Reversals

Reversals forex mein ahem maqamat hote hain jo mojooda trend ki bunyad mein tabdeel ka izhar karte hain. Traders reversals ko tawajju se dekhte hain kyun ke ye unke liye munafa bakhsh mauqay pesh kar sakti hain. Reversal ko pehchanana traders ke liye ahem hai jo naye trends par faida uthana chahte hain aur jo mojooda trend mein shift hone ke khatre se bachna chahte hain. Aik aam pattern jo reversal ko ishara karta hai, woh Head and Shoulders pattern hai. Is pattern mein teen chhatiyan hoti hain: aik ziadahead do shoulders ke darmiyan. Head and Shoulders pattern complete hone par ye ishara karta hai ke mojooda trend apna dum kho raha hai, aur ek reversal qareeb hai. Double tops aur bottoms bhi ahem reversal patterns hain. Double top tab hota hai jab ke price do martaba aik peak tak pohanchti hai pehle ke revers hojaye, jo ke ek potential downtrend ko darust karti hai. Ulta, double bottom ek potential uptrend ko darust karti hai.

Triple tops aur bottoms is mawad ko mazeed lekar jatay hain, teen martaba peak ya trough hone par hi reversal confirm hota hai. Ye patterns trend reversal ke zor daar isharaat mane jatay hain. Iske ilawa, rounding tops aur bottoms asal trend ki slope mein gradual tabdeeli ka zahiri tasawwur dete hain, jo ke market sentiment ka shift aur potential reversal ko indicate kar sakte hain.

Retracements

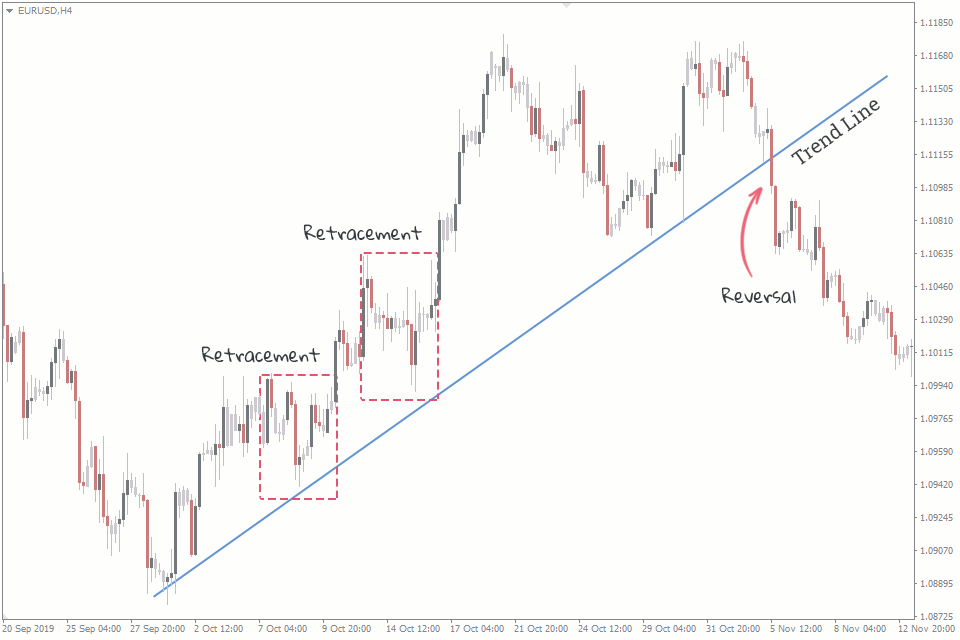

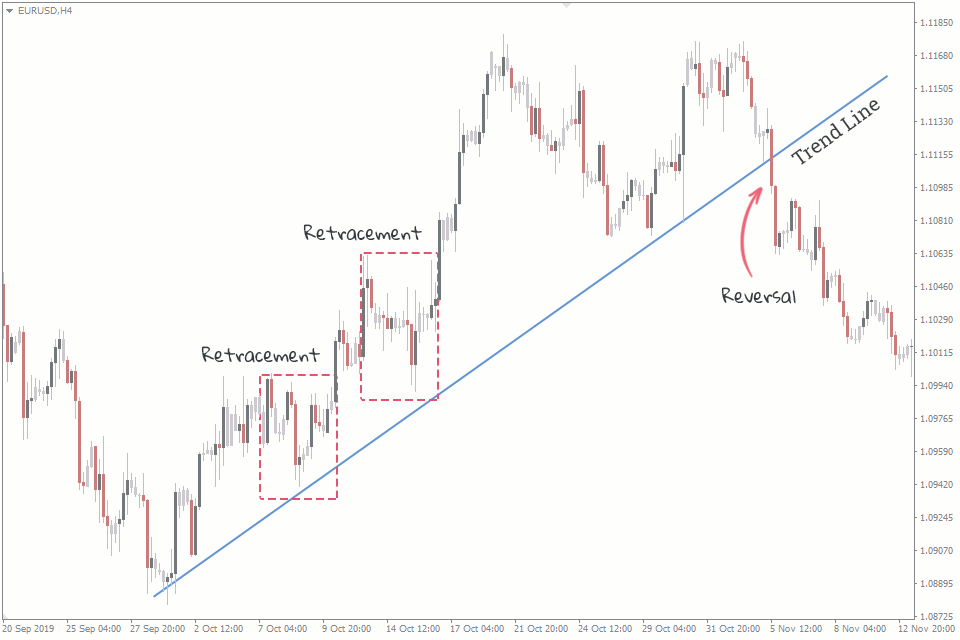

Retracements, reversal ke mukhalif mein, mojooda trend mein temporary reversal ko darust karte hain. Ye chand lamhay ke liye rukawat hoti hain jo hoti hai jab market apni asal rah par wapis aati hai. Traders aksar Fibonacci retracement levels ka istemal karte hain potential retracement levels ko pehchanne ke liye. Fibonacci retracement levels 38.2%, 50%, aur 61.8%. Fibonacci sequence aur ratios par mabni hote hain aur inka inteshaar technical analysis mein am hai. Retracements ek mazeed concept ke hisse hain jo technical analysis mein "Elliott Wave Theory" ke naam se mashhoor hai. Is theory ke mutabiq, market movements ek repetitive wave pattern ko follow karte hain. Panch wave ka movement ke baad (impulse wave), aam taur par teesre wave ka retracement hota hai (corrective wave) phir trend apni asal raaste par chalta hai. Retracements ko samajhna traders ke liye zaroori hai jo trend-following strategies istemal kar rahe hain, kyun ke ye unko mawafiq prices par dakhil hone ke liye potential entry points faraham karte hain.

Features of Retracements

Retracements ke aik key feature hai inka taluq support aur resistance levels ke saath. Ek retracement ke doran, prices aksar established support ya resistance levels par mawafiqi se takraati hain, jo ke traders ke faislay par asar dalte hain ke woh positions mein dakhil ya bahar hojayein. Retracements aur mojooda support ya resistance levels ke darmiyan ka taluq analysis ko mazeed complicated banata hai. Fibonacci retracement levels dynamic support aur resistance levels ka kaam karte hain, traders ko mawafiqi se takraat hone wale points ko monitor karne mein madad faraham karte hain. 38.2% level ko ek halka retracement mana jata hai, 50% level aik moderate retracement hai, aur 61.8% level aik gehra retracement hai. Har level prevailing trend ki taqat aur uske jaari rahne ke imkanat ko samajhne mein madadgar hota hai.

Reversals aur retracements ke darmiyan farq inke dorayi, shadeedgi, aur asal trend ke liye dalail ka tareeqa hai. Reversals zyada muddat ke liye hote hain aur market sentiment mein zyada gehra tabdeel ko darust karte hain, aksar mojooda trend ko poori tarah se ulat dete hain. Ulta, retracements chand lamhay ke liye hoti hain aur mojooda trend ke context mein temporary rukawat darust karti hain. Jabke reversals ko aksar khaas chart patterns jaise ke head and shoulders ya double tops aur bottoms ke zariye pehchana jata hai, retracements ko aam taur par Fibonacci retracement levels ke saath jora jata hai. Reversals zyada gehra market sentiment ka shift darust karte hain, jabke retracements mojooda trend ke maqam mein ek chand lamhay ki interruption darust karte hain.

Trading Strategies for Reversals and Retracements

Traders reversals aur retracements ke liye mukhtalif strategies istemal karte hain, jo unke risk tolerance, trading style, aur market conditions par mabni hoti hain. Reversal strategies mein, traders breakout strategies istemal kar sakte hain jab khaas chart patterns pehchane jate hain. Is mein trade dakhil karne ka waqt woh hota hai jab price kisi ahem level ko todati hai, jo ke reversal ko tasdeeq karta hai. Tasdeeq reversal trading mein ahem hai takay jhootay signals ke khatre ko kam kiya ja sake. Dosri taraf retracement strategies trend-following approaches par amal karti hain. Traders Fibonacci levels par retracement ka intezar karte hain, khaas karke 50% level par, kyun ke ye halkay aur gehray retracements ke darmiyan balance ka point mana jata hai. 50% retracement level ke qareeb trade karna trend followers ke liye aam hai jo asal trend ki taraf wapis lautne ka intezar kar rahe hote hain.

Reversals forex mein ahem maqamat hote hain jo mojooda trend ki bunyad mein tabdeel ka izhar karte hain. Traders reversals ko tawajju se dekhte hain kyun ke ye unke liye munafa bakhsh mauqay pesh kar sakti hain. Reversal ko pehchanana traders ke liye ahem hai jo naye trends par faida uthana chahte hain aur jo mojooda trend mein shift hone ke khatre se bachna chahte hain. Aik aam pattern jo reversal ko ishara karta hai, woh Head and Shoulders pattern hai. Is pattern mein teen chhatiyan hoti hain: aik ziadahead do shoulders ke darmiyan. Head and Shoulders pattern complete hone par ye ishara karta hai ke mojooda trend apna dum kho raha hai, aur ek reversal qareeb hai. Double tops aur bottoms bhi ahem reversal patterns hain. Double top tab hota hai jab ke price do martaba aik peak tak pohanchti hai pehle ke revers hojaye, jo ke ek potential downtrend ko darust karti hai. Ulta, double bottom ek potential uptrend ko darust karti hai.

Triple tops aur bottoms is mawad ko mazeed lekar jatay hain, teen martaba peak ya trough hone par hi reversal confirm hota hai. Ye patterns trend reversal ke zor daar isharaat mane jatay hain. Iske ilawa, rounding tops aur bottoms asal trend ki slope mein gradual tabdeeli ka zahiri tasawwur dete hain, jo ke market sentiment ka shift aur potential reversal ko indicate kar sakte hain.

Retracements

Retracements, reversal ke mukhalif mein, mojooda trend mein temporary reversal ko darust karte hain. Ye chand lamhay ke liye rukawat hoti hain jo hoti hai jab market apni asal rah par wapis aati hai. Traders aksar Fibonacci retracement levels ka istemal karte hain potential retracement levels ko pehchanne ke liye. Fibonacci retracement levels 38.2%, 50%, aur 61.8%. Fibonacci sequence aur ratios par mabni hote hain aur inka inteshaar technical analysis mein am hai. Retracements ek mazeed concept ke hisse hain jo technical analysis mein "Elliott Wave Theory" ke naam se mashhoor hai. Is theory ke mutabiq, market movements ek repetitive wave pattern ko follow karte hain. Panch wave ka movement ke baad (impulse wave), aam taur par teesre wave ka retracement hota hai (corrective wave) phir trend apni asal raaste par chalta hai. Retracements ko samajhna traders ke liye zaroori hai jo trend-following strategies istemal kar rahe hain, kyun ke ye unko mawafiq prices par dakhil hone ke liye potential entry points faraham karte hain.

Features of Retracements

Retracements ke aik key feature hai inka taluq support aur resistance levels ke saath. Ek retracement ke doran, prices aksar established support ya resistance levels par mawafiqi se takraati hain, jo ke traders ke faislay par asar dalte hain ke woh positions mein dakhil ya bahar hojayein. Retracements aur mojooda support ya resistance levels ke darmiyan ka taluq analysis ko mazeed complicated banata hai. Fibonacci retracement levels dynamic support aur resistance levels ka kaam karte hain, traders ko mawafiqi se takraat hone wale points ko monitor karne mein madad faraham karte hain. 38.2% level ko ek halka retracement mana jata hai, 50% level aik moderate retracement hai, aur 61.8% level aik gehra retracement hai. Har level prevailing trend ki taqat aur uske jaari rahne ke imkanat ko samajhne mein madadgar hota hai.

Reversals aur retracements ke darmiyan farq inke dorayi, shadeedgi, aur asal trend ke liye dalail ka tareeqa hai. Reversals zyada muddat ke liye hote hain aur market sentiment mein zyada gehra tabdeel ko darust karte hain, aksar mojooda trend ko poori tarah se ulat dete hain. Ulta, retracements chand lamhay ke liye hoti hain aur mojooda trend ke context mein temporary rukawat darust karti hain. Jabke reversals ko aksar khaas chart patterns jaise ke head and shoulders ya double tops aur bottoms ke zariye pehchana jata hai, retracements ko aam taur par Fibonacci retracement levels ke saath jora jata hai. Reversals zyada gehra market sentiment ka shift darust karte hain, jabke retracements mojooda trend ke maqam mein ek chand lamhay ki interruption darust karte hain.

Trading Strategies for Reversals and Retracements

Traders reversals aur retracements ke liye mukhtalif strategies istemal karte hain, jo unke risk tolerance, trading style, aur market conditions par mabni hoti hain. Reversal strategies mein, traders breakout strategies istemal kar sakte hain jab khaas chart patterns pehchane jate hain. Is mein trade dakhil karne ka waqt woh hota hai jab price kisi ahem level ko todati hai, jo ke reversal ko tasdeeq karta hai. Tasdeeq reversal trading mein ahem hai takay jhootay signals ke khatre ko kam kiya ja sake. Dosri taraf retracement strategies trend-following approaches par amal karti hain. Traders Fibonacci levels par retracement ka intezar karte hain, khaas karke 50% level par, kyun ke ye halkay aur gehray retracements ke darmiyan balance ka point mana jata hai. 50% retracement level ke qareeb trade karna trend followers ke liye aam hai jo asal trend ki taraf wapis lautne ka intezar kar rahe hote hain.

:max_bytes(150000):strip_icc()/dotdash_Final_Retracement_vs_Reversal_Whats_the_Difference_Nov_2020-03-caa055c3a84f4f409aa3e1324672aedb.jpg)

تبصرہ

Расширенный режим Обычный режим