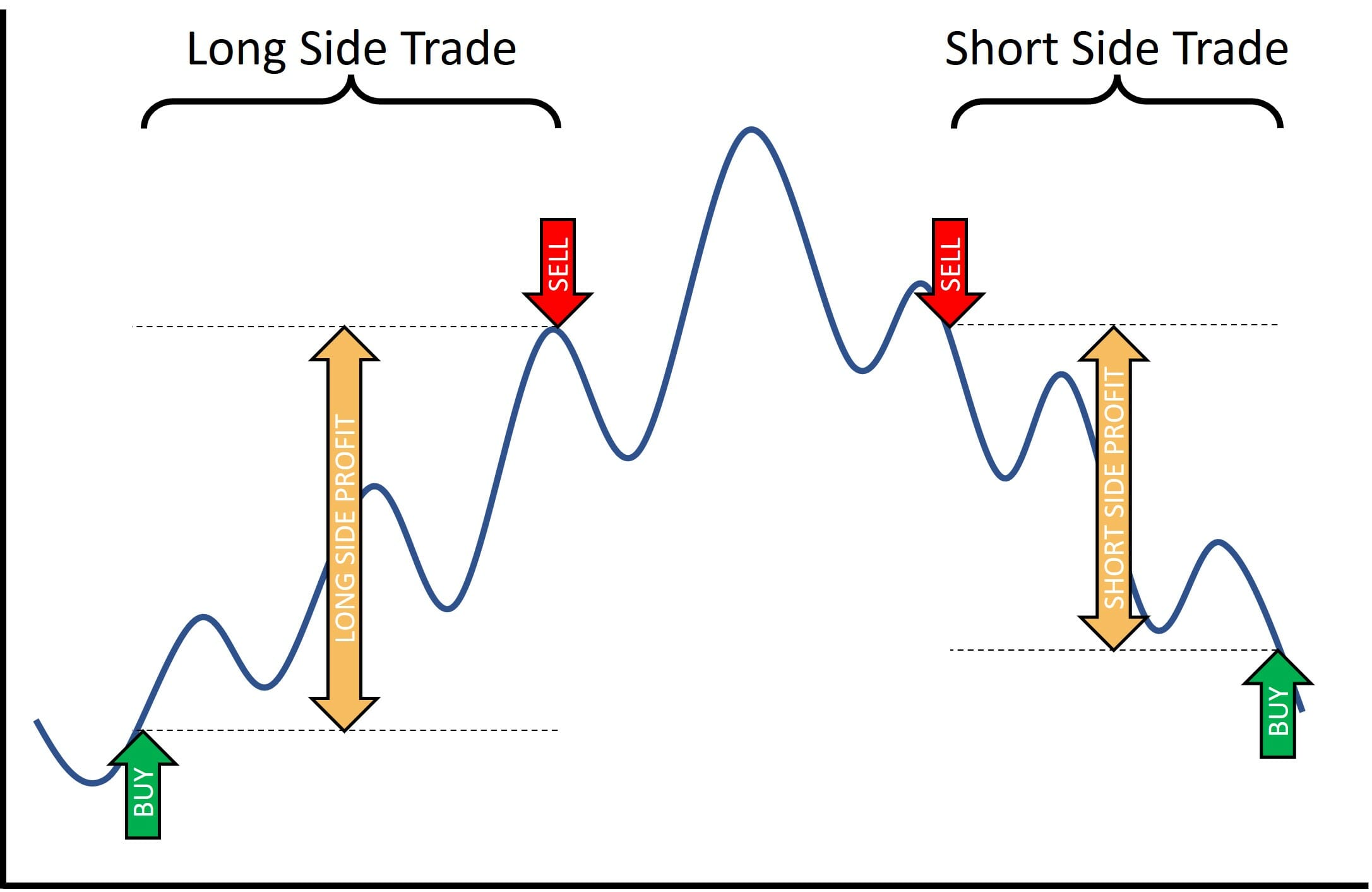

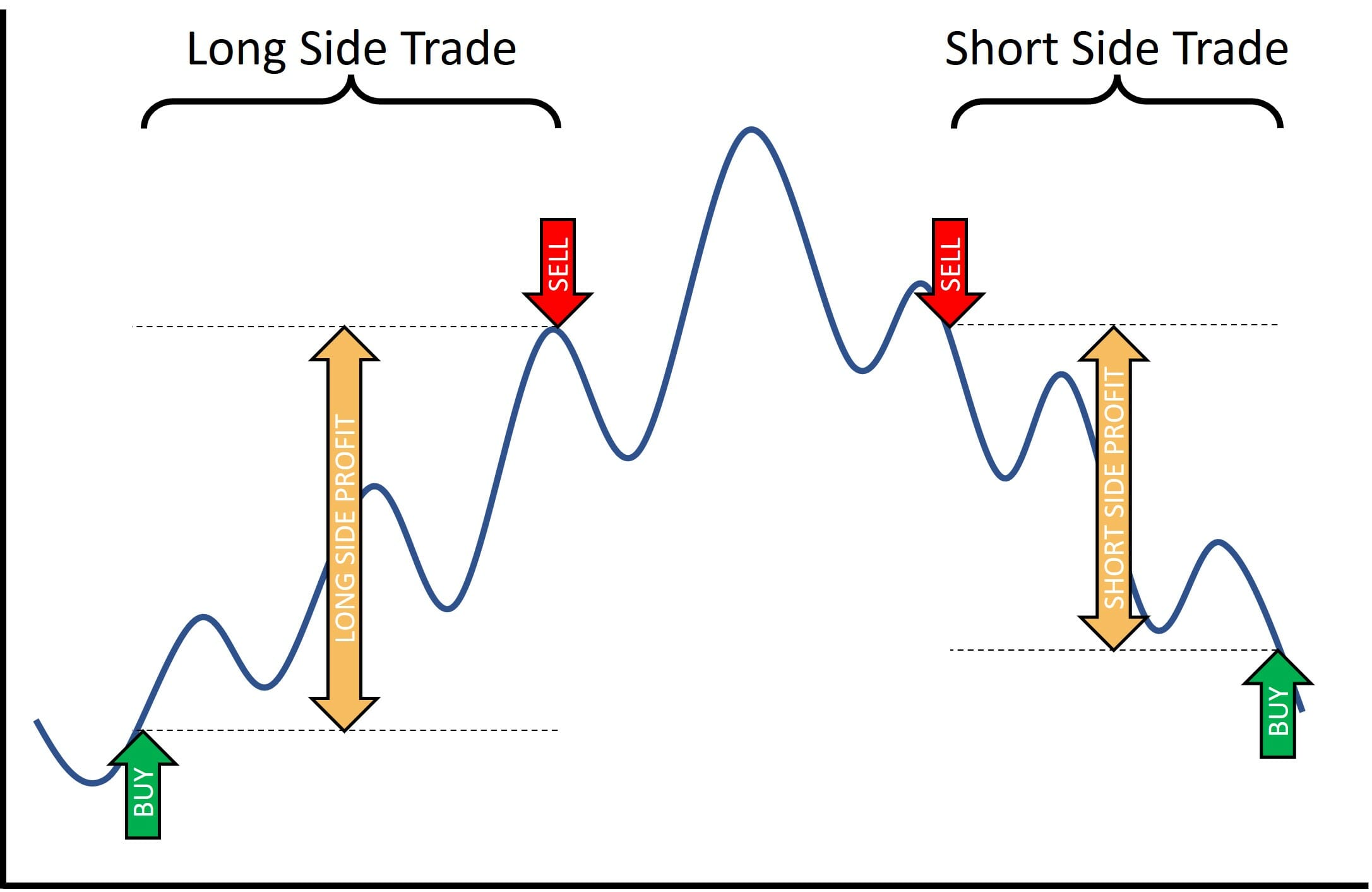

Forex market mein short selling ek munafa bhara lekin risk bhara tijarat hai jo yeh shamil karta hai ke aap ek currency pair ko bech kar umeed karte hain ke iski qeemat ghat jayegi. Aam tijarat se mukhtalif, jahan aap neeche se khareedte hain aur ooncha bechte hain, short selling aapko ooncha bechne aur neeche khareedne ki ijaazat deta hai. Jabki yeh tijarat munafa ki mauqaat farahem kar sakti hai, iske andar shamil khatron ko samajhna aur mawafiq khatra nigrani ke tajaweez karna ahem hai. Forex market mein short selling ka matlab hai ke aap ek currency pair ko bech kar uski qeemat mein kami hone ki umeed karte hain. Is tijarat mein, aap currency broker se currency pair hasil karne ka izazat lete hain aur usko mojooda market qeemat par bechte hain. Maqsad yeh hai ke aap is currency ko mustaqbil mein kam qeemat par khareedain, jisse farq se munafa hasil ho. Misal ke taur par agar aapko lagta hai ke euro ki qeemat American dollar ke khilaaf kamzor hojayegi, to aap EUR/USD currency pair ko bechenge. Agar aapki tawaqul sahi hai aur euro sach mein kamzor hoti hai, to aap euros ko kam qeemat par khareed kar munafa hasil kar sakte hain.

Components of Short Selling in Forex

Risks and Challenges

Components of Short Selling in Forex

- Borrowing Currency: Short selling mein shamil hone ke liye, aapko wo currency jo aap bechna chahte hain, apne broker se udhaar lena hoga. Is udhaar lene ke liye aam taur par margin account ka istemal hota hai. Yaad rahe ke udhaar lene ke sath sath kuch qeemati faide bhi ho sakte hain, jese ke bhatta ya juray.

- Selling the Currency Pair: Jab aap currency udhaar lete hain, to aap ise market mein bech sakte hain. Is se currency pair mein bechne ka dabao barh jata hai aur iski qeemat mein kami ati hai.

- Monitoring the Market: Kamiyabi hasil karne ke liye market ko mustaqil tor par nazar rakhna zaroori hai. Forex qeematen buland tanawul ke amar hote hain, aur ghair mutawaqit waqiyat ya maqami malumaton se tezi se qeemat mein izafah ho sakta hai. Tijaratkar ko maalumat haasil rakhna aur tez taur par amal karne ke liye tayyar rehna chahiye.

- Buying Back at a Lower Price: Short selling ka aik aakhri maqasid hai ke currency ko bech kar ise kam qeemat par khareedna. Bechne aur khareedne ke dauran paida hone wale munafa ka farq, udhaar lene ke koi bhi kharche ke sath, aapke munafa ko darust karta hai.

- Profit in Falling Markets: Short selling ka aik bada faida yeh hai ke aap girte hue market mein bhi munafa hasil kar sakte hain. Riwayati tijarat ke tareeqon ko girte hue shorat mein amal karna mushkil ho sakta hai, lekin short selling tijaratkaron ko girte hue qeematon se faida uthane ka mauqa deta hai.

- Diversification: Short selling, aapke tijarat portfolio mein tahaffuz ke liye aik zariya bhi farahem kar sakta hai. Agar aap long positions ka ek silsila rakh rahe hain aur girne wale markets ke khilaaf nuksan se bachna chahte hain, to short selling aapko nuksan ko kam karne mein madad kar sakta hai.

- Hedging Against Risk: Short selling aik hedging strategy ka kaam bhi kar sakta hai. Agar aapke paas long positions ka silsila hai aur aap girne wale markets mein hone wale nuksan se bachna chahte hain, to short selling aapko un nuksanon ko kam karne mein madad kar sakta hai.

Risks and Challenges

- Unlimited Losses: Long position lena ke mukable mein, jahan aapke nuksan aapke neeche ki rakam tak mehdood hote hain, short selling be-muddat nuksan ka khatra laaye hai. Agar currency pair ki qeemat badhne ki bajaye giray, to aapke nuksan tezi se barh sakte hain.

- Timing is Crucial: Kamyabi se bhari short selling ka maqsad badi had tak moqaat par mabni hai. Market ki gharzayish ko sahi tarah se samajhna mushkil hai aur galat waqt par kia gaya tajaweez lambay samay tak hone wale nuksanat ka sabab ban sakti hai.

- Interest and Fees: Currency udhaar lena kuch kharchon ke saath aata hai, jese ke sood aur juray. Ye kharche munafa ko kam kar sakte hain, khaas kar agar trade ko lambay arsay tak rakha jaye.

- Margin Calls: Short selling mein shamil hone ke liye aapko aik margin account ki zarurat hoti hai, aur agar trade aapke khilaaf hojata hai, to aap ko aik margin call ka samna karna pad sakta hai. Iska matlab hai ke aapko mogheya jama karna hoga taake nuksanat ko dhakne ke liye.

تبصرہ

Расширенный режим Обычный режим