Forex market mein trading karna mukhtalif tareeqon aur strategies par faislay karna shamil hai. Do mukhtalif tareeqon mein se ek price action aur doosra indicator-based trading hai. Har ek tareeqa apni asoolon aur unke tabedariyoon ke sath aata hai.

Price Action Trading

Price action trading ek aesi strategy hai jo future price movements ko peshgoi karne ke liye tareekhi price movements ka tanqeedi mutala karta hai. Is tareeqe ka istemaal karne wale traders currency pair ki asal qeemat aur iske mutaliq market dynamics par tawajju dete hain. Iska bunyadi usool ye hai ke tamam maqool malumat qeemat mein muntashir hai, aur traders price patterns, candlestick formations, aur support/resistance levels ki taqat ka jayeza laga kar faislay kar sakte hain. Price action trading ka aik bunyadi pehlu chart patterns ko samajhna hai. Traders triangles, flags, aur head and shoulders jese formations ko pehchanne ki koshish karte hain taake wo potential trend reversals ya continuations ko pehchan saken. Candlestick patterns jese doji, engulfing, aur hammer bhi market sentiment ko samajhne mein ahem hai.

Support aur resistance levels price action analysis mein aham kirdar ada karte hain. Support wo price level hai jahan ek currency pair ka qeemat girne mein mushkil hota hai, jabke resistance ek level hai jahan ise barhne mein mushkil hoti hai. Ye levels traders ko potential entry aur exit points ka pata lagane aur risk ko manage karne mein madad karte hain. Trend analysis bhi price action trading mein aham hai. Traders current trend ko pehchan kar faislay karte hain aur ye dekhte hain ke wo trend ko follow karna chahiye ya phir potential reversals ke liye dekhein. Moving averages is maqsad mein istemal hote hain ke price data ko smooth karen aur trend ki taraf ishara karen.

Indicator-Based Trading

Indicator-based trading ke khilaf mein, ye matematiki hisaab aur tareekhi price aur volume data ki analysis par mabni hai. Indicators ka istemal karte hue traders trends, momentum, volatility, aur dusre maqool market factors ko pehchanne ki koshish karte hain. Kuch mashhoor indicators mein moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Bollinger Bands shamil hain. Moving averages aam istemal hone wale indicators hain jo trend ko pehchanne mein madad karte hain. Traders aksar short-term aur long-term moving averages ke darmiyan crossovers ko potential entry ya exit signals ke taur par dekhte hain. RSI ek momentum oscillator hai jo price movements ki tezi aur tabdili ko napta hai, jiski madad se traders overbought ya oversold conditions ko pehchan sakte hain.

MACD ek trend-following momentum indicator hai jo security ki price ke do moving averages ke darmiyan talluqat ko dikhata hai. Traders aksar MACD line crossovers aur MACD aur price ke darmiyan divergence ko potential trend reversals ya continuations ke liye dekhte hain. Bollinger Bands ek middle band hai jo N-period simple moving average hota hai aur do outer bands hote hain jo N-period standard deviations ke darmiyan hotay hain. Traders Bollinger Bands ka istemal volatility aur potential reversal points ko pehchanne ke liye karte hain.

Combining Price Action and Indicators

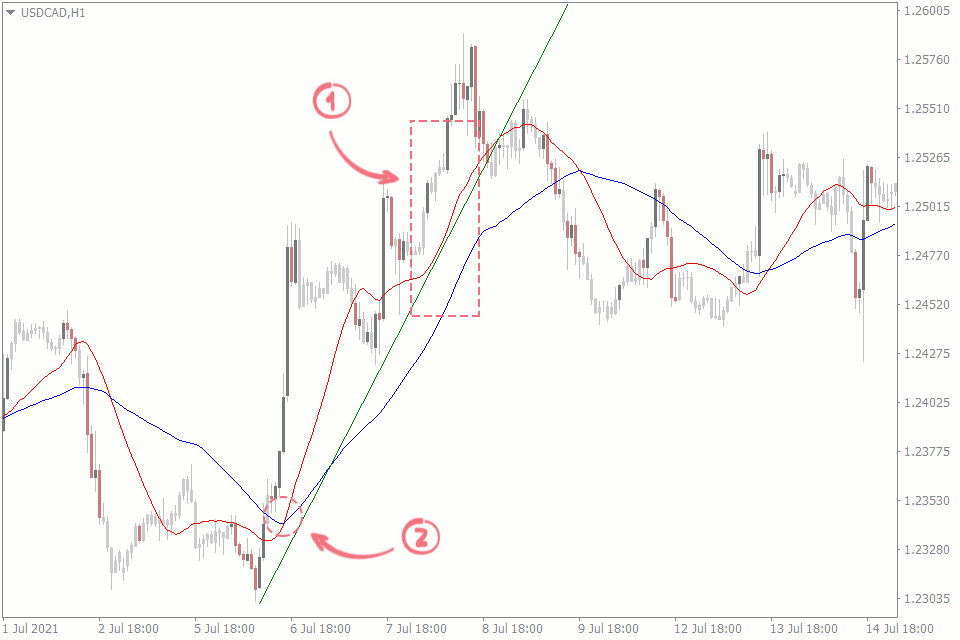

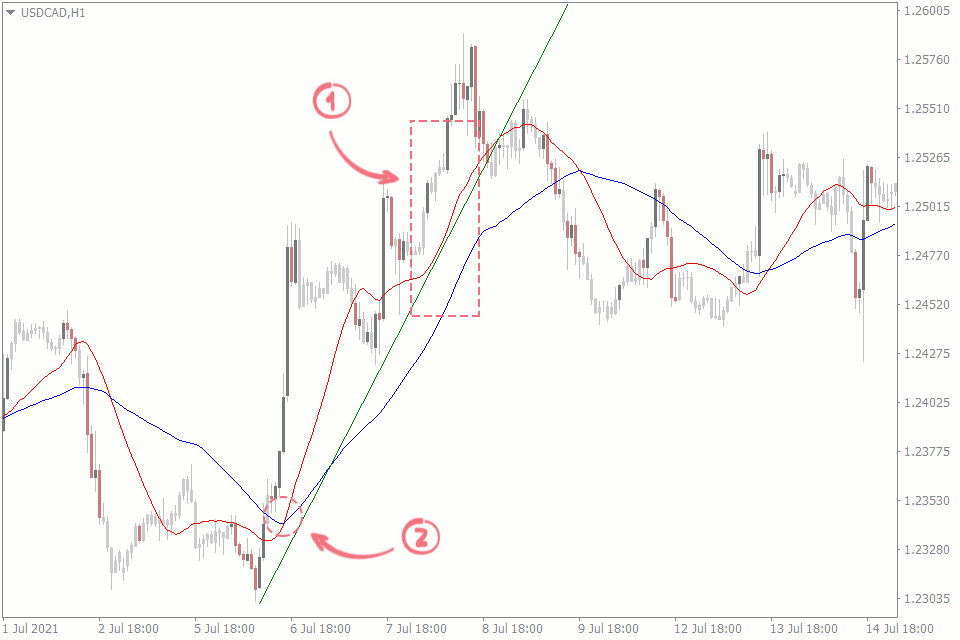

Jabke price action aur indicator-based trading ko aksar mukhtalif tareeqon ki surat mein dekha jata hai, bohat se kaamyab traders dono tareeqon ko mila kar zayada malumat hasil karne ka faisla karte hain. For example, ek trader price action ka istemal karke key support aur resistance levels ko pehchan sakti hai, phir us level par market overbought ya oversold hai ye malum karne ke liye RSI jese indicator ka istemal kar sakti hai. Moving averages price action ke sath istemal karne ke liye aksar istemal hote hain taake trend ko tasdeeq kiya ja sake. Agar currency pair apne moving averages ke upar trade kar raha hai aur higher highs aur higher lows bana raha hai, to ye price action analysis ke zariye pehchane gaye bullish sentiment ko mazbooti deta hai. Barabar iske sath, agar price action aur indicator ke darmiyan divergence hai, to ye potential reversal ya current trend mein kamzori ko darust karta hai.

Price Action Trading

Price action trading ek aesi strategy hai jo future price movements ko peshgoi karne ke liye tareekhi price movements ka tanqeedi mutala karta hai. Is tareeqe ka istemaal karne wale traders currency pair ki asal qeemat aur iske mutaliq market dynamics par tawajju dete hain. Iska bunyadi usool ye hai ke tamam maqool malumat qeemat mein muntashir hai, aur traders price patterns, candlestick formations, aur support/resistance levels ki taqat ka jayeza laga kar faislay kar sakte hain. Price action trading ka aik bunyadi pehlu chart patterns ko samajhna hai. Traders triangles, flags, aur head and shoulders jese formations ko pehchanne ki koshish karte hain taake wo potential trend reversals ya continuations ko pehchan saken. Candlestick patterns jese doji, engulfing, aur hammer bhi market sentiment ko samajhne mein ahem hai.

Support aur resistance levels price action analysis mein aham kirdar ada karte hain. Support wo price level hai jahan ek currency pair ka qeemat girne mein mushkil hota hai, jabke resistance ek level hai jahan ise barhne mein mushkil hoti hai. Ye levels traders ko potential entry aur exit points ka pata lagane aur risk ko manage karne mein madad karte hain. Trend analysis bhi price action trading mein aham hai. Traders current trend ko pehchan kar faislay karte hain aur ye dekhte hain ke wo trend ko follow karna chahiye ya phir potential reversals ke liye dekhein. Moving averages is maqsad mein istemal hote hain ke price data ko smooth karen aur trend ki taraf ishara karen.

Indicator-Based Trading

Indicator-based trading ke khilaf mein, ye matematiki hisaab aur tareekhi price aur volume data ki analysis par mabni hai. Indicators ka istemal karte hue traders trends, momentum, volatility, aur dusre maqool market factors ko pehchanne ki koshish karte hain. Kuch mashhoor indicators mein moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Bollinger Bands shamil hain. Moving averages aam istemal hone wale indicators hain jo trend ko pehchanne mein madad karte hain. Traders aksar short-term aur long-term moving averages ke darmiyan crossovers ko potential entry ya exit signals ke taur par dekhte hain. RSI ek momentum oscillator hai jo price movements ki tezi aur tabdili ko napta hai, jiski madad se traders overbought ya oversold conditions ko pehchan sakte hain.

MACD ek trend-following momentum indicator hai jo security ki price ke do moving averages ke darmiyan talluqat ko dikhata hai. Traders aksar MACD line crossovers aur MACD aur price ke darmiyan divergence ko potential trend reversals ya continuations ke liye dekhte hain. Bollinger Bands ek middle band hai jo N-period simple moving average hota hai aur do outer bands hote hain jo N-period standard deviations ke darmiyan hotay hain. Traders Bollinger Bands ka istemal volatility aur potential reversal points ko pehchanne ke liye karte hain.

Combining Price Action and Indicators

Jabke price action aur indicator-based trading ko aksar mukhtalif tareeqon ki surat mein dekha jata hai, bohat se kaamyab traders dono tareeqon ko mila kar zayada malumat hasil karne ka faisla karte hain. For example, ek trader price action ka istemal karke key support aur resistance levels ko pehchan sakti hai, phir us level par market overbought ya oversold hai ye malum karne ke liye RSI jese indicator ka istemal kar sakti hai. Moving averages price action ke sath istemal karne ke liye aksar istemal hote hain taake trend ko tasdeeq kiya ja sake. Agar currency pair apne moving averages ke upar trade kar raha hai aur higher highs aur higher lows bana raha hai, to ye price action analysis ke zariye pehchane gaye bullish sentiment ko mazbooti deta hai. Barabar iske sath, agar price action aur indicator ke darmiyan divergence hai, to ye potential reversal ya current trend mein kamzori ko darust karta hai.

تبصرہ

Расширенный режим Обычный режим