba bhi zaroori hota hai. Woh tajurba hasil karte hain ke market mein breakout hone ke baad kaunsa level acha hota hai entry ke liye.

- Stop-Loss Aur Target Levels: Har trading strategy mein stop-loss aur target levels ka tay karna bohot zaroori hai. Yeh levels trader ko nuksan se bachane aur munafa hasil karne mein madad karte hain.

Range Breakout Strategy Ke Faiday Aur Nuksan:

Faiday:

- Is strategy ke istemal se traders ko strong trends ka faida uthane ka mauqa milta hai.

- Breakout hone par market mein tezi ya girawat ka andaza lagaya ja sakta hai.

- Entry aur exit points ko tay karke trading plan ko asaan banaya ja sakta hai.

Nuksan:

- Range breakout strategy mein kabhi-kabhi false signals bhi aate hain jo traders ko ghalt faisle par majboor kar sakte hain.

- Market conditions ki tabdeeliyon ke bawajood, yeh strategy hamesha kaamyaab nahi hoti.

Akhri Alfaz:

Range breakout strategy ek tijarat ka aik maqami dor hai jo traders ko market ke mojooda halat aur range ke andar hone wale breakout ki pehchan mein madad karta hai. Lekin, har trading strategy ki tarah, iska bhi istemal karte waqt hoshyari aur tajaweezat ka khayal rakhna zaroori hai. Trading mein kamyaabi hasil karne ke liye, maharat aur tajaweezat dono ko barabar par istemal karna bohot zaroori ha

تبصرہ

Расширенный режим Обычный режим