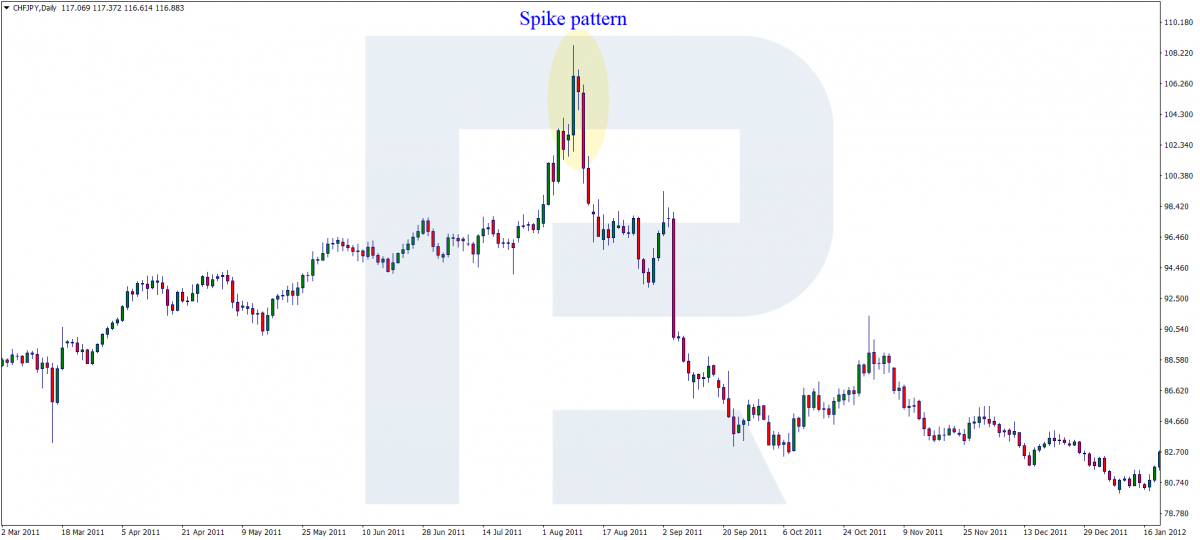

Spike candlestick pattern forex trading mein aik aisa pattern hai jo keh price ki tezi se uchalne ya girne ki koshish ko zahir karta hai. Is pattern mein aik lamba wick hota hai jo keh price ki extreme movement ko show karta hai. Agar price ki movement kaafi zyada ho to is ko spike kehte hain. Spike pattern ka istemal traders karte hain trend reversal ki pehchan karne ke liye. Agar spike pattern uptrend ke baad banta hai to is ka matlab hai keh buyers ki taqat kam ho rahi hai aur sellers market mein control le rahe hain. Is surat mein price girne ka imkan zyada hota hai. Agar spike pattern downtrend ke baad banta hai to is ka matlab hai keh sellers ki taqat kam ho rahi hai aur buyers market mein control le rahe hain. Is surat mein price barhne ka imkan zyada hota hai. Spike pattern ki trading karne ke liye kuch baatein yaad rakhni chahiye:

- Spike pattern tabhi valid hota hai jab price ki movement normal se zyada ho. Agar price ki movement normal ho to is ko spike nahi kehte.

- Spike pattern tabhi trade karna chahiye jab reversal candlestick pattern bhi bane. Jaise keh pin bar, hammer, shooting star, harami, engulfing, etc. In patterns se confirmation milta hai keh trend reversal hone wala hai.

- Spike pattern ki trading mein stop loss ka istemal zaroori hai. Stop loss spike ke opposite end par lagana chahiye. Agar spike pattern uptrend ke baad bana hai to stop loss spike ke high par lagana chahiye. Agar spike pattern downtrend ke baad bana hai to stop loss spike ke low par lagana chahiye.

- Spike pattern ki trading mein risk to reward ratio ka khayal rakhna chahiye. Risk to reward ratio kam se kam 1:2 hona chahiye. Yani keh agar aap 10 pips ka risk le rahe hain to aap ka target kam se kam 20 pips hona chahiye.

تبصرہ

Расширенный режим Обычный режим