Relative Vigor Index (RVI) Indicator kia hota hy Introduction

Relative Vigor Index (RVI) ek technical analysis indicator hai jo stock market, forex aur commodities jaise financial markets mein istemal hota hai. Is indicator ka maqsad market trend aur price movements ki samjhne mein madad karna hai. RVI un traders aur investors ke liye khaas hai jo short-term aur medium-term price trends ko samajhna chahte hain.RVI (Relative Vigor Index) indicator short-term aur medium-term trends ko samajhne mein traders aur investors ki madad karta hai. Iska sahi istemal karke, aap market ke momentum aur price movements ko behtar tareekay se analyze kar sakte hain. Lekin, yaad rahe ke technical analysis indicators ke istemal mein training aur practice ahem hote hain, taa ke aap is ka sahi istemal kar saken.

RVI Kaise Kaam Karta Hai

Relative Vigor Index (RVI) ka calculation price ki velocity aur relative strength par mabni hota hai. Is indicator ka formula price movements aur unke closing prices par mabni hota hai. Ye calculation bullish aur bearish trends ko samajhne mein madad deta hai. RVI indicator ka istemal kisi bhi financial market mein trends ko samajhne aur price movements ko analyze karne ke liye hota hai. Is indicator ki madad se traders aur investors market ke momentum ko samajh sakte hain. Yeh unko yeh maloom karne mein madad karta hai ke kya market bullish ya bearish direction mein ja raha hai.

RVI Ka Istemal Kaise Karein

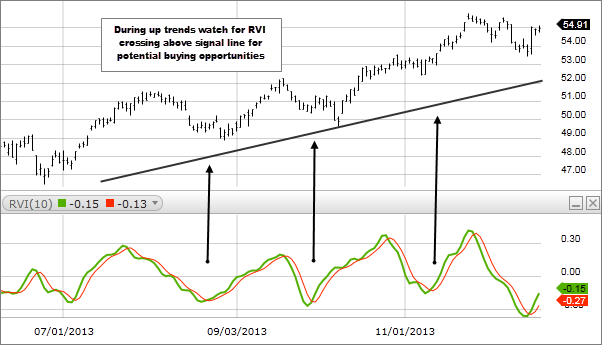

RVI indicator ko samajhne ke liye, yeh ahem hai ke iska istemal sahi tarikay se kiya jaye. Yahan kuch mukhtasar steps diye gaye hain jo traders aur investors RVI ka sahi istemal karne mein madadgar sabit ho sakte hain. Sab se pehle, aapko price data collect karna hoga jispar RVI calculation kiya jayega. Is data mein price ki velocity aur closing prices shamil honge. RVI ka calculation price movements aur closing prices ke basis par hota hai. Is calculation se aapko RVI values milenge jo market momentum ko represent karte hain. RVI values ko samajhne ke liye, aapko iska trend aur direction dekhna hoga. Agar RVI values positive hain to yeh bullish trend ki nishandahi kar sakte hain jabkay negative values bearish trend ko indicate kar sakte hain.

RVI Ka Muaqqafiyat Ke Sath Istemal

RVI indicator ka istemal sirf data collection aur calculation se zyada hai. Aapko iska sahi interpretation aur muaqqafiyat se istemal karna hoga. Yeh kisi single indicator ki tarah istemal nahin hota, balkay dusre technical indicators aur price patterns ke saath mil kar istemal hota hai.RVI indicator ki ek ahem tareeqa divergence hai. Agar price aur RVI ke beech mein divergence nazar aaye, to yeh trend reversal ki nishandahi ho sakti hai

Relative Vigor Index (RVI) ek technical analysis indicator hai jo stock market, forex aur commodities jaise financial markets mein istemal hota hai. Is indicator ka maqsad market trend aur price movements ki samjhne mein madad karna hai. RVI un traders aur investors ke liye khaas hai jo short-term aur medium-term price trends ko samajhna chahte hain.RVI (Relative Vigor Index) indicator short-term aur medium-term trends ko samajhne mein traders aur investors ki madad karta hai. Iska sahi istemal karke, aap market ke momentum aur price movements ko behtar tareekay se analyze kar sakte hain. Lekin, yaad rahe ke technical analysis indicators ke istemal mein training aur practice ahem hote hain, taa ke aap is ka sahi istemal kar saken.

RVI Kaise Kaam Karta Hai

Relative Vigor Index (RVI) ka calculation price ki velocity aur relative strength par mabni hota hai. Is indicator ka formula price movements aur unke closing prices par mabni hota hai. Ye calculation bullish aur bearish trends ko samajhne mein madad deta hai. RVI indicator ka istemal kisi bhi financial market mein trends ko samajhne aur price movements ko analyze karne ke liye hota hai. Is indicator ki madad se traders aur investors market ke momentum ko samajh sakte hain. Yeh unko yeh maloom karne mein madad karta hai ke kya market bullish ya bearish direction mein ja raha hai.

RVI Ka Istemal Kaise Karein

RVI indicator ko samajhne ke liye, yeh ahem hai ke iska istemal sahi tarikay se kiya jaye. Yahan kuch mukhtasar steps diye gaye hain jo traders aur investors RVI ka sahi istemal karne mein madadgar sabit ho sakte hain. Sab se pehle, aapko price data collect karna hoga jispar RVI calculation kiya jayega. Is data mein price ki velocity aur closing prices shamil honge. RVI ka calculation price movements aur closing prices ke basis par hota hai. Is calculation se aapko RVI values milenge jo market momentum ko represent karte hain. RVI values ko samajhne ke liye, aapko iska trend aur direction dekhna hoga. Agar RVI values positive hain to yeh bullish trend ki nishandahi kar sakte hain jabkay negative values bearish trend ko indicate kar sakte hain.

RVI Ka Muaqqafiyat Ke Sath Istemal

RVI indicator ka istemal sirf data collection aur calculation se zyada hai. Aapko iska sahi interpretation aur muaqqafiyat se istemal karna hoga. Yeh kisi single indicator ki tarah istemal nahin hota, balkay dusre technical indicators aur price patterns ke saath mil kar istemal hota hai.RVI indicator ki ek ahem tareeqa divergence hai. Agar price aur RVI ke beech mein divergence nazar aaye, to yeh trend reversal ki nishandahi ho sakti hai

تبصرہ

Расширенный режим Обычный режим