Relation of Margin and Leverage

Introduction

Fellows,

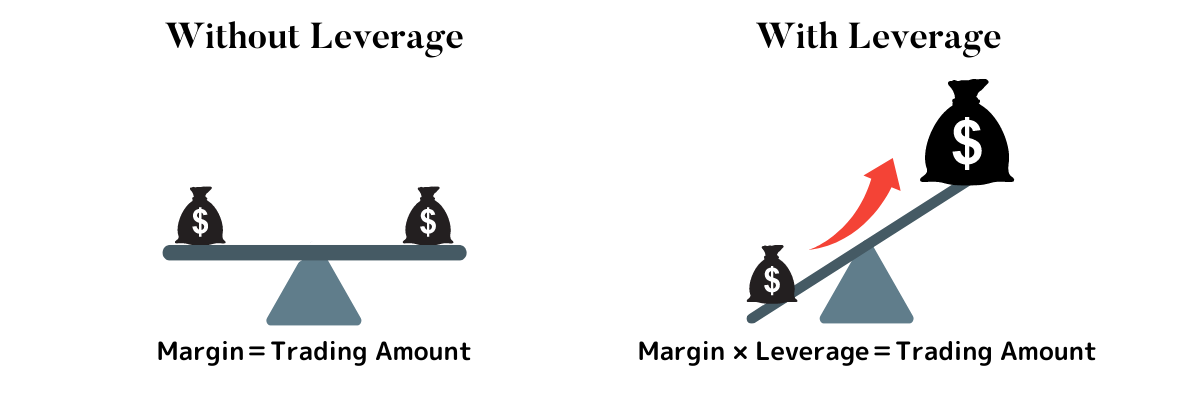

Trading market main Margin forex trading mein simply trader k pas account mein jitni bhi raqam ho so usi ko margin kehtay hain. Ideally, aik Average forex trader kay pas kabhi bhi trading kay liye enough sarmaya nahi hota, aisay mein leverage trader kay kam ata ha. Leverage ko ap capital samajh lein, jo broker ki taraf se trader ko capital volume extend k liye diya jata hain.. For example, agar aik trader kay pas account Margin trader ke account ka jo actual balance hota hain wo hota hain aur margin ka sahih tareeqe se istemal krna aur thore margin ka istemal krna trader ke lie safe hota he aur trader jo trade open krta hain us kaa margin muqrr hota he aur hr trading pair ka alg alg margin muqrr hota he aur yeh trader ka apna sarmya hota he aur baqe bat jo leverage ke hote he to leverage bhe aik capital hota he jo keh hmare account balance mein show to nhe ho rha hota lakin jb hm apne order market mein lagate hein to humko order lagate time broker aik leverage deta hain jo k hmare capital mein shamil ho jate hain. Hum bahooht ziada trading kr sktay hain.

Different

Fellows,

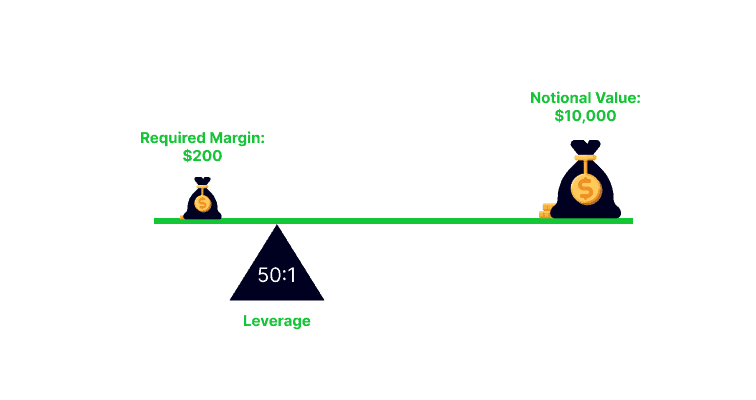

Like agar trader ka leverage account mein 1:50 he to es ka mtlb yeh hota he keh trader apne sarmya ka 1$ trading mein laga rha he aur 49$ trading ke lie broker trader ko de rha he es trah se trader apne thore se sarmya se ziaada trading ke volume lots lga skta he yeh he margin aur leverage ka jaiza jo ap ko smjha dia he umeed he ap ko es margin awar leverage donon account main hmary pass hoty hain aor margin ka use krna bhi low chhy aor leverage ka use krna bhi low must hay aor trading main margin trader ka own balance hota hay jo us nay invest kia hota hay ya jo bonus hota hay wo balance trader ka total margin kahlata hay aor leverage aik different chez hain. aor is main jo capital involve hota hay woh broker trader ko provide krta hay aor is leverage ka sahi use krna trader kay liay must hay trader trading account main high leverage na rkhain aor trading main margin level bhi small use krain aor trading main successful aor profitable trading k liay trader ko margin awar leverage donon ka low use krna hay aor trading main boht mutat tarz apnaty howy trading krni hai aor trader is margin aor leverage ki waja sy trading market main small investment sy high volume ki lots ka use kar skta hain.

Conclusion

Fellows,

trader ko forex trading market main zyada trading volume ki trades place krnay ki permission broker data hain. Esss laiy trader k account main mojood wo raqam jo kisi bhi currency ko khareednay kay liye broker ko chahiye hoti hay esko hum margin kehty hay aur agar margin kam hota hay to es surat main trading platform trader ko currency khareedny ki ejazar nahi daita esi trha agar aik trader loss main ja raha hay to us broker ka trading software tab tab tak he trades ko open rehnay daita hain. jab tak keh trader kay account main required margin rehta hay jaisay he margin khatam hota hay to jo trades run ho rahi hoti hay wo khud he close ho jati hay awar humay market main loss ka samna par jata hain. Nechy Margin aur leverage kay taluk ko es example say samjh sakty hain. Hum aisay 1000 dolor say mini account open kea hay es ka matlab hay keh humara margin 1000 dolor hay maslan humary trading account ki leverage 1:100 hay eska matlab hay keh humay aik mini lot khareednay kay liay 100 dolor darkar hon gay hum nay agar EUR/USD pair par 5 lots khareed li hain to humary pass remaining margin forex trading main markgin osko katy hain jo hmary apss hmary account main raqam hoti hai jis ko hum use kartyu hain apni invest main jub hum trading k liye lot lagty hain tu hmain margin se pata chlta hai k hmary account main kitna bonus hai or hum kitni invest ks ath trading karty haijn jub k leverge main hmain brokers khud aik target deta hai jesa k hum osko brokers ki traf se raqam di jati hai jis ko hum use karty hain apni trading main tu es main zeayada yahi farak hai or hum khud apni trading main ezaafa akar sakty hain.

Thanks

Introduction

Fellows,

Trading market main Margin forex trading mein simply trader k pas account mein jitni bhi raqam ho so usi ko margin kehtay hain. Ideally, aik Average forex trader kay pas kabhi bhi trading kay liye enough sarmaya nahi hota, aisay mein leverage trader kay kam ata ha. Leverage ko ap capital samajh lein, jo broker ki taraf se trader ko capital volume extend k liye diya jata hain.. For example, agar aik trader kay pas account Margin trader ke account ka jo actual balance hota hain wo hota hain aur margin ka sahih tareeqe se istemal krna aur thore margin ka istemal krna trader ke lie safe hota he aur trader jo trade open krta hain us kaa margin muqrr hota he aur hr trading pair ka alg alg margin muqrr hota he aur yeh trader ka apna sarmya hota he aur baqe bat jo leverage ke hote he to leverage bhe aik capital hota he jo keh hmare account balance mein show to nhe ho rha hota lakin jb hm apne order market mein lagate hein to humko order lagate time broker aik leverage deta hain jo k hmare capital mein shamil ho jate hain. Hum bahooht ziada trading kr sktay hain.

Different

Fellows,

Like agar trader ka leverage account mein 1:50 he to es ka mtlb yeh hota he keh trader apne sarmya ka 1$ trading mein laga rha he aur 49$ trading ke lie broker trader ko de rha he es trah se trader apne thore se sarmya se ziaada trading ke volume lots lga skta he yeh he margin aur leverage ka jaiza jo ap ko smjha dia he umeed he ap ko es margin awar leverage donon account main hmary pass hoty hain aor margin ka use krna bhi low chhy aor leverage ka use krna bhi low must hay aor trading main margin trader ka own balance hota hay jo us nay invest kia hota hay ya jo bonus hota hay wo balance trader ka total margin kahlata hay aor leverage aik different chez hain. aor is main jo capital involve hota hay woh broker trader ko provide krta hay aor is leverage ka sahi use krna trader kay liay must hay trader trading account main high leverage na rkhain aor trading main margin level bhi small use krain aor trading main successful aor profitable trading k liay trader ko margin awar leverage donon ka low use krna hay aor trading main boht mutat tarz apnaty howy trading krni hai aor trader is margin aor leverage ki waja sy trading market main small investment sy high volume ki lots ka use kar skta hain.

Conclusion

Fellows,

trader ko forex trading market main zyada trading volume ki trades place krnay ki permission broker data hain. Esss laiy trader k account main mojood wo raqam jo kisi bhi currency ko khareednay kay liye broker ko chahiye hoti hay esko hum margin kehty hay aur agar margin kam hota hay to es surat main trading platform trader ko currency khareedny ki ejazar nahi daita esi trha agar aik trader loss main ja raha hay to us broker ka trading software tab tab tak he trades ko open rehnay daita hain. jab tak keh trader kay account main required margin rehta hay jaisay he margin khatam hota hay to jo trades run ho rahi hoti hay wo khud he close ho jati hay awar humay market main loss ka samna par jata hain. Nechy Margin aur leverage kay taluk ko es example say samjh sakty hain. Hum aisay 1000 dolor say mini account open kea hay es ka matlab hay keh humara margin 1000 dolor hay maslan humary trading account ki leverage 1:100 hay eska matlab hay keh humay aik mini lot khareednay kay liay 100 dolor darkar hon gay hum nay agar EUR/USD pair par 5 lots khareed li hain to humary pass remaining margin forex trading main markgin osko katy hain jo hmary apss hmary account main raqam hoti hai jis ko hum use kartyu hain apni invest main jub hum trading k liye lot lagty hain tu hmain margin se pata chlta hai k hmary account main kitna bonus hai or hum kitni invest ks ath trading karty haijn jub k leverge main hmain brokers khud aik target deta hai jesa k hum osko brokers ki traf se raqam di jati hai jis ko hum use karty hain apni trading main tu es main zeayada yahi farak hai or hum khud apni trading main ezaafa akar sakty hain.

Thanks

تبصرہ

Расширенный режим Обычный режим