Bullish Engulfing Candlestick Pattern ka Introduction

Candlestick patterns trading ke liye aik ahem tool hain jo traders ko market ke trends aur price movements ke baray mein maloomati signals faraham karte hain. Ek aise pattern jo market mein bearish (price kam hone wala) trend ke bad bullish (price barhne wala) trend ki shuruaat ko darust karta hai, woh hai "Bullish Engulfing" candlestick pattern. Is article mein, hum Roman Urdu mein Bullish Engulfing pattern ki wusat tafseelat par ghor karenge, iske formation ko samjhenge, iski ahmiyat ko janenge, aur traders ke liye iska istemal samjhayenge.Bullish Engulfing candlestick pattern aik powerful tool hai jo traders ko market ke trend reversals ka pata lagane mein madadgar hota hai. Lekin, yaad rahe ke trading mein safalta hasil karne ke liye sahi knowledge, practice, aur risk management ka bhi bohat ahem hissa hai. Is pattern ko samajhne ke bad, traders ko mazeed market analysis aur dusre technical tools ka bhi istemal karna chahiye.

Bullish Engulfing Pattern Ki Pehchan

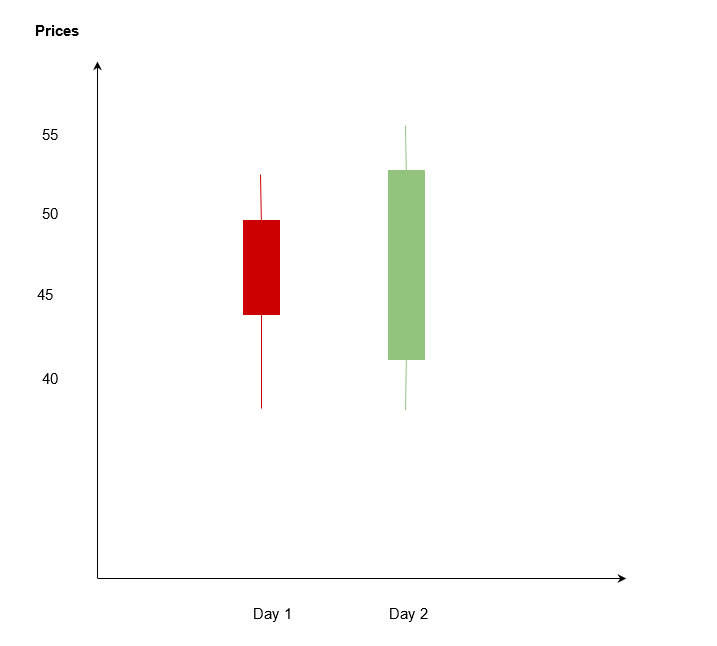

Bullish Engulfing pattern aik reversal pattern hai jo market mein bearish trend ke bad aik bullish trend ki shuruaat ko darust karta hai. Is pattern mein do candlesticks aik sath aate hain, aur doosri candlestick pehli candlestick ko puri tarah se "engulf" karti hai, yaani ke uski high aur low price us se zyada ya kam hoti hai. Chaliye is pattern ko do mukhtalif steps mein samajhte hain:

Pehli Candlestick (Bearish)

Bullish Engulfing pattern ka pehla step hota hai jab pehli candlestick aik bearish (price kam hone wala) candle hoti hai. Is candle ki shape aur position bearish trend ko represent karti hai, matlab ke price kam ho raha hai.

Doosri Candlestick (Bullish)

Doosra step hai doosri candlestick ka, jo aksar pehli candlestick ko poori tarah se engulf karti hai. Iska matlab hai ke doosri candle ki high price pehli candle ki high price se zyada hoti hai, aur low price pehli candle ki low price se kam hoti hai.Target price ko tay karte waqt, traders Bullish Engulfing pattern ke size aur market conditions ko madde nazar rakhte hain. Isse woh andaza lagate hain ke price kitna barh sakta hai.

Bullish Engulfing Pattern Ki Ahmiyat

Bullish Engulfing pattern ki ahmiyat ye hai ke isse bullish market reversal ka strong signal milta hai. Doosri candlestick pehli candlestick ko puri tarah se "swallow" kar leti hai, isse maloom hota hai ke bearish pressure khatam ho rahi hai aur bullish momentum shuru ho raha hai. Ab jab hum Bullish Engulfing pattern ki formation aur ahmiyat samajh chuke hain, to aage chalte hain aur dekhte hain ke traders isko kis tarah se istemal karte hain. Traders Bullish Engulfing pattern ke confirm hone par long position (buying) le sakte hain. Yani ke woh price ke barhne wale signals ko pakar sakte hain aur market mein enter kar sakte hain.Risk management bohat ahem hai, is liye traders apne trades ke sath stop-loss orders bhi lagate hain. Isse nuksan se bacha ja sakta hai agar market unforeseen taur par reverse hota ha

Candlestick patterns trading ke liye aik ahem tool hain jo traders ko market ke trends aur price movements ke baray mein maloomati signals faraham karte hain. Ek aise pattern jo market mein bearish (price kam hone wala) trend ke bad bullish (price barhne wala) trend ki shuruaat ko darust karta hai, woh hai "Bullish Engulfing" candlestick pattern. Is article mein, hum Roman Urdu mein Bullish Engulfing pattern ki wusat tafseelat par ghor karenge, iske formation ko samjhenge, iski ahmiyat ko janenge, aur traders ke liye iska istemal samjhayenge.Bullish Engulfing candlestick pattern aik powerful tool hai jo traders ko market ke trend reversals ka pata lagane mein madadgar hota hai. Lekin, yaad rahe ke trading mein safalta hasil karne ke liye sahi knowledge, practice, aur risk management ka bhi bohat ahem hissa hai. Is pattern ko samajhne ke bad, traders ko mazeed market analysis aur dusre technical tools ka bhi istemal karna chahiye.

Bullish Engulfing Pattern Ki Pehchan

Bullish Engulfing pattern aik reversal pattern hai jo market mein bearish trend ke bad aik bullish trend ki shuruaat ko darust karta hai. Is pattern mein do candlesticks aik sath aate hain, aur doosri candlestick pehli candlestick ko puri tarah se "engulf" karti hai, yaani ke uski high aur low price us se zyada ya kam hoti hai. Chaliye is pattern ko do mukhtalif steps mein samajhte hain:

Pehli Candlestick (Bearish)

Bullish Engulfing pattern ka pehla step hota hai jab pehli candlestick aik bearish (price kam hone wala) candle hoti hai. Is candle ki shape aur position bearish trend ko represent karti hai, matlab ke price kam ho raha hai.

Doosri Candlestick (Bullish)

Doosra step hai doosri candlestick ka, jo aksar pehli candlestick ko poori tarah se engulf karti hai. Iska matlab hai ke doosri candle ki high price pehli candle ki high price se zyada hoti hai, aur low price pehli candle ki low price se kam hoti hai.Target price ko tay karte waqt, traders Bullish Engulfing pattern ke size aur market conditions ko madde nazar rakhte hain. Isse woh andaza lagate hain ke price kitna barh sakta hai.

Bullish Engulfing Pattern Ki Ahmiyat

Bullish Engulfing pattern ki ahmiyat ye hai ke isse bullish market reversal ka strong signal milta hai. Doosri candlestick pehli candlestick ko puri tarah se "swallow" kar leti hai, isse maloom hota hai ke bearish pressure khatam ho rahi hai aur bullish momentum shuru ho raha hai. Ab jab hum Bullish Engulfing pattern ki formation aur ahmiyat samajh chuke hain, to aage chalte hain aur dekhte hain ke traders isko kis tarah se istemal karte hain. Traders Bullish Engulfing pattern ke confirm hone par long position (buying) le sakte hain. Yani ke woh price ke barhne wale signals ko pakar sakte hain aur market mein enter kar sakte hain.Risk management bohat ahem hai, is liye traders apne trades ke sath stop-loss orders bhi lagate hain. Isse nuksan se bacha ja sakta hai agar market unforeseen taur par reverse hota ha

تبصرہ

Расширенный режим Обычный режим