Introduction :

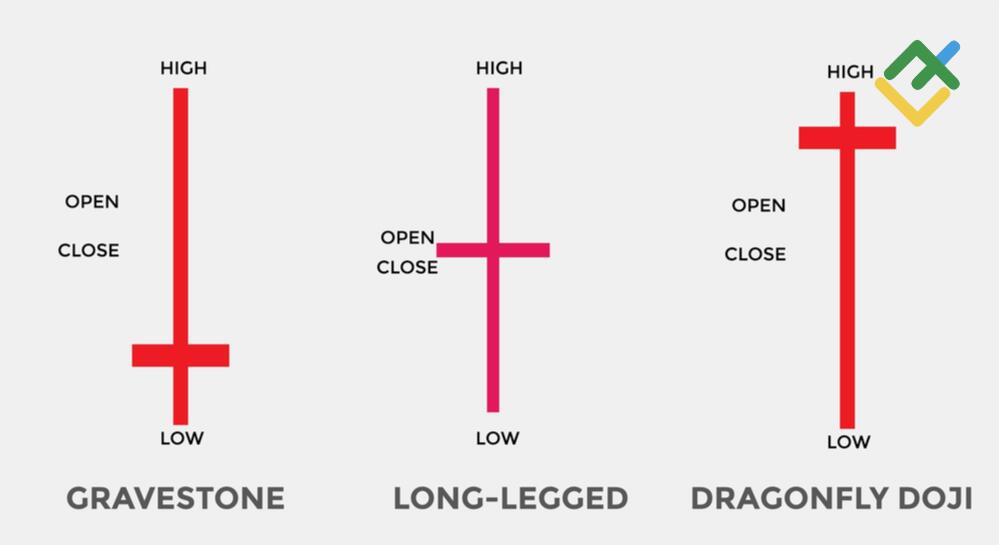

forex market mein Doji candlestick woh hote hey jo kh forex market mein kese assert ke start honay wale price aam tor par close honay wale price kay barabar hote hey jab aisa hota hey to aam tor par aik mokamal doji pattern ban jata hey

tahum forex market mmein es pattern kay andar ager 2 prices chand tik kay inside mein aik jaice hot hey to esay forex market mein Doji pattern ka naam deya jata hey es ka koi asol nahi hota hey yeh aik aam trader kay tor par forex trader kar sakta hey Doji pattern forex market mein aik mofeed pattern hota hey

Doji pattern ka estamal :

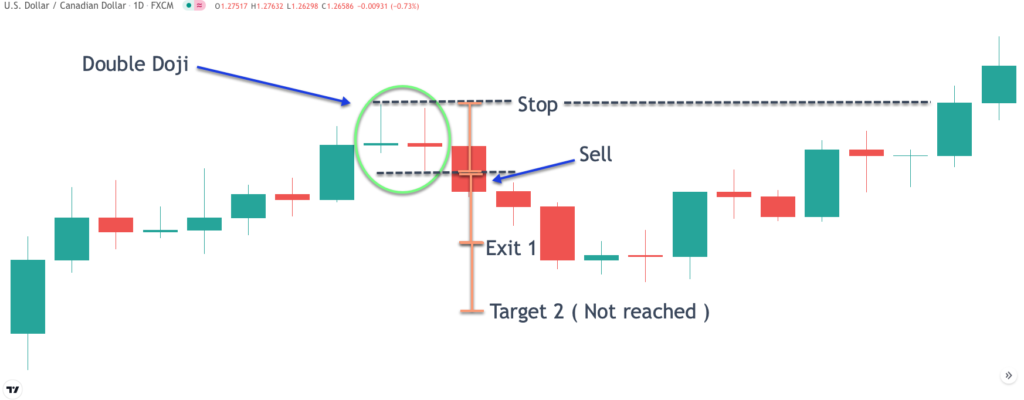

forex market mein Doji pattern Day trader ka aik important hesa hota hey kunkeh yeh aam tor par trader ko batata hey or yeh forex market mein reversal janay wala hota hey ager ap ko forex market mein yaqeen nahi hota hey to yeh aik strong pattern hota hey to forx market mein Doji ap ko aik achay rehnoma kay tor par kam karta hey

forex market mein kai kesam ke doji candle stick pattern hotay hein to forex market mein es ka matlab yeh hota hey keh assert aik new up trend start karnay wala hey ager woh up trend kay doran bante hey to es ka matlab hey keh assert aik new down trend start karna wala hey

Doji market ka analysis:

lahza forex market mein Doji sab say important estamal mein say aik hote hey es ke pehchan ke jate hey jab market mein koi estamal nahi ke jate hey humen forx market mein es cheez ka pata chalta hey es ko forex market mein oper ya nechay keya ja sakta hey top forex market mein aik aisa assert hota hey jab forex market ke pehchan ke ja sakte hey trend start keya ja sakta hey nechay woh hota hey jab aik rallying assert oper ke taraf barhna start ho jata hey

doji forex market mein reversal janay kay le aik acha indicator hota hey kunkeh yeh forex market kay up trend mmein market kay reversal janay ke taraf eshara hota hey or forex market mein seller ke janab say market kay nechay trend ka analysis keya ja sakta hey candlestick kay shadow ke lambai daikh kar market mein assane paida ke ja sakte hey or forex market mein es bat ka andaza lagaya ja sakta hey

forex market mein Doji candlestick woh hote hey jo kh forex market mein kese assert ke start honay wale price aam tor par close honay wale price kay barabar hote hey jab aisa hota hey to aam tor par aik mokamal doji pattern ban jata hey

tahum forex market mmein es pattern kay andar ager 2 prices chand tik kay inside mein aik jaice hot hey to esay forex market mein Doji pattern ka naam deya jata hey es ka koi asol nahi hota hey yeh aik aam trader kay tor par forex trader kar sakta hey Doji pattern forex market mein aik mofeed pattern hota hey

Doji pattern ka estamal :

forex market mein Doji pattern Day trader ka aik important hesa hota hey kunkeh yeh aam tor par trader ko batata hey or yeh forex market mein reversal janay wala hota hey ager ap ko forex market mein yaqeen nahi hota hey to yeh aik strong pattern hota hey to forx market mein Doji ap ko aik achay rehnoma kay tor par kam karta hey

forex market mein kai kesam ke doji candle stick pattern hotay hein to forex market mein es ka matlab yeh hota hey keh assert aik new up trend start karnay wala hey ager woh up trend kay doran bante hey to es ka matlab hey keh assert aik new down trend start karna wala hey

Doji market ka analysis:

lahza forex market mein Doji sab say important estamal mein say aik hote hey es ke pehchan ke jate hey jab market mein koi estamal nahi ke jate hey humen forx market mein es cheez ka pata chalta hey es ko forex market mein oper ya nechay keya ja sakta hey top forex market mein aik aisa assert hota hey jab forex market ke pehchan ke ja sakte hey trend start keya ja sakta hey nechay woh hota hey jab aik rallying assert oper ke taraf barhna start ho jata hey

doji forex market mein reversal janay kay le aik acha indicator hota hey kunkeh yeh forex market kay up trend mmein market kay reversal janay ke taraf eshara hota hey or forex market mein seller ke janab say market kay nechay trend ka analysis keya ja sakta hey candlestick kay shadow ke lambai daikh kar market mein assane paida ke ja sakte hey or forex market mein es bat ka andaza lagaya ja sakta hey

تبصرہ

Расширенный режим Обычный режим