Counter attack

Counter attack line pattern, stock market technical analysis mein ek candlestick pattern hai. Yeh pattern bearish trend ke baad ek bullish reversal pattern ko represent karta hai. Counter attack line pattern mein, ek bearish candlestick (do wnward trend) ke baad ek bullish candlestick (upward trend) aata hai. Bullish candlestick ka open price bearish candlestick ke close price ke aas-pass hota hai, aur uska price bearish candlestick ke body mein re-entry karta hai.Is pattern mein bullish candlestick bearish sentiment ko counter karta hai, jaise ki ek "counter attack" karne ka concept hai. Bearish trend ke continuation se bachne ki sambhavna hoti hai aur price reversal ka indication hota hai.Counter attack line pattern ka interpretation bullish reversal pattern hai, lekin iski effectiveness aur reliability ko confirm karne ke liye additional analysis aur market context ki zaroorat hoti hai. Traders aur investors is pattern ko price action analysis mein istemal karte hain aur dusre indicators aur tools ke saath combine karke trading decisions lete hain.Yeh pattern ek signal hai, lekin iski sakti aur profitability ka assurance ke liye thorough analysis aur risk management ke saath istemal karna zaroori hai

Bearish counter attack

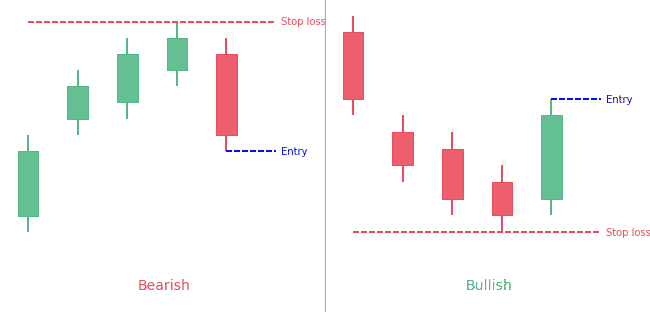

Bearish counter attack line pattern, stock market technical analysis mein ek bearish reversal pattern hai, jise candlestick charts ke dwara represent kiya jata hai. Yeh pattern bullish trend ke baad ek bearish reversal ko indicate karta hai.Bearish counter attack line pattern mein, ek bullish candlestick (upward trend) ke baad ek bearish candlestick (downward trend) aata hai. Bearish candlestick ka open price bullish candlestick ke close price ke aas-pass hota hai, aur uska price bullish candlestick ke body mein re-entry karta hai.Pattern ka naam "counter attack line" hai, kyunki bearish candlestick bullish sentiment ko counter karta hai, jaise ki ek "counter attack" karne ka concept hai. Bullish trend ke continuation se bachne ki sambhavna hoti hai aur price reversal ka indication hota hai.Bearish counter attack line pattern ka interpretation bearish reversal pattern hai, lekin iski effectiveness aur reliability ko confirm karne ke liye additional analysis aur market context ki zaroorat hoti hai. Traders aur investors is pattern ko price action analysis mein istemal karte hain aur dusre indicators aur tools ke saath combine karke trading decisions lete hain.Yeh pattern ek signal hai, lekin iski sakti aur profitability ka assurance ke liye thorough analysis aur risk management ke saath istemal karna zaroori hai. Market conditions aur context ko bhi dhyan mein rakhna zaroori hai.

Bullish Counter attack

Bullish counter attack line pattern, stock market technical analysis mein ek bullish reversal pattern hai, jise candlestick charts ke dwara represent kiya jata hai. Yeh pattern bearish trend ke baad ek bullish reversal ko indicate karta hai.Bullish counter attack line pattern mein, ek bearish candlestick (downward trend) ke baad ek bullish candlestick (upward trend) aata hai. Bullish candlestick ka open price bearish candlestick ke close price ke aas-pass hota hai, aur uska price bearish candlestick ke body mein re-entry karta hai.Pattern ka naam "counter attack line" hai, kyunki bullish candlestick bearish sentiment ko counter karta hai, jaise ki ek "counter attack" karne ka concept hai. Bearish trend ke continuation se bachne ki sambhavna hoti hai aur price reversal ka indication hota hai.Bullish counter attack line pattern ka interpretation bullish reversal pattern hai, lekin iski effectiveness aur reliability ko confirm karne ke liye additional analysis aur market context ki zaroorat hoti hai. Traders aur investors is pattern ko price action analysis mein istemal karte hain aur dusre indicators aur tools ke saath combine karke trading decisions lete hain.Yeh pattern ek signal hai, lekin iski sakti aur profitability ka assurance ke liye thorough analysis aur risk management ke saath istemal karna zaroori hai. Market conditions aur context ko bhi dhyan mein rakhna zaroori

Trading

Counterattack line candlesticks pattern bi ek bht ehm indicators hai jis se hame market ki movement show hoti hy aur ham thek tareky se andaza kar lety hain keh currency pair ko buy karna hai ya sell karna hy , is kyle ek to hamen bt zyada mehnat karna pary ge takeh ham is tool aur is indicators ko achy tareky se samaja saken .isko samajna bht mushkil hy yeh ek tarah ka technical analysis hota hy jo keh bht ziada complex hota hy . is se professional traders bi andaza laga lety hain market buy ki traf j arhe hy ya market sell ki taraf ja rahi hy . is lye hamen chahye keh aagar ham isko thek tarah se samkjen gy to is se ham apni trade ko secure kar sakenge ,is tarah ke indicators me market trend reverse bu show ho sakta hy aur forward bi show ho sakta hy . jb bi market me up gt red shuru hota hy aur ek line close ho jati hai to dusri line ek gap ke sath open hoti hy .yeh gap kuch is tarah se banta hy keh bearish candle aur ballish candle ek dosry ke sath ek e point py a akr mil jate hain .jaise e yeh ek pooint py a kar milte hain to usi time me jo trend hamen dhakny ko milta hy us me selling traders bht ziada hoty hain kuch is time dosno candles ek e point py mili hw hoti hy . aur yeh bht yakini bat hai keh market apni trend selling me e lay kar ja raha hota hy . aur agar dono candlestick ek dusre se ek point py ni milty to is sorat me trend buying kaise show hota hai aur market buy currency pair ki traf e jati hy.

Counter attack line pattern, stock market technical analysis mein ek candlestick pattern hai. Yeh pattern bearish trend ke baad ek bullish reversal pattern ko represent karta hai. Counter attack line pattern mein, ek bearish candlestick (do wnward trend) ke baad ek bullish candlestick (upward trend) aata hai. Bullish candlestick ka open price bearish candlestick ke close price ke aas-pass hota hai, aur uska price bearish candlestick ke body mein re-entry karta hai.Is pattern mein bullish candlestick bearish sentiment ko counter karta hai, jaise ki ek "counter attack" karne ka concept hai. Bearish trend ke continuation se bachne ki sambhavna hoti hai aur price reversal ka indication hota hai.Counter attack line pattern ka interpretation bullish reversal pattern hai, lekin iski effectiveness aur reliability ko confirm karne ke liye additional analysis aur market context ki zaroorat hoti hai. Traders aur investors is pattern ko price action analysis mein istemal karte hain aur dusre indicators aur tools ke saath combine karke trading decisions lete hain.Yeh pattern ek signal hai, lekin iski sakti aur profitability ka assurance ke liye thorough analysis aur risk management ke saath istemal karna zaroori hai

Bearish counter attack

Bearish counter attack line pattern, stock market technical analysis mein ek bearish reversal pattern hai, jise candlestick charts ke dwara represent kiya jata hai. Yeh pattern bullish trend ke baad ek bearish reversal ko indicate karta hai.Bearish counter attack line pattern mein, ek bullish candlestick (upward trend) ke baad ek bearish candlestick (downward trend) aata hai. Bearish candlestick ka open price bullish candlestick ke close price ke aas-pass hota hai, aur uska price bullish candlestick ke body mein re-entry karta hai.Pattern ka naam "counter attack line" hai, kyunki bearish candlestick bullish sentiment ko counter karta hai, jaise ki ek "counter attack" karne ka concept hai. Bullish trend ke continuation se bachne ki sambhavna hoti hai aur price reversal ka indication hota hai.Bearish counter attack line pattern ka interpretation bearish reversal pattern hai, lekin iski effectiveness aur reliability ko confirm karne ke liye additional analysis aur market context ki zaroorat hoti hai. Traders aur investors is pattern ko price action analysis mein istemal karte hain aur dusre indicators aur tools ke saath combine karke trading decisions lete hain.Yeh pattern ek signal hai, lekin iski sakti aur profitability ka assurance ke liye thorough analysis aur risk management ke saath istemal karna zaroori hai. Market conditions aur context ko bhi dhyan mein rakhna zaroori hai.

Bullish Counter attack

Bullish counter attack line pattern, stock market technical analysis mein ek bullish reversal pattern hai, jise candlestick charts ke dwara represent kiya jata hai. Yeh pattern bearish trend ke baad ek bullish reversal ko indicate karta hai.Bullish counter attack line pattern mein, ek bearish candlestick (downward trend) ke baad ek bullish candlestick (upward trend) aata hai. Bullish candlestick ka open price bearish candlestick ke close price ke aas-pass hota hai, aur uska price bearish candlestick ke body mein re-entry karta hai.Pattern ka naam "counter attack line" hai, kyunki bullish candlestick bearish sentiment ko counter karta hai, jaise ki ek "counter attack" karne ka concept hai. Bearish trend ke continuation se bachne ki sambhavna hoti hai aur price reversal ka indication hota hai.Bullish counter attack line pattern ka interpretation bullish reversal pattern hai, lekin iski effectiveness aur reliability ko confirm karne ke liye additional analysis aur market context ki zaroorat hoti hai. Traders aur investors is pattern ko price action analysis mein istemal karte hain aur dusre indicators aur tools ke saath combine karke trading decisions lete hain.Yeh pattern ek signal hai, lekin iski sakti aur profitability ka assurance ke liye thorough analysis aur risk management ke saath istemal karna zaroori hai. Market conditions aur context ko bhi dhyan mein rakhna zaroori

Trading

Counterattack line candlesticks pattern bi ek bht ehm indicators hai jis se hame market ki movement show hoti hy aur ham thek tareky se andaza kar lety hain keh currency pair ko buy karna hai ya sell karna hy , is kyle ek to hamen bt zyada mehnat karna pary ge takeh ham is tool aur is indicators ko achy tareky se samaja saken .isko samajna bht mushkil hy yeh ek tarah ka technical analysis hota hy jo keh bht ziada complex hota hy . is se professional traders bi andaza laga lety hain market buy ki traf j arhe hy ya market sell ki taraf ja rahi hy . is lye hamen chahye keh aagar ham isko thek tarah se samkjen gy to is se ham apni trade ko secure kar sakenge ,is tarah ke indicators me market trend reverse bu show ho sakta hy aur forward bi show ho sakta hy . jb bi market me up gt red shuru hota hy aur ek line close ho jati hai to dusri line ek gap ke sath open hoti hy .yeh gap kuch is tarah se banta hy keh bearish candle aur ballish candle ek dosry ke sath ek e point py a akr mil jate hain .jaise e yeh ek pooint py a kar milte hain to usi time me jo trend hamen dhakny ko milta hy us me selling traders bht ziada hoty hain kuch is time dosno candles ek e point py mili hw hoti hy . aur yeh bht yakini bat hai keh market apni trend selling me e lay kar ja raha hota hy . aur agar dono candlestick ek dusre se ek point py ni milty to is sorat me trend buying kaise show hota hai aur market buy currency pair ki traf e jati hy.

WHAT DOES THE BEARISH PATTERN TELL TRADER

WHAT DOES THE BEARISH PATTERN TELL TRADER

تبصرہ

Расширенный режим Обычный режим