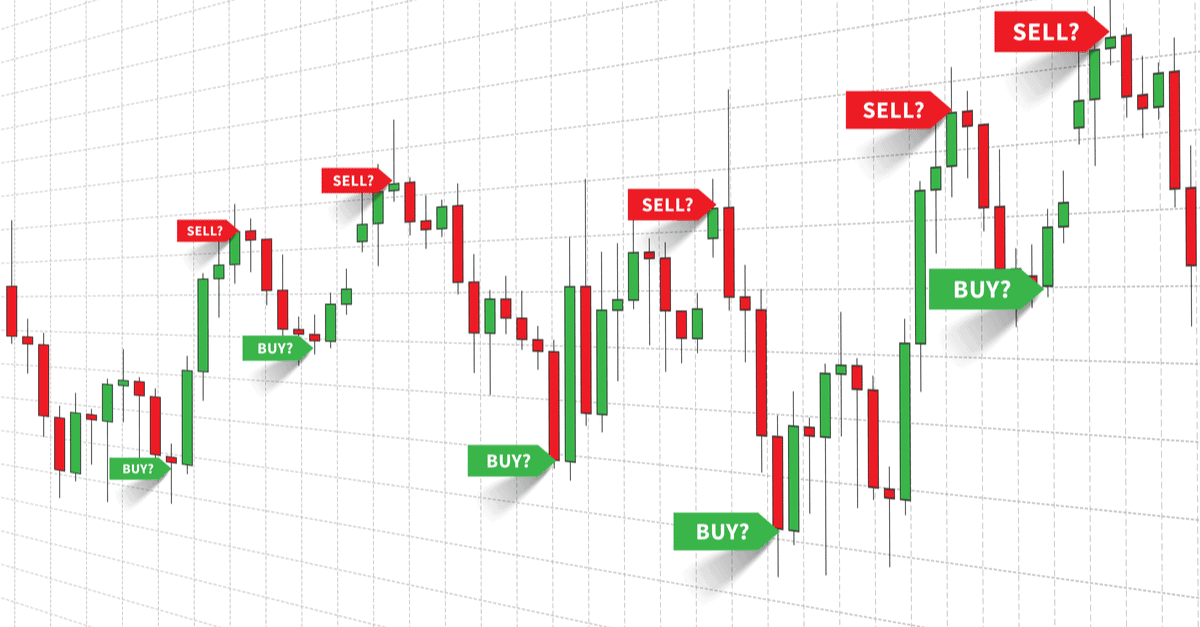

Forex trading ke dunia mein Tower Top aur Tower Bottom aise makhsoos qeemat ke patterns ko bayan karne ke liye istemal hote hain jo tijarat karne walon ko market mein mukhlis mudde par pehchaan karne mein madadgar ho sakte hain. Ye patterns forex market mein khareedne walon aur bechne walon ke darmiyan musalsal jang ka tasawur dete hain, aur ye market ke jazbat aur future qeemat chalne ki qeemati malumat farahem kar sakte hain. Tower Top aur Tower Bottom patterns dono tazagi ke daur ke baad aane wale consolidation phase se mushkilat se muktalif hain. Ye patterns kisi bhi time frame mein ho sakte hain, chahay wo chhote intra-day charts hon ya lambi muddat ke haftay ya mahine ke charts hon. In patterns ko samajhna aur inke ahmiyat ko samajhna tijarat karnewalon ko zyada maqool faislay karne mein madadgar ho sakta hai aur inki over-all trading strategies ko behtar bana sakta hai.

Pattern Identification

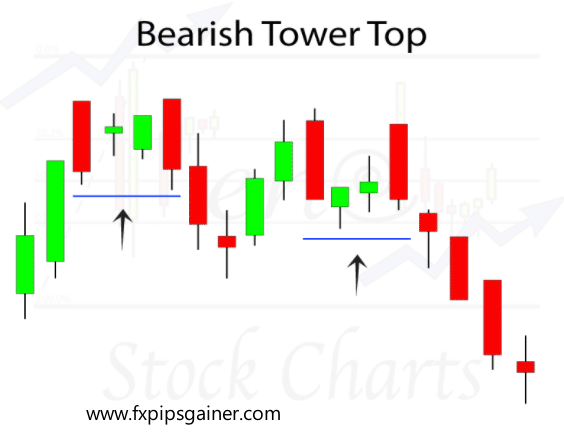

Tower Top pattern is surat mein banta hai jab kisi aset ki qeemat mein tezi aur ahem izafay ke baad ek dora-e-mustawar ya side mein movement hoti hai. Ibtidaai tez izafa pattern ke tower hissay ko banata hai, jabke baad mein hone wala consolidation phase top hissay ko banata hai. Traders is pattern ko aksar ek mukhlis ulte ishara samajhte hain, jo batata hai ke market taqat khatam ho rahi hai aur rukh badalne wala hai. Ibtidaai qeemat mein izafa ke baad woh mustawar phase jo aata hai, wo mukhtalif suraton mein ho sakta hai, jese ke triangle, rectangle, ya aik silsila jo ke chhote peaks aur barhte hue lows ko shamil karta hai. Ye phase market mein ek temporary rukawat ko darust karta hai, jab ke khareedne walay aur bechne walay apni jagahon ko dobara tajaweez karte hain. Is consolidation phase ki muddat mukhtalif ho sakti hai, kuch Tower Top patterns ko pooray hone mein dinon ya hafton tak lag sakta hai.

Confirmation Signals

Ek Tower Top pattern ko tasdeeq karne ke liye, traders kuch khaas sifat dekhte hain. Pehle to, ibtidaai qeemat mein izafa ahem hona chahiye aur iske sath hi volume bhi aam se zyada hona chahiye, jo ke zyada khareedne ki dabao ko darust karta hai. Is kharidari mein izafa karne wale activity ka izhar aksar market ki umeed ya aset ke aas paas khushkhabri se hota hai. Lekin jab qeemat peak tak pohanchti hai aur consolidate hone lagti hai, to volume kam hojati hai, jisse ke tasat aur khareedne mein kamzori aur buyers ka dilchaspi kam hone ka ishara hota hai. Dusri baat, traders consolidation phase ke doran tajaweez ke nishaan dhoondte hain, jese ke chhote price ranges, kam volatility, aur volume mein kami. Ye ishara karte hain ke market mein raijhan ka wqt aa gaya hai, jab ke khareedne walay thak jatay hain ya exhasted hojatay hain. Iske ilawa, lower highs ke banne aur support levels ke possible breaches bhi Tower Top pattern ki tasdeeq ke liye mazeed dalail farahem kar sakte hain, jo ke batata hai ke sellers ka control barh raha hai.

Interpretation and Reversal Signals

Jab Tower Top pattern tasdeeq hota hai, traders short positions lena ya apni mojood long positions ko bechna consider kar sakte hain. Wo technical indicators ka istemal kar sakte hain, jese ke moving averages, trendlines, ya oscillators, optimal entry aur exit points tajaweez karne ke liye. Stop-loss orders ko hilne walay highs ke upar lagaya ja sakta hai, kisi bhi mumkin ulte ishara ke khilaf hifazati tajaweez ke liye, jabke profit targets previous support levels ya Fibonacci retracement levels par base kiye ja sakte hain. Mukhalif taur par, a Tower Bottom pattern is surat mein banta hai jab kisi aset ki qeemat mein tezi aur tez giraawat ke baad aane wala consolidation phase hota hai. Ye pattern market mein ek mukhlis rukh badalne ko darust karta hai, jo ke batata hai ke bechne walon ka hosla kamzor ho raha hai aur market sentiment bullish hone ki taraf ja rahi hai. Tower Top pattern ki tarah, Tower Bottom pattern ke consolidation phase mein mukhtalif shaklon mein aa sakta hai, jese ke triangles, rectangles, ya higher lows aur lower highs ke aik silsile mein. Ye phase bechnay ki dabao mein ek temporary rukawat darust karta hai, jis se buyers ko apna aitemad dobara hasil hota hai aur positions ikhatta karne mein madad milti hai. Phir bhi, consolidation phase ki muddat mukhtalif ho sakti hai, kuch Tower Bottom patterns ko pura hone mein dinon ya mahinon tak lag sakta hai.

Formation and Components

Ek Tower Bottom pattern ko tasdeeq karne ke liye, traders kuch khaas sifat dekhte hain. Pehle to, ibtidaai girawat ki qeemat ahem honi chahiye aur iske sath hi volume bhi aam se zyada hona chahiye, jo ke zyada bechne ki dabao ko darust karta hai. Ye girawat aksar negative khabron ya market sentiment mein tabdili se shuru hoti hai. Jab qeemat ek minimum point tak pohanchti hai aur consolidate hone lagti hai, to volume kam hojati hai, jisse ke bechne walon ki thakawat aur market sentiment mein raijhan ka ishara hota hai. Dusri baat, traders consolidation phase ke doran tajaweez ke nishaan dhoondte hain, jese ke chhote price ranges, kam volatility, aur volume mein kami. Ye ishara karte hain ke market sentiment mein mukhalif rukh aanay ka dor hai, jabke buyers dikhane lagte hain aur sellers hesitant hojatay hain. Iske ilawa, higher lows ke banne aur resistance levels ke possible breaches bhi Tower Bottom pattern ki tasdeeq ke liye mazeed dalail farahem kar sakte hain, jo ke batata hai ke buyers ka control barh raha hai. Jab Tower Bottom pattern tasdeeq hota hai, traders long positions lena ya aset mein kharidari karne ka intezar kar sakte hain. Wo technical indicators aur tools ka istemal kar sakte hain, optimal entry aur exit points tajaweez karne ke liye, aur apni risk management strategy tay karne ke liye. Stop-loss orders ko hilne walay lows ke neeche lagaya ja sakta hai, kisi bhi mumkin ulte ishara ke khilaf hifazati tajaweez ke liye, jabke profit targets previous resistance levels ya Fibonacci extension levels par base kiye ja sakte hain.

Pattern Identification

Tower Top pattern is surat mein banta hai jab kisi aset ki qeemat mein tezi aur ahem izafay ke baad ek dora-e-mustawar ya side mein movement hoti hai. Ibtidaai tez izafa pattern ke tower hissay ko banata hai, jabke baad mein hone wala consolidation phase top hissay ko banata hai. Traders is pattern ko aksar ek mukhlis ulte ishara samajhte hain, jo batata hai ke market taqat khatam ho rahi hai aur rukh badalne wala hai. Ibtidaai qeemat mein izafa ke baad woh mustawar phase jo aata hai, wo mukhtalif suraton mein ho sakta hai, jese ke triangle, rectangle, ya aik silsila jo ke chhote peaks aur barhte hue lows ko shamil karta hai. Ye phase market mein ek temporary rukawat ko darust karta hai, jab ke khareedne walay aur bechne walay apni jagahon ko dobara tajaweez karte hain. Is consolidation phase ki muddat mukhtalif ho sakti hai, kuch Tower Top patterns ko pooray hone mein dinon ya hafton tak lag sakta hai.

Confirmation Signals

Ek Tower Top pattern ko tasdeeq karne ke liye, traders kuch khaas sifat dekhte hain. Pehle to, ibtidaai qeemat mein izafa ahem hona chahiye aur iske sath hi volume bhi aam se zyada hona chahiye, jo ke zyada khareedne ki dabao ko darust karta hai. Is kharidari mein izafa karne wale activity ka izhar aksar market ki umeed ya aset ke aas paas khushkhabri se hota hai. Lekin jab qeemat peak tak pohanchti hai aur consolidate hone lagti hai, to volume kam hojati hai, jisse ke tasat aur khareedne mein kamzori aur buyers ka dilchaspi kam hone ka ishara hota hai. Dusri baat, traders consolidation phase ke doran tajaweez ke nishaan dhoondte hain, jese ke chhote price ranges, kam volatility, aur volume mein kami. Ye ishara karte hain ke market mein raijhan ka wqt aa gaya hai, jab ke khareedne walay thak jatay hain ya exhasted hojatay hain. Iske ilawa, lower highs ke banne aur support levels ke possible breaches bhi Tower Top pattern ki tasdeeq ke liye mazeed dalail farahem kar sakte hain, jo ke batata hai ke sellers ka control barh raha hai.

Interpretation and Reversal Signals

Jab Tower Top pattern tasdeeq hota hai, traders short positions lena ya apni mojood long positions ko bechna consider kar sakte hain. Wo technical indicators ka istemal kar sakte hain, jese ke moving averages, trendlines, ya oscillators, optimal entry aur exit points tajaweez karne ke liye. Stop-loss orders ko hilne walay highs ke upar lagaya ja sakta hai, kisi bhi mumkin ulte ishara ke khilaf hifazati tajaweez ke liye, jabke profit targets previous support levels ya Fibonacci retracement levels par base kiye ja sakte hain. Mukhalif taur par, a Tower Bottom pattern is surat mein banta hai jab kisi aset ki qeemat mein tezi aur tez giraawat ke baad aane wala consolidation phase hota hai. Ye pattern market mein ek mukhlis rukh badalne ko darust karta hai, jo ke batata hai ke bechne walon ka hosla kamzor ho raha hai aur market sentiment bullish hone ki taraf ja rahi hai. Tower Top pattern ki tarah, Tower Bottom pattern ke consolidation phase mein mukhtalif shaklon mein aa sakta hai, jese ke triangles, rectangles, ya higher lows aur lower highs ke aik silsile mein. Ye phase bechnay ki dabao mein ek temporary rukawat darust karta hai, jis se buyers ko apna aitemad dobara hasil hota hai aur positions ikhatta karne mein madad milti hai. Phir bhi, consolidation phase ki muddat mukhtalif ho sakti hai, kuch Tower Bottom patterns ko pura hone mein dinon ya mahinon tak lag sakta hai.

Formation and Components

Ek Tower Bottom pattern ko tasdeeq karne ke liye, traders kuch khaas sifat dekhte hain. Pehle to, ibtidaai girawat ki qeemat ahem honi chahiye aur iske sath hi volume bhi aam se zyada hona chahiye, jo ke zyada bechne ki dabao ko darust karta hai. Ye girawat aksar negative khabron ya market sentiment mein tabdili se shuru hoti hai. Jab qeemat ek minimum point tak pohanchti hai aur consolidate hone lagti hai, to volume kam hojati hai, jisse ke bechne walon ki thakawat aur market sentiment mein raijhan ka ishara hota hai. Dusri baat, traders consolidation phase ke doran tajaweez ke nishaan dhoondte hain, jese ke chhote price ranges, kam volatility, aur volume mein kami. Ye ishara karte hain ke market sentiment mein mukhalif rukh aanay ka dor hai, jabke buyers dikhane lagte hain aur sellers hesitant hojatay hain. Iske ilawa, higher lows ke banne aur resistance levels ke possible breaches bhi Tower Bottom pattern ki tasdeeq ke liye mazeed dalail farahem kar sakte hain, jo ke batata hai ke buyers ka control barh raha hai. Jab Tower Bottom pattern tasdeeq hota hai, traders long positions lena ya aset mein kharidari karne ka intezar kar sakte hain. Wo technical indicators aur tools ka istemal kar sakte hain, optimal entry aur exit points tajaweez karne ke liye, aur apni risk management strategy tay karne ke liye. Stop-loss orders ko hilne walay lows ke neeche lagaya ja sakta hai, kisi bhi mumkin ulte ishara ke khilaf hifazati tajaweez ke liye, jabke profit targets previous resistance levels ya Fibonacci extension levels par base kiye ja sakte hain.

تبصرہ

Расширенный режим Обычный режим