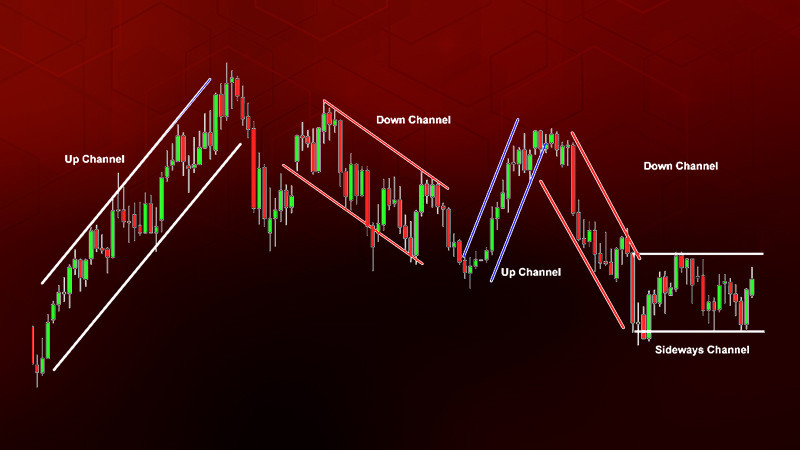

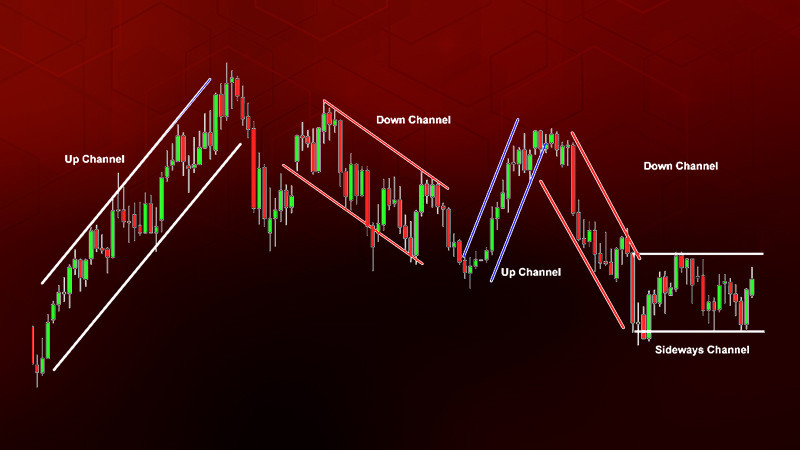

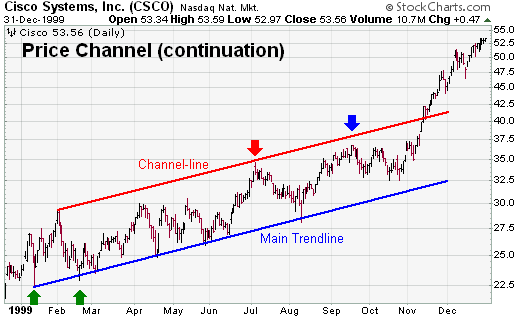

Price channel patterns forex market mein takneeki tajaweez ka aham hissa hain, jinhain traders ko mumtaz price movements ki taraf rukh karne mein madad milti hai. Ye patterns traders ko trends, reversals, aur unke trades ke liye dakhil ya nikalne ke mumkin points ka andaza lagane mein madad karti hain. Forex mein price channels ki ahmiyat ko samajhna, traders ki salahiyaton ko be had behtar banane mein madad kar sakta hai/ Price channels tijarat mein muqarar muddat ke dauran price movements ka graphical representation hote hain. Ye aksar price chart ke oopar aur neeche do mazboot lineon se bante hain, jo ke ek channel ko banate hain. Oonchi line resistance level ko darust karti hai, jabke neeche wali line support level ko nazar andaz karti hai. Traders price channels ka istemal karte hain taake wo ye samajh sakein ke currency pair kis range mein hai aur potential breakout ya breakdown points ko pehchan sakein.

Trend Trend Identification

Price channels ka aik pehla kaam trend ko pehchan karne ka hai. Channel ke andar prices ka rukh dekhte hue traders mojooda trend ko maloom kar sakte hain. Uptrend mein prices aksar channel ke oopar hisse mein rehti hain, jabke downtrend mein ye channel ke neeche taraf jaati hain. Ye trends pehchan karne se traders ko ye maloom hota hai ke wo uptrend mein long ja sakte hain ya downtrend mein short ja sakte hain. Price channels support aur resistance levels ka wazeh tasawwur faraham karte hain. Channel ka neeche wala hissa aik dynamic support level ka kaam karta hai, jabke oonchi line dynamic resistance level ko darust karti hai. Jab prices upper line ke qareeb aati hain, to traders ise reversal ka potential point samajh sakte hain. Umul raaye, jab prices lower line ke qareeb aati hain, to traders buying opportunities talash sakte hain, umid karte hue ke prices phir se barh sakti hain.

Volatility and Breakouts

Price channels bhi market ki volatility mein taameel karte hain. Tang channels low volatility ko darust karte hain, jo ke market mein consolidation ya faisla nahi karne ka doran hoti hai. Mutasira channels mein izafah volatility ko darust karte hain, jo ke aksar significant price movements ke pehle aata hai. Traders breakouts ke liye nazar rakhte hain, jab prices channel ke hadood se bahar jaati hain, kyun ke ye naye trend ya mojooda trend ka continuation hone ki alamat ho sakti hai. Price channels ke andar, traders aksar khaas patterns ko dekhte hain jo potential price movements ke bare mein izafah faraham kar sakte hain. Aam pattern "flag" hota hai, jo ke channel ke andar rectangular-shaped consolidation ko darust karta hai. Flags aksar strong continuation moves ke pehle aata hain, aur traders inhe future price direction ko anumaan lagane ke liye istemal karte hain.

Trading Strategies Using Price Channels

Traders price channels ke istemal se mutaliq mukhtalif strategies ka istemal karte hain taake wo maqool faislay kar sakein. Aik mashhoor tareeqa trend following hai, jisme traders uptrend mein long jaate hain jab prices lower channel line se bounce hoti hain aur downtrend mein short jaate hain jab prices upper channel line se wapas jaati hain. Dusra tareeqa breakouts ko trade karne ka hai, jisme traders positions lete hain jab prices channel ke hadood se bahar jaati hain, jo ke naye trend ya mojooda trend ka continuation ho sakta hai. Price channels ka bhi aham hissa risk management mein hota hai. Traders channel ki chaurai ka istemal stop-loss aur take-profit levels tay karnay ke liye kar sakte hain. Wider channels bade volatility ko darust karte hain, is wajah se inke liye bade stop-loss orders ki zaroorat ho sakti hai, jabke tang channels mein tight stops ki zaroorat ho sakti hai. Price channels ko is taur par istemal karna traders ko apne risk exposure ko manage karne mein madad karta hai aur unke capital ko hifazati taur par istemal karne mein madad karta hai.

Confirmation with Other Indicators

Price channel analysis ko bharpoor banane ke liye, traders aksar mazeed takneeki indicators ka istemal karte hain. Moving averages, oscillators, aur volume analysis price channels se liye gaye signals ko tasdiq karne mein madadgar ho sakte hain. Mazeed indicators ko milane se overall analysis ko mazboot banaya ja sakta hai aur successful trades karne ki mumkinat ko barha sakte hain. Price channels ka market ke participants par bhi aik psychological asar hota hai. Traders aur investors in channels par tawajju dete hain, aur jab prices channel ke hadood ke qareeb aati hain, ye aksar buying ya selling decisions ko trigger karte hain. Is collective behavior ka asar hota hai, jisme bohot se market participants ki actions channels ke andar mutabaqat mein aati hain aur ye apne aap ko puri hoti hain. Jabke price channels qeemati tools hain, traders ko inke rukawat par bhi ghor karna zaroori hai. Marketen achaanak bhi hosakti hain, aur price channels hamesha mustaqbil ki harkat ko sahi taur par nahi pesh kar sakti hain. Mazid factors jese ke maasharti waaqiyaat, saeqeeliyati hawalay, ya ghair mutawaqqi khabrain currency prices par asar daal sakti hain, channels ke musalat hone ke baghair. Is liye, traders ko apne faislay mein price channels ko aik mukammal analysis ka hissa banane ke liye aur trading decisions se pehle mazeed factors ko mad e nazar rakhne ki zaroorat hai.

Trend Trend Identification

Price channels ka aik pehla kaam trend ko pehchan karne ka hai. Channel ke andar prices ka rukh dekhte hue traders mojooda trend ko maloom kar sakte hain. Uptrend mein prices aksar channel ke oopar hisse mein rehti hain, jabke downtrend mein ye channel ke neeche taraf jaati hain. Ye trends pehchan karne se traders ko ye maloom hota hai ke wo uptrend mein long ja sakte hain ya downtrend mein short ja sakte hain. Price channels support aur resistance levels ka wazeh tasawwur faraham karte hain. Channel ka neeche wala hissa aik dynamic support level ka kaam karta hai, jabke oonchi line dynamic resistance level ko darust karti hai. Jab prices upper line ke qareeb aati hain, to traders ise reversal ka potential point samajh sakte hain. Umul raaye, jab prices lower line ke qareeb aati hain, to traders buying opportunities talash sakte hain, umid karte hue ke prices phir se barh sakti hain.

Volatility and Breakouts

Price channels bhi market ki volatility mein taameel karte hain. Tang channels low volatility ko darust karte hain, jo ke market mein consolidation ya faisla nahi karne ka doran hoti hai. Mutasira channels mein izafah volatility ko darust karte hain, jo ke aksar significant price movements ke pehle aata hai. Traders breakouts ke liye nazar rakhte hain, jab prices channel ke hadood se bahar jaati hain, kyun ke ye naye trend ya mojooda trend ka continuation hone ki alamat ho sakti hai. Price channels ke andar, traders aksar khaas patterns ko dekhte hain jo potential price movements ke bare mein izafah faraham kar sakte hain. Aam pattern "flag" hota hai, jo ke channel ke andar rectangular-shaped consolidation ko darust karta hai. Flags aksar strong continuation moves ke pehle aata hain, aur traders inhe future price direction ko anumaan lagane ke liye istemal karte hain.

Trading Strategies Using Price Channels

Traders price channels ke istemal se mutaliq mukhtalif strategies ka istemal karte hain taake wo maqool faislay kar sakein. Aik mashhoor tareeqa trend following hai, jisme traders uptrend mein long jaate hain jab prices lower channel line se bounce hoti hain aur downtrend mein short jaate hain jab prices upper channel line se wapas jaati hain. Dusra tareeqa breakouts ko trade karne ka hai, jisme traders positions lete hain jab prices channel ke hadood se bahar jaati hain, jo ke naye trend ya mojooda trend ka continuation ho sakta hai. Price channels ka bhi aham hissa risk management mein hota hai. Traders channel ki chaurai ka istemal stop-loss aur take-profit levels tay karnay ke liye kar sakte hain. Wider channels bade volatility ko darust karte hain, is wajah se inke liye bade stop-loss orders ki zaroorat ho sakti hai, jabke tang channels mein tight stops ki zaroorat ho sakti hai. Price channels ko is taur par istemal karna traders ko apne risk exposure ko manage karne mein madad karta hai aur unke capital ko hifazati taur par istemal karne mein madad karta hai.

Confirmation with Other Indicators

Price channel analysis ko bharpoor banane ke liye, traders aksar mazeed takneeki indicators ka istemal karte hain. Moving averages, oscillators, aur volume analysis price channels se liye gaye signals ko tasdiq karne mein madadgar ho sakte hain. Mazeed indicators ko milane se overall analysis ko mazboot banaya ja sakta hai aur successful trades karne ki mumkinat ko barha sakte hain. Price channels ka market ke participants par bhi aik psychological asar hota hai. Traders aur investors in channels par tawajju dete hain, aur jab prices channel ke hadood ke qareeb aati hain, ye aksar buying ya selling decisions ko trigger karte hain. Is collective behavior ka asar hota hai, jisme bohot se market participants ki actions channels ke andar mutabaqat mein aati hain aur ye apne aap ko puri hoti hain. Jabke price channels qeemati tools hain, traders ko inke rukawat par bhi ghor karna zaroori hai. Marketen achaanak bhi hosakti hain, aur price channels hamesha mustaqbil ki harkat ko sahi taur par nahi pesh kar sakti hain. Mazid factors jese ke maasharti waaqiyaat, saeqeeliyati hawalay, ya ghair mutawaqqi khabrain currency prices par asar daal sakti hain, channels ke musalat hone ke baghair. Is liye, traders ko apne faislay mein price channels ko aik mukammal analysis ka hissa banane ke liye aur trading decisions se pehle mazeed factors ko mad e nazar rakhne ki zaroorat hai.

تبصرہ

Расширенный режим Обычный режим