Leading aur lagging indicators forex trading mein ahem auzar hain jo traders ko market ke trends ka tajziya karne, maqool faislay lene aur asal trading strategies tayar karne mein madad karte hain. Ye indicators market ki halat ka tafseeli mutala karnay mein aur potential future price movements ko pehle se shanaakht karne mein madadgar sabit hote hain.

Leading Indicators

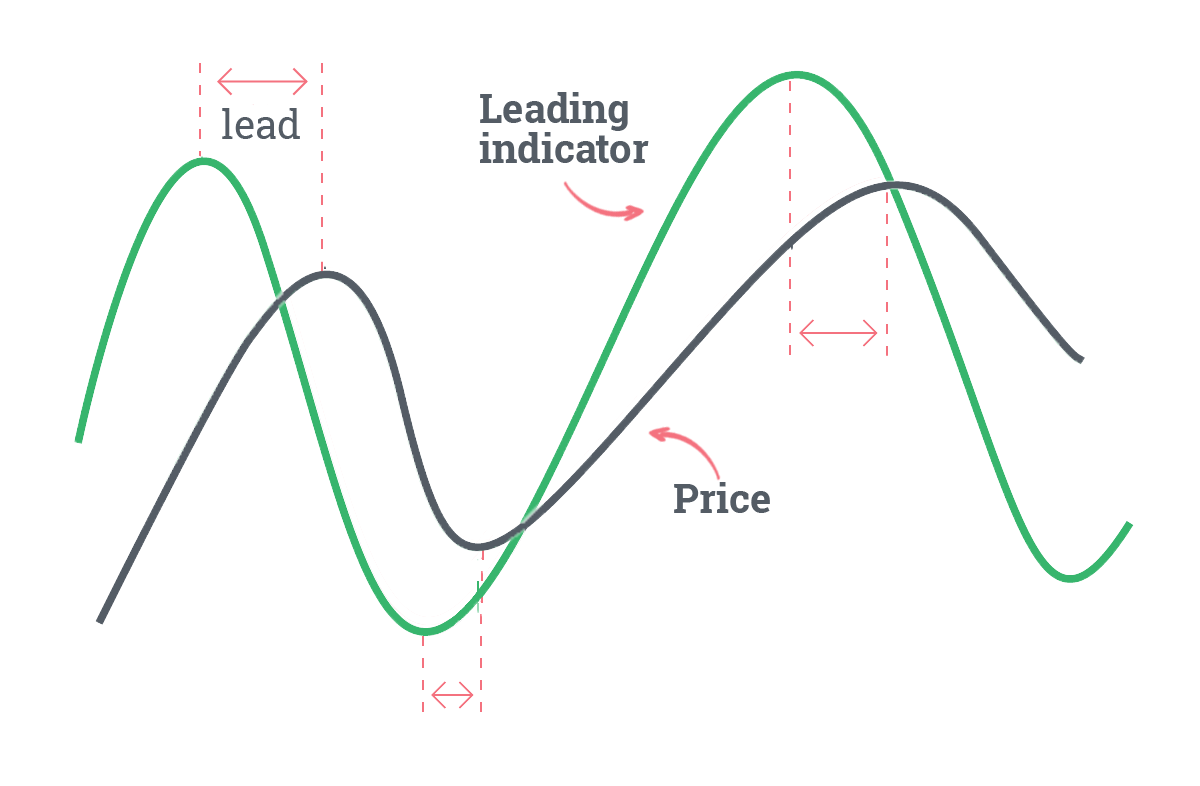

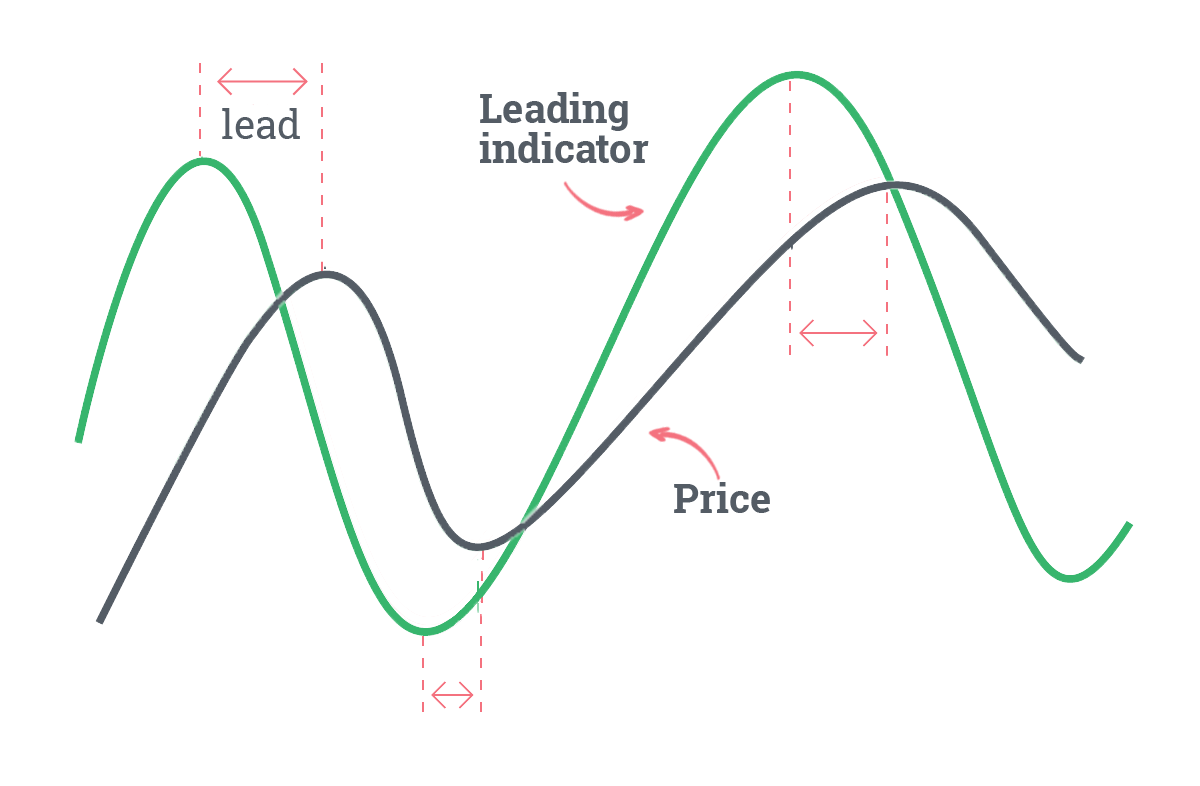

Leading indicators woh maali ya maeeshati maqool hote hain jo asal market movements se pehle future market movements ka andaza dene mein madad kartay hain. Ye indicators is liye peshgoi tool kehlaye jatay hain kyun ke inka maqsad haalat-e-mandi par mabni tasawwurat ki roshni mein market ke rukh ko pehchanne ka hai. Traders aksar leading indicators ka istemal potential trend reversals, entry points aur overall market ki taqat ka andaza lagane ke liye karte hain. Forex trading mein sab se aam istemal hone wala leading indicator hai Moving Average Convergence Divergence (MACD). MACD ek trend-following momentum indicator hai jo kisi asset ki price ke do exponential moving averages ka farq nikalta hai. Traders MACD ka istemal trend ki taqat, rukh, momentum aur muddat mein tabdiliyon ko pehchanne ke liye karte hain, jo ke waqt par faislay lene ke liye qeemati malumat faraham karta hai.

Ek aur leading indicator hai Relative Strength Index (RSI), jo market mein hawale se haleat ki inteha ko pehchankar overbought ya oversold shiraeat ko shanaakht karne ke liye istemal hota hai. RSI ki qeemat 0 se 100 ke darmiyan hoti hai, jahan 70 ke upar ki readings overbought conditions ko aur 30 ke neeche ki readings oversold conditions ko darust karti hain. Traders RSI ka istemal potential trend reversals ko anayat karnay aur entry ya exit points ko pehchanne ke liye karte hain.

Lagging Indicators

Leading indicators ke mukhalif, lagging indicators asal market movements ko follow karte hain aur mojooda market trend ko tasdeeq kartay hain. Ye indicators market ke guzishta halaat ke baray mein malumat faraham karnay mein madad kartay hain. Jab ke ye future price movements ko peshgoi nahi karte, lagging indicators mojooda trends ki tasdeeq mein mufeed sabit hote hain, jo traders ko zyada malumat se mabni faislay lene mein madad karte hain. Sab se mashhoor lagging indicator mein se ek hai Moving Average, jo price data ko aik naye aur barabri hone wale rekha banane ke liye halak karta hai. Traders moving averages ka istemal trendon ko pehchanne, trend reversals ki tasdeeq karne aur market mein shor ko filter karne ke liye karte hain. Iske do asooli types hote hain: Simple Moving Average (SMA) aur Exponential Moving Average (EMA), jo dono market trends ko mukhtalif nazariyat se dekhanay mein madad karte hain.

Ek aur prachalit lagging indicator hai Bollinger Bands, jo ek middle band se bana hota hai jo aik N-period simple moving average hota hai aur do outer bands jo price ki standard deviations hote hain. Bollinger Bands traders ko overbought ya oversold shiraeat aur potential trend reversals ko pesh karnay mein madad karte hain, bands ki chaurai ko hilchayi gayi price movements ke mutabiq tafseel se mutalahiz karke.

Significance in Forex Trading

Leading aur lagging indicators ki ehmiyat samajhna forex trading mein kamiyabi ke liye intehai zaroori hai. Leading indicators traders ko market movements ke potential andazay dene mein qudrati quwat faraham karte hain, jo unko waqt par faislay lene mein madad karte hain. Market ki momentum aur trend direction mein tabdiliyon ko peshgoi karke, traders moqtadira waqt par positions mein dakhil ho sakte hain aur exit kar sakte hain, munafa ko zyada say zyada hasil karne mein madad karte hue. Dusri taraf, lagging indicators mojooda trends ki tasdeeq faraham karte hain aur false signals ki mumkinat ko kam karte hain. Jabke ye future movements ko peshgoi nahi karte, lagging indicators market ki tafseel se mutalik malumat faraham karte hain, jo traders ko unke gumanat ki tasdeeq karne mein madad karte hain aur unhein zyada malumat faraham karte hain. Leading aur lagging indicators ko ek trading strategy mein jorna traders ko mukhtalif rukh se tajaweezat bana sakti hai jo dono predictive aur confirmatory elements ko shamil karti hai.

Utilizing Both Types of Indicators

Kamyab forex traders aksar apni trading strategies mein leading aur lagging indicators dono ko shamil karte hain takay wo barabri ka aur tafseeli tajaweez bana sakein. Is combination se traders leading indicators ki peshgoi quwat ko istemal kar sakte hain jabke lagging indicators unke faislay ko tasdeeq karke false signals ko filter karte hain. Ye dono qisam ke indicators ka milaap overall trading strategy ki itlaat ko mazeed behtar bana sakta hai. Misaal ke taur par aik trader RSI (leading indicator) ka istemal karke market mein potential overbought ya oversold conditions ko pesh karna chahta hai. Jab RSI aik mukhtalif trend ko signal karta hai, to trader mojooda trend ki tasdeeq karne aur false signals ko filter karne ke liye lagging indicators jese ke moving averages ya Bollinger Bands ka istemal kar sakta hai. Is do tauri approach se trading strategy ki overrall itlaat ko barhaya ja sakta hai.

Leading Indicators

Leading indicators woh maali ya maeeshati maqool hote hain jo asal market movements se pehle future market movements ka andaza dene mein madad kartay hain. Ye indicators is liye peshgoi tool kehlaye jatay hain kyun ke inka maqsad haalat-e-mandi par mabni tasawwurat ki roshni mein market ke rukh ko pehchanne ka hai. Traders aksar leading indicators ka istemal potential trend reversals, entry points aur overall market ki taqat ka andaza lagane ke liye karte hain. Forex trading mein sab se aam istemal hone wala leading indicator hai Moving Average Convergence Divergence (MACD). MACD ek trend-following momentum indicator hai jo kisi asset ki price ke do exponential moving averages ka farq nikalta hai. Traders MACD ka istemal trend ki taqat, rukh, momentum aur muddat mein tabdiliyon ko pehchanne ke liye karte hain, jo ke waqt par faislay lene ke liye qeemati malumat faraham karta hai.

Ek aur leading indicator hai Relative Strength Index (RSI), jo market mein hawale se haleat ki inteha ko pehchankar overbought ya oversold shiraeat ko shanaakht karne ke liye istemal hota hai. RSI ki qeemat 0 se 100 ke darmiyan hoti hai, jahan 70 ke upar ki readings overbought conditions ko aur 30 ke neeche ki readings oversold conditions ko darust karti hain. Traders RSI ka istemal potential trend reversals ko anayat karnay aur entry ya exit points ko pehchanne ke liye karte hain.

Lagging Indicators

Leading indicators ke mukhalif, lagging indicators asal market movements ko follow karte hain aur mojooda market trend ko tasdeeq kartay hain. Ye indicators market ke guzishta halaat ke baray mein malumat faraham karnay mein madad kartay hain. Jab ke ye future price movements ko peshgoi nahi karte, lagging indicators mojooda trends ki tasdeeq mein mufeed sabit hote hain, jo traders ko zyada malumat se mabni faislay lene mein madad karte hain. Sab se mashhoor lagging indicator mein se ek hai Moving Average, jo price data ko aik naye aur barabri hone wale rekha banane ke liye halak karta hai. Traders moving averages ka istemal trendon ko pehchanne, trend reversals ki tasdeeq karne aur market mein shor ko filter karne ke liye karte hain. Iske do asooli types hote hain: Simple Moving Average (SMA) aur Exponential Moving Average (EMA), jo dono market trends ko mukhtalif nazariyat se dekhanay mein madad karte hain.

Ek aur prachalit lagging indicator hai Bollinger Bands, jo ek middle band se bana hota hai jo aik N-period simple moving average hota hai aur do outer bands jo price ki standard deviations hote hain. Bollinger Bands traders ko overbought ya oversold shiraeat aur potential trend reversals ko pesh karnay mein madad karte hain, bands ki chaurai ko hilchayi gayi price movements ke mutabiq tafseel se mutalahiz karke.

Significance in Forex Trading

Leading aur lagging indicators ki ehmiyat samajhna forex trading mein kamiyabi ke liye intehai zaroori hai. Leading indicators traders ko market movements ke potential andazay dene mein qudrati quwat faraham karte hain, jo unko waqt par faislay lene mein madad karte hain. Market ki momentum aur trend direction mein tabdiliyon ko peshgoi karke, traders moqtadira waqt par positions mein dakhil ho sakte hain aur exit kar sakte hain, munafa ko zyada say zyada hasil karne mein madad karte hue. Dusri taraf, lagging indicators mojooda trends ki tasdeeq faraham karte hain aur false signals ki mumkinat ko kam karte hain. Jabke ye future movements ko peshgoi nahi karte, lagging indicators market ki tafseel se mutalik malumat faraham karte hain, jo traders ko unke gumanat ki tasdeeq karne mein madad karte hain aur unhein zyada malumat faraham karte hain. Leading aur lagging indicators ko ek trading strategy mein jorna traders ko mukhtalif rukh se tajaweezat bana sakti hai jo dono predictive aur confirmatory elements ko shamil karti hai.

Utilizing Both Types of Indicators

Kamyab forex traders aksar apni trading strategies mein leading aur lagging indicators dono ko shamil karte hain takay wo barabri ka aur tafseeli tajaweez bana sakein. Is combination se traders leading indicators ki peshgoi quwat ko istemal kar sakte hain jabke lagging indicators unke faislay ko tasdeeq karke false signals ko filter karte hain. Ye dono qisam ke indicators ka milaap overall trading strategy ki itlaat ko mazeed behtar bana sakta hai. Misaal ke taur par aik trader RSI (leading indicator) ka istemal karke market mein potential overbought ya oversold conditions ko pesh karna chahta hai. Jab RSI aik mukhtalif trend ko signal karta hai, to trader mojooda trend ki tasdeeq karne aur false signals ko filter karne ke liye lagging indicators jese ke moving averages ya Bollinger Bands ka istemal kar sakta hai. Is do tauri approach se trading strategy ki overrall itlaat ko barhaya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим