The Piercing Line Candlestick Pattern

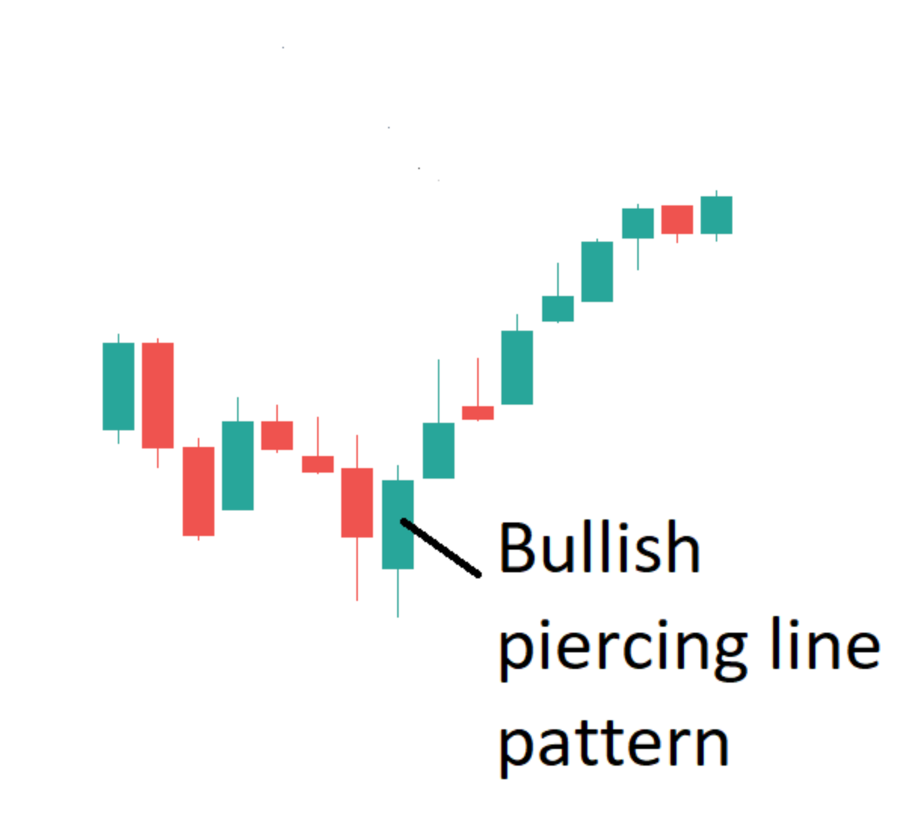

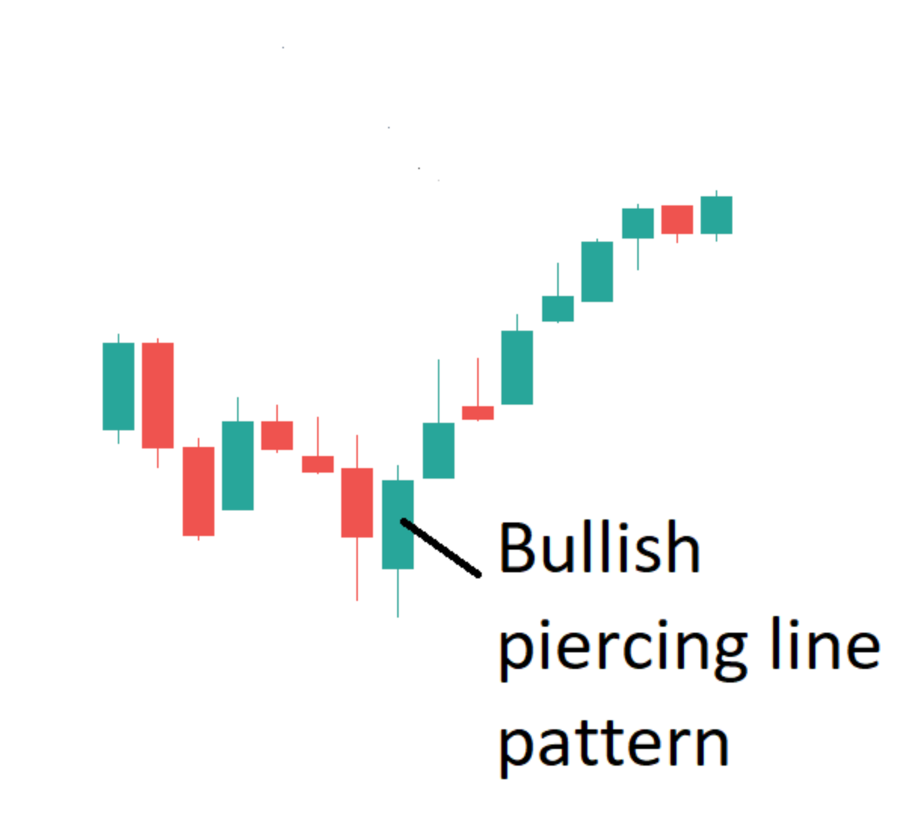

Piercing Line candlestick pattern ek bullish reversal pattern hai jo kay aam taur par foreign exchange market mein dekha jata hai. Ye ek candlestick charting technique hai jo price action ka istemal karta hai take future price movements ko predict kiya ja sake. Piercing Line pattern wo hota hai jo kuch candlesticks ko shamil karta hai jo ek khaas pattern ko follow karte hain, jo potential price reversal ko darust kartay hain. Piercing Line pattern chaar candlesticks se bana hota hai, jisme pehlay teen candlesticks ek downtrend ko banatay hain. Candle 1 ek bearish candle hai jo pehlay din ki candle ke qareeb khulta hai aur iski bandish bhi uski qareeb hai. Dusri Candle 2 ek bearish candle hai jo Candle 1 ki qareeb bandish hoti hai aur iski bhi bandish qareeb hoti hai. Teesri Candle 3 bhi ek bearish candle hai jo Candle 2 ki qareeb bandish hoti hai aur iski bhi bandish qareeb hoti hai.

Components of Piercing Line Pattern

Candle 4 jo ke Piercing Line candle ke naam se bhi maloom hoti hai, wo wo candle hai jo potential price reversal ko darust karta hai. Ye candle Candle 3 ki qareeb khulta hai aur iski bandish Candle 3 ki qareeb bandish hoti hai, lekin iski bari ka bara hissa Candle 3 ke darmiyan ki line ke upar hota hai. Ye darust karta hai ke buyers ne market mein dakhil ho gaye hain aur price ko upar ki taraf le ja sakte hain, jo potential price reversal ko darust karta hai. Piercing Line pattern ko bullish reversal pattern kaha jata hai kyunki iska ishara hai ke price ne apna minimum reach kar liya hai aur ab upar ki taraf ja raha hai. Ye pattern forex market mein khaas kar istemal hota hai kyunki ye traders ko potential price reversals ko pehchanne aur inform kiye gaye trading decisions lene mein madad karta hai. Piercing Line pattern tab sab se asar afreen hota hai jab ye ek downtrend mein dikhai deta hai ya jab price kisi support level ke qareeb hota hai. Jab Piercing Line pattern ek downtrend mein dikhai deta hai, to ye ishara hota hai ke price ne apna minimum reach kar liya hai aur ab upar ja raha hai. Jab Piercing Line pattern kisi support level ke qareeb dikhai deta hai, to ye ishara hota hai ke price ne support paya hai aur ab upar ja raha hai.

Interpreting the Piercing Line Pattern

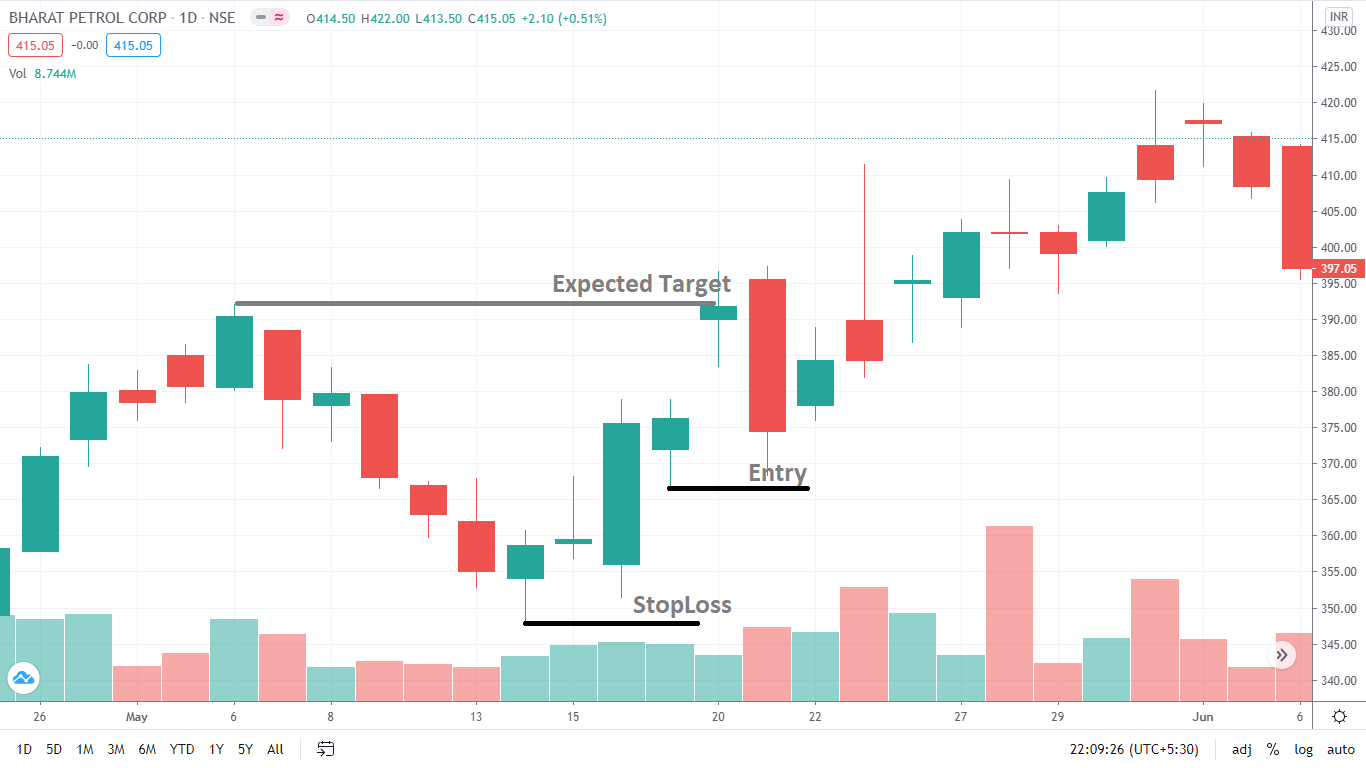

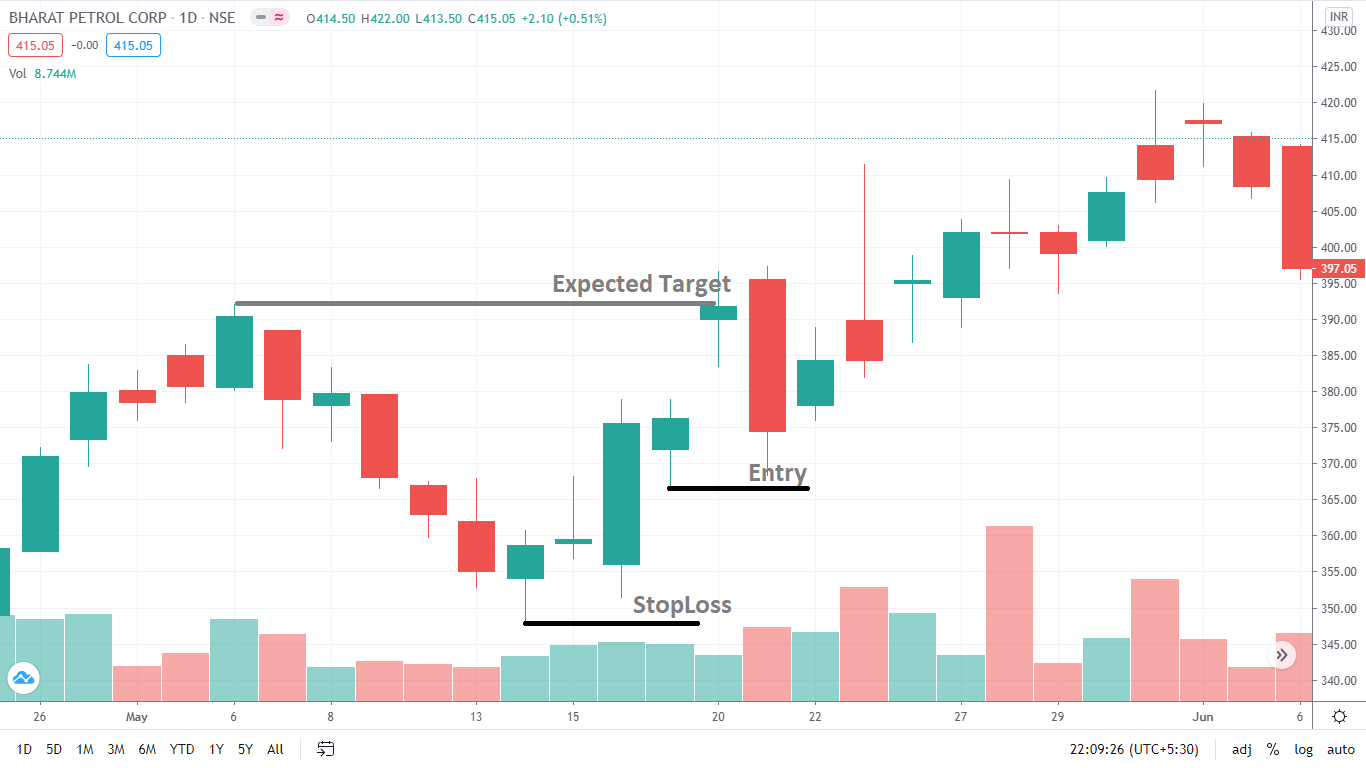

Lekin ye zaroori hai ke Piercing Line pattern foolproof indicator nahi hai, aur iski reliability par kai factors asar daal sakte hain. Ek aisa factor hai jo Piercing Line pattern se pehle hone wale downtrend ka duration hai. Jitna zyada downtrend hoga, utni zyada Piercing Line pattern ki reliability hogi. Piercing Line pattern ki reliability par asar daalne wala doosra factor ye hai ke pattern banne ke doran trading volume kitna tha. Piercing Line pattern banne ke doran high volume ek achha ishara hai, kyunki ye darust karta hai ke market mein significant buying pressure hai. Traders Piercing Line pattern ko kuch tareeqon se istemal karke inform kiye gaye trading decisions le sakte hain. Ek tareeqa ye hai ke Piercing Line candle ki bandish par ek buy order lagaya jaye, jisme Candle 3 ke neeche ek stop-loss order bhi lagaya jaye. Ye strategy traders ko Piercing Line pattern ke darust kardahish ishara ki taraf le ja sakti hai.

Trading Strategies

Traders Piercing Line pattern ke saath istemal karne wale doosre strategies bhi istemal kar sakte hain, jisme ek buy order lagane se pehle confirmation ka intezar kiya jaye. Confirmation ek aisi bullish candle ki shakal mein ho sakti hai jo Piercing Line candle ke baad aati hai, ishara karte hue ke buyers ab bhi market par qabu rakhte hain. Piercing Line pattern ke ilawa, forex market mein traders inform kiye gaye trading decisions lene ke liye kuch aur candlestick patterns ka bhi istemal kar sakte hain. Ek aisa pattern hai Doji pattern, jo ek neutral pattern hai aur ishara karta hai ke buyers aur sellers ek barabari ke haal mein hain. Doosra pattern hai Hammer pattern, jo ek bullish pattern hai aur ishara karta hai ke sellers ne market par qabu khona shuru kar diya hai. Hammer pattern ek lambi lower shadow aur choti body se milta hai, ishara karte hue ke buyers ne din ke end mein price ko upar ki taraf dhakela hai.

Piercing Line candlestick pattern ek bullish reversal pattern hai jo kay aam taur par foreign exchange market mein dekha jata hai. Ye ek candlestick charting technique hai jo price action ka istemal karta hai take future price movements ko predict kiya ja sake. Piercing Line pattern wo hota hai jo kuch candlesticks ko shamil karta hai jo ek khaas pattern ko follow karte hain, jo potential price reversal ko darust kartay hain. Piercing Line pattern chaar candlesticks se bana hota hai, jisme pehlay teen candlesticks ek downtrend ko banatay hain. Candle 1 ek bearish candle hai jo pehlay din ki candle ke qareeb khulta hai aur iski bandish bhi uski qareeb hai. Dusri Candle 2 ek bearish candle hai jo Candle 1 ki qareeb bandish hoti hai aur iski bhi bandish qareeb hoti hai. Teesri Candle 3 bhi ek bearish candle hai jo Candle 2 ki qareeb bandish hoti hai aur iski bhi bandish qareeb hoti hai.

Components of Piercing Line Pattern

Candle 4 jo ke Piercing Line candle ke naam se bhi maloom hoti hai, wo wo candle hai jo potential price reversal ko darust karta hai. Ye candle Candle 3 ki qareeb khulta hai aur iski bandish Candle 3 ki qareeb bandish hoti hai, lekin iski bari ka bara hissa Candle 3 ke darmiyan ki line ke upar hota hai. Ye darust karta hai ke buyers ne market mein dakhil ho gaye hain aur price ko upar ki taraf le ja sakte hain, jo potential price reversal ko darust karta hai. Piercing Line pattern ko bullish reversal pattern kaha jata hai kyunki iska ishara hai ke price ne apna minimum reach kar liya hai aur ab upar ki taraf ja raha hai. Ye pattern forex market mein khaas kar istemal hota hai kyunki ye traders ko potential price reversals ko pehchanne aur inform kiye gaye trading decisions lene mein madad karta hai. Piercing Line pattern tab sab se asar afreen hota hai jab ye ek downtrend mein dikhai deta hai ya jab price kisi support level ke qareeb hota hai. Jab Piercing Line pattern ek downtrend mein dikhai deta hai, to ye ishara hota hai ke price ne apna minimum reach kar liya hai aur ab upar ja raha hai. Jab Piercing Line pattern kisi support level ke qareeb dikhai deta hai, to ye ishara hota hai ke price ne support paya hai aur ab upar ja raha hai.

Interpreting the Piercing Line Pattern

Lekin ye zaroori hai ke Piercing Line pattern foolproof indicator nahi hai, aur iski reliability par kai factors asar daal sakte hain. Ek aisa factor hai jo Piercing Line pattern se pehle hone wale downtrend ka duration hai. Jitna zyada downtrend hoga, utni zyada Piercing Line pattern ki reliability hogi. Piercing Line pattern ki reliability par asar daalne wala doosra factor ye hai ke pattern banne ke doran trading volume kitna tha. Piercing Line pattern banne ke doran high volume ek achha ishara hai, kyunki ye darust karta hai ke market mein significant buying pressure hai. Traders Piercing Line pattern ko kuch tareeqon se istemal karke inform kiye gaye trading decisions le sakte hain. Ek tareeqa ye hai ke Piercing Line candle ki bandish par ek buy order lagaya jaye, jisme Candle 3 ke neeche ek stop-loss order bhi lagaya jaye. Ye strategy traders ko Piercing Line pattern ke darust kardahish ishara ki taraf le ja sakti hai.

Trading Strategies

Traders Piercing Line pattern ke saath istemal karne wale doosre strategies bhi istemal kar sakte hain, jisme ek buy order lagane se pehle confirmation ka intezar kiya jaye. Confirmation ek aisi bullish candle ki shakal mein ho sakti hai jo Piercing Line candle ke baad aati hai, ishara karte hue ke buyers ab bhi market par qabu rakhte hain. Piercing Line pattern ke ilawa, forex market mein traders inform kiye gaye trading decisions lene ke liye kuch aur candlestick patterns ka bhi istemal kar sakte hain. Ek aisa pattern hai Doji pattern, jo ek neutral pattern hai aur ishara karta hai ke buyers aur sellers ek barabari ke haal mein hain. Doosra pattern hai Hammer pattern, jo ek bullish pattern hai aur ishara karta hai ke sellers ne market par qabu khona shuru kar diya hai. Hammer pattern ek lambi lower shadow aur choti body se milta hai, ishara karte hue ke buyers ne din ke end mein price ko upar ki taraf dhakela hai.

تبصرہ

Расширенный режим Обычный режим