Forex trading ya kisi bhi tijarat mein, kabhi nuksan ka samna kerna parta ha. ye nuksan traders ke liye mushkil waqt hota hai, lekin es mushkil se guzar kar bhi, zaroori hai ke aap apna plan barqarar rakhein aur apne kiye gaye ghalatiyon se seekhain. yahan hum baat karenge ke trading mein nuksan ka samna kyun hota hai aur iske sath kaise deal karna chahiye.

What Is Loss In Forex Trading ?

Market Volatility:

Market mein hone wale sudden changes, ya volatility, nuksan ka ek bada sabab hu sakte hain. esmein traders ke faisle par asar hota hai aur nuksan hu sakta hai.

Ghaltiyan Aur Analysis Ghalat Honay Ka Khatra:

Kabhi-kabhi traders apni analysis mein ghalatiyan kar lete hain ya phir unka takhmina galat hu jata hai, jiski wajah se nuksan ho sakta hai.

Leverage Ka Barah-e-Rast Istemal:

Agar leverage ka barah-e-rast istemal nahi kiya jata, toh traders ku loss ka samna kerna kam hu sakta hai. Leverage sahi sa istemal nahi kiya gaya toh loss had se zyada badh sakta hai.

How To Control Situation After Face Loss In Trading ?

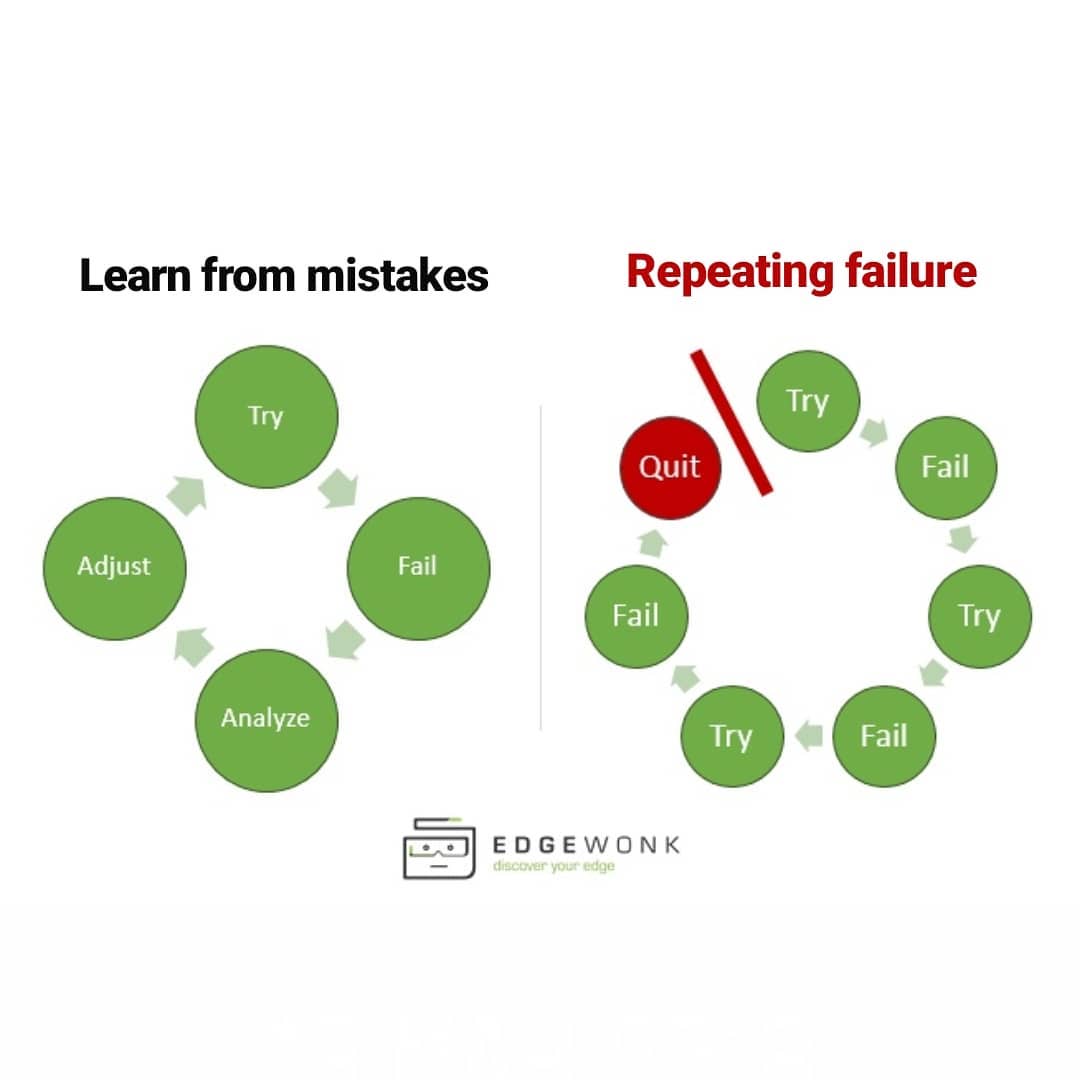

Don't Change Your Plain:

Loss ku face kerne ke baad bhi, apne trading plan ko barqarar rakhna zaroori hai. Aapko apni strategies par yaqeen rakhna chahiye aur ghalatiyon se sabak sikhe kar aage badhna chahiye.

Identify Your Mistakes:

Hr loss ki wajah ko samjhna zaruri hai. Apni trades ko review karein aur dekhein ke apne kis point par ghalati ki hai. Mistakes ko identify karke aap future mein unse bach sakte hain.

Use Of Risk Management :

Har trader ko apne risk management strategies ko dobara tajwez karna chahiye. Nuksan ka samna karna aam hai, lekin risk ko control mein rakhna zaroori hai.

Emotions Ko Control Karein:

Nuksan ka samna karte waqt, emotions ko control karna mushkil ho sakta hai. Lekin is mushkil waqt mein bhi shant aur tajaweez se kaam lena zaroori hai.

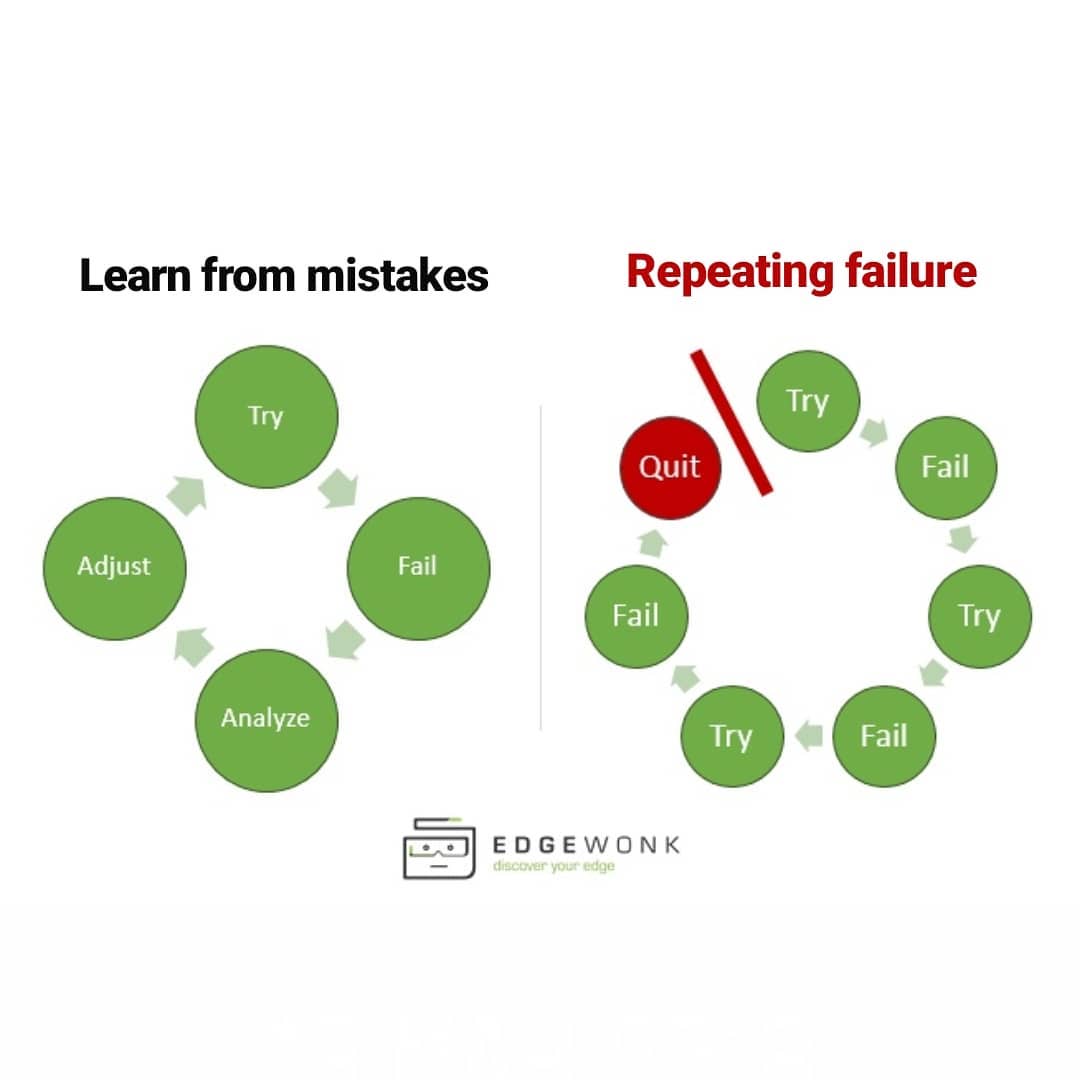

Lear From Loss

Ghalatiyon Ko Avoid Karein:

Nuksan se seekhna matlab yeh nahi hai ke aap ghalatiyon ko dohrayein. Balki, ghalatiyon se bachne ke liye apne approach ko improve karein.

Educate Yourself:

Trading mein maharat hasil karna zaroori hai. Nuksan ka samna karne ke baad, khud ko educate karein, naye tareeqon ko sikhein, aur trading skills ko behtar banayein.

Trading Journal Banayein:

Har trade ko record karne ke liye trading journal banayein. Ismein apne trades ki details, entry aur exit points, aur market conditions ko note karein. Isse aap apni performance ko analyze kar sakte hain.

Nuksan ka samna karna trading ka aik hissa hai, lekin esse hr trader ko guzarna parta hai. Sab se zaruri hai ke aap is mushkil waqt mein apne plan ko barqarar rakhein, apni ghalatiyon se seekhein, aur apne skills ko behtar banayein.

تبصرہ

Расширенный режим Обычный режим